Stock Market Opens Higher Amid Key Updates

Stock Market and Economic Updates

Stock futures showed an upward trend as the week began, with the Nasdaq and S&P 500 gaining momentum. Futures tied to the S&P 500 rose by 0.3%, while Nasdaq futures climbed 0.6%, reflecting optimism as the market looks to build on October's strong performance. The Dow Jones Industrial Average futures also edged up by 0.1%. October had ended on a high note, with the S&P 500 rising 2.3% and the Nasdaq Composite surging 4.7%, marking its seventh consecutive month of gains.

Investor focus this week shifts toward key earnings updates from major corporations. Palantir Technologies (PLTR), a leader in AI-driven software, is set to report earnings later today. Other notable companies including Advanced Micro Devices (AMD) and Super Micro Computer (SMCI) are expected to release their results this week, which could influence broader market trends. Treasury yields showed slight declines, with the 10-year note yield slipping to 4.08%, while Bitcoin remained stable at $108,000.

Global Market Influences

OPEC+ announced over the weekend that it would pause output hikes until the first quarter of 2026, although a modest increase is planned for December. This decision comes after the group had already slowed its production pace in October due to concerns over a potential supply glut. Crude oil futures initially rose following the announcement but reversed course during early trading, reflecting investor uncertainty about demand dynamics.

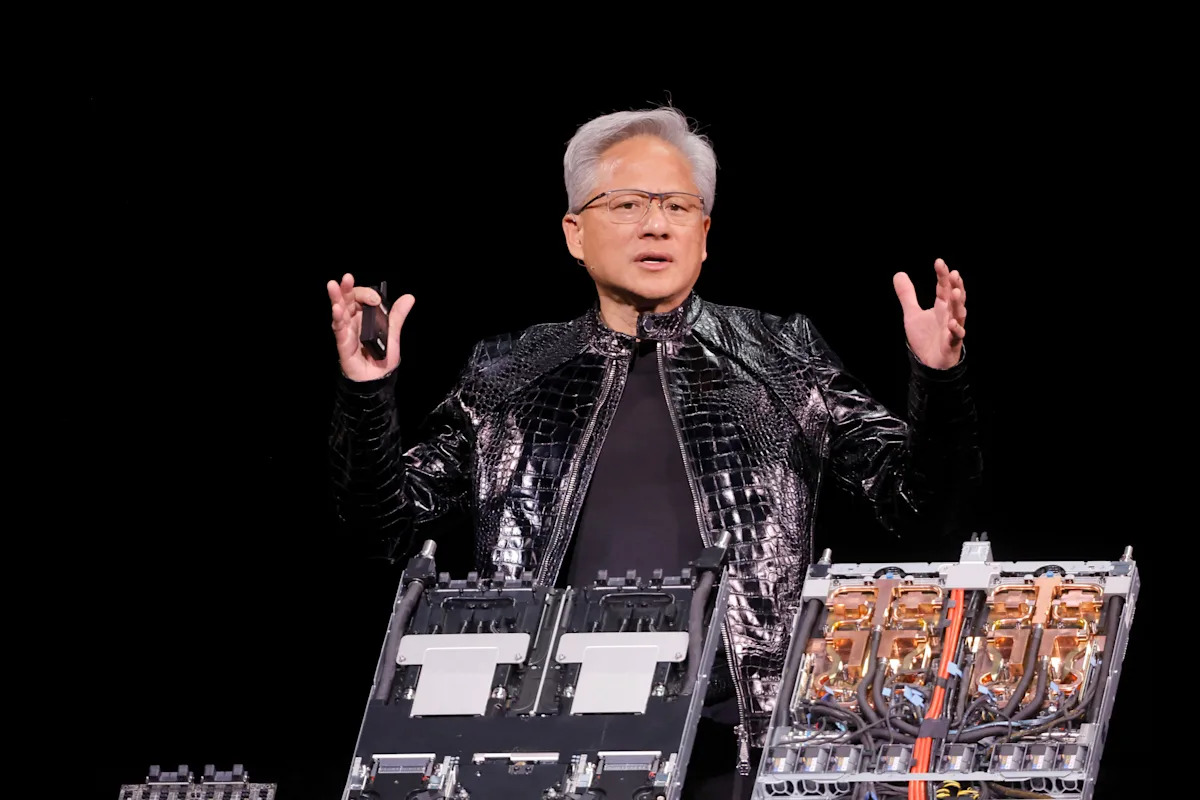

Meanwhile, China announced it would suspend additional rare earth export restrictions, a move welcomed by global markets. The decision also includes halting investigations targeting American semiconductor companies, signaling a potential thaw in U.S.-China trade tensions. Shares of semiconductor firms like Nvidia (NVDA) and Advanced Micro Devices (AMD) saw pre-market gains on the back of this news. The easing of restrictions is expected to provide some relief to the global semiconductor supply chain, which has faced significant disruptions in recent years.

Corporate News Highlights

Kimberly-Clark (KMB) made headlines by announcing its acquisition of Kenvue (KVUE), the maker of Tylenol, in a cash-and-stock deal valued at $48.7 billion. This move positions Kimberly-Clark as a stronger player in the health and wellness sector, creating a combined entity with an estimated value of over $30 billion. However, Kenvue is facing ongoing litigation concerns, which could pose challenges for Kimberly-Clark. The acquisition news sent Kenvue shares soaring 20% pre-market, while Kimberly-Clark’s stock dropped 15% as investors reacted to the deal's financial implications.

Berkshire Hathaway (BRK.A, BRK.B) reported a record cash pile in its latest quarterly update, reaching an all-time high. This development has sparked speculation about Warren Buffett's cautious approach in the current market environment, as the conglomerate refrains from major acquisitions amid elevated valuations. The company's profits improved by 17% over the previous quarter, supported by a mild hurricane season and investment gains. Buffett's gradual transition from his role as CEO is also closely watched as the firm prepares for leadership changes in early 2024.

About the author