Atlassian Reports Record Q2 2026 Earnings with Strong Cloud Growth

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 3d ago

0mins

Should l Buy TEAM?

Source: seekingalpha

- Record Cloud Revenue: Atlassian achieved its first-ever $1 billion cloud revenue quarter in Q2, representing a 26% year-over-year increase, which signifies robust growth in its cloud business and is expected to further drive future revenue expansion.

- Strong Enterprise Sales: The company recorded over 1,000 customers upgrading to the Teamwork Collection in Q2, purchasing more than 1 million seats, indicating a strong preference for standardizing on the Atlassian system, thereby reinforcing its market position.

- Accelerated AI Adoption: Rovo surpassed 5 million monthly active users, demonstrating the rapid adoption of AI capabilities that are transforming work processes and directly driving business growth and customer demand.

- Long-Term Growth Confidence: Management reaffirmed a target of over 20% compounded annual revenue growth through FY27, along with a commitment to maintain a non-GAAP operating margin above 25%, reflecting confidence in future market opportunities.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy TEAM?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on TEAM

Wall Street analysts forecast TEAM stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for TEAM is 235.57 USD with a low forecast of 185.00 USD and a high forecast of 320.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

23 Analyst Rating

19 Buy

4 Hold

0 Sell

Strong Buy

Current: 98.410

Low

185.00

Averages

235.57

High

320.00

Current: 98.410

Low

185.00

Averages

235.57

High

320.00

About TEAM

Atlassian Corporation is a provider of team collaboration and productivity software. The Company specializes in software development, work management, and enterprise service management software, which enables enterprises to connect their business and technology teams with an artificial intelligence (AI)-powered system of work. Its interconnected portfolio of apps, AI agents, and Collections, each with discrete value propositions, delivers solutions for software teams, IT operations and support teams, leadership, and business teams. Its apps, agents, and Collections are all built on the Atlassian Cloud Platform and data model: a common technology foundation that connects teams, information, and workflows throughout an organization. Its apps include Jira, Confluence, Loom, Jira Service Management, Rovo, Bitbucket, Compass, Jira Product Discovery, Jira Align, Focus and Talent. It offers team collaboration products on its Data Center deployment option. It operates the Dia and Arc browsers.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Tech Stock Decline: Concerns over AI have led to a decline in tech stocks over the past week, putting pressure on the market as investors await crucial economic data and hints from the Federal Reserve regarding potential rate cuts.

- Dow Jones Performance: The Dow Jones closed above 50,000 points for the first time on Friday, posting significant weekly gains, indicating a rotation of funds into other sectors and boosting investor confidence.

- Economic Data Focus: Key economic releases, including the nonfarm payrolls report and consumer price index, are set to be released this week, which could influence the Fed's rate decisions, with markets pricing in the first rate cut potentially in June.

- Stock Movements: Eli Lilly shares rose 2.1% in premarket trading, while Hims & Hers dropped 14% after canceling a weight-loss pill launch due to FDA legal threats, highlighting market sensitivity to regulatory risks.

See More

- Stellantis Loss Warning: Stellantis (NYSE:STLA) plummeted 26.24% this week after the company warned of a full-year net loss, significantly eroding investor confidence and potentially impacting future financing capabilities.

- Gartner Earnings Miss: Gartner (NYSE:IT) fell 25.41% this week following the release of its fourth-quarter financial results and a downward revision of its FY26 guidance, with analysts' pessimistic outlook likely to exert further pressure on the stock.

- Reddit Stock Decline: Reddit (NYSE:RDDT) dropped 23.10% this week as multiple analysts lowered their price forecasts, reflecting market concerns over its profitability and potentially hindering its financing and expansion plans.

- Analyst Downgrades: Several analysts adjusted their price targets downward for these companies, indicating a widespread bearish sentiment regarding their future performance, which may lead investors to reassess their portfolios.

See More

- Market Overreaction: Nvidia CEO Jensen Huang argues that the sell-off in software stocks due to the introduction of AI tools is irrational, as these tools are designed to work alongside existing software rather than replace it, indicating a lack of rationality in the market's pessimism towards the software industry.

- Microsoft's Strong Performance: Microsoft has seen a 160% increase in paid users for its generative AI copilots in products like Microsoft 365, and despite a 27% drop from its high, its adjusted earnings grew by 24% in the last quarter, showcasing the company's robust performance in the AI sector.

- AppLovin's Rapid Growth: AppLovin's Axon machine learning engine provides a competitive edge in its ad tech software, and although its stock is down 52%, its earnings surged by 96% in the last quarter, indicating strong potential in the advertising technology space.

- HubSpot's Innovative Leadership: HubSpot has become the first CRM vendor to integrate its platform with three leading generative AI tools, and despite a 73% decline in stock price, its adjusted earnings increased by 22%, demonstrating its ongoing innovation capabilities in customer relationship management.

See More

- Analyst Rating Maintained: Canaccord Genuity analyst David Hynes maintains a Buy rating on Atlassian (NASDAQ:TEAM) with a price target of $230, indicating confidence in the company's future growth despite current stock price declines due to sector-wide valuation compression.

- Revenue Growth Expectations: Hynes anticipates that Atlassian's fiscal Q2 revenue growth will exceed guidance, potentially enabling the company to raise its full-year cloud targets, thereby enhancing investor confidence in its long-term growth potential.

- Market Reaction Analysis: Despite recent price target cuts from several research firms, including UBS lowering its target from $185 to $145 and BofA from $200 to $170, Hynes believes the company's pricing strategies and product upgrades will improve revenue run rates.

- Competitive Landscape Consideration: While analysts remain optimistic about Atlassian's prospects, the article notes that certain AI stocks may offer greater upside potential and lower downside risk, reflecting changing market preferences for investments across different technology sectors.

See More

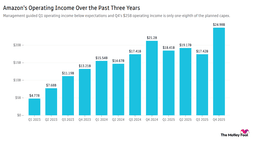

- Amazon's Capital Expenditure Surge: Amazon plans to increase its capital expenditure to $200 billion in 2026, nearly matching its total revenue of $213 billion for Q4, leading to an over 8% drop in stock price during morning trading, indicating market concerns about its financial health.

- Accelerating AWS Growth: CEO Andy Jassy reported a 24% growth rate for AWS, the fastest in 13 quarters, with an annualized revenue of $142 billion; however, management anticipates Q1 operating income will fall short of analyst expectations, reflecting intensified market competition.

- Bitcoin Price Volatility: Bitcoin has dropped 50% from its 2025 peak, falling to around $60,000, which reflects waning confidence in government support for cryptocurrencies, although some analysts suggest this is merely a market correction rather than the end of crypto.

- Severe Market Reactions: Despite a 10% revenue increase in Q3, DOCS and PIDoximity saw their stock plunge over 30% due to declining net income under margin pressure, highlighting investors' acute sensitivity to profitability.

See More

- Significant Revenue Growth: Atlassian reported Q2 revenue of $1.59 billion, surpassing analyst expectations of $1.54 billion, with a year-over-year increase of 23%, showcasing the company's robust performance in cloud services.

- Improved Profitability: Adjusted earnings per share reached $1.22, exceeding the analyst estimate of $1.14, while operating income hit $430.2 million, with an operating margin rising from 26% last year to 27%, reflecting effective cost control and efficiency improvements.

- Strong Cash Flow: The company generated $177.8 million in operating cash flow and $168.5 million in free cash flow during the quarter, ending with $1.6 billion in cash and cash equivalents, providing ample funding for future investments.

- Optimistic Outlook: Atlassian expects Q3 revenue to range between $1.689 billion and $1.697 billion, with cloud revenue projected to grow around 23%, and has raised its fiscal 2026 sales outlook to $6.362 billion, indicating strong confidence in future growth.

See More