Taiwan Semiconductor: The Core of AI Investment

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 1d ago

0mins

Should l Buy TSM?

Source: Fool

- Massive Market Opportunity: By 2030, annual data center spending is projected to reach $3 trillion to $4 trillion, presenting a significant market opportunity for investors, particularly in AI, where Taiwan Semiconductor stands to benefit as a core supplier.

- Revenue Growth Potential: Taiwan Semiconductor anticipates AI chip revenue to grow at nearly a 60% compound annual growth rate through 2029, with overall revenue expected to achieve a 25% CAGR from 2024 to 2029, showcasing its strong performance in the rapidly expanding AI market.

- Global Expansion Strategy: The company has established chip production facilities in the U.S., Germany, and Japan, mitigating potential geopolitical risks and ensuring its competitiveness and supply chain stability in the global market.

- Attractive Valuation: Despite a growth rate in the mid-20% range, Taiwan Semiconductor's stock trades at a reasonable 24 times forward earnings, compared to 25 to 30 times for other tech stocks, indicating strong investment value and expected continued growth with rising AI spending.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy TSM?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on TSM

Wall Street analysts forecast TSM stock price to fall over the next 12 months. According to Wall Street analysts, the average 1-year price target for TSM is 313.46 USD with a low forecast of 63.24 USD and a high forecast of 390.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

8 Analyst Rating

7 Buy

1 Hold

0 Sell

Strong Buy

Current: 335.750

Low

63.24

Averages

313.46

High

390.00

Current: 335.750

Low

63.24

Averages

313.46

High

390.00

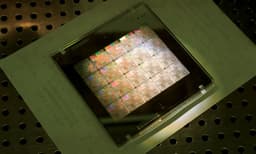

About TSM

Taiwan Semiconductor Manufacturing Co Ltd is a Taiwan-based integrated circuit foundry service provider. The Company is primarily engaged in integrated circuit manufacturing services. It offers advanced process technologies, specialised process solutions, advanced photomask and silicon stacking, and packaging-related technologies, while supporting a comprehensive design ecosystem. The Company's products serve diverse electronic sectors including artificial intelligence, high-performance computing, wired and wireless communications, automotive and industrial equipment, personal computing, information applications, consumer electronics, smart internet of things, and wearable devices.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Massive Market Opportunity: By 2030, annual data center spending is projected to reach $3 trillion to $4 trillion, presenting a significant market opportunity for investors, particularly in AI, where Taiwan Semiconductor stands to benefit as a core supplier.

- Revenue Growth Potential: Taiwan Semiconductor anticipates AI chip revenue to grow at nearly a 60% compound annual growth rate through 2029, with overall revenue expected to achieve a 25% CAGR from 2024 to 2029, showcasing its strong performance in the rapidly expanding AI market.

- Global Expansion Strategy: The company has established chip production facilities in the U.S., Germany, and Japan, mitigating potential geopolitical risks and ensuring its competitiveness and supply chain stability in the global market.

- Attractive Valuation: Despite a growth rate in the mid-20% range, Taiwan Semiconductor's stock trades at a reasonable 24 times forward earnings, compared to 25 to 30 times for other tech stocks, indicating strong investment value and expected continued growth with rising AI spending.

See More

- Strong Market Demand: Nvidia's data center business saw a 66% year-over-year growth in the recent quarter, indicating robust demand for its chips and further solidifying its market leadership in AI.

- New Platform Launch: The upcoming Rubin platform from Nvidia will integrate six different chips, expected to deliver five times the performance of the current Blackwell platform, significantly enhancing the efficiency and capability of AI supercomputers.

- Profitability Surge: Nvidia achieved a net income of $99 billion over the past year on $187 billion in revenue, showcasing its profitability and pricing power in a high-demand environment, which further strengthens its blue-chip status.

- Long-Term Growth Potential: TSMC anticipates AI chip demand to grow at an annualized rate of over 50% through 2029, coupled with its $34 billion revenue growth, indicating its strong competitive advantage in chip manufacturing and future investment value.

See More

- Market Potential: Morgan Stanley's latest research indicates that corporate spending in the AI investment cycle is projected to reach $10 trillion, suggesting that the AI market is still in its early stages with significant future growth potential.

- Nvidia's Competitive Edge: Nvidia (NVDA) achieved a 66% year-over-year growth in its data center business, and with the upcoming Rubin platform expected to deliver five times the computing power of its current offerings, it is solidifying its leadership position in the AI sector.

- TSMC's Robust Performance: Taiwan Semiconductor Manufacturing (TSM) reported a 25% year-over-year revenue growth in Q4, reaching $34 billion, demonstrating strong demand and market share in chip manufacturing, with AI chip demand expected to grow at an annualized rate of over 50%.

- Significant Investment Value: Nvidia and TSMC stocks are trading at forward P/E ratios of 24 and 23, respectively, reflecting their blue-chip status in the AI market, and investors can expect solid returns in the future.

See More

- Market Dynamics: As of February 2, the S&P 500 hovers near 7,002, and while investors express concerns about the monetization potential of tech investments in AI, historical trends suggest that investing in fundamentally strong companies at reasonable valuations is a wise long-term strategy.

- Micron's Recovery: After a challenging 2023 and 2024, Micron Technology is poised for a solid comeback, having secured pricing and volume agreements for high-bandwidth memory in 2026, which enhances revenue visibility significantly amid demand outpacing supply.

- Expansion Plans: Micron plans to invest $7 billion in a new advanced packaging facility in Singapore and has signed a letter of intent to acquire Powerchip Semiconductor's P5 fab in Taiwan for $1.8 billion, which is expected to boost DRAM production capacity by 2027.

- TSMC's Dominance: Taiwan Semiconductor Manufacturing Company is central to the global AI infrastructure buildout, with advanced chips projected to account for 74% of its wafer revenues in 2025, and it aims to commence volume production of A16 chips in the second half of 2026, further solidifying its competitive edge.

See More

- Key Factors in AI Economy: Futurum Equities' latest AI Fifteen report identifies computing, data, deployment, and security as critical factors defining the AI economy, emphasizing their importance for future development.

- Broadcom Revenue Growth: Broadcom (NASDAQ:AVGO) reported AI chip revenue of $6.5 billion this quarter, with guidance of $8.2 billion next quarter, indicating nearly 100% year-over-year growth and showcasing its strong performance in the AI market.

- Backlog Situation: The company's backlog across XPUs, switches, optics, and racks exceeds $73 billion, reflecting its dominant position in the AI semiconductor market and ongoing growth potential.

- Competitive Market Advantage: Broadcom launched its first Wi-Fi 8 access point and switch, further solidifying its position in the AI-driven networking market, while ranking in the 96th percentile for quality and 78th for momentum in Benzinga's performance metrics, demonstrating its robust market performance.

See More

- Investment Acceleration: Samsung Electronics is ramping up investments in advanced semiconductor manufacturing to meet the surging global demand for high-performance chips, particularly driven by artificial intelligence workloads, thereby enhancing its market competitiveness.

- Yield Control: The company is prioritizing tighter control over production yields, aiming for leadership in next-generation foundry processes, especially at the 2-nanometer node, by collaborating with Invisix to improve yields, showcasing its technological foresight.

- Technological Breakthrough: The design of 2-nanometer chips utilizes Gate-All-Around (GAA) nanosheet transistors, moving beyond the limitations of FinFET technology, with the goal of delivering higher performance and lower power consumption than 3-nanometer and 7-nanometer nodes, thus facilitating faster data processing for AI and high-performance computing.

- Market Competition: In the context of Taiwan Semiconductor's aggressive move into 2-nanometer production, Samsung's investment strategy becomes particularly crucial, especially as Taiwan Semiconductor has already begun volume production of its 2-nanometer chips, positioning Samsung to gain a more advantageous position in the future market.

See More