Core Scientific Shares Surge Amid CoreWeave Acquisition Talks

Written by John R. Smitmithson, Senior Financial Analyst & Columnist

Updated: Fri, 27 Jun 25 15:01

4mins

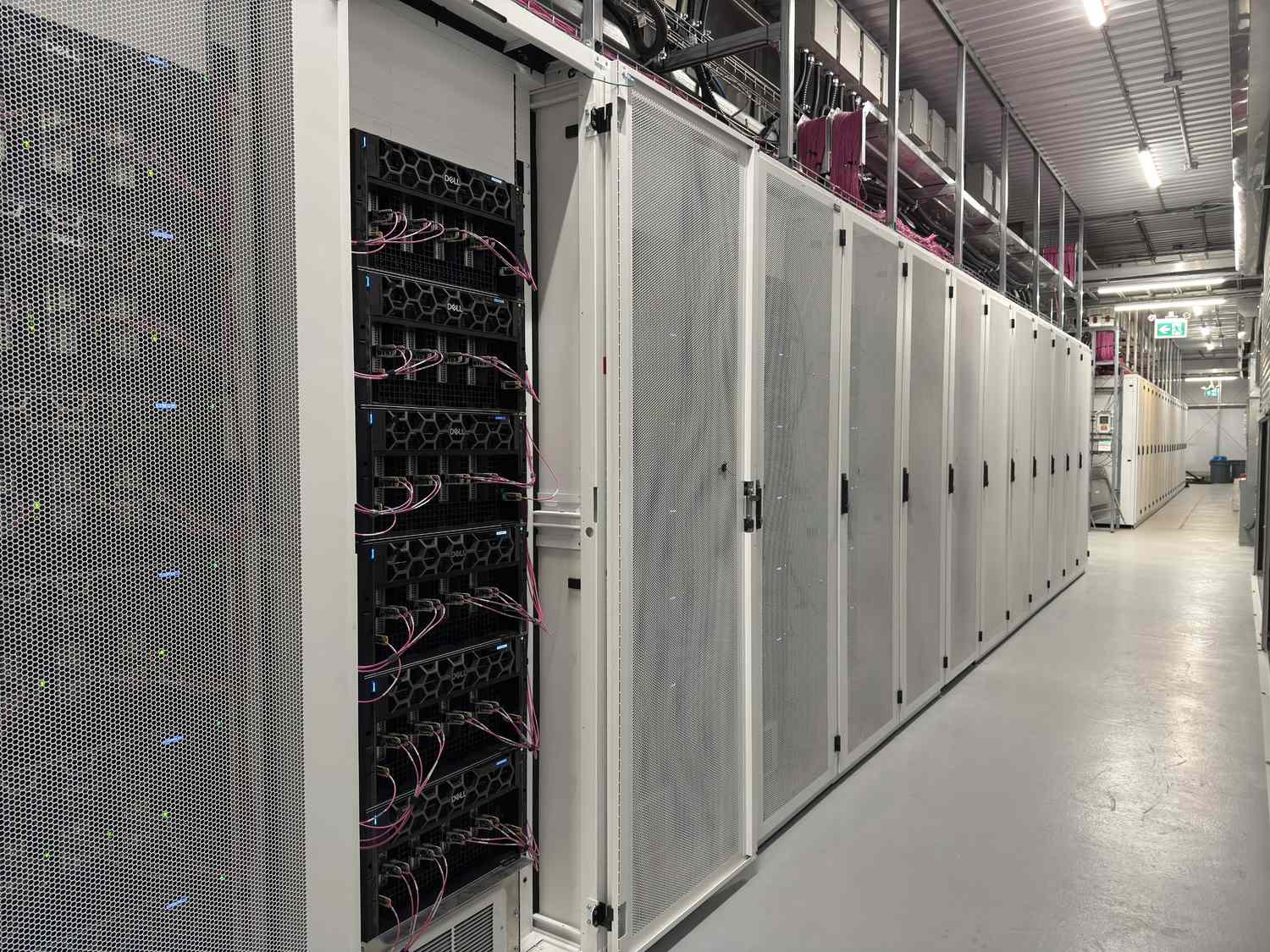

Core Scientific (CORZ) stock has seen a dramatic rise, soaring 33% on Thursday and continuing premarket gains following reports of acquisition interest from CoreWeave (CRWV). The Wall Street Journal revealed that CoreWeave, an AI hyperscaler, previously offered $5.75 per share for Core Scientific, a major bitcoin mining infrastructure provider, but was rejected. Renewed acquisition discussions have reignited investor interest, pushing Core Scientific into positive territory for the year. The companies share existing agreements, including a $10 billion hosting partnership.

Sources

Sources- Core Scientific Stock Extends Rally Report CoreWeave Acquisition Talks

yahoo

yahoo - Core Scientific Stock Extends Rally Report CoreWeave Acquisition Talks

investopedia

investopedia - CRWV–CORZ Potential Deal Unlock $2.8 Billion Hidden Value Bitcoin Miner, Says Morgan Stanley - Core

benzinga

benzinga

Keep Reading

Keep ReadingAbout the author

Preview

John R. Smitmithson

With over 15 years of experience in global financial markets, John R. Smitmithson holds a Master’s degree in Finance from the London School of Economics. A former investment strategist at Goldman Sachs, he specializes in macroeconomic trends and equity analysis, contributing authoritative insights to Intellectia’s market overviews.

Top News

Related Articles

Latest Newswire

LIVE

4 minute ago

-

US

Tesla's European Market Sales Decline Again, Continuing Low Trend

9 minute ago

-

US

Norwegian Sovereign Wealth Fund to Vote Against Tesla CEO Musk's Compensation Plan

9 minute ago

-

Macro

Foreign Investors Reduce Holdings in Indian Consumer Stocks Amid Concerns Over Sustainability of Festive Season Spending

10 minute ago

-

Macro

Dutch Bank: U.S. Treasury Yield Curve Remains Too Flat

12 minute ago

-

US

U.S. Commerce and Defense Departments Announce Funding for Vulcan Elements to Boost Domestic Rare Earth Magnet Production

- Core Scientific Stock Extends Rally Report CoreWeave Acquisition Talks

yahoo

yahoo - Core Scientific Stock Extends Rally Report CoreWeave Acquisition Talks

investopedia

investopedia - CRWV–CORZ Potential Deal Unlock $2.8 Billion Hidden Value Bitcoin Miner, Says Morgan Stanley - Core

benzinga

benzinga

People Also Watch

CFBK

CF Bankshares Inc

23.350

USD

+0.65%

MRNO

Murano Global Investments Plc

2.700

USD

0.00%

CUB

Lionheart Holdings

10.620

USD

0.00%

GBTG

Global Business Travel Group Inc

7.670

USD

-2.42%

IMPP

Imperial Petroleum Inc

5.620

USD

+2.00%

PBFS

Pioneer Bancorp Inc

13.110

USD

-0.23%

VYNE

Vyne Therapeutics Inc

0.346

USD

-2.81%

UTMD

Utah Medical Products Inc

58.490

USD

+0.67%

ONEW

OneWater Marine Inc

15.600

USD

+0.45%