Why Hims & Hers Stock Popped Tuesday, but Eli Lilly and Novo Nordisk Dropped

Written by Emily J. Thompson, Senior Investment Analyst

Updated: May 06 2025

0mins

Should l Buy HIMS?

Source: NASDAQ.COM

Hims & Hers Health Performance: Hims & Hers stock surged 11.2% after reporting a sales beat with a 111% year-over-year increase, despite an earnings miss of $0.20 per share compared to the expected $0.23. The company forecasts continued growth, projecting sales between $2.3 billion and $2.4 billion for the year.

Impact on Competitors: The positive outlook for Hims & Hers is seen as a competitive threat to larger drugmakers like Eli Lilly and Novo Nordisk, whose stocks fell by 3.2% following the news, indicating concerns about sharing future profits in the GLP-1 market.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy HIMS?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on HIMS

Wall Street analysts forecast HIMS stock price to rise

12 Analyst Rating

2 Buy

7 Hold

3 Sell

Hold

Current: 16.690

Low

29.00

Averages

42.88

High

85.00

Current: 16.690

Low

29.00

Averages

42.88

High

85.00

About HIMS

Hims & Hers Health, Inc. provides a consumer-first platform, which helps customers to fulfill their health and wellness needs. Its platform includes access to a provider network, a clinically focused electronic medical record system, digital prescriptions, cloud pharmacy fulfillment, and personalization capabilities. Its digital platform enables access to treatments for a range of chronic conditions, including those related to sexual health, hair loss, dermatology, mental health, and weight loss. It connects patients to licensed healthcare professionals who can prescribe medications when appropriate and prescriptions are fulfilled online through licensed pharmacies on a subscription basis. It also offers access to a range of health and wellness products designed to meet individual needs, which can include curated prescription and non-prescription products. Through its mobile applications, consumers can access a range of educational programs, wellness content, and other services.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Intensifying Market Competition: Novo Nordisk plans to launch its Wegovy drug in vials to counteract pressure from rival Eli Lilly in the rapidly growing weight-loss market, especially after Lilly's introduction of vials for Zepbound in 2024 led to a surge in demand and shortages of its injector pens.

- Flexible Dosing Advantage: The new vial format will offer more flexible dosing compared to prefilled injector pens, although patients will need to manually draw the medication into a syringe, a change aimed at meeting the broader needs of obesity patients and aligning with Novo Nordisk's long-term strategic goals.

- Sales Outlook Downgrade: Novo Nordisk expects adjusted sales growth for 2026 to decline by 5% to 13%, primarily due to the impact of the U.S. “Most Favored Nations” agreement and the expiration of the semaglutide molecule patent in certain international markets, which will negatively affect the company's future revenue.

- Legal Action Update: Novo Nordisk recently filed a lawsuit against Hims & Hers, demonstrating the company's proactive stance in protecting its market share and intellectual property, even as its stock price fell by 0.82% to $48.34 at the time of publication, reflecting market concerns about its future performance.

See More

- Medicare Coverage Goal: CEO Mike Doustdar of Novo Nordisk stated that the company aims to reach about 15 million new patients once Medicare begins covering obesity treatments, although he cautioned that the expansion of coverage is unlikely to happen quickly, indicating challenges in market adoption.

- Significant Price Reductions: Wegovy pills are listed at $149 on the newly launched TrumpRx website, representing an approximately 89% discount from prevailing market prices, while Wegovy and Ozempic pens start at $199, showcasing Novo Nordisk's strategic pricing adjustments in a competitive landscape.

- Increased Competitive Pressure: In contrast, Eli Lilly expects revenues of $80–$83 billion, exceeding Wall Street's forecast of $77.62 billion, indicating strong market performance, which puts pressure on Novo Nordisk to implement strategies to close the gap.

- Stock Price Volatility: Over the past year, Novo Nordisk's stock has declined by 40.41%, closing at $48.74, reflecting market concerns regarding its future growth prospects, particularly amid intensifying competition.

See More

- Market Share Risk: Novo Nordisk's forecast for 2026 indicates potential sales and profit declines of up to 13%, starkly contrasting with Eli Lilly's projected 25% growth, highlighting increasing pressure on the company in the weight loss drug market that could undermine investor confidence.

- Patent Lawsuit and Regulatory Warning: Novo has filed a patent infringement lawsuit against Hims & Hers and received a warning from the FDA regarding misleading advertising, which not only increases legal risks but may also impact the company's brand image and market strategy.

- Patient Growth and New Drug Launch: Despite challenges, Novo's Wegovy drug has attracted 246,000 patients since its January launch, indicating strong market demand that is expected to help the company regain some market share amid competition.

- Future Treatment Options: Novo plans to introduce a higher dose of Wegovy and the next-generation drug CagriSema, which has shown a potential 23% weight loss in clinical trials, potentially aiding the company in reshaping its market position in the future.

See More

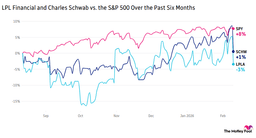

- AI Tax Tool Impact: Altruist's new Hazel AI tax planning tool can analyze 1040 forms, pay, and account statements in minutes, significantly enhancing advisor efficiency, which led to LPL Financial and Charles Schwab shares dropping 8.3% and 7.4% respectively, highlighting the pressure traditional financial services face from AI competition.

- Cloudflare's Strong Performance: Following its 2022 recommendation, Cloudflare reported a 34% year-over-year revenue increase in Q4, with annual contract value growing nearly 50%, and forecasts close to $2.8 billion in revenue for 2026, resulting in a 14% stock price increase in after-hours trading, indicating robust market demand and investor confidence.

- Mattel's Major Decline: Mattel's stock plummeted 30% due to disappointing Q3 results, with the CEO expressing skepticism about the return of toy manufacturing to the U.S., reflecting significant challenges and a loss of market confidence for the company.

- Moderna's Vaccine Application Rejected: The FDA rejected Moderna's application for a seasonal mRNA flu vaccine, causing a 9% drop in pre-market trading, illustrating the substantial impact of regulatory hurdles on biopharmaceutical companies.

See More

- Stock Price Plunge: Hims & Hers Health, Inc. (HIMS) saw an 11% drop in stock price over three days, extending its losing streak to eight sessions, primarily driven by FDA pressure on compounded GLP-1 drugs and a lawsuit from Novo Nordisk, indicating market concerns over its future profitability.

- Price Target Cuts: Deutsche Bank lowered its price target for HIMS from $42 to $31, suggesting about 80% upside potential, while Canaccord reduced its target from $68 to $30 but maintained a 'Buy' rating, reflecting some confidence in a potential rebound despite the challenges.

- Increased Legal Risks: Novo Nordisk has filed a lawsuit against HIMS seeking a permanent ban on its sales of compounded semaglutide products, alleging patent infringement and unlawful mass marketing of unapproved drugs, which adds another layer of operational uncertainty for HIMS.

- Market Sentiment Shift: Despite regulatory pressures, retail sentiment for HIMS on Stocktwits remains 'extremely bullish', with users suggesting the stock is near its bottom and could rebound following the upcoming earnings report, reflecting investor optimism about the company's future.

See More

- Significant Research Findings: Hoth Therapeutics' study revealed that GDNF led to a 10% to 15% reduction in weight gain in female mice on a high-fat diet over 12 weeks, while semaglutide showed no meaningful effects, indicating GDNF's potential in weight management.

- Liver Health Improvement: The GDNF treatment resulted in a 20% to 30% reduction in liver weight and effectively prevented fat accumulation, highlighting its applicability in addressing obesity-related fatty liver disease, which could introduce new treatment options to the market.

- Positive Market Reaction: Although HOTH shares rose over 5% in pre-market trading, they fell 6% after the opening bell, reflecting initial investor optimism regarding the GDNF study results and the potential for new therapies in the obesity treatment landscape.

- Future Research Plans: Hoth intends to conduct further studies to better understand GDNF's mechanisms, with clinical trials targeted for 2027, aiming to drive innovation in the obesity treatment sector and enhance the company's competitiveness in the rapidly growing weight-loss drug market.

See More