TD SYNNEX Delivers Strong Q4, Raises Dividend Amid IT Growth Momentum; Stock Gains

Quarterly Performance: TD SYNNEX Corp reported a fourth-quarter revenue of $15.85 billion, exceeding analyst expectations, with an adjusted EPS of $3.09 and a 10% year-over-year revenue increase.

Future Outlook: The company anticipates first-quarter adjusted EPS between $2.65 and $3.15, projecting revenue of $14.4 billion to $15.2 billion, while also increasing its quarterly cash dividend by 10%.

Trade with 70% Backtested Accuracy

Analyst Views on SNX

About SNX

About the author

- Earnings Report Schedule: TD SYNNEX will report its financial results for the first fiscal quarter of 2026, ending February 28, 2026, before market open on March 31, 2026, followed by a conference call at 9:00 a.m. ET, enhancing investor transparency through live webcast access.

- Segment Reporting Update: The company revised its reportable segments in Q1 2026 to four main business units, including IT distribution across the Americas, Europe, and Asia-Pacific and Japan, along with Hyve Solutions, to better reflect business management and resource allocation.

- Product Portfolio Strength: TD SYNNEX's distribution business consolidates over 200,000 IT hardware, software, and systems products, supporting the global IT ecosystem and enhancing the company's competitive edge and customer service capabilities in the market.

- Global Customer Support: As a Fortune 100 company, TD SYNNEX supports over 150,000 customers across more than 100 countries with a comprehensive edge-to-cloud portfolio spanning cybersecurity and artificial intelligence, further solidifying its central role in the global technology ecosystem.

- Perfect Score Achievement: TD SYNNEX received a score of 100 on the Human Rights Campaign's 2026 Corporate Equality Index, joining 534 honored companies, which highlights its leadership in LGBTQ+ workplace inclusion.

- Ongoing Commitment: CEO Patrick Zammit emphasized that earning the top score for the fourth consecutive year exemplifies the global team's dedication to fostering a workplace where everyone is respected and valued, reinforcing the company's culture.

- Policy Impact: The 2026 CEI results indicate that 98% of rated companies include sexual orientation and gender identity in their non-discrimination policies, showcasing U.S. businesses' proactive efforts in promoting LGBTQ+ friendly policies, impacting over 22 million U.S. workers.

- Comprehensive Coverage: 87% of companies provide comprehensive healthcare coverage for all employees, including transgender individuals for medically necessary care, reflecting the corporate responsibility and commitment to supporting LGBTQ+ employees and their families.

Market Opening: U.S. stock markets are set to open in two hours.

Brookfield Wealth Solutions Performance: Brookfield Wealth Solutions Ltd. (BNT) saw a 6.5% increase in pre-market trading.

TD SYNNEX Corp Performance: TD SYNNEX Corp. (SNX) experienced a 5.4% rise in pre-market trading.

Overall Market Sentiment: The pre-market gains indicate a positive sentiment ahead of the market opening.

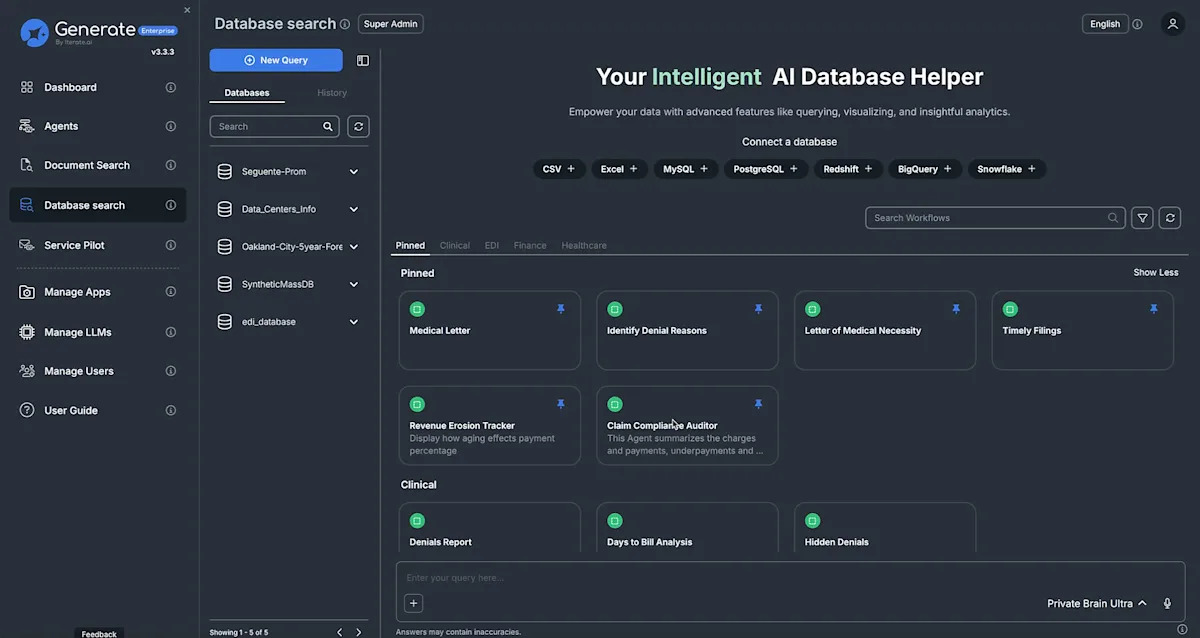

- Healthcare Revenue Recovery: Iterate.ai, in collaboration with TD SYNNEX and HPE, has launched Generate for Healthcare, a solution designed to help hospital systems identify and recover millions in unpaid and underpaid insurance claims, addressing a critical financial challenge in the healthcare sector.

- Technological Advantage: The solution operates on HPE Private Cloud AI and NVIDIA technology, enabling seamless integration across multiple EMR systems to identify payment gaps and coding errors in real-time, thereby enhancing financial transparency and operational efficiency for hospitals.

- Market Opportunity: The implementation of Generate for Healthcare is expected to deliver significant financial returns for hospitals, with software costs representing only 0.1% of net patient revenue, while optimizing operations and accelerating revenue inflow to help hospitals navigate increasingly complex financial environments.

- Strategic Partnerships: By partnering with HPE and TD SYNNEX, Iterate.ai not only strengthens its market competitiveness but also provides partners with innovative solutions that address payment erosion in healthcare, driving business growth and differentiation.

- Revenue Recovery Solution: Iterate.ai's Generate for Healthcare, launched in partnership with TD SYNNEX and HPE, aims to help hospital systems identify and recover millions in unpaid and underpaid insurance claims, addressing a critical financial challenge in the healthcare sector.

- Technological Architecture Advantage: The solution, built on HPE Private Cloud AI and NVIDIA technology, seamlessly integrates with multiple EMR systems to identify payment gaps and coding errors in real-time, significantly enhancing financial transparency and operational efficiency for hospitals.

- Market Opportunity: The implementation cost of Generate for Healthcare represents only 0.1% of net patient revenue, providing healthcare organizations with a substantial revenue opportunity while helping partners stand out in a competitive market.

- Strategic Collaboration: By partnering with HPE and TD SYNNEX, Iterate.ai can rapidly bring this solution to market, ensuring hospitals can quickly deploy it and realize financial benefits, further solidifying its leadership position in the healthcare AI space.

Rising Dividends: Several stocks, particularly in the data center sector, have significantly increased their dividends, with some raising payouts by as much as 60%, indicating strong earnings stability and potential for income investors.

CenterPoint Energy Performance: CenterPoint Energy is projected to deliver a total return of approximately 24% in 2025, supported by data center expansion and a forecasted increase in load demand in the Houston area.

TD SYNNEX Growth: TD SYNNEX reported a total return of just under 30% in 2025, driven by strong demand for data center solutions, although it operates on low margins in the IT distribution sector.

EMCOR's Impressive Returns: EMCOR Group delivered a 35% total return in 2025 and announced a 60% increase in its quarterly dividend, reflecting robust performance and strong organic growth in the data center market.