First Guaranty Bancshares (FGBI) Reports Q1 Loss, Tops Revenue Estimates

Earnings Report Overview: First Guaranty Bancshares (FGBI) reported a quarterly loss of $0.54 per share, significantly below the Zacks Consensus Estimate of $0.17, marking an earnings surprise of -417.65%. Despite this, the company exceeded revenue expectations with $24.58 million for the quarter.

Future Outlook and Industry Context: The stock currently holds a Zacks Rank #3 (Hold), indicating it is expected to perform in line with the market. Investors are advised to monitor earnings estimate revisions and industry performance, as the Banks - Southeast sector ranks in the top 20% of Zacks industries.

Trade with 70% Backtested Accuracy

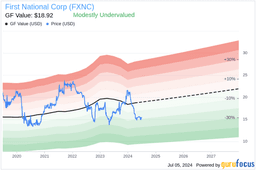

Analyst Views on FXNC

About FXNC

About the author

- Banking Offices Reduction: First National Corporation has announced a reduction in its banking offices from 33 to 28 locations.

- Strategic Decision: This decision is part of a strategic move to streamline operations and improve efficiency within the organization.

Strategic Branch Optimization: First Bank has announced a new plan aimed at optimizing its branch network to enhance operational efficiency and customer service.

Focus on Customer Experience: The initiative is designed to improve the overall customer experience by strategically positioning branches in high-demand areas.

Cost Efficiency Measures: The bank aims to reduce costs associated with underperforming branches while reallocating resources to more profitable locations.

Long-term Growth Strategy: This optimization plan is part of First Bank's broader strategy for sustainable growth and adapting to changing market conditions.

- Earnings Per Share Growth: First National Bank reported a Q4 GAAP EPS of $0.61, a significant increase from $0.00 a year prior, reflecting enhanced profitability and restored market confidence.

- Slight Decline in ROA: The return on average assets stood at 1.06%, a slight decrease from 1.09% in the previous quarter but still higher than 0.18% a year ago, indicating stability in asset management.

- Significant Loan Growth: The bank experienced a loan growth of $16.3 million for the quarter, translating to an annualized growth rate of 4.6%, suggesting increased activity in the lending market that could boost future revenues.

- Improved Asset Quality: Non-performing assets declined to 0.32% of total loans, demonstrating effective risk management and asset quality control measures, which enhance investor confidence.

- Quarterly Net Income Surge: First National Corporation reported a net income of $5.5 million for Q4 2025, rebounding significantly from a loss of $1 million in the same quarter last year, demonstrating a strong financial recovery post-Touchstone integration that boosts investor confidence.

- Earnings Per Share Growth: The company achieved a basic earnings per share of $1.97 for the full year 2025, up 97% from $1.00 in 2024, reflecting successful strategies in customer retention and loan growth that further enhance shareholder returns.

- Significant Loan Growth: The company experienced a loan growth of $16.3 million in Q4, with an annualized growth rate of 4.6%, supported by a team of experienced bankers in the Richmond, Roanoke, and Staunton markets, strengthening its competitive position.

- Increased Shareholder Returns: The company raised its quarterly dividend by 9.7% in Q4 while growing tangible book value per share by 14%, which not only enhances shareholder investment returns but also lays a foundation for future capital growth.

Financial Performance: First National Corporation reported a net income of $5.05 million for Q2, an increase from $2.44 million in the same quarter last year, driven by growth in net interest income which rose to $18.55 million.

Adjusted Earnings: The adjusted earnings per share (EPS) increased to $0.57 from $0.48 a year ago, despite a rise in provision for credit losses to $911,000 compared to $400,000 in the previous year.

New Leadership Appointment: First National Corporation has appointed Chris Layne as Senior Vice President and Regional Market Executive for Richmond, where he will oversee business banking and development in the area.

Community Commitment: Chris Layne brings over 20 years of banking experience and a strong commitment to community service, aiming to enhance customer relationships and support local businesses through First Bank's services.