TeamViewer drops 12% on deal to buy 1E from Carlyle for $720M By Investing.com

TeamViewer's Acquisition of 1E: TeamViewer AG has agreed to acquire London-based IT firm 1E for $720 million, with expectations that the deal will enhance its market position and contribute significantly to revenue by 2027.

Market Reaction and Analyst Insights: Following the announcement, TeamViewer's shares dropped 12%, reflecting investor concerns about the company's growth trajectory and the high cost multiple of the acquisition compared to its core operations.

Trade with 70% Backtested Accuracy

Analyst Views on TMV

About the author

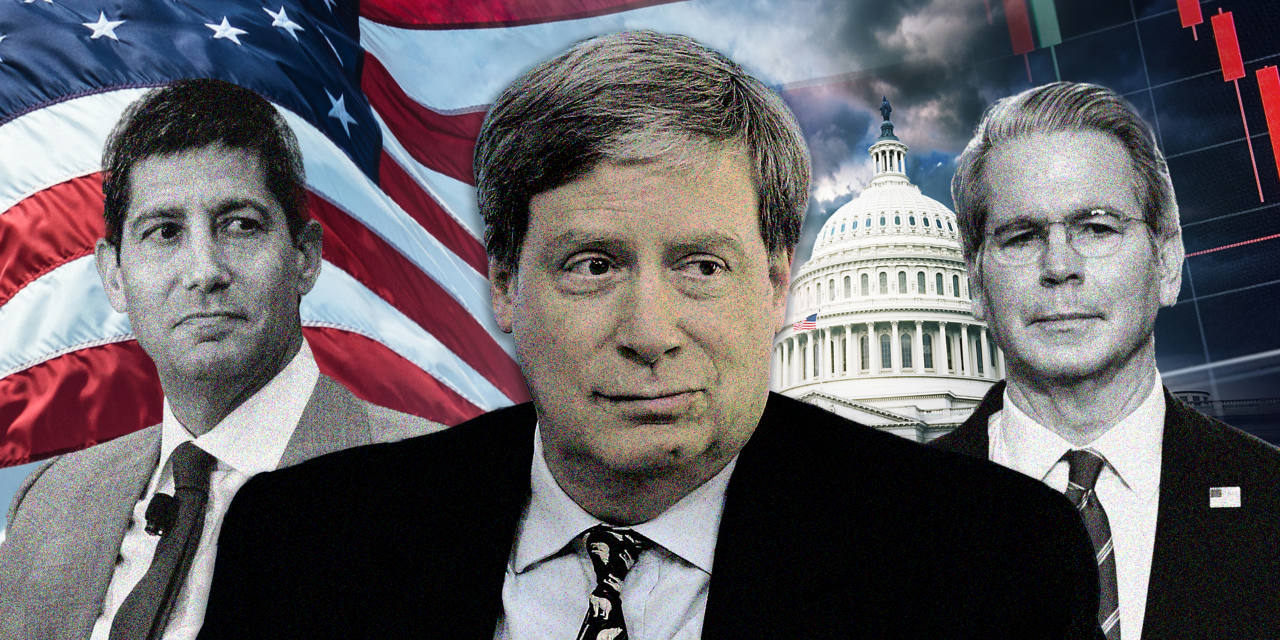

Druckenmiller's Investment Strategy: Legendary investor Stanley Druckenmiller has been shorting long-term U.S. Treasury bonds, allocating 15% to 25% of his portfolio to this strategy over the past year.

Market Impact and Attention: His significant bearish position on U.S. government debt gained notable attention in fall 2024, highlighting his approach to aligning policy with investment opportunities.

Bond Market Volatility: The bond market is experiencing significant sell-offs and volatility, with long-term Treasury yields rising sharply due to President Trump's tariffs, leading to a decline in traditional safe-haven assets like the iShares 20+ Year Treasury Bond ETF (TLT).

Investment Strategies in Rising Rates: Investors are exploring strategies to navigate the rising interest rates, such as investing in senior loans, floating rate notes, shorting U.S. treasuries, and considering niche ETFs that hedge against rising rates, while also being cautious of sectors that typically perform poorly in high-rate environments.

Performance of Long-term Treasury Bonds: An investment in the leading ETF for long-term U.S. Treasury bonds at its peak in August 2020 would have resulted in a 41.3% loss, even after accounting for reinvested interest income.

Impact of Leveraged ETFs: Two leveraged ETFs that aim to amplify daily returns on long-term Treasurys have experienced even more extreme performance fluctuations compared to standard Treasury bond investments.

TeamViewer's Financial Performance: TeamViewer shares rose over 6% after announcing a pro-forma ARR growth forecast of 7.5%-10.8% for FY25, with revenue expected to reach €778-797 million, exceeding analyst expectations and indicating a stronger growth trajectory.

Future Growth Projections: The company aims for double-digit revenue growth starting in 2027, with projected revenues of €850-870 million for FY26 and €1,030-1,060 million for FY28, while also focusing on increasing Enterprise revenue share and improving EBITDA margins.

Roubini's New ETF Approach: Economist Nouriel Roubini, now dubbed "Dr. Realist," co-manages the Atlas America ETF, which deviates from traditional 60/40 stock-bond allocations by focusing on Treasuries, gold, real estate, and agricultural commodities to combat expected inflation of 5%.

Market Predictions and Strategies: Roubini anticipates that rising inflation will negatively impact both stocks and bonds, leading to significant losses in defensive assets like Treasuries, while advocating for investments in gold and REITs with climate risk assessments to navigate future market challenges.

TeamViewer's Revenue Performance: TeamViewer AG reported that its annual revenue for the 2024 fiscal year reached approximately 671 million euros, exceeding its guidance range and reflecting a 9% increase at constant currencies, driven by strong billings from large enterprise clients.

Market Reaction and Future Outlook: Following the announcement, shares of TeamViewer rose in early trading; however, the company has seen a decline of over 20% in share value over the past year, with full results set to be released on February 12.