Steering the Course: GE Aerospace Keeps CEO Culp At The Helm Through 2027

- CEO Tenure Extension: GE Aerospace extends CEO Larry Culp's tenure until the end of 2027, with an option for a one-year extension.

- Boeing Offer Declined: Culp declined an offer from Boeing to become its CEO, as reported by Reuters.

- Financial Performance: During Culp's tenure, GE's debt decreased by over $100 billion, cash flow quadrupled, and market capitalization grew by approximately $100 billion.

- Recent Developments: GE announced the U.S. Army accepting two engines for testing on the UH-60 Black Hawk and the development of a hybrid electric engine for narrow-body jets.

- Stock Performance: GE stock has gained over 85% in the last 12 months, with investors able to access it through ETFs like IShares U.S. Aerospace & Defense ETF and TCW Transform Systems ETF.

Trade with 70% Backtested Accuracy

Analyst Views on ITA

About the author

Drone Technology in Military: Drone technology is increasingly important in military strategies, particularly for the United States.

Focus on Dominance: The development of drone dominance is a key objective for America, highlighting its significance in modern warfare.

Impact on Travelers: The emphasis on drone technology may lead to complications for travelers, suggesting potential disruptions.

Current Trends: The growing interest in drones reflects broader trends in military innovation and defense strategies.

- Defense Stocks Performance: Defense stocks have seen a recent increase in value, attracting investor attention.

- Smart Money Insight: Investors are advised to monitor the actions of institutional investors, referred to as "smart money," for better investment decisions.

- Defense Stocks Potential: The article discusses whether defense stocks can provide both dividends and growth driven by capital spending.

- Income Investors' Interest: Income investors are particularly focused on the performance of defense stocks in terms of returns and growth opportunities.

- Earnings Announcement: Lockheed Martin's earnings report is scheduled for Thursday.

- Stock Performance: The company's shares have shown recent improvement but still underperform compared to industry peers over the past year.

Military Spending and Defense Contractors: President Trump's focus on increasing military capabilities benefits defense contractors, provided that this growth translates into higher cash flow and earnings.

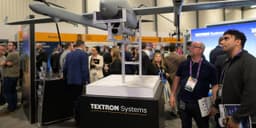

Textron's Performance: Recent financial results from Textron indicate that the anticipated benefits of military spending do not always materialize as expected.

- Emerging Trend: Investors in the global defense industry are now considering the trend of deconsolidation alongside the impact of recent policy changes.

- Impact of Policy Changes: Several dramatic policy changes are influencing investor sentiment and strategies within the defense sector.

- Industry Dynamics: The shift towards deconsolidation suggests a potential restructuring of companies within the defense industry.

- Investor Considerations: Investors must navigate both the implications of policy changes and the emerging trend of deconsolidation in their decision-making processes.