Medline Inc. IPO Raises Over $7 Billion, Analysts Initiate Coverage

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 12 2026

0mins

Should l Buy MDLN?

Source: Benzinga

- IPO Success: Medline closed its IPO in December 2025, raising over $7 billion by offering 248.44 million shares at $29 each, marking the largest IPO globally in 2025 and significantly enhancing its market position.

- Market Leadership: Analysts highlight Medline's leadership in the U.S. medical-surgical product manufacturing and distribution sector, projecting sustainable high-single-digit organic growth driven by market share gains and strong demand.

- Positive Analyst Ratings: Firms like Bank of America and BTIG initiated coverage with 'Buy' ratings and a price target of $50, indicating a 23% potential upside, reflecting strong market confidence in Medline's growth prospects.

- Enhanced Financial Flexibility: Post-IPO, Medline plans to pay down $4 billion in debt, leaving approximately $1 billion for potential M&A or international expansion, further solidifying its competitive edge in a $375 billion addressable market.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy MDLN?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on MDLN

Wall Street analysts forecast MDLN stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for MDLN is 47.92 USD with a low forecast of 42.00 USD and a high forecast of 52.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

14 Analyst Rating

13 Buy

1 Hold

0 Sell

Strong Buy

Current: 44.720

Low

42.00

Averages

47.92

High

52.00

Current: 44.720

Low

42.00

Averages

47.92

High

52.00

No data

About MDLN

Medline Inc. is a provider of medical-surgical products and supply chain solutions serving all points of care. The Company delivers mission-critical products used daily across the full range of care settings, from hospitals and surgery centers to physician offices and post-acute facilities. It operates through two segments: Medline Brand and Supply Chain Solutions. These segments offer approximately 335,000 medical-surgical products, including surgical and procedural kits, gloves and protective apparel, urological and incontinence care, wound care, and consumable lab and diagnostics products. Its Medline Brand products are organized into three product categories: Front Line Care, Surgical Solutions, and Laboratory and Diagnostics. The Supply Chain Solutions segment procures and distributes a variety of third-party products from national brands and also provides tailored logistics and supply chain optimization services to domestic and international consumers.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- IPO Financing Scale: Medline's IPO successfully raised $6.3 billion at a price of $29 per share, significantly enhancing the company's capital structure, with plans to use the proceeds to pay down $16.5 billion in debt, thereby improving financial health.

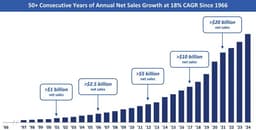

- Sales Growth Momentum: Since its founding in 1966, Medline has achieved an average annual sales growth of 18%, with projections indicating sales will reach $30 billion by 2026, demonstrating strong growth potential in the medical supply market, particularly given the resilience of healthcare demand amid economic uncertainties.

- Market Competitive Advantage: With 335,000 products and 33 manufacturing facilities, Medline offers next-day delivery to 95% of U.S. customers, leveraging its private label products to enhance margins and solidify its leadership position in the medical product supply chain.

- Superior Financial Performance: Medline boasts a gross margin of approximately 27.4%, significantly higher than key competitors, and is projected to generate $1.5 billion in free cash flow in 2025, showcasing its profitability and cash flow generation capabilities, further enhancing its investment appeal.

See More

- Successful IPO: Medline went public on December 17, 2025, at Nasdaq, marking the largest private equity-backed IPO in U.S. history by raising over $7 billion, demonstrating strong market demand for medical supplies.

- Stock Performance: Since its debut, Medline's stock has surged nearly 30%, reflecting investor confidence in its growth potential and providing a positive signal for future IPOs of private equity-backed companies.

- Private Equity Market Dynamics: The number of global private equity exits rose 5.4% last year to 3,149, yet the total deal value declined by 21.2% year-over-year to $412.1 billion, indicating pressure and recalibration within the industry amid high interest rates.

- Investor Confidence: Due to stalled exits over recent years, private equity fundraising declined by 11% in 2025 to $490.81 billion, leading limited partners to be cautious about reinvesting, reflecting concerns over future investment returns.

See More

- Recovery of Deal Cycle: Blackstone's COO Jonathan Gray stated that the global deal cycle has hit 'escape velocity', with accelerating IPO and M&A activities indicating a market resurgence, particularly driven by rising investments tied to artificial intelligence.

- Surge in IPO Activity: According to Blackstone, global IPO issuance surged 40% year-over-year in the fourth quarter, with a staggering 2.5-fold increase in the U.S. market, reflecting strong demand from investors for new public offerings.

- Improved Liquidity: Gray noted that the return of exits is enhancing limited partner liquidity, as capital and gains return, making it easier for limited partners to allocate more capital to Blackstone, thereby reigniting the capital flywheel.

- Earnings Report Performance: Despite reporting fourth-quarter revenue of $3.94 billion, down 5% year-over-year, Blackstone's distributable earnings reached $2.2 billion, exceeding analyst expectations, showcasing the company's resilience in adversity, even as its stock fell by 2.62%.

See More

- Rating Downgrade: Goldman Sachs analyst Katherine Murphy initiated coverage of Super Micro Computer (NASDAQ:SMCI) on January 13 with a Sell rating and a price target of $26, reflecting a pessimistic outlook that may lead to decreased investor confidence.

- Merger Approval: Shareholders of Huntington Bancshares (NASDAQ:HBAN) and Cadence Bank approved their pending merger on January 6, which is expected to enhance market competitiveness and resource integration, driving future business growth.

- Analyst Support: Multiple analysts initiated coverage of Medline Inc. (NASDAQ:MDLN) on January 12 with bullish ratings, indicating a positive market sentiment towards the company's prospects that could attract more investor interest.

- Market Reaction: Super Micro Computer's shares jumped 11.1% to settle at $32.66 on Friday, indicating mixed market reactions to Jim Cramer's sell recommendation, which may influence subsequent investment decisions.

See More

- Super Micro Computer Rating: Analysts have rated Super Micro Computer as a sell, indicating concerns about its future performance, which could lead to decreased investor confidence and negatively impact its stock price.

- Alkermes Stock Recommendation: Alkermes has been rated as not recommended by analysts, reflecting skepticism about its growth potential, which may affect its ability to raise capital and overall market performance.

- Medline Investment Outlook: Medline is strongly recommended as a buy by analysts, who describe its stock performance as 'unbelievable', potentially attracting more investor interest and driving its stock price higher.

- STMicroelectronics Investment Advice: STMicroelectronics is viewed as cheap and performing well, with analysts suggesting a buy, which could attract value investors and enhance its market position.

See More

- IPO Success: Medline closed its IPO in December 2025, raising over $7 billion by offering 248.44 million shares at $29 each, marking the largest IPO globally in 2025 and significantly enhancing its market position.

- Market Leadership: Analysts highlight Medline's leadership in the U.S. medical-surgical product manufacturing and distribution sector, projecting sustainable high-single-digit organic growth driven by market share gains and strong demand.

- Positive Analyst Ratings: Firms like Bank of America and BTIG initiated coverage with 'Buy' ratings and a price target of $50, indicating a 23% potential upside, reflecting strong market confidence in Medline's growth prospects.

- Enhanced Financial Flexibility: Post-IPO, Medline plans to pay down $4 billion in debt, leaving approximately $1 billion for potential M&A or international expansion, further solidifying its competitive edge in a $375 billion addressable market.

See More