Qorvo Inc stock drops amid market strength

Written by Emily J. Thompson, Senior Investment Analyst

Updated: May 19 2025

0mins

Should l Buy QRVO?

Source: Coinmarketcap

Qorvo Inc's stock price fell by 8.60% during regular trading, crossing below its 5-day SMA, indicating a significant decline in investor confidence.

This drop occurs amid broader market strength, with the Nasdaq-100 up 0.59% and the S&P 500 up 0.14%. The stock's performance reflects market caution, as it approaches its 52-week low of $49.46, raising concerns about its growth potential and impacting investor sentiment.

As Qorvo Inc nears its low point, investors may reconsider its investment value, particularly in the current market environment, which could lead to further capital inflows or outflows based on market reactions.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy QRVO?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on QRVO

Wall Street analysts forecast QRVO stock price to rise

17 Analyst Rating

1 Buy

15 Hold

1 Sell

Hold

Current: 84.290

Low

85.00

Averages

100.08

High

110.00

Current: 84.290

Low

85.00

Averages

100.08

High

110.00

About QRVO

Qorvo, Inc. is a global provider of connectivity and power solutions. The Company supplies semiconductor solutions. The Company operates through three segments: High Performance Analog (HPA), Connectivity and Sensors Group (CSG) and Advanced Cellular Group (ACG). The HPA segment is a global supplier of radio frequency (RF), analog mixed signal and power management solutions. The CSG segment is a global supplier of connectivity and sensor solutions, with broad expertise spanning ultra-wideband (UWB), Matter, Bluetooth Low Energy (BLE), Zigbee, Thread, Wi-Fi, cellular solutions for the Internet of Things (IoT) and microelectromechanical system (MEMS)-based sensors. The ACG segment is a global supplier of advanced cellular solutions for smartphones, wearables, laptops, tablets and other devices. The Company serves diverse segments of global markets, including automotive, consumer, defense and aerospace, industrial and enterprise, infrastructure and mobile.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- AUM Overview: As of the end of 2025, Starboard Value reported an AUM of $5.29 billion, slightly down from $5.53 billion the previous year, indicating a stable asset base despite a broader market increase of 16%.

- Portfolio Additions: In 2025, Starboard added several new positions, including over 7.5 million shares of Qorvo (QRVO), valued at over $634 million, reflecting a strong belief in the semiconductor sector's growth potential.

- Stake Adjustments: The fund increased its stake in Kenvue (KVUE) to over 27 million shares worth $471 million, while also boosting its holdings in Salesforce (CRM) by 68%, demonstrating confidence in these companies' future performance.

- Exit and Reduction Strategy: Starboard completely exited positions in companies like Pfizer (PFE) in 2025 and reduced holdings in Match Group (MTCH), showcasing its adaptive strategy in response to market conditions.

See More

- Shareholder Vote Outcome: Over 71.2 million Qorvo shareholders voted in favor of the merger with Skyworks Solutions, while just under 138,000 opposed, indicating strong shareholder support that is expected to enhance the company's competitive position in the RF chip market.

- Transaction Valuation: The merger is valued at approximately $22 billion, with Qorvo shareholders set to receive $32.50 in cash and 0.960 shares of Skyworks common stock per Qorvo share upon closing, providing a stable return and enhancing investment value for shareholders.

- Equity Distribution: Post-merger, Skyworks shareholders will own 63% of the combined entity, while Qorvo shareholders will hold 37%, a structure that will help Skyworks maintain a dominant position in future market expansions.

- Regulatory Scrutiny: Both companies have received a request for additional information from the U.S. Federal Trade Commission, indicating regulatory interest in the merger; however, the deal is still expected to close by early 2027, reflecting confidence from both parties.

See More

- Regulatory Review Extension: Skyworks (SWKS) and Qorvo (QRVO) received a second request for information from the U.S. Federal Trade Commission on Thursday, extending the waiting period under the HSR Act until 30 days after both companies substantially comply, potentially delaying the merger process.

- Positive Cooperation Stance: Both companies have stated they will work cooperatively with the FTC, which not only aids in expediting the review process but may also enhance the regulatory body's confidence in the merger.

- Transaction Scale and Value: The merger between Skyworks and Qorvo is valued at approximately $22 billion, with expectations to close by early 2027 pending regulatory approval, significantly strengthening their competitive position in the RF chip market.

- Synergy Target: Skyworks has set a $500 million synergy target from the merger and projects Q2 revenue could reach $925 million, indicating strong potential for business integration and robust market demand post-merger.

See More

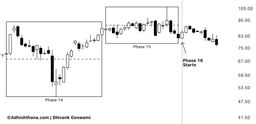

- Phase Analysis: Qorvo stock is currently in Phase 16 of its 18-phase Adhishthana cycle, and despite being in a triad formation, the overall structure has not shown encouraging signals, indicating a potentially bleak future trajectory.

- Triad Characteristics: Within the Guna triad framework, Phases 14, 15, and 16 collectively determine whether the stock can achieve a Nirvana move in Phase 18, but the current lack of necessary Satoguna support makes such a move unlikely.

- Investor Outlook: With a weak triad formation unfolding, Qorvo's long-term outlook remains disappointing; while short-term rallies may occur, the broader structure does not support a sustained bullish outcome, likely leading to disappointment in Phase 18.

- Historical Performance: Since August 2021, Qorvo stock has underperformed, having broken its Cakra formation in Phase 9, and has continued to trade with a negative bias, a trend expected to persist into its final phase.

See More

- Chipmaker Strength: ASML reported record Q4 bookings of €13.2 billion, significantly exceeding the consensus of €6.85 billion, which boosted chipmakers and AI infrastructure stocks, enhancing market confidence in AI spending sustainability.

- Fed Policy Unchanged: The FOMC maintained the interest rate at 3.50%-3.75% as expected, with Chair Powell indicating strong economic performance without signaling imminent rate cuts, keeping market focus on future policy directions.

- Dollar and Gold Fluctuations: The dollar index rebounded after hitting a nearly four-year low, while President Trump's comments on dollar weakness pushed gold prices up over 3% to a new all-time high, reflecting increased demand for safe-haven assets.

- Economic Data Expectations: Initial jobless claims are expected to rise by 5,000 to 205,000 this week, and Q3 nonfarm productivity is anticipated to remain at 4.9%, indicating ongoing economic growth and potential market volatility.

See More

- ASML Record Orders: ASML Holding NV reported Q4 bookings of €13.2 billion, significantly exceeding the consensus of €6.85 billion, indicating robust demand for advanced semiconductor manufacturing and reinforcing its leadership in the chip-making sector.

- Mixed Stock Performance: While the S&P 500 index reached a new all-time high and the Nasdaq 100 hit a three-month peak, market sentiment was tempered by the Federal Reserve's decision to keep interest rates steady, reflecting investor uncertainty regarding future economic policies.

- Interest Rate Policy Impact: The Fed's choice to maintain the benchmark rate between 3.5% and 3.75% ends a series of three consecutive rate cuts aimed at protecting the labor market, which may exert short-term negative pressure on the stock market.

- Market Focus: This week, the market will closely monitor new tariff news and the prospects for a continued resolution to fund the government, with initial jobless claims expected to rise by 5,000 to 205,000, highlighting the fragility of economic recovery.

See More