Actinium Presents New ATNM-400 Breast Cancer Data Showing Potent Efficacy

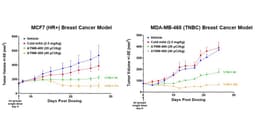

- Potent Anti-Tumor Activity: ATNM-400 demonstrated significant tumor growth inhibition across various breast cancer models, particularly in hormone receptor-positive and triple-negative types, with all treatment regimens well tolerated and no significant weight changes observed, indicating its potential for clinical application.

- Efficacy in Resistant Models: In trastuzumab- and tamoxifen-resistant breast cancer cells, ATNM-400 exhibited enhanced cytotoxicity, and combining it with standard treatments resulted in greater cytotoxicity and tumor regression, showcasing its promise as a combination therapy.

- Mechanistic Evidence of DNA Damage: Treatment with ATNM-400 led to irreversible double-strand DNA breaks in breast cancer cells, activating AKT phosphorylation, which indicates its effective mechanism in resistant models and may provide new options for treating hard-to-treat breast cancer.

- Broad Applicability: Beyond breast cancer, ATNM-400 has shown potential efficacy in prostate cancer and non-small cell lung cancer, supporting its development as a multi-indication targeted radiotherapy to meet clinical needs.

Trade with 70% Backtested Accuracy

Analyst Views on ATNM

About ATNM

About the author

- Investor Attention: As the earnings season unfolds, mid to low market capitalization healthcare stocks are drawing investor attention due to their strong earnings momentum, indicating growing market confidence in this sector.

- Analyst Expectations: The EPS Revision Grade reflects the trend in analyst earnings estimates, with A+ ratings indicating optimistic projections for future performance, potentially driving stock prices higher.

- List of A+ Rated Stocks: Currently, companies such as Aldeyra Therapeutics, Altimmune, Annovis Bio, and Assertio Holdings have received A+ EPS Revision Grades, showcasing their strong performance in the eyes of analysts.

- Market Strategy Impact: These A+ rated healthcare stocks are likely to attract more investor interest, potentially triggering positive sentiment towards the healthcare sector as a whole, thereby enhancing the performance of related ETFs.

- FibroBiologics Outperformance: FibroBiologics, Inc. (FBLG) surged 7.68% in after-hours trading to close at $0.41, indicating speculative interest or technical momentum despite no specific news.

- Nyxoah Earnings Boost Confidence: Nyxoah SA (NYXH) advanced 3.94% to $5.28 after reporting preliminary Q4 and full-year 2025 results, with guidance for Q1 2026 enhancing investor confidence in its growth trajectory.

- Fortress Biotech's Continued Volatility: Fortress Biotech, Inc. (FBIO) climbed 6.90% to $4.49 in after-hours trading, continuing a trend of volatility without any fresh news impacting the stock.

- Revvity Collaboration Drives Growth: Revvity, Inc. (RVTY) posted a 4.92% gain to close at $109.00, as investors digest the January announcement of a collaboration with Eli Lilly to expand access to predictive models via the Revvity Signals platform.

- Strong Anti-Tumor Activity: ATNM-400 demonstrated significant tumor growth inhibition across various breast cancer models, particularly in hormone receptor-positive and triple-negative cases, with all treatment regimens well tolerated and no significant body weight changes observed, indicating its potential clinical value.

- Effectiveness Against Resistant Tumors: The drug induced irreversible DNA damage in standard treatment-resistant breast cancer models, showcasing its unique advantage in addressing resistant tumors and potentially offering new treatment options for patients.

- Broad Applicability: ATNM-400 not only shows strong efficacy in breast cancer but also exhibits promising anti-tumor activity in prostate cancer and non-small cell lung cancer, supporting its potential as a targeted radiotherapy for multiple solid tumors.

- Market Demand Alignment: With an estimated increase to 250,000 women living with metastatic breast cancer by 2030, the development of ATNM-400 aligns perfectly with this growing market need, potentially providing new hope for patients with hard-to-treat breast cancer.

- Potent Anti-Tumor Activity: ATNM-400 demonstrated significant tumor growth inhibition across various breast cancer models, particularly in hormone receptor-positive and triple-negative types, with all treatment regimens well tolerated and no significant weight changes observed, indicating its potential for clinical application.

- Efficacy in Resistant Models: In trastuzumab- and tamoxifen-resistant breast cancer cells, ATNM-400 exhibited enhanced cytotoxicity, and combining it with standard treatments resulted in greater cytotoxicity and tumor regression, showcasing its promise as a combination therapy.

- Mechanistic Evidence of DNA Damage: Treatment with ATNM-400 led to irreversible double-strand DNA breaks in breast cancer cells, activating AKT phosphorylation, which indicates its effective mechanism in resistant models and may provide new options for treating hard-to-treat breast cancer.

- Broad Applicability: Beyond breast cancer, ATNM-400 has shown potential efficacy in prostate cancer and non-small cell lung cancer, supporting its development as a multi-indication targeted radiotherapy to meet clinical needs.

New Treatment for Resistant Cancers: Actinium Pharmaceuticals announced promising preclinical data for ATNM-400, an antibody radioconjugate showing anti-tumor activity in hormone-resistant and HER2-resistant breast cancer, as well as efficacy in prostate and non-small cell lung cancers.

Presentation at SABCS: The data will be presented at the 2025 San Antonio Breast Cancer Symposium, highlighting ATNM-400's potential to overcome resistance to standard therapies like tamoxifen and trastuzumab, and its ability to synergize with existing treatments.

Broad Indication Potential: ATNM-400 demonstrates best-in-class efficacy across multiple solid tumors, with significant opportunities in high-value markets, including prostate cancer and NSCLC, where it has shown superior activity compared to leading therapies.

Innovative Mechanism: Utilizing Actinium-225, ATNM-400 targets a disease-driving protein linked to poor prognosis, offering a novel approach that may improve outcomes for patients with difficult-to-treat cancers, addressing significant unmet clinical needs.

ATNM-400 Overview: Actinium Pharmaceuticals' ATNM-400 is a first-in-class antibody radioconjugate targeting a non-PSMA antigen, demonstrating potent anti-tumor activity and prolonged survival in prostate cancer models resistant to standard therapies like enzalutamide and 177Lu-PSMA-617.

Efficacy and Resistance: Preclinical studies show that ATNM-400 outperforms existing treatments, achieving durable tumor control and complete regression in 40% of cases when combined with enzalutamide, highlighting its potential in overcoming treatment resistance.

Clinical Implications: The novel mechanism of ATNM-400 offers a promising alternative for patients with metastatic castration-resistant prostate cancer (mCRPC) who have limited options due to low or absent PSMA expression, addressing a significant unmet clinical need.

Future Directions: Actinium plans to explore ATNM-400's applications beyond prostate cancer, including non-small cell lung cancer (NSCLC), where it has shown potential to overcome resistance to existing therapies, further expanding its therapeutic impact.