Macy's Raises FY2025 Forecast, Alongside REV Group, HealthEquity, Alphabet, and Other Major Stocks Gaining Ground on Wednesday

U.S. Stock Market Performance: U.S. stocks showed mixed results, with the Dow Jones index dropping over 150 points, while several companies, including Macy's, reported strong earnings and raised their future guidance.

Macy's Earnings Report: Macy's shares surged 19.1% after exceeding second-quarter estimates and increasing its FY2025 adjusted EPS guidance from $1.60-$2.00 to $1.70-$2.05, along with a sales guidance increase.

Notable Stock Gains: Other significant stock gainers included Breeze Holdings (up 31.1%), Ur-Energy (up 14.2%), and REV Group (up 11%), all reporting positive earnings and guidance.

Analyst Upgrades: Analysts upgraded several stocks, including Peakstone Realty and Alkermes, with new price targets reflecting positive outlooks based on recent performance and financial forecasts.

Trade with 70% Backtested Accuracy

Analyst Views on HIMS

About HIMS

About the author

- Attraction of Shorted Stocks: LCID stock has become a target for heavy shorting as many experienced traders and institutional investors believe the company's fundamentals are overvalued, reflecting a pessimistic outlook on its future performance.

- Short Selling Mechanics: Short sellers bet on significant risks facing the company, such as poor earnings or industry headwinds, which may lead to a decline in stock price, thus garnering attention for short-selling strategies in the market.

- Short Squeeze Dynamics: When a stock's price unexpectedly rises, short sellers are forced to buy back shares to cover their positions, creating a surge in demand that further drives up the price, resulting in a feedback loop that can lead to explosive gains in a short time frame.

- Most Shorted Stocks List: As of February 13, the most heavily shorted stocks include companies with market caps above $2 billion and free floats exceeding 5 million shares, with short interest serving as a barometer of market sentiment.

- Stock Price Plunge: Hims & Hers Health (HIMS) shares fell approximately 16% on Monday following a lawsuit from Novo Nordisk (NVO), indicating market concerns over legal uncertainties and investment risks surrounding the company.

- Surge in Short Interest: As of February 11, short interest in HIMS reached a new 52-week high of 77.5 million shares, representing 37% of the float, reflecting a growing pessimism among investors regarding the company's outlook.

- Legal Challenge Impact: Novo Nordisk's lawsuit alleges that HIMS violated key patents related to its weight loss drug Wegovy, prompting HIMS to withdraw its copycat version amid regulatory scrutiny, which has further unsettled the market.

- Market Volatility Expectations: According to S3 Partners, HIMS is projected to experience a one-day price move of +/-14% following its Q4 2025 results scheduled for February 23, highlighting the high uncertainty surrounding the company's future performance.

- Intensifying Market Competition: Novo Nordisk plans to launch its Wegovy drug in vials to counteract pressure from rival Eli Lilly in the rapidly growing weight-loss market, especially after Lilly's introduction of vials for Zepbound in 2024 led to a surge in demand and shortages of its injector pens.

- Flexible Dosing Advantage: The new vial format will offer more flexible dosing compared to prefilled injector pens, although patients will need to manually draw the medication into a syringe, a change aimed at meeting the broader needs of obesity patients and aligning with Novo Nordisk's long-term strategic goals.

- Sales Outlook Downgrade: Novo Nordisk expects adjusted sales growth for 2026 to decline by 5% to 13%, primarily due to the impact of the U.S. “Most Favored Nations” agreement and the expiration of the semaglutide molecule patent in certain international markets, which will negatively affect the company's future revenue.

- Legal Action Update: Novo Nordisk recently filed a lawsuit against Hims & Hers, demonstrating the company's proactive stance in protecting its market share and intellectual property, even as its stock price fell by 0.82% to $48.34 at the time of publication, reflecting market concerns about its future performance.

- Medicare Coverage Goal: CEO Mike Doustdar of Novo Nordisk stated that the company aims to reach about 15 million new patients once Medicare begins covering obesity treatments, although he cautioned that the expansion of coverage is unlikely to happen quickly, indicating challenges in market adoption.

- Significant Price Reductions: Wegovy pills are listed at $149 on the newly launched TrumpRx website, representing an approximately 89% discount from prevailing market prices, while Wegovy and Ozempic pens start at $199, showcasing Novo Nordisk's strategic pricing adjustments in a competitive landscape.

- Increased Competitive Pressure: In contrast, Eli Lilly expects revenues of $80–$83 billion, exceeding Wall Street's forecast of $77.62 billion, indicating strong market performance, which puts pressure on Novo Nordisk to implement strategies to close the gap.

- Stock Price Volatility: Over the past year, Novo Nordisk's stock has declined by 40.41%, closing at $48.74, reflecting market concerns regarding its future growth prospects, particularly amid intensifying competition.

- Market Share Risk: Novo Nordisk's forecast for 2026 indicates potential sales and profit declines of up to 13%, starkly contrasting with Eli Lilly's projected 25% growth, highlighting increasing pressure on the company in the weight loss drug market that could undermine investor confidence.

- Patent Lawsuit and Regulatory Warning: Novo has filed a patent infringement lawsuit against Hims & Hers and received a warning from the FDA regarding misleading advertising, which not only increases legal risks but may also impact the company's brand image and market strategy.

- Patient Growth and New Drug Launch: Despite challenges, Novo's Wegovy drug has attracted 246,000 patients since its January launch, indicating strong market demand that is expected to help the company regain some market share amid competition.

- Future Treatment Options: Novo plans to introduce a higher dose of Wegovy and the next-generation drug CagriSema, which has shown a potential 23% weight loss in clinical trials, potentially aiding the company in reshaping its market position in the future.

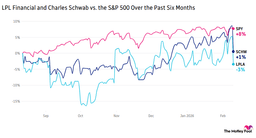

- AI Tax Tool Impact: Altruist's new Hazel AI tax planning tool can analyze 1040 forms, pay, and account statements in minutes, significantly enhancing advisor efficiency, which led to LPL Financial and Charles Schwab shares dropping 8.3% and 7.4% respectively, highlighting the pressure traditional financial services face from AI competition.

- Cloudflare's Strong Performance: Following its 2022 recommendation, Cloudflare reported a 34% year-over-year revenue increase in Q4, with annual contract value growing nearly 50%, and forecasts close to $2.8 billion in revenue for 2026, resulting in a 14% stock price increase in after-hours trading, indicating robust market demand and investor confidence.

- Mattel's Major Decline: Mattel's stock plummeted 30% due to disappointing Q3 results, with the CEO expressing skepticism about the return of toy manufacturing to the U.S., reflecting significant challenges and a loss of market confidence for the company.

- Moderna's Vaccine Application Rejected: The FDA rejected Moderna's application for a seasonal mRNA flu vaccine, causing a 9% drop in pre-market trading, illustrating the substantial impact of regulatory hurdles on biopharmaceutical companies.