Court Approves Asset Purchase Agreements for Del Monte Foods

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 1h ago

0mins

Should l Buy FDP?

Source: Newsfilter

- Asset Purchase Approval: Del Monte Foods Corporation has received court approval for asset purchase agreements covering its vegetable, tomato, refrigerated fruit, and broth businesses, marking a significant milestone in the company's Chapter 11 restructuring process and ensuring brand continuity under new ownership.

- Transaction Details: The agreements involve the sale of Del Monte and S&W brand vegetable and tomato assets to Fresh Del Monte Produce, broth assets to B&G Foods, and shelf-stable fruit business assets to Pacific Coast Producers, with expected closure in Q1 2026.

- Commitment to Service Continuity: The CEO emphasized the company's focus on maintaining service continuity for customers and partners during the transaction period, ensuring a smooth transition for team members and reinforcing the importance of customer relationships.

- Competitive Auction Process: The asset sales were determined through a competitive court-supervised auction process, reflecting market recognition of Del Monte's brand value and future potential, thereby strengthening the company's position in the food industry.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy FDP?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on FDP

About FDP

Fresh Del Monte Produce Inc. is a vertically integrated producer, marketer and distributor of fresh and fresh-cut fruit and vegetables as well as a producer and distributor of prepared food in Europe, Africa and the Middle East. It markets its products under the DEL MONTE brand, MANN brand and other related trademarks. Its segment includes fresh and value-added products, banana, and other products and services. Fresh and value-added products segment includes pineapples; fresh-cut fruit; fresh-cut vegetables, which include fresh-cut salads; melons; vegetables; non-tropical fruit, which includes grapes, apples, citrus, blueberries, strawberries, pears, peaches, plums, nectarines, cherries and kiwis; other fruit and vegetables, avocados, and prepared foods, including prepared fruit and vegetables, juices, other beverages, and meals and snacks. Other products and services segment includes its third-party freight and logistic services business and its Jordanian poultry and meats business.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Asset Purchase Approval: Del Monte Foods Corporation has received court approval for asset purchase agreements covering its Vegetable, Fruit, Tomato, and Broth & Stock businesses, establishing a clear path for the future of its brands and operations.

- Smooth Transition Focus: The CEO emphasized that productive discussions with buyers have commenced to ensure a seamless operational transition for team members, customers, and vendors, while maintaining high-quality food delivery.

- Competitive Auction Outcome: The sale transactions were determined through a competitive court-supervised auction process, representing the highest offers for the company's assets, with expected closure in the first quarter of 2026.

- Commitment to Service Continuity: Del Monte Foods is dedicated to maintaining service continuity during the transaction period, ensuring that customer and partner needs are met, which reflects the company's responsibility and commitment to the market.

See More

- Asset Purchase Approval: Del Monte Foods Corporation has received court approval for asset purchase agreements covering its vegetable, tomato, refrigerated fruit, and broth businesses, marking a significant milestone in the company's Chapter 11 restructuring process and ensuring brand continuity under new ownership.

- Transaction Details: The agreements involve the sale of Del Monte and S&W brand vegetable and tomato assets to Fresh Del Monte Produce, broth assets to B&G Foods, and shelf-stable fruit business assets to Pacific Coast Producers, with expected closure in Q1 2026.

- Commitment to Service Continuity: The CEO emphasized the company's focus on maintaining service continuity for customers and partners during the transaction period, ensuring a smooth transition for team members and reinforcing the importance of customer relationships.

- Competitive Auction Process: The asset sales were determined through a competitive court-supervised auction process, reflecting market recognition of Del Monte's brand value and future potential, thereby strengthening the company's position in the food industry.

See More

- Asset Purchase Agreements: Del Monte Foods has reached asset purchase agreements with three successful bidders covering its Vegetable, Fruit, Tomato, and Broth & Stock businesses, ensuring the continuity of its assets and operations under new ownership, demonstrating the enduring value of its brands.

- Court-Supervised Auction: The transactions are part of a court-supervised auction process and are expected to receive approval from the U.S. Bankruptcy Court for the District of New Jersey on January 28, 2026, with ownership transfer anticipated by the end of Q1 2026 if all conditions are met.

- Strategic Operational Support: CEO Greg Longstreet stated that these transactions create opportunities for the brands and businesses to thrive, with Del Monte Foods committed to supporting its team members, customers, and vendors while delivering high-quality food products.

- Ongoing Customer Service: Throughout the asset transition process, Del Monte Foods will continue to serve customers and fulfill orders, ensuring that its beloved brands remain healthy, delicious, and convenient.

See More

- Asset Purchase Agreements: Del Monte Foods has reached asset purchase agreements with three successful bidders covering its vegetable, tomato, and refrigerated fruit businesses, expected to provide a clear path forward for the company’s assets and operations under new ownership.

- Brand Value Realization: The transactions include the sale of assets related to well-known brands such as Del Monte® and S&W® to Fresh Del Monte Produce Inc., demonstrating the enduring value of Del Monte's brands and enhancing its competitive position in the market.

- Court Approval Process: All transactions are subject to approval by the U.S. Bankruptcy Court in New Jersey, with a hearing scheduled for January 28, 2026, and if approved, the transactions are expected to close by the end of Q1 2026, ensuring a smooth transition of operations.

- Commitment to Ongoing Operations: Despite the asset sale process, Del Monte Foods continues to serve customers and fulfill orders, committing to maintain high-quality food products and support for team members and suppliers during the transition period.

See More

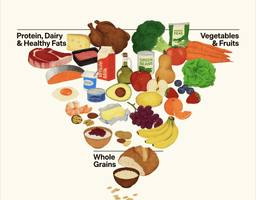

- New Food Pyramid Unveiled: Health Secretary Kennedy's new food pyramid prioritizes protein and dairy, potentially raising consumer food costs to $175 per week, leading to an annual family expenditure of $36,400, which significantly strains household budgets.

- Policy Shift Impact: The new guidelines oppose added sugars and highly processed foods, likely forcing major food companies like PepsiCo and Coca-Cola to adjust product formulations and marketing strategies to align with the government's redefined health standards.

- Meat Companies Benefit: With the new focus on high-protein foods, meat producers such as Tyson Foods and Seaboard Corporation may see increased demand and sales growth, positioning them favorably in the market.

- Health Food Stocks in Focus: As consumer interest in healthy eating rises, stocks associated with health-focused companies like Sprouts Farmers Market and Chipotle may attract investor attention, potentially impacting their market performance.

See More

- Rating Upgrade: Fresh Del Monte's rating increased from 87% to 91% according to Peter Lynch's investment strategy, reflecting improvements in the company's fundamentals and stock valuation, indicating strong market interest in its future growth.

- Industry Position: As a vertically integrated producer of fresh and fresh-cut fruits and vegetables, Fresh Del Monte is enhancing its influence in European, Middle Eastern, and African markets, further solidifying its leadership in the crops industry.

- Product Diversification: The company's offerings include a variety of fresh and value-added products such as pineapples and fresh-cut fruits and vegetables, catering to diverse market demands and enhancing its competitive edge and customer loyalty.

- Financial Health: Fresh Del Monte's robust financial condition and strong balance sheet support its ongoing growth, which is expected to attract more investor attention and elevate its market valuation.

See More