Blue Moon Metals Completes Acquisition of Springer Mine and Processing Plant

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Feb 10 2026

0mins

Should l Buy BMM?

Source: Yahoo Finance

- Acquisition Completed: Blue Moon Metals has successfully closed the acquisition of the Springer critical metals mine and processing plant for a total consideration of $18 million, including a $500,000 initial deposit, marking a significant milestone in the U.S. critical metals market.

- Resource Potential: The acquired assets include historically mined tungsten deposits and a flotation mill previously used for tungsten ore processing, which are expected to support Blue Moon's long-term growth strategy to meet the increasing U.S. tungsten demand.

- Project Progress: Blue Moon is advancing its underground exploration at the Blue Moon mine in California, having completed 128 meters of decline work as part of a $16.5 million phase 1 development program, which is expected to accelerate resource confirmation to support redevelopment plans.

- Strategic Alignment: This acquisition aligns with the initiatives under Section 232 of the Trade Expansion Act aimed at strengthening domestic supply chains for critical minerals, and Blue Moon's expansion will help enhance U.S. mining and processing capabilities.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy BMM?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on BMM

Wall Street analysts forecast BMM stock price to rise

0 Analyst Rating

0 Buy

0 Hold

0 Sell

Current: 5.800

Low

Averages

High

Current: 5.800

Low

Averages

High

About BMM

Blue Moon Metals Inc. is a mineral exploration and development company. The Company is advancing four brownfield polymetallic projects, including the Nussir copper-gold-silver project in Norway, the NSG copper-zinc-gold-silver project in Norway and the Blue Moon zinc-gold-silver-copper project in the United States, and the Springer tungsten-molybdenum project in the United States. All four projects are well located with existing local infrastructure including roads, power and historical infrastructure. The Nussir Property copper-silver-gold mine is located in northern Norway. The NSG copper-zinc-gold-silver project is also located in Nordland County, Norway. The Blue Moon Deposit is located in east central California within Mariposa County in the Foothills. The property is accessible by gravel roads off a nearby paved highway.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Financing Details: Blue Moon Metals announced that its mining contractor LNS has subscribed to 168,514 common shares at a price of $7.208 per share, raising C$1.2 million, with the financing expected to close around March 17, 2026.

- Historical Investment Review: This financing follows LNS's previous investments of C$4.2 million and C$1.13 million made on December 19, 2024, and May 8, 2025, respectively, demonstrating LNS's ongoing confidence and support for the Nussir project.

- Use of Proceeds: The funds raised will be allocated for underground development at the Nussir project, aimed at enhancing production capacity and resource extraction efficiency, thereby strengthening the company's competitive position in the market.

- Project Background: Blue Moon is advancing five polymetallic projects, including Nussir, all located in areas with robust infrastructure, aligning with the global demand for critical metals like zinc, copper, and tungsten essential for economic and national security.

See More

- Financing Details: Blue Moon Metals announced that its mining contractor LNS subscribed to 168,514 common shares at a price of $7.208 per share for the Nussir copper-gold-silver project, with the financing expected to close around March 17, 2026, indicating sustained confidence in the project.

- Historical Financing Review: This financing follows LNS's previous subscriptions of C$4.2 million in December 2024 and C$1.13 million in May 2025, reflecting its long-term commitment and trust in the Nussir project.

- Use of Proceeds: The proceeds from this financing will be allocated to underground development at the Nussir project, which is expected to enhance production capacity and resource extraction efficiency, thereby strengthening the company's competitive position in the polymetallic market.

- Market Outlook: Blue Moon is advancing five polymetallic projects, including Nussir, and with the rising global demand for critical metals like zinc, copper, and tungsten, the company is poised for significant growth in the future.

See More

- Stock Surge: Blue Moon Metals (BMM) saw an 11.5% increase in its stock price on Monday, reaching an all-time high of $5.80, reflecting strong market confidence following its acquisition of the Apex mine.

- Acquisition Details: Under the agreement, Blue Moon will issue 7 million common shares to Teck Resources (TECK), representing 8% of its outstanding shares, while Teck will receive a 0.5% net smelter returns royalty, enhancing its revenue potential in mining.

- Value Chain Integration: Blue Moon aims to integrate its California mine with processing at the Springer complex in Nevada and smelting at Teck's Trail Operations in Canada, creating a fully integrated North American value chain that boosts operational efficiency.

- Strategic Partnership: This deal strengthens Blue Moon's relationship with key shareholder Hartree Partners, which is collaborating with the U.S. government on a $12 billion critical metals stockpile, highlighting Blue Moon's strategic positioning in the critical metals sector.

See More

- Drilling Activity Overview: Blue Moon Metals plans to conduct underground and surface infill and step-out drilling in 2026 across four projects in the U.S. and Norway, aimed at supporting ongoing geological evaluation and project advancement.

- Project Implementation Details: The drilling activities include a program at the Springer Tungsten Mine, which is expected to provide critical mineral resource data that will facilitate further project development.

- Strategic Implications: Through these drilling activities, Blue Moon aims to enhance its competitiveness in the tungsten market and lay the groundwork for future resource development, thereby boosting investor confidence.

- Management Statement: VP Exploration Theodore Veligrakis stated that these drilling activities will provide the necessary geological information to support the company's long-term strategic objectives.

See More

- Drilling Program Scale: Blue Moon Metals plans approximately 40,000 meters of drilling across four projects in 2026, marking the largest drilling initiative in the company's history aimed at advancing mineral resource evaluation and project development.

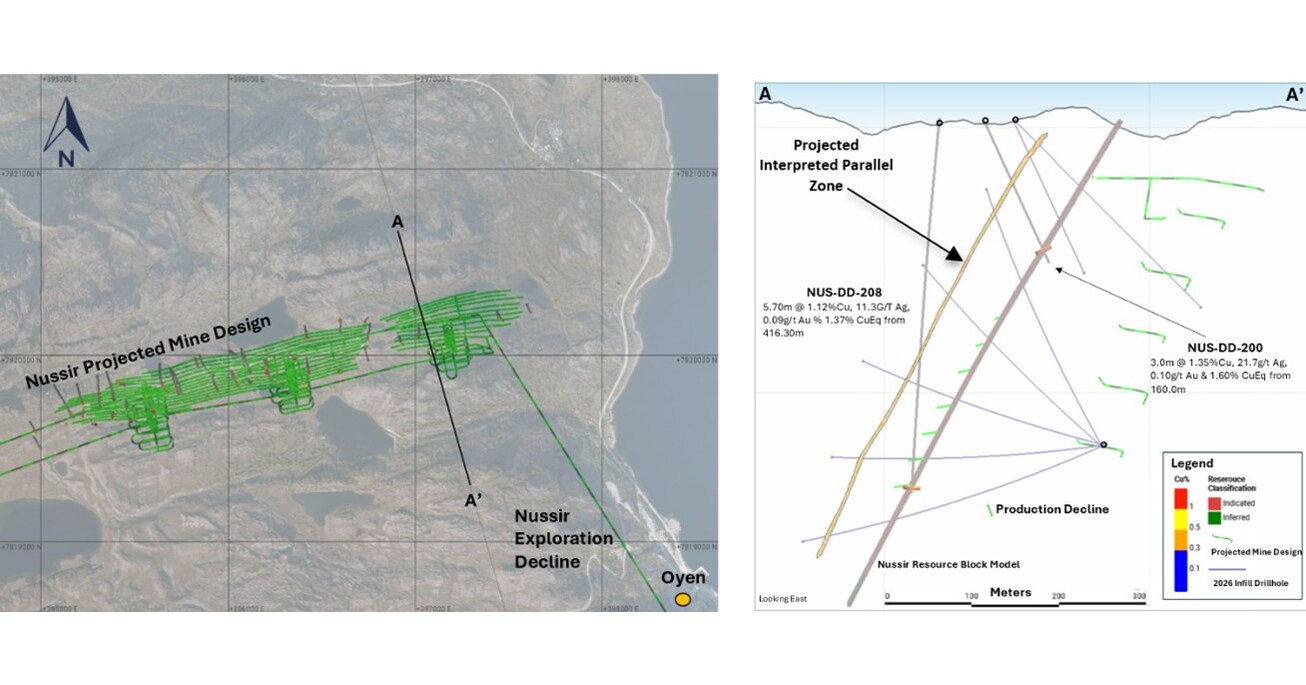

- Nussir Project Progress: At the Nussir Copper-Gold-Silver Project, approximately 3,000 meters of surface drilling and 7,000 meters of underground drilling are planned, targeting the copper-rich portion of the mineralization to support further resource assessment and development.

- Blue Moon Project Update: At the Blue Moon Polymetallic Project in California, a 16,000-meter drilling program is underway, aimed at converting existing inferred resources to indicated resources, which is expected to provide critical data for future detailed studies.

- NSG Project Plans: The NSG Copper-Zinc Project plans approximately 10,000 meters of underground drilling focused on expanding the 9.23 million-ton inferred resource to enhance copper and zinc resource assessments, further driving project development.

See More

- Transaction Completion: Blue Moon Metals has successfully closed the acquisition of the Springer critical metals mine and processing plant, paying a total of $18 million, marking a significant milestone in the critical metals sector and expected to enhance its competitiveness in the U.S. market.

- Resource Potential: The acquired assets include a historically mined tungsten deposit, and with tungsten prices having more than doubled in recent months, Blue Moon plans to accelerate confirmatory drilling to update historical resources, thereby supporting future redevelopment plans.

- Strategic Development: The acquisition aligns with the U.S. strategy to strengthen domestic critical mineral supply chains, and the addition of the Springer Mine will help address the current lack of domestic processing capacity, driving long-term growth in the critical metals sector.

- Underground Development Progress: Blue Moon's underground exploration in California is on track, having completed a 128-meter decline as part of a $16.5 million phase 1 development program, which is expected to further enhance the company's resource development capabilities.

See More