Upstart Holdings Set to Release Earnings Report

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 5 days ago

0mins

Should l Buy UPST?

Source: Benzinga

- Earnings Expectations: Upstart is projected to report earnings per share of 46 cents and revenue of $288.67 million, having beaten EPS estimates in the last four quarters and revenue estimates in three of the last four, indicating strong market confidence and profitability.

- Recent Performance: In the latest quarter, Upstart posted EPS of 52 cents, exceeding the consensus estimate of 42 cents, although revenue of $277.11 million fell slightly short of the $279.62 million estimate, reflecting the company's adaptability amidst market fluctuations.

- Stock Dynamics: Currently, Upstart's stock is trading 23% below its 20-day simple moving average and 30.2% below its 100-day moving average, indicating challenges in regaining upward momentum, while shares have increased by 37.87% over the past 12 months but are closer to their 52-week lows, suggesting cautious market sentiment.

- Technical Indicator Analysis: The RSI stands at 31.06, indicating neutral territory, suggesting the stock is neither overbought nor oversold, while the MACD is below its signal line, indicating bearish pressure on the stock, advising traders to remain cautious.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy UPST?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on UPST

Wall Street analysts forecast UPST stock price to rise

13 Analyst Rating

7 Buy

4 Hold

2 Sell

Moderate Buy

Current: 30.190

Low

20.00

Averages

56.73

High

80.00

Current: 30.190

Low

20.00

Averages

56.73

High

80.00

About UPST

Upstart Holdings, Inc. is an artificial intelligence (AI) lending marketplace. The Company’s platform includes personal loans, automotive retail and refinance loans, home equity lines of credit (HELOCs), and small dollar loans. It applies artificial intelligence models and cloud applications to the process of underwriting consumer credit. Its AI marketplace connects consumers with its lending partner. Its consumers can access Upstart-powered loans via Upstart.com, through a lender-branded product on its lending partners’ own websites, and through auto dealerships that use its Upstart Auto Retail software. Its platform enables lenders provide a product their customers want, rather than letting customers seek loans from competitors. Its cloud-based software platform incorporates technologies and software development approaches to allow for development of new features, such as cloud-native technologies, data integrity and security, and configurable multi-tenant architecture, and others.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Significant Stock Drop: Upstart Holdings (UPST) saw its stock plummet 13% in Wednesday afternoon trading as investors reacted to mixed guidance, despite Q4 earnings exceeding Wall Street estimates and 2026 revenue guidance surpassing consensus.

- Divergence in Volume and Margins: BTIG analyst Vincent Caintic highlighted that while transaction volumes exceeded expectations, EBITDA margins fell below consensus, leading to mixed market sentiment, particularly as new auto and home loan products yield only a 4% take-rate.

- Increased Reliance on Institutional Investors: Caintic explained that Upstart now requires a $100M receivables buyer to achieve the same revenue at a 4% take-rate compared to a $50M buyer at an 8% take-rate, indicating heightened reliance on institutional investor demand and increased funding risk.

- Market Rating Discrepancies: While the SA Quant system assigns a Sell rating due to poor momentum and profitability scores, the average analyst rating is Hold, and the average Wall Street rating is Buy, indicating some market confidence in Upstart's future prospects.

See More

- Strong Earnings: Upstart's revenue grew 35% year-over-year to $265 million in the final quarter of fiscal 2025, and the company achieved a profit of $18.6 million, indicating ongoing progress in the alternative credit scoring market.

- Surge in Loan Originations: The quarter saw an 86% increase in loan originations, with projected sales for 2026 expected to reach approximately $1.4 billion, a significant improvement from last year's $1.0 billion, highlighting the company's enhanced competitiveness.

- Management Change Impact: The imminent exit of co-founder and CEO Dave Girouard raises concerns among investors, as this will mark the first time the original CEO is not at the helm, potentially affecting confidence in the company's future direction.

- Guidance Policy Shift: Upstart's decision to cease quarterly guidance in favor of annual estimates may raise transparency concerns among investors, despite still being adequate, which could negatively impact short-term stock performance.

See More

- Acadia Healthcare Stock Surge: Acadia Healthcare's stock rose 10% after investor David Einhorn announced his purchases, reflecting market optimism about the new management's ability to enhance performance, which could improve future profitability.

- Vertiv's Upbeat Guidance: Vertiv's stock jumped nearly 20% due to its optimistic guidance for 2026, with orders accelerating significantly in Q4, surpassing Wall Street expectations and indicating strong demand in the data center market.

- Unity Software's Downgrade: Unity Software's shares fell nearly 30% after issuing a first-quarter revenue outlook between $480 million and $490 million, below analysts' expectations of $492.1 million, raising concerns about its future growth prospects.

- Smurfit WestRock Order Improvement: Smurfit WestRock's stock soared over 10% after revealing improved product orders in late December, with expectations of reaching $7 billion in profits by 2030, highlighting its long-term growth potential.

See More

- Stock Performance: UPS stock fell by 14.4% following the announcement of its Q4 results.

- Financial Outlook: The company's outlook and leadership changes contributed to the decline in share value.

See More

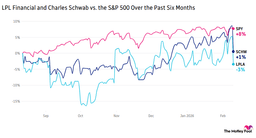

- AI Tax Tool Impact: Altruist's new Hazel AI tax planning tool can analyze 1040 forms, pay, and account statements in minutes, significantly enhancing advisor efficiency, which led to LPL Financial and Charles Schwab shares dropping 8.3% and 7.4% respectively, highlighting the pressure traditional financial services face from AI competition.

- Cloudflare's Strong Performance: Following its 2022 recommendation, Cloudflare reported a 34% year-over-year revenue increase in Q4, with annual contract value growing nearly 50%, and forecasts close to $2.8 billion in revenue for 2026, resulting in a 14% stock price increase in after-hours trading, indicating robust market demand and investor confidence.

- Mattel's Major Decline: Mattel's stock plummeted 30% due to disappointing Q3 results, with the CEO expressing skepticism about the return of toy manufacturing to the U.S., reflecting significant challenges and a loss of market confidence for the company.

- Moderna's Vaccine Application Rejected: The FDA rejected Moderna's application for a seasonal mRNA flu vaccine, causing a 9% drop in pre-market trading, illustrating the substantial impact of regulatory hurdles on biopharmaceutical companies.

See More