Is Investing in the First Trust Indxx Aerospace & Defense ETF (MISL) a Good Idea?

Overview of the ETF: The First Trust Indxx Aerospace & Defense ETF (MISL), launched on October 25, 2022, aims to provide broad exposure to the Aerospace & Defense sector, with assets over $201.27 million and an annual operating expense of 0.6%.

Performance and Holdings: MISL has shown a 34.43% increase this year and a 29.72% rise over the past year, with a concentrated portfolio of about 35 holdings, where the top 10 account for 60.33% of total assets. It holds a Zacks ETF Rank of 2 (Buy), indicating strong potential for investors.

Trade with 70% Backtested Accuracy

Analyst Views on MISL

About the author

Overview of the ETF: The First Trust Indxx Aerospace & Defense ETF (MISL), launched on October 25, 2022, aims to provide broad exposure to the Aerospace & Defense sector, with assets over $201.27 million and an annual operating expense of 0.6%.

Performance and Holdings: MISL has shown a 34.43% increase this year and a 29.72% rise over the past year, with a concentrated portfolio of about 35 holdings, where the top 10 account for 60.33% of total assets. It holds a Zacks ETF Rank of 2 (Buy), indicating strong potential for investors.

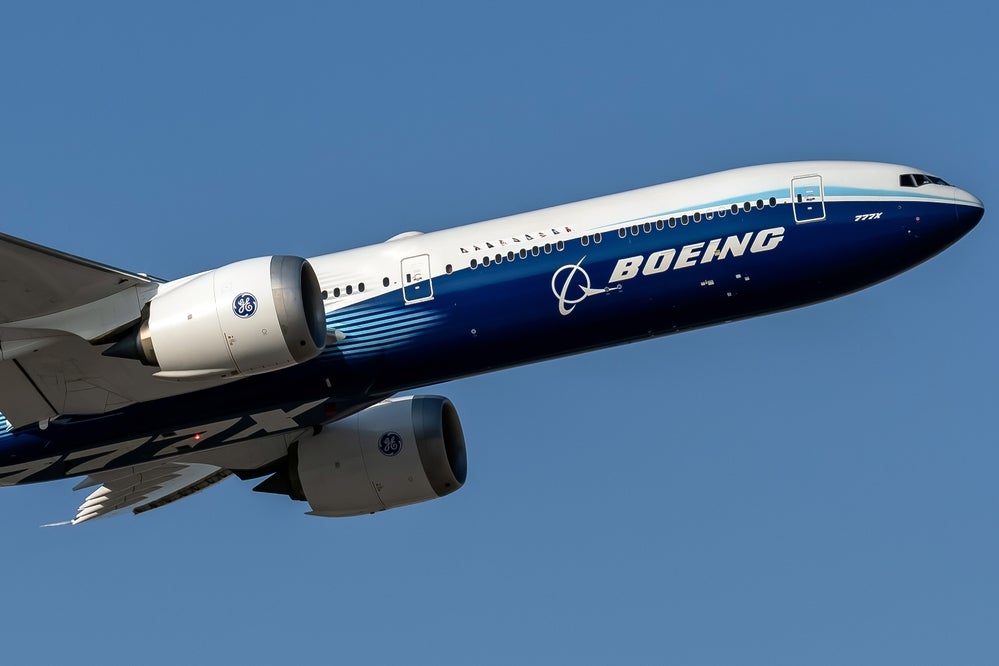

Boeing's Stock Performance: Boeing shares have surged approximately 20% this year, recovering from previous declines, with significant recent orders boosting investor confidence, including a landmark $96 billion deal with Qatar Airways.

Impact of Trade Relations: The company's resurgence is linked to improved international trade relations, particularly with China lifting its ban on Boeing deliveries, and the influence of President Trump's policies, which have positively affected Boeing's market position.

Lockheed Martin's Partnership with Bristow Group: Lockheed Martin's Sikorsky has entered a long-term agreement with Bristow Group to enhance support for its S-92 helicopter fleet, which is vital for offshore energy and search and rescue operations. The deal includes Sikorsky’s Total Assurance Program, providing predictable aftermarket support and access to essential resources.

Financial Performance and Stock Movement: Lockheed Martin reported a 4% year-over-year increase in net sales, reaching $18 billion, and beat earnings expectations with a GAAP EPS of $7.28. Following these announcements, LMT shares rose by 1.94%, reflecting positive investor sentiment.

Analyst Rating and Financial Performance: Truist Securities analyst Michael Ciarmoli maintained a Buy rating on Lockheed Martin with a price target of $579, following a strong first-quarter report showing a 4% increase in net sales to $18 billion and GAAP EPS of $7.28, exceeding expectations.

Future Outlook and Growth Potential: Lockheed Martin anticipates FY25 net sales between $73.75 billion and $74.75 billion, while the current geopolitical climate is expected to drive increased defense spending, enhancing demand for their capabilities and potentially alleviating share price uncertainty.

Boeing's Divestiture: Boeing has agreed to sell parts of its Digital Aviation Solutions division to Thoma Bravo for $10.55 billion, with the deal expected to finalize by the end of 2025 pending regulatory approval.

Company Focus and Performance: Following the sale, Boeing will maintain its core digital capabilities while continuing production of the 737 Max aircraft, having recently secured essential fasteners; the company plans to release its first-quarter financial results on April 23.

Boeing's Market Position: Goldman Sachs analyst Noah Poponak maintains a Buy rating on Boeing with a price target of $213, noting that the impact of halted deliveries from Chinese airlines due to U.S.–China trade tensions will be minimal as China represents only 2% of Boeing's backlog.

Future Prospects: Poponak believes Boeing can redirect its inventory of 737 MAX 8 aircraft intended for China to other Asian markets, particularly India, which shows strong demand for narrowbody jets, allowing Boeing to sustain its delivery schedule without reliance on Chinese orders.