Considering the Lottery? Investing in IonQ Might Be a Smarter Choice.

Lottery vs. Stock Market Investment

Lottery Participation: Approximately 50% of Americans purchase a lottery ticket at least once a year, despite the extremely low odds of winning the Powerball jackpot, which stands at one in 292 million. The annual cost of buying a daily ticket amounts to $730, which often leads to financial losses that are unlikely to be offset by smaller winnings.

Stock Ownership: Only 21% of U.S. families own individual stocks directly, contrasting with the widespread lottery ticket purchases. The stock market is recognized as a significant wealth creator, with the S&P 500 delivering an average annual return of about 10% since 1957.

Investment Opportunities

S&P 500 Returns: If an individual had invested $730 annually in the S&P 500 over the past decade, their total investment of $7,300 would have grown to approximately $12,800, while a lump sum investment would have increased to around $28,250, showcasing substantial returns that outpace inflation.

Speculative Stocks: IonQ, a company in the quantum computing sector, has seen its stock price increase by 475% over the past year, although it still trades nearly 20% below its all-time high. The quantum computing market is projected to grow at a compound annual growth rate (CAGR) of 34.8% from 2024 to 2032, driven by advancements in technology.

IonQ's Business Model and Future Prospects

Quantum Computing Technology: IonQ utilizes "trapped ion" technology to enhance the efficiency and accuracy of its quantum computers. The company currently offers three systems and plans to launch a fourth, the Tempo, by the end of the year. Its systems are measured in algorithmic qubits (AQ), with expectations for the Tempo to achieve at least 64 AQ.

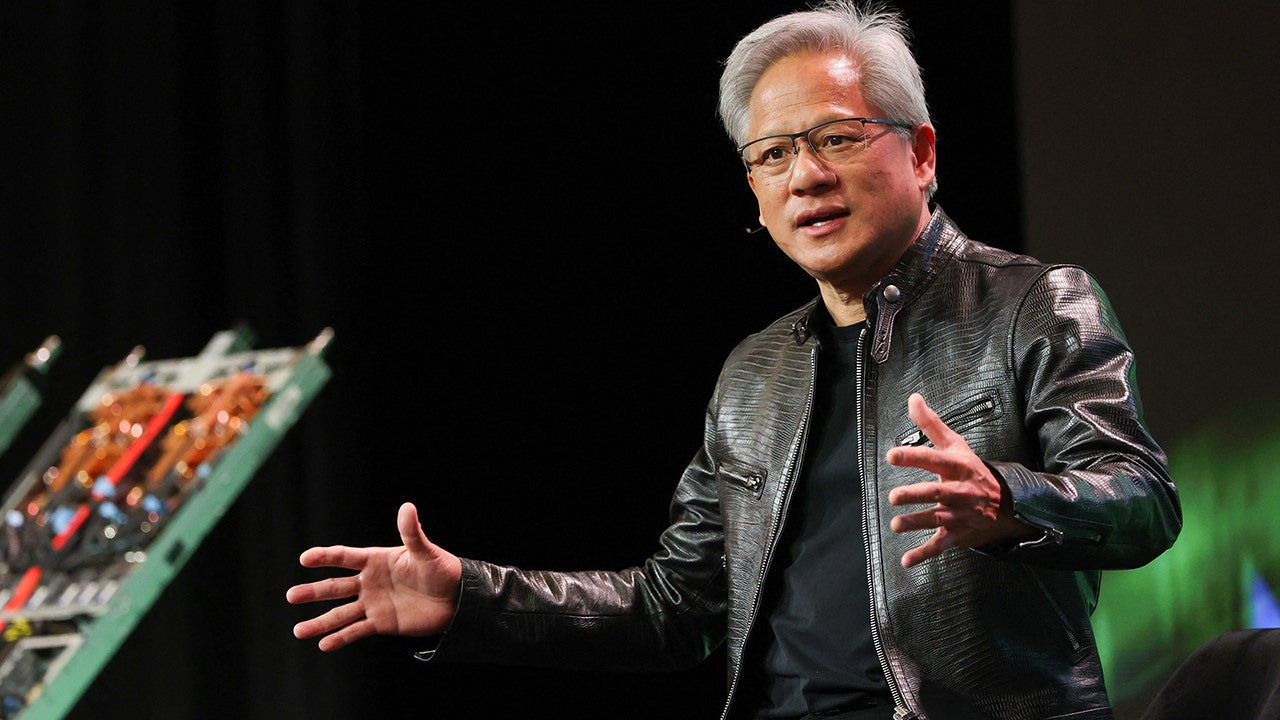

Revenue Growth: Analysts predict IonQ's revenue will rise from $43 million in 2024 to $315 million by 2027 as its technology gains traction across various industries. The integration of Nvidia's CUDA platform into its systems positions IonQ favorably within the growing AI market.

Investment Risks and Recommendations

Market Valuation: IonQ has a market capitalization of $12.85 billion, trading at over 40 times its projected sales for 2027, indicating a high-risk investment profile. The company is expected to remain unprofitable in the near term, making it a riskier choice compared to traditional index funds.

Alternative Stock Recommendations: The Motley Fool's Stock Advisor has identified ten stocks that are currently recommended for investment, which have historically provided substantial returns. Notably, past recommendations like Netflix and Nvidia have yielded extraordinary returns, significantly outperforming the S&P 500's average.

Trade with 70% Backtested Accuracy

Analyst Views on IONQ

About IONQ

About the author

- Strong Earnings Report: IonQ reported a Q4 non-GAAP EPS of -$0.20, beating expectations by $0.03, indicating improved financial management despite ongoing losses.

- Revenue Surge: The company achieved revenue of $61.89 million, a staggering 429% year-over-year increase, surpassing market expectations by $21.51 million, reflecting IonQ's robust growth in the quantum computing sector.

- 2026 Financial Outlook: IonQ anticipates full-year 2026 revenue between $225 million and $245 million, significantly above the consensus estimate of $192.63 million, showcasing strong confidence in future growth.

- Adjusted EBITDA Forecast: The company expects an adjusted EBITDA loss of between $330 million and $310 million for 2026, indicating that while losses are projected to widen, market confidence remains strong as evidenced by a 7% increase in share price.

- Quantum Network Deployment: IonQ successfully deployed technology for Romania's National Quantum Communication Infrastructure, marking a significant milestone in Europe's efforts to secure communications against cyber threats, likely boosting investor confidence and expanding the company's technological footprint in the region.

- Network Scale: The project features 36 quantum-secured links spanning over 1,500 kilometers, connecting six major metropolitan areas in Romania, showcasing the scalability and operational readiness of quantum-secure communications, thereby enhancing national security and the overall European quantum communications infrastructure.

- Partnerships: The deployment involved collaboration with 12 universities and several national agencies, emphasizing the project's importance for national security and the broader European quantum communications infrastructure, further solidifying IonQ's leadership position in the industry.

- Stock Performance: IonQ shares rose 14.17% to $38.35 during Thursday's premarket trading, indicating strong short-term momentum, with a 112.5% increase over the past 12 months, reflecting market optimism about its future growth potential.

- U.S. Stock Market Performance: U.S. stock indexes closed mixed on Thursday, with the S&P 500 gaining 0.03%.

- Decline in Other Indexes: The Dow Jones Industrial Average decreased by 0.54%, while the Nasdaq Composite fell by 1.18%.

- Significant Financial Improvement: IonQ generated $61.9 million in revenue for Q4 2025, representing a 429% year-over-year increase, indicating that its quantum computing business is achieving substantial financial results, thereby boosting investor confidence.

- Profitability Enhancement: The company reported a diluted earnings per share of $1.93 for Q4 2025, compared to a diluted loss per share of $0.93 in Q4 2024, showcasing a remarkable improvement in profitability that further solidifies its leadership in the quantum computing sector.

- Future Growth Expectations: IonQ's management provided revenue guidance for 2026 of $225 million to $245 million, and achieving the midpoint would signify nearly 81% year-over-year growth, reflecting the company's confidence in future performance and market potential.

- Increased Investment Appeal: With growing sales and achieving quarterly profits, IonQ's leadership position in quantum computing is becoming more pronounced, attracting the attention of risk-averse investors, and its stock is expected to have higher growth potential in 2026.

- Stock Surge: IonQ's stock surged 22.7% in Thursday trading despite a bearish market backdrop, with the S&P 500 down 0.6% and the Nasdaq Composite down 1.4%, indicating strong investor confidence in its performance.

- Earnings Beat: The company reported a non-GAAP loss of $0.20 per share on revenue of $61.89 million, surpassing Wall Street's expectations of a $0.23 loss and $40.38 million in sales, highlighting its competitive edge in the quantum computing sector.

- Significant Sales Growth: IonQ's sales increased by an impressive 429% year-over-year, demonstrating rapidly rising demand for its technologies and services, which further solidifies its position in the quantum computing market.

- Optimistic Outlook: The company expects sales for 2023 to range between $225 million and $245 million, significantly exceeding the average analyst estimate of $192.6 million, reflecting IonQ's confidence in future performance and strong market demand.