SK Group Chairman Warns of Bottlenecks Due to Rapid Growth of AI Data Centers, According to Report

AI Data Center Growth: SK Group Chairman Chey Tae-won highlighted that the rapid expansion of AI data centers is causing supply bottlenecks for chips and other essential components.

Global Competition in AI: Chey emphasized the intense global competition in AI, noting that major economies like the U.S. and China have implemented national strategies to gain an advantage.

Event Context: Chey made these remarks during a business event at the APEC summit in South Korea, attended by global business leaders, including U.S. President Donald Trump and Chinese President Xi Jinping.

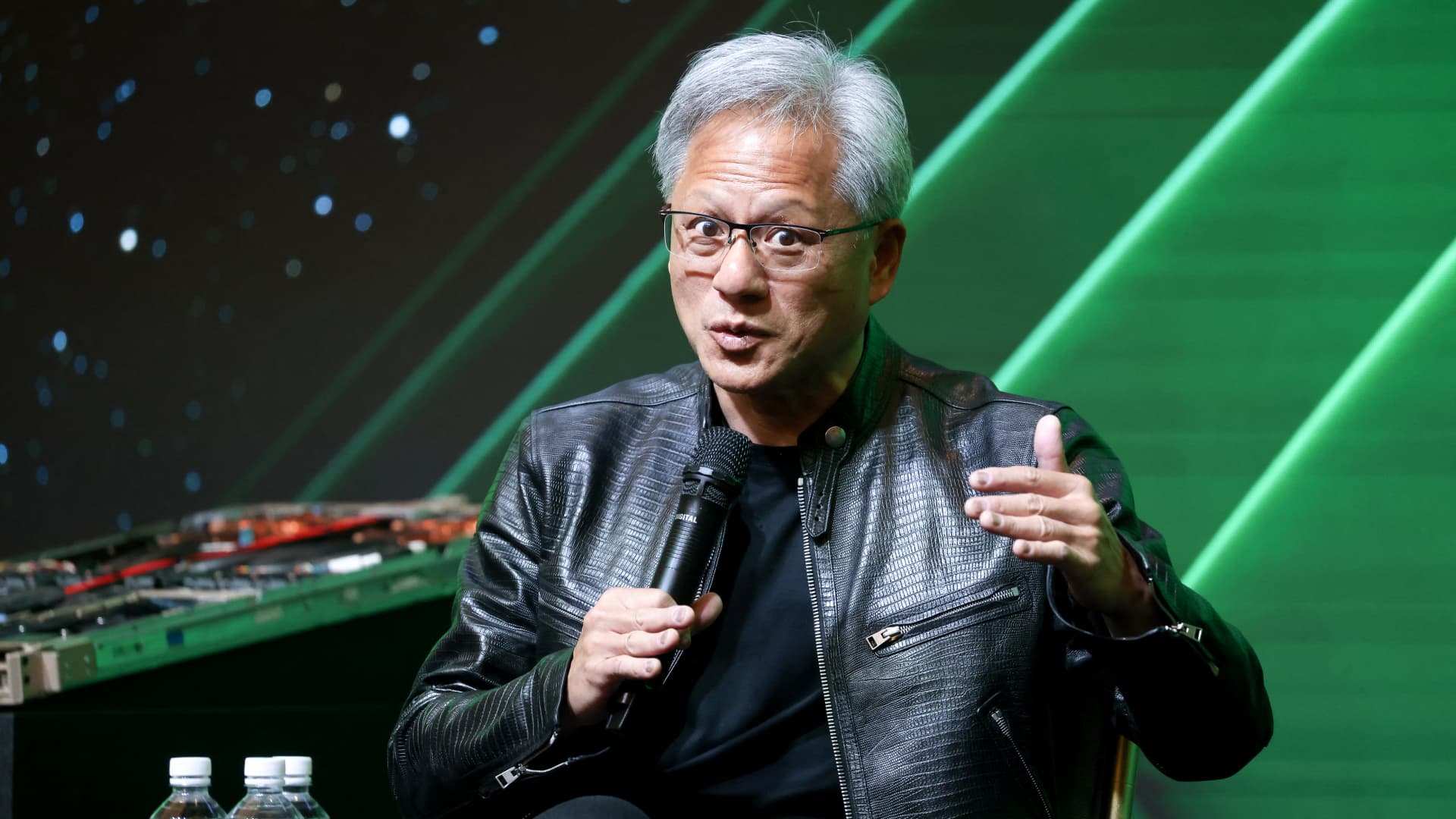

SK Hynix's Role: SK hynix, a subsidiary of SK Group, is a significant supplier of High-Bandwidth Memory chips to Nvidia, which is positioned to benefit from the growing AI market.

Trade with 70% Backtested Accuracy

Analyst Views on NVDA

About NVDA

About the author

- Significant Earnings Growth: Nvidia's latest earnings report reveals a revenue of $68.1 billion for the quarter ending January 25, reflecting an impressive growth rate of 73%, which is exceptionally rare among tech companies, indicating robust market demand and business performance.

- Stock Price Volatility: Despite strong performance, Nvidia's stock price has declined following the earnings release, currently trading at a P/E ratio of 37, which drops to 23 based on expected earnings, highlighting market concerns over its high valuation.

- Market Position Consolidation: As the world's most valuable company with a market cap of $4.4 trillion, Nvidia maintains a strong investment appeal despite overall bearish sentiment in tech, thanks to its leadership in the AI chip sector.

- Cautious Investor Sentiment: Analysts suggest that investors should approach Nvidia with caution in the current market environment, as while its business remains strong, the likelihood of the stock doubling in value in the short term is low, necessitating realistic expectations.

- Core Investment: The Vanguard Total Stock Market ETF (VTI) tracks the entire U.S. stock market and owns over 3,500 stocks, providing investors with the convenience of investing in thousands of stocks with a single click, making it ideal for those looking to simplify their investments.

- Cost Advantage: With an expense ratio of just 0.03%, investing $10,000 incurs only $3 in annual fees, significantly lowering investment costs and enhancing long-term return potential for investors.

- Long-Term Return Potential: Since its inception in 2001, the ETF has averaged a 9.2% annual total return, meaning a $10,000 investment would be worth over $90,000 today, demonstrating its effectiveness as a wealth-building tool.

- Concentration Risk and Lack of Diversification: Despite holding many stocks, the ETF's performance is heavily reliant on the top 10 companies, presenting significant concentration risk, while lacking exposure to international stocks and fixed-income assets, which may hinder portfolio diversification.

- Stock Price Fluctuation: IREN shares fell about 5% in Wednesday's after-market session after rising nearly 13% during regular trading, indicating market divergence regarding its future performance.

- AI Cloud Revenue Forecast: The company forecasts an annualized revenue of $3.7 billion from its AI Cloud segment this year, bolstered by the purchase of 50,000 advanced gaming processing units (GPUs) from Nvidia, increasing total capacity to 150,000 units and solidifying its market position.

- Impact of Financing Plans: IREN plans to raise up to $6 billion through an at-the-market stock offering to fund its expansion, which has pressured the stock price; however, retail investors remain optimistic about the company's growth prospects.

- Retail Investor Sentiment Shift: On Stocktwits, retail investor sentiment flipped from 'bearish' to 'bullish', as traders believe the company's expansion efforts will lead to explosive growth, reflecting confidence in its investments in AI infrastructure.

- Strong Earnings Report: Broadcom's fiscal Q1 2026 revenue reached $19.31 billion, surpassing the $19.18 billion consensus forecast with a 29% year-over-year increase, indicating robust growth potential in the AI chip sector.

- Improved Profitability: Adjusted earnings per share (EPS) rose 28% to $2.05, exceeding expectations of $2.03, while adjusted EBITDA grew 30% to $13.13 billion, further boosting investor confidence.

- Optimistic Future Outlook: Broadcom projects AI chip revenue to exceed $100 billion by 2027, having secured the necessary supply chain, reflecting strong confidence in future demand, particularly with a positive relationship with OpenAI.

- Shareholder Return Plan: The company announced a newly authorized $10 billion share repurchase program, which, combined with strong financial performance and an optimistic outlook, enhances market confidence in Broadcom's stock.

- Market Share Comparison: Nvidia commands an impressive 86% market share in AI data center revenue, compared to AMD's mere 7%, highlighting Nvidia's dominant position in the data center processor market, which is likely to attract more customers in the future.

- Major Deal Impact: AMD's agreement with Meta to supply up to 6 gigawatts of AI data center processing, valued at over $100 billion, represents a significant win for AMD; however, its high stock valuation raises concerns among investors.

- Financial Performance Divergence: Nvidia's recent Q4 fiscal 2026 results revealed a 65% increase in sales to nearly $216 billion, with adjusted earnings rising 60% to $4.77 per share, indicating strong growth momentum in the AI sector.

- Valuation Comparison: Nvidia's P/E ratio stands at 53, which, while above the tech sector average, is significantly lower than AMD's 101, making Nvidia a more attractive investment in the AI stock landscape given its robust financial performance.

- Market Expectations: Polymarket traders predict a 78% chance of Bitcoin dropping to $55,000, a 63% chance to $50,000, and a 51% chance to $45,000 in 2026, indicating a bearish sentiment that investors should navigate cautiously.

- Investment Strategies: In a down market, investors might consider Bitcoin-related stocks, particularly those transitioning computing power to AI, which not only provides indirect exposure to Bitcoin but also capitalizes on AI's growth potential.

- Derivatives Trading: Hedge fund managers are actively trading options on the iShares Bitcoin Trust (IBIT), the top Bitcoin ETF globally by assets under management, reflecting sustained interest in Bitcoin derivatives despite their inherent risks.

- Long-Term Holding Strategy: While Bitcoin is currently experiencing cyclical fluctuations, long-term investors may opt to buy and hold Bitcoin at lower prices, anticipating a future price recovery, a strategy that has historically proven effective.