Digital Realty Trust Reports Record Earnings and Strong Growth Outlook

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 3d ago

0mins

Should l Buy DLR?

Source: Yahoo Finance

Digital Realty Trust's stock rose by 3.84% and reached a 20-day high amid positive market conditions.

The company reported a core FFO of $7.39 per share for 2025, a 10% increase over 2024, highlighting its robust growth in the data center industry. Additionally, Digital Realty signed over $1 billion in new leases, setting a historical record, and projects core FFO guidance for 2026 to be between $7.90 and $8.00 per share, reflecting strong future growth expectations.

This impressive performance positions Digital Realty as a leader in the data center sector, capitalizing on increasing demand for cloud and AI services, and suggests a positive outlook for investors.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy DLR?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on DLR

Wall Street analysts forecast DLR stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for DLR is 189.06 USD with a low forecast of 139.00 USD and a high forecast of 220.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

18 Analyst Rating

15 Buy

2 Hold

1 Sell

Strong Buy

Current: 164.650

Low

139.00

Averages

189.06

High

220.00

Current: 164.650

Low

139.00

Averages

189.06

High

220.00

About DLR

Digital Realty Trust, Inc. is a real estate investment trust. The Company owns, acquires, develops, and operates data centers through its operating partnership subsidiary, Digital Realty Trust, L.P. The Company is focused on providing data center, colocation, and interconnection solutions for domestic and international customers across a variety of industry verticals ranging from cloud and information technology services, communications and social networking to financial services, manufacturing, energy, healthcare, and consumer products. Its portfolio consists of over 308 data centers, of which 121 are located in the United States, 112 are located in Europe, 36 are located in Latin America, 16 are located in Africa, 16 are located in Asia, six are located in Australia and three are located in Canada. Its PlatformDIGITAL is a global data center platform for scaling digital business which enables customers to deploy their critical infrastructure with a global data center provider.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Data Center Certification: Digital Realty's NRT14 data center in Tokyo achieves NVIDIA DGX-Ready Data Center certification, becoming one of the first facilities in Japan to meet high-density AI workload standards, reinforcing its strategic position in AI infrastructure.

- Performance Support: NRT14 supports high-density AI workloads of over 100 kW per rack, utilizing liquid-cooled Blackwell architecture that can deliver 25 times greater energy efficiency than traditional air-cooled systems, significantly reducing operational costs and enhancing performance.

- Regional Collaboration Expansion: This certification continues Digital Realty's partnership with NVIDIA, further expanding its AI infrastructure footprint in the Asia Pacific, enhancing scalability across a globally consistent platform to help enterprises rapidly deploy and scale AI applications.

- Sustainability Commitment: Digital Realty's development of AI-ready infrastructure in the Asia Pacific underscores its commitment to low-carbon infrastructure, supporting customers in balancing high-performance computing needs with regional sustainability goals.

See More

- Data Center Certification: Digital Realty's NRT14 data center in the Greater Tokyo area achieves NVIDIA DGX-Ready Data Center certification, becoming one of the first facilities in Japan to support high-density AI workloads, reinforcing its strategic position in AI infrastructure.

- Performance Support: NRT14 is capable of supporting high-density AI workloads of over 100 kW per rack, utilizing liquid cooling technology that offers up to 25 times the energy efficiency of traditional air-cooled systems, significantly reducing operational costs and enhancing performance for enterprises.

- Regional Collaboration Expansion: This certification continues Digital Realty's partnership with NVIDIA, further expanding its AI infrastructure footprint in the Asia Pacific, enabling enterprises to rapidly deploy and scale their AI-driven transformation needs.

- Sustainability Commitment: The development of AI-ready infrastructure in the Asia Pacific reflects Digital Realty's commitment to low-carbon infrastructure, supporting customers in balancing high-performance computing needs with regional sustainability goals.

See More

- Investor Trends: Investors are moving away from AI investments despite a significant market surge today.

- Data Center REITs: The only exception to this trend is the continued interest in data center real estate investment trusts (REITs).

See More

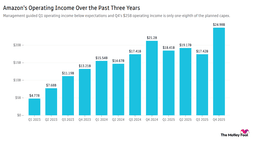

- Amazon's Capital Expenditure Surge: Amazon plans to increase its capital expenditure to $200 billion in 2026, nearly matching its total revenue of $213 billion for Q4, leading to an over 8% drop in stock price during morning trading, indicating market concerns about its financial health.

- Accelerating AWS Growth: CEO Andy Jassy reported a 24% growth rate for AWS, the fastest in 13 quarters, with an annualized revenue of $142 billion; however, management anticipates Q1 operating income will fall short of analyst expectations, reflecting intensified market competition.

- Bitcoin Price Volatility: Bitcoin has dropped 50% from its 2025 peak, falling to around $60,000, which reflects waning confidence in government support for cryptocurrencies, although some analysts suggest this is merely a market correction rather than the end of crypto.

- Severe Market Reactions: Despite a 10% revenue increase in Q3, DOCS and PIDoximity saw their stock plunge over 30% due to declining net income under margin pressure, highlighting investors' acute sensitivity to profitability.

See More

- Price Adjustment: Stifel has reduced the target price for Digital Realty Trust Inc. from $210 to $200.

- Market Impact: This adjustment reflects changes in market conditions and expectations for the company's performance.

See More