SiriusPoint and Garrett Motion Rated Strong Buy with Earnings Growth

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Dec 24 2025

0mins

Should l Buy GTX?

Source: NASDAQ.COM

- SiriusPoint Earnings Growth: SiriusPoint Ltd. has seen its Zacks Consensus Estimate for current year earnings increase by 7.6% over the last 60 days, indicating enhanced profitability that is likely to boost investor confidence and drive stock price appreciation.

- Valuation Advantage: With a price-to-earnings ratio of 9.43 compared to the S&P 500's 25.25, SiriusPoint appears undervalued, potentially attracting value investors and increasing market demand for its shares.

- Garrett Motion Earnings Outlook: Garrett Motion Inc. has experienced a 2.1% increase in its Zacks Consensus Estimate for next year’s earnings over the past 60 days, reflecting an improvement in future profitability that may draw more investors to the stock.

- Industry Comparison: Garrett Motion's P/E ratio of 12.06, significantly lower than the S&P 500's 25.25, combined with its A Value Score, highlights its investment appeal in the industrial technology sector, which could lead to stock price increases.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy GTX?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on GTX

Wall Street analysts forecast GTX stock price to rise

3 Analyst Rating

3 Buy

0 Hold

0 Sell

Strong Buy

Current: 18.230

Low

21.00

Averages

22.00

High

23.00

Current: 18.230

Low

21.00

Averages

22.00

High

23.00

About GTX

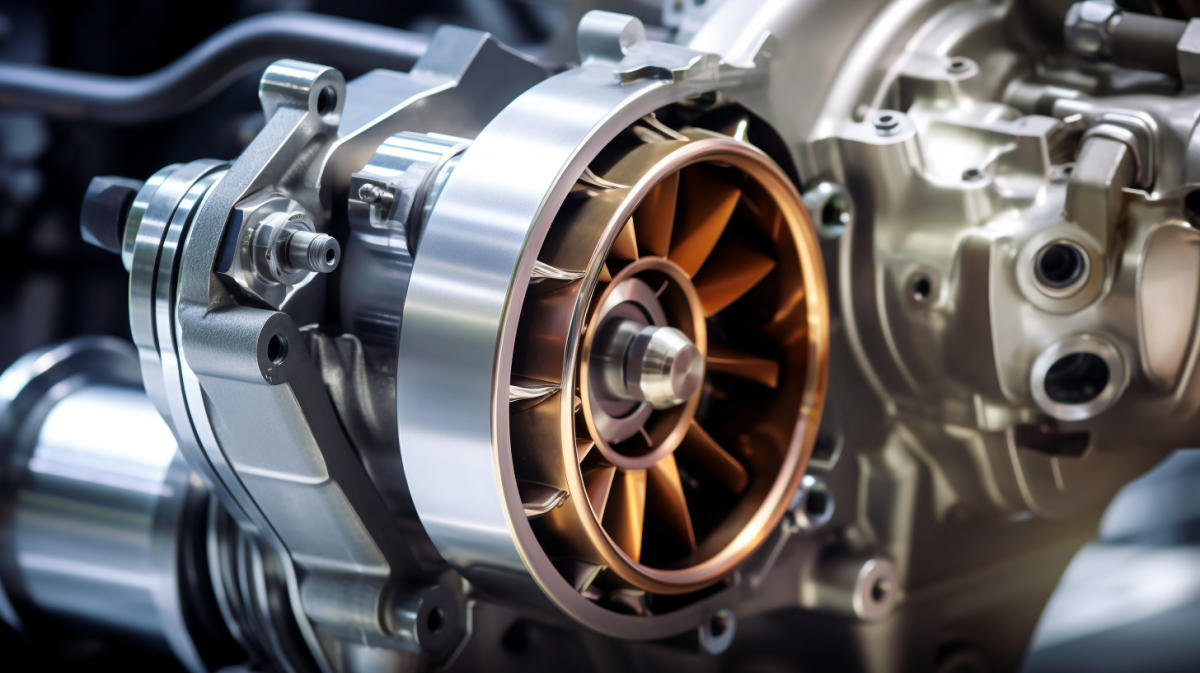

Garrett Motion Inc is a Switzerland-based automotive technology company. The Company designs, manufactures and sells turbocharger and electric boosting technologies for light and commercial vehicle original equipment manufacturers (OEMs) and the aftermarket. The Company offers turbochargers for gasoline, diesel, natural gas and electrified (hybrid and fuel cell) powertrains. In addition, the Company provides products and services for the connected vehicle market, including software focused on automotive cybersecurity and integrated vehicle health management (IVHM). The Company has a number of research and development (R&D) centers, engineering facilities and factories around the world, as well as a global distribution network. It is a spin-off of Honeywell International Inc.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Market Trend Insights: In the latest Motley Fool Scoreboard episode, analysts delve into Garrett Motion's market dynamics, offering unique insights into future investment opportunities aimed at helping investors navigate potential market shifts.

- Investment Opportunity Assessment: The episode highlights potential investment opportunities that Garrett Motion may face in the future, with analysts providing guidance on making informed investment decisions in a rapidly changing market environment.

- Stock Price Reference: The stock prices mentioned in the episode are from January 21, 2026, reflecting the market's current assessment of Garrett Motion, prompting investors to monitor future price fluctuations to optimize their investment strategies.

- Rich Video Content: Released on March 2, 2026, the video covers market trends and investment opportunities, aiming to provide viewers with comprehensive market analysis and investment advice.

See More

- Market Trend Insights: In the Motley Fool Scoreboard episode, analysts discussed market trends surrounding Garrett Motion, noting that while the company was not included in the current top 10 stock recommendations, its potential in automotive technology remains noteworthy.

- Investment Opportunity Assessment: Although Garrett Motion did not make it to the Motley Fool recommendation list, analysts highlighted potential investment opportunities for the company, particularly in collaborations with industry giants like Nvidia and Intel.

- Historical Performance Comparison: The Motley Fool Stock Advisor boasts an average return of 941%, significantly outperforming the S&P 500's 194%, indicating that investors should be cautious in stock selection, and Garrett Motion's performance warrants further observation.

- Investor Community Engagement: Motley Fool encourages investors to join its community for the latest investment advice and market analysis, emphasizing that while Garrett Motion is not on the recommendation list, its potential value still deserves attention.

See More

- Earnings Decline: Yatsen Holding Ltd reported adjusted earnings of 7 cents per share for Q4, down from 14 cents in the previous year, indicating a significant decline in profitability that could undermine investor confidence.

- Sales Growth: Despite the drop in earnings, Yatsen's sales increased from $157.347 million to $197.258 million, suggesting that the company still has growth potential in market demand, which may lay the groundwork for future recovery.

- Stock Price Volatility: Yatsen's shares fell 10.1% to $4.00 in pre-market trading, reflecting a negative market reaction to its earnings report, which could lead to increased selling pressure from investors in the short term.

- Market Trends: U.S. stock futures were generally lower, with Dow futures falling around 1%, indicating a broader market sentiment that may have a ripple effect on Yatsen and other stocks' performance.

See More

- Stake Increase: Apis Capital Advisors, LLC disclosed in a February 17, 2026 SEC filing that it increased its stake in Garrett Motion by 2,090,000 shares, raising its ownership to 6.77%, with the investment now valued at $38.87 million, reflecting a significant $36.96 million increase, indicating strong confidence in the company.

- Performance Metrics: As of February 17, 2026, Garrett Motion's shares were priced at $20.62, representing a remarkable 125.4% increase over the past year, significantly outperforming the S&P 500 by 115.68 percentage points, showcasing the company's robust performance and market recognition in the automotive parts sector.

- Market Demand: Despite the rise of electric vehicles, the automotive industry remains heavily reliant on internal combustion engines, with stringent fuel economy and emissions regulations sustaining demand for turbochargers; Garrett Motion's products enable automakers to meet these requirements while maintaining performance, ensuring revenue stability.

- Investment Outlook: As hybrid vehicles gain traction, Garrett Motion's profitability will depend on steady global vehicle output and ongoing demand for advanced combustion technology, prompting investors to monitor the duration of this transitional phase and its implications for the company's future performance.

See More

- Stake Increase: Apis Capital Advisors, LLC disclosed an increase of 2,090,000 shares in Garrett Motion in a recent SEC filing dated February 17, 2026, with an estimated trade size of approximately $33.28 million, indicating strong confidence in the company.

- Value Appreciation: At quarter-end, the value of Garrett Motion's stake reached $38.87 million, reflecting a $36.96 million increase from the prior period due to both trading activity and price appreciation, further solidifying its position in the portfolio.

- Asset Management Proportion: Following this transaction, Garrett Motion now constitutes 6.77% of Apis Capital's 13F reportable assets under management, highlighting its significance despite not being among the top five holdings in the fund.

- Strong Market Performance: As of February 17, 2026, Garrett Motion shares were priced at $20.62, representing a 125.4% increase over the past year, significantly outperforming the S&P 500 by 115.68 percentage points, underscoring its competitive edge in the automotive parts industry.

See More

- Electrification Milestone: Garrett Motion announced a partnership with Chinese commercial vehicle HVAC leader Cling to integrate its oil-free, foil bearing-based centrifugal compressor into next-generation electric bus and truck platforms, with production set to begin in 2027, thereby enhancing the efficiency and environmental responsibility of electric transportation.

- Compressor Technology Advantage: The new high-speed compressor operates at over 160,000 RPM, is 50% smaller and 30% lighter than traditional scroll compressors, and significantly reduces noise levels, providing EV manufacturers with a more energy-efficient thermal management solution that improves overall system performance and extends vehicle range.

- Financial Performance Exceeds Expectations: In Q4, Garrett achieved a 9% year-over-year increase in commercial vehicle revenue and a 4% rise in aftermarket sales, generating $99 million in operating cash flow and $139 million in adjusted free cash flow, indicating strong financial health.

- Future Outlook and Shareholder Returns: The company projects total revenue between $3.6 billion and $3.8 billion for 2023 and plans to repurchase $250 million in stock by 2026, with the CEO highlighting the zero-emission product portfolio as a core element of its long-term growth strategy, reflecting confidence in future market opportunities.

See More