Legence Prices Upsized Secondary Offering of 8.4M Shares at $45 Each

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Dec 12 2025

0mins

Should l Buy LGN?

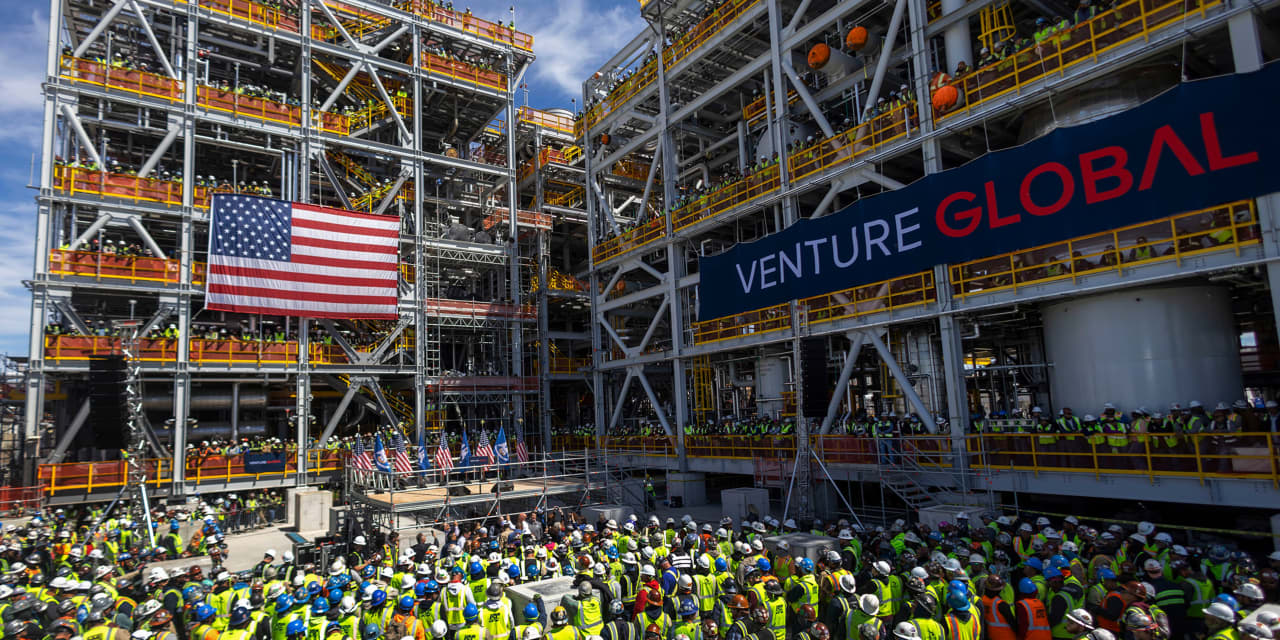

Source: Newsfilter

- Upsized Offering: Legence Corp. announced the pricing of an upsized secondary offering of 8,402,178 shares at $45 each, reflecting strong market demand, with the offering expected to close on December 16, 2025.

- Underwriter Participation: The offering is led by Goldman Sachs and Jefferies, with participation from multiple financial institutions, indicating strong market confidence in Legence, which may support future financing opportunities for the company.

- No Proceeds for Company: Legence will not receive any proceeds from the offering as all shares are sold by stockholders affiliated with Blackstone, allowing the company to maintain focus on its core operations rather than capital raising.

- Market Positioning: Legence specializes in engineering and maintenance services for technically demanding sectors, serving over 60% of the Nasdaq-100 Index clients, showcasing its strong competitive position and potential for sustained growth.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy LGN?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on LGN

Wall Street analysts forecast LGN stock price to fall

11 Analyst Rating

10 Buy

1 Hold

0 Sell

Strong Buy

Current: 51.380

Low

37.00

Averages

45.40

High

54.00

Current: 51.380

Low

37.00

Averages

45.40

High

54.00

About LGN

Legence Corp. is a provider of engineering, installation and maintenance services for mission-critical systems in buildings. The Company operates through two segments: Engineering & Consulting, and Installation & Maintenance. Its Engineering & Consulting segment designs heating, ventilation and air conditioning (HVAC) and other mechanical, electrical and plumbing (MEP) systems for buildings, develops strategies to help reduce energy usage and make buildings more sustainable and provides program and project management services for clients’ installation and retrofit projects. Its Installation & Maintenance segment fabricates and installs HVAC systems, process piping and other MEP systems in new and existing industrial, commercial and institutional buildings and provides ongoing preventative and corrective maintenance services for those systems. It focuses on technically demanding buildings sectors, including technology, life sciences, healthcare and education.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Strong Earnings Report: RingCentral reported Q4 earnings of $1.18 per share, surpassing the analyst consensus estimate of $1.14, indicating robust profitability and boosting market confidence in its future performance.

- Sales Beat Expectations: The company posted quarterly sales of $644.033 million, exceeding the analyst consensus of $643.509 million, reflecting its competitive position and sustained customer demand in the market.

- Significant Stock Surge: Following the positive earnings report, RingCentral's stock price jumped 37.3% to $40.35 during Friday's trading session, demonstrating investor optimism regarding the company's growth prospects.

- Shareholder Return Initiatives: The company not only raised its first-quarter guidance but also initiated a quarterly dividend and expanded its share buyback program, highlighting its commitment to shareholder returns and confidence in future cash flows.

See More

- Earnings Release Schedule: Legence Corp. will release its Q4 and full-year 2025 earnings on March 27, 2026, prior to market open, providing investors with crucial financial data and operational insights.

- Conference Call Details: The company will host an earnings conference call at 10:00 am EST on the same day, offering a detailed review of financial results and operations, thereby enhancing transparency and boosting investor confidence.

- Webcast Access: The conference call will be broadcast live on the company's website, allowing investors to listen in real-time through the provided link, ensuring timely information dissemination.

- Replay Availability: A replay of the call will be accessible on the company's website until April 27, 2026, facilitating information access for investors who cannot attend live, thus improving communication efficiency between the company and its investors.

See More

- Upsized Offering: Legence Corp. announced that underwriters fully exercised their option to purchase an additional 1,260,326 shares of its Class A common stock, increasing the total offering to 9,662,504 shares, indicating strong market demand for the company's stock.

- Price Stability: The offering price of $45 per share, despite Legence not selling any shares directly and receiving no proceeds, reflects market recognition of the company's value, which helps maintain stock price stability.

- Strong Underwriter Lineup: Goldman Sachs and Jefferies acted as joint lead book-running managers, with numerous reputable financial institutions involved, showcasing market confidence and support for Legence, thereby enhancing the company's financing capabilities.

- Market Impact: This offering will further strengthen Legence's capital structure; although the company did not directly benefit, the increased liquidity and market attention may pave the way for future strategic investments and business expansion.

See More

- Acquisition Completed: Legence Corp. has successfully completed its acquisition of The Bowers Group for $325 million, marking a significant milestone in its growth strategy and expected to enhance its service capabilities in Northern Virginia and the DC Metro area.

- Diverse Funding Sources: The acquisition was financed through a combination of cash on hand, borrowings from a revolving credit line, a $200 million upsizing of Legence's term loan, and the issuance of approximately 2.55 million shares of Class A common stock, demonstrating the company's financial flexibility and strength.

- Future Growth Potential: With over 40 years of expertise in mechanical, plumbing, and process system solutions, Bowers is expected to enhance Legence's service quality and market share, further solidifying its leadership position in technically demanding sectors.

- Strategic Synergies: This acquisition will not only enhance Legence's service offerings but also drive long-term performance growth by providing more comprehensive solutions to meet customer needs, thereby increasing customer satisfaction.

See More

- Acquisition Completed: Legence has officially completed its acquisition of Bowers Group for $325 million, marking a significant milestone in its growth strategy and expected to enhance its service capabilities in Northern Virginia and the DC Metro area.

- Funding Structure: The acquisition was financed through a combination of cash, borrowings from a revolving credit line, the issuance of approximately 2.55 million shares, and a $200 million upsizing of Legence's term loan, demonstrating the company's financial flexibility and strength.

- Market Positioning: With over 40 years of experience in mechanical, plumbing, and process system solutions, Bowers Group's acquisition enables Legence to offer higher quality services, further solidifying its market position in technically demanding sectors.

- Future Outlook: Legence CEO Jeff Sprau stated that the acquisition will combine both companies' expertise to enhance customer service, indicating that the company is poised for greater success in the future.

See More