GXO Logistics Q2: Revenue Gains Offset By Profit Margin Squeeze

GXO Logistics Q2 Performance: GXO Logistics reported a 19% year-over-year increase in second quarter revenue to $2.85 billion, surpassing expectations, while organic revenue rose 2%. The company also secured $270 million in annualized revenue from new business and achieved a twelve-month high pipeline of $2.3 billion.

Future Outlook and Growth Plans: The company reaffirmed its FY24 outlook with expected organic revenue growth of 2% to 5% and adjusted EBITDA between $805 million and $835 million. CEO Malcolm Wilson highlighted growth initiatives in Germany and the completion of the Wincanton acquisition to expand into aerospace and defense sectors in Europe.

Trade with 70% Backtested Accuracy

Analyst Views on CSD

About the author

Earnings Report: Kyndryl Holdings reported a second-quarter adjusted earnings per share of 38 cents, surpassing analyst expectations, while revenues of $3.721 billion slightly missed estimates, reflecting a 1% year-over-year decline.

AI Expansion: The company is expanding its AI services with new technology hubs in the U.K., France, Singapore, and an AI Innovation Lab in India, with 25% of recent signings being AI-related.

Share Buyback: Kyndryl repurchased 2.9 million shares for $89 million in the second quarter and has approved an additional $400 million for share buybacks, while maintaining a strong cash position of $1.33 billion.

Future Outlook: For fiscal year 2026, Kyndryl anticipates a 1% revenue growth, projecting approximately $15.20 billion in revenue, and aims to achieve sustainable mid-single-digit growth by fiscal year 2028.

GE Vernova's Gas Turbine Supply: GE Vernova Inc. plans to supply seven high-efficiency 7HA.02 gas turbines for a new natural gas-powered data center campus in Pennsylvania, which will repurpose the former Homer City Generating Station and is expected to begin construction this year.

Economic Impact and Emission Reduction: The project aims to create over 10,000 construction jobs and 1,000 permanent positions, while cutting emissions by 60–65% per megawatt-hour, supporting the growing demand for AI and high-performance computing.

Analyst Price Target Increase: BofA Securities analyst Andrew Obin raised the price target for GE Vernova Inc. to $485 from $415, maintaining a Buy rating despite the company reporting revenue growth of 5% year-over-year but missing consensus estimates.

Future Outlook and Challenges: GE Vernova reaffirmed its 2025 outlook with projected revenues of $36-$37 billion, while facing challenges such as increased R&D spending and lower first-quarter EBITDA guidance, although orders exceeded expectations at $13.2 billion.

GXO Logistics Partnership: GXO Logistics has partnered with The Perfume Shop to provide weekly deliveries to over 200 stores using a shared transport network, which enhances delivery efficiency and reduces CO2 emissions and urban congestion.

Recent Developments: The company also established a long-term partnership with Calliope in Italy for various logistics services, while its stock saw a 1.59% increase, closing at $43.55.

Analyst Upgrade: Stifel analyst Selman Akyol upgraded DT Midstream, Inc. (DTM) to a Buy rating and raised the price target to $106, citing the recent stock pullback as a buying opportunity and highlighting the company's upcoming natural gas pipeline acquisition which will enhance its market position.

Financial Projections: The acquisition is expected to increase DTM's EBITDA beyond $1 billion and diversify its customer base, with anticipated free cash flow after dividends rising to approximately $240 million by year-end 2025, despite a slight increase in leverage.

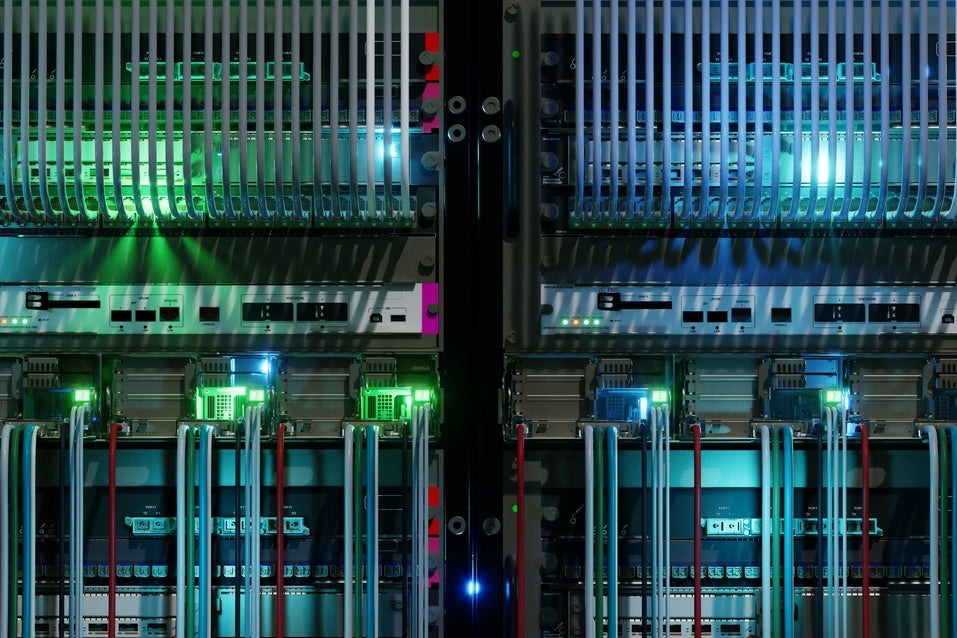

Partnership Expansion: Kyndryl Holdings has expanded its partnership with Nokia to provide advanced data center networking solutions, combining Kyndryl's expertise in hybrid cloud management with Nokia's secure networking technologies.

Integration and Benefits: The collaboration will integrate Nokia’s Event-Driven Automation technology with Kyndryl's Bridge platform to enhance network automation and management, helping enterprises modernize their data center networks while addressing regulatory requirements and technology transformation needs.