Nova Named IBD Stock Of The Day Amid Strong AI-Driven Demand

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Dec 30 2025

0mins

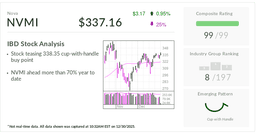

Should l Buy NVMI?

Source: Yahoo Finance

- AI-Driven Demand Surge: Nova, as a supplier of semiconductor manufacturing equipment, is experiencing strong business growth driven by the AI megatrend, highlighting the company's significant position in a rapidly evolving market.

- Increased Market Recognition: The widespread application of AI technologies has led to a notable increase in demand for Nova's products, further solidifying its leadership in the semiconductor industry.

- Rising Investor Interest: Being named IBD Stock Of The Day reflects heightened investor recognition of Nova's future growth potential, which could drive stock price appreciation.

- Strategic Market Positioning: The company's robust performance in AI-related sectors indicates a strategic alignment with market trends, likely attracting more investor attention moving forward.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy NVMI?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on NVMI

Wall Street analysts forecast NVMI stock price to fall over the next 12 months. According to Wall Street analysts, the average 1-year price target for NVMI is 355.25 USD with a low forecast of 335.00 USD and a high forecast of 390.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

7 Analyst Rating

5 Buy

2 Hold

0 Sell

Moderate Buy

Current: 426.710

Low

335.00

Averages

355.25

High

390.00

Current: 426.710

Low

335.00

Averages

355.25

High

390.00

About NVMI

Nova Ltd, former Nova Measuring Instruments Ltd,is an Israel based company which provides metrology solutions for the semiconductor manufacturing industry. The Company offers in-line Optical and x-ray stand-alone metrology systems, as well as integrated optical metrology systems, which are attached directly to wafer fabrication process equipment. Its metrology systems measure various film thickness and composition properties, as well as critical-dimension (CD) variables during various front-end and back-end of line steps in the semiconductor wafer fabrication process. Its product portfolio includes a set of in-situ, integrated and stand-alone metrology platforms suited for dimensional, films and material metrology measurements for process control across multiple semiconductor manufacturing process steps. Its products include NovaScan 2040, NovaScan 3090Next, Nova i500, Nova T500, Nova T600, Nova V2600 TSV metrology system among others.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Share Reduction: Harel Insurance disclosed on February 3, 2026, that it sold 4,177,000 shares of the Invesco KBW Bank ETF (KBWB), amounting to an estimated $330 million transaction, indicating a diminished confidence in this investment.

- Market Impact: The sale resulted in a $326.68 million decline in the value of its KBWB position, reflecting negative market movements and raising concerns about the future profitability of the banking sector amid changing interest rates.

- Strategic Shift: While reducing its KBWB holdings, Harel Insurance increased investments in healthcare (TEVA and XLV) and technology (GOOGL, NVMI, and SMH), suggesting a strategic pivot towards sectors expected to benefit from improving economic conditions and rising corporate spending on AI.

- ETF Performance Overview: As of February 2, 2026, KBWB was priced at $87.64, up 26.2% over the past year; however, in a declining interest rate environment, the potential for modest gains in bank ETFs like KBWB may necessitate cautious investor evaluation of future market performance.

See More

- Share Sale Scale: Harel Insurance disclosed in its SEC filing on February 3, 2026, that it sold 4,177,000 shares of the Invesco KBW Bank ETF (KBWB), with an estimated transaction value of approximately $330 million, reflecting its sensitivity to market dynamics.

- Asset Management Changes: This transaction resulted in a decline of $326.68 million in Harel's quarter-end position value, indicating a 2.9% negative impact on its assets under management (AUM), suggesting a need for reevaluation of its investment strategy.

- Portfolio Adjustment Strategy: Following the sale of KBWB shares, Harel holds only 620 shares valued at about $52,000, indicating a potential shift towards increasing investments in healthcare and technology sectors to navigate economic uncertainties.

- Market Environment Impact: With two rate cuts by the Federal Reserve, investors are cautious about the future performance of bank ETFs like KBWB, anticipating that lower interest rates will pressure banks' net interest margins and profits, potentially leading to slower growth in ETF returns.

See More

Market Opening: U.S. stock markets are set to open in two hours.

Nextpower Inc. Performance: Nextpower Inc. Cl A (NXT) saw a 12.4% increase in pre-market trading.

Seagate Technology Performance: Seagate Technology Holdings PLC (STX) experienced a 9.1% rise in pre-market trading.

Overall Market Sentiment: The pre-market gains indicate positive sentiment among investors ahead of the market opening.

See More

- Conference Participation: Nova's CFO Guy Kizner will present at the 28th Annual Needham Growth Conference on January 14, 2026, where he is expected to discuss the company's future growth opportunities and strategic direction.

- Live Webcast: The event will be available via a live webcast on Nova's Investor Relations website, enhancing real-time investor access to company updates and increasing transparency and investor confidence.

- One-on-One Meetings: Management will be available for in-person meetings on January 13 and 14, aimed at strengthening investor relations and fostering potential investment opportunities.

- Industry Position: As a leading innovator in semiconductor manufacturing, Nova provides high-performance metrology solutions that help customers improve product yields and market responsiveness, further solidifying its competitive advantage in the industry.

See More

- Earnings Release Schedule: Nova expects to release its Q4 and full-year 2025 financial results before the Nasdaq opens on February 12, 2026, highlighting the company's commitment to transparency and investor communication.

- Conference Call Details: CEO Gaby Waisman and CFO Guy Kizner will host a conference call at 8:30 a.m. Eastern Time on the same day to analyze financial performance and engage with investors, enhancing stakeholder relations.

- Replay Availability: The conference call will be available for replay from February 12 to 19, 2026, ensuring that investors who cannot attend live can access critical information, thereby strengthening investor relations.

- Global Business Context: As a leading innovator in semiconductor manufacturing, Nova's financial results will provide important insights into its performance in high-precision metrology and process control solutions, as well as its future growth potential.

See More

- AI-Driven Demand Surge: Nova, as a supplier of semiconductor manufacturing equipment, is experiencing strong business growth driven by the AI megatrend, highlighting the company's significant position in a rapidly evolving market.

- Increased Market Recognition: The widespread application of AI technologies has led to a notable increase in demand for Nova's products, further solidifying its leadership in the semiconductor industry.

- Rising Investor Interest: Being named IBD Stock Of The Day reflects heightened investor recognition of Nova's future growth potential, which could drive stock price appreciation.

- Strategic Market Positioning: The company's robust performance in AI-related sectors indicates a strategic alignment with market trends, likely attracting more investor attention moving forward.

See More