Materialise Schedules Q4 2025 Financial Results Release

- Earnings Release Schedule: Materialise NV will release its financial results for Q4 2025 on February 19, 2026, at 2:30 a.m. ET, reflecting the company's ongoing commitment to transparency and investor communication.

- Management Conference Call: Senior management will hold a conference call on the same day at 8:30 a.m. ET to discuss the financial results, aiming to enhance investor confidence through direct communication and provide deeper financial insights.

- Webcast Access: Investors can access the live audio webcast of the conference call through the company's website, ensuring that all stakeholders can obtain key information in real-time, thereby improving information accessibility and transparency.

- Industry Leadership: As a global leader in 3D-printed medical devices and software, Materialise's financial results will provide critical data supporting its ongoing innovation and market leadership across multiple sectors, including healthcare, automotive, and aerospace.

Trade with 70% Backtested Accuracy

Analyst Views on MTLS

About MTLS

About the author

- Earnings Release Schedule: Materialise NV will release its financial results for Q4 2025 on February 19, 2026, at 2:30 a.m. ET, reflecting the company's ongoing commitment to transparency and investor communication.

- Management Conference Call: Senior management will hold a conference call on the same day at 8:30 a.m. ET to discuss the financial results, aiming to enhance investor confidence through direct communication and provide deeper financial insights.

- Webcast Access: Investors can access the live audio webcast of the conference call through the company's website, ensuring that all stakeholders can obtain key information in real-time, thereby improving information accessibility and transparency.

- Industry Leadership: As a global leader in 3D-printed medical devices and software, Materialise's financial results will provide critical data supporting its ongoing innovation and market leadership across multiple sectors, including healthcare, automotive, and aerospace.

Materialise NV: The company specializes in 3D printing software and services, holds a Zacks Rank #1, and has seen a 33.3% increase in earnings estimates over the past 60 days, with shares up 2% in three months.

Calix, Inc.: This cloud and software platform provider also has a Zacks Rank #1, with a 15.4% rise in earnings estimates in the last 60 days, and its shares increased by 12.7% over six months.

Alcoa Corporation: A producer of aluminum products, Alcoa has a Zacks Rank #1 and a 6.1% increase in earnings estimates recently, with shares soaring 44.3% in three months.

Investment Insights: Zacks Investment Research is preparing to release its top 10 stock picks for 2026, following a history of significant gains, and encourages investors to download their latest recommendations.

Zacks Rank #1 Stocks: Five stocks have been added to the Zacks Rank #1 (Strong Buy) List, including James River Group Holdings, Calix, Materialise NV, America Movil, and Norwood Financial Corp., all of which have seen significant increases in their earnings estimates over the past 60 days.

Earnings Estimate Increases: The earnings estimates for these companies have risen by 10.5% (James River), 15.4% (Calix), 33.3% (Materialise), 7.8% (America Movil), and 16.6% (Norwood) during the same period.

Top Picks for 2026: Zacks is preparing to release its top 10 stock picks for 2026, with a historical performance of +2,530.8% from 2012 to November 2025, significantly outperforming the S&P 500.

Free Stock Analysis Reports: The article offers free stock analysis reports for the highlighted companies, encouraging readers to download them for more insights.

Validea's Upgrade for Materialise NV: Validea's Price/Sales Investor model, based on Kenneth Fisher's strategy, upgraded Materialise NV (MTLS) from a rating of 68% to 80%, indicating increased interest in the stock due to its strong fundamentals and valuation.

Company Overview: Materialise NV is a Belgium-based software company specializing in 3D printing services and solutions across various industries, including healthcare, automotive, and aerospace, with a global presence.

Kenneth Fisher's Investment Philosophy: Kenneth Fisher, a prominent money manager and author, is known for popularizing the price/sales ratio as a method for identifying attractive stocks, emphasizing a contrarian approach to investing.

Validea's Research Service: Validea provides investment research based on the strategies of renowned investors like Warren Buffett and Benjamin Graham, aiming to help investors identify stocks that have historically outperformed the market.

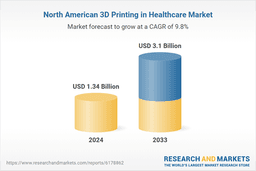

Market Growth Projection: The North America 3D Printing in Healthcare Market is expected to grow from US$ 1.34 billion in 2024 to US$ 3.1 billion by 2033, with a CAGR of 9.75% driven by personalized medical solutions and advancements in biocompatible materials.

Key Applications and Innovations: Major applications include customized surgical models, implants, and prosthetics, with the U.S. leading due to its advanced healthcare system and regulatory support, fostering innovation in 3D printing technologies.

Challenges to Adoption: High initial costs and complex regulatory frameworks pose significant challenges to widespread adoption, particularly for smaller healthcare facilities, which may limit access to advanced 3D printing technologies.

Future Outlook: Despite challenges, the integration of machine learning and AI into 3D printing processes, along with the expiration of patents, is expected to enhance market growth and innovation in personalized healthcare solutions.