Key Takeaways

- Government and commercial investment in launch services, satellite technologies, and space-based communications is expected to propel the global space economy to surpass $1.5 trillion by 2040.

- It is necessary to consider space-related revenue proportions, government contracts, technological innovation, financial strength, launch reliability, and market positioning when choosing the best space stocks.

- A variety of exposures are provided by RKLB, ASTS, SPCE, PL, RDW, and MAXR in the areas of launch services, satellite manufacturing, space-based broadband, Earth observation, in-space manufacturing, and geospatial intelligence.

Introduction

Have you ever asked yourself why space companies are doing well even when the market is shaky? The space industry is changing rapidly due to improvements in reusable rockets and satellites and greater usage by businesses. With the industry’s expected growth to $1 trillion by 2040, investors are now considering space stocks as a lucrative investment.

However, choosing the right space stocks requires you to analyze the options thoroughly. Government contracts, technological advancements, and strong financial standing are key to success. This is when technologies such as Intellectia AI are useful, providing predictions and suggestions to help investors decide how and when to trade.

What Are Space Stocks?

Space stocks are companies listed on stock exchanges that mainly work with technology or projects related to space—including launches, satellites, Earth observation, and similar applications. They have many varieties:

- Launch providers: Launch providers such as Rocket Lab, Astra, and Virgin Galactic focus on sending people and cargo into space.

- Satellite operators: Companies such as AST SpaceMobile act as satellite operators to provide data and communications services.

- Engineering firms & tech suppliers: These companies are involved in the fabrication of spacecraft components, ground systems, and technology for support.

All of them are essential for developing the space ecosystem, starting with a launch into orbit and ending with a return to Earth.

Why Invest in Space Stocks?

Explosive Market Growth

At a compound annual growth rate (CAGR) of roughly 5.5%, the global space economy is expected to reach over $1.55 trillion by 2040. This pattern suggests that there is a growing need for infrastructure and technologies based in space.

Massive Institutional Investment

The U.S. Department of Defense, NASA, ESA, and other government organizations continue to invest billions in space innovation. At the same time, private giants like Blue Origin and SpaceX are making significant investments in commercial space projects.

Breakthrough Technologies Reduce Costs

Space access is becoming significantly less expensive thanks to innovations like low-Earth orbit (LEO) satellite constellations and reusable rockets. Over time, these efficiencies are increasing the sector's profitability and scalability.

Expanding Commercial Applications

These days, space assets support a variety of industries, from satellite internet to real-time Earth observation. The potential for revenue is increased by this diversification beyond defense into telecom, agriculture, logistics, and other areas.

High-Growth and Diversified Returns

Space stocks provide a special combination of portfolio diversification and rapid growth. You can access a variety of space-related revenue streams by investing in businesses in the launch, satellite, and infrastructure sectors.

Criteria for Selecting Best Space Stocks

Space‑Related Revenue Proportion

For a space stock to be strong, it should get a large part of its income from operations taking place in space. Using this approach, you ensure you only invest in companies with clear exposure, not those with a blended mix.

Strategic Partnerships & Government Contracts

Those companies contracted by NASA, the DoD, or large telecom companies achieve financial security and a lasting reputation. Often, joining forces on a project means there will likely be greater demand in the future and less risk.

Technological Innovation

Prioritize businesses with innovations such as reusable rockets, satellite systems powered by artificial intelligence, or leading propulsion technologies. These make operations cheaper and create new business opportunities.

Financial Stability & Growth Outlook

A good market cap, continuous revenue growth, and reliable cash flow show that a company is strong financially. If companies have many outstanding orders and new projects in the pipeline, they have a better chance of growing in the future.

Launch Reliability & Track Record

A company must succeed in its new product launches with little room for error. If companies are reliable, customers trust them and return repeatedly.

Market Position & Focus

Industry leaders in segments like launch services, satellite data analysis, or space logistics are often the biggest earners and hold most of the shares in the industry. A thorough understanding of an area or expertise usually gives an advantage over others.

6 Best Space Stocks to Buy

| Company | Ticker | Market Cap | Key Strengths |

|---|---|---|---|

| Rocket Lab | RKLB | $13.3 B | Proven launch platform, consistently growing revenue |

| AST SpaceMobile | ASTS | $7.4 B | Unique mission to provide cell service via space |

| Virgin Galactic | SPCE | $0.13 B | High-profile space tourism, public brand |

| Planet Labs | PL | $1.77 B | Deep backlog, profitable FCF, AI‑enabled imagery |

| Redwire | RDW | $1.42 B | Hardware & components supplier, diversified clients |

| Intuitive Machines | LUNR | ~$0.46B | Aerospace technology focused on lunar landers and space exploration. |

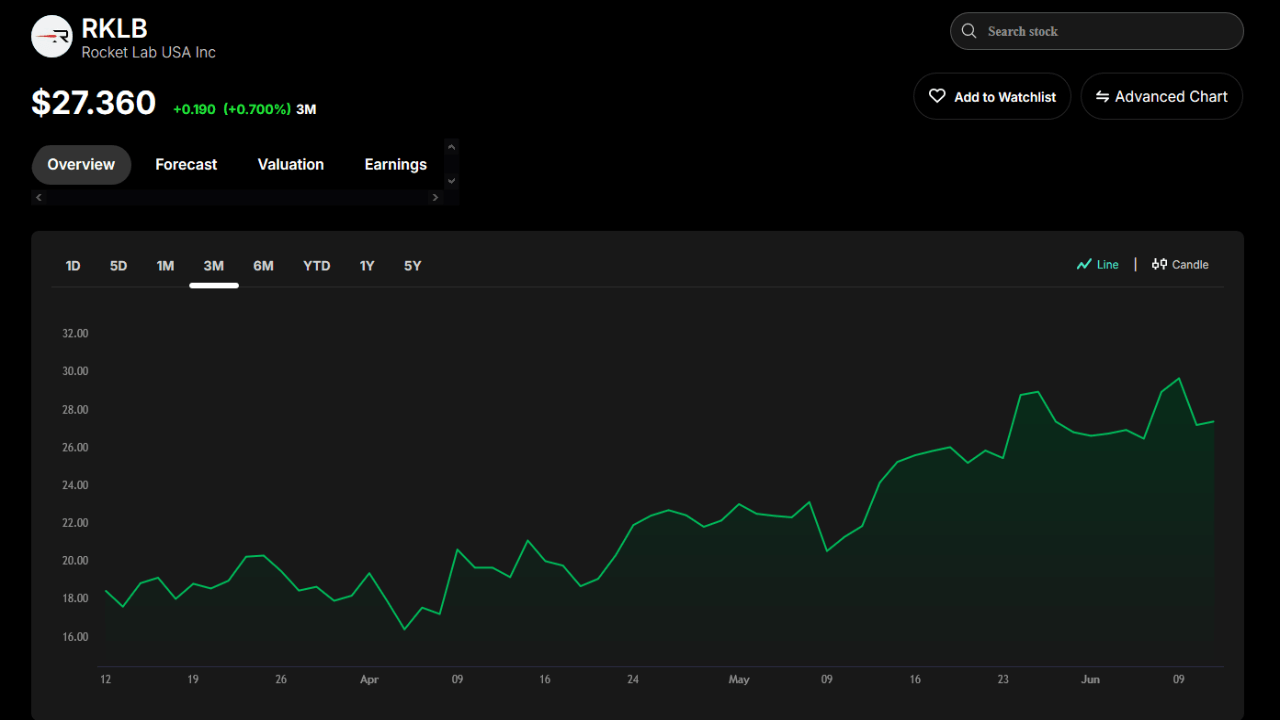

Rocet Lab (RKLB)

Rocket Lab (RKLB) is a business that covers everything from launch services to spacecraft, focusing on small‑satellite operations. Their $13.3 billion market cap and continuous quarterly revenue of about $122 M helped them beat their profits this time, but their earnings are still down year-over-year. According to analysts, a strong buy recommendation is given, and investors could see a ~4.2% gain in value in the coming month.

RKLB benefits from its strong Neutron rocket, dependable Electron launches, and growing space satellite sector. This is a good choice if you want a confident space company with promising upside.

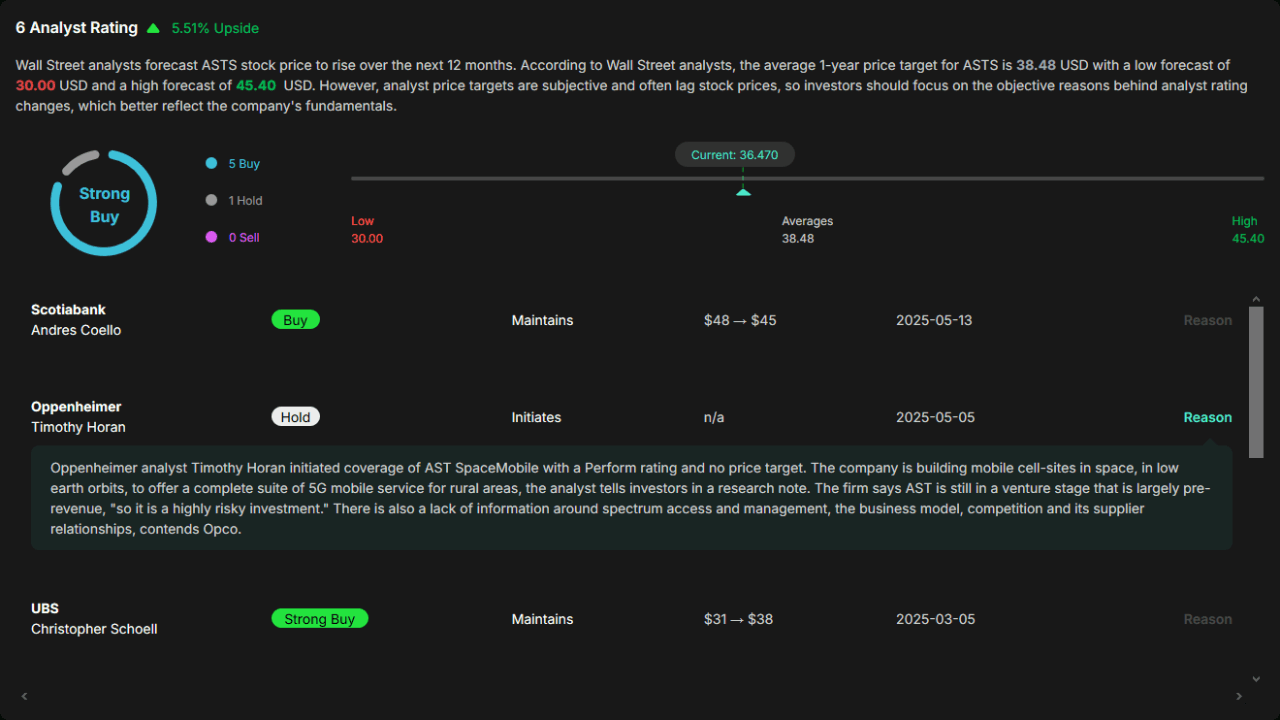

AST SpaceMobile (ASTS)

AST SpaceMobile (ASTS) is a U.S. company that is working to launch the first cellular broadband network from space to ordinary mobile phones. The company has a market cap of $7.4 billion and modestly exceeded earnings estimates in the first quarter. According to market analysts, there are neutral-to-bull signals and a predicted price of ~$32.67, which means a ~4.8% rise.

ASTS is different because it connects the telecommunication world with one of the satellites. If you believe in the power of satellite-enabled global communication and are also looking for quick growth, this is a good Strong Buy stock.

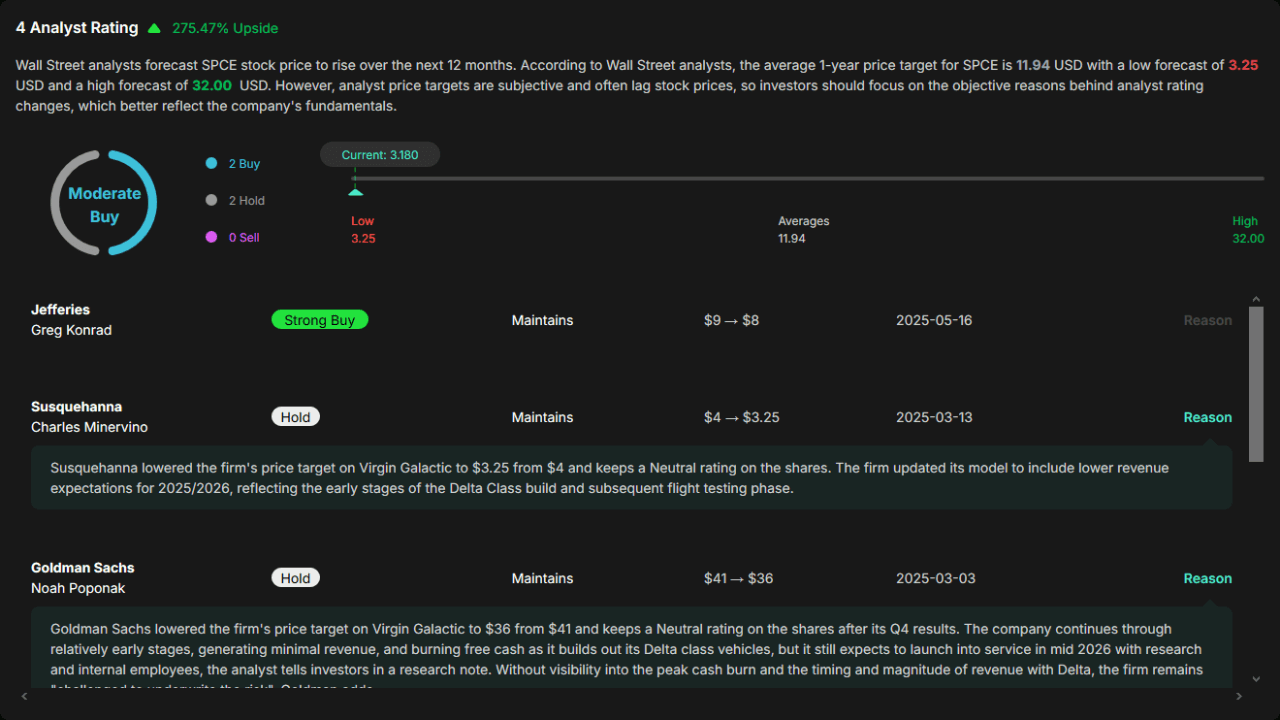

Virgin Galactic (SPCE)

Virgin Galactic (SPCE) is valued at $130–140 million, and it is a well-known player in space tourism, helping bring commercial space travel to civilians. The firm’s shares saw a ~3% increase to $3.22 due to overall market gains.

SPCE is different because it looks at suborbital human spaceflight, making it a key player in a unique field. Even though the income from Virgin Galactic is not significant, investors with a long-term view can benefit from being among the earliest entrants into the space tourism market.

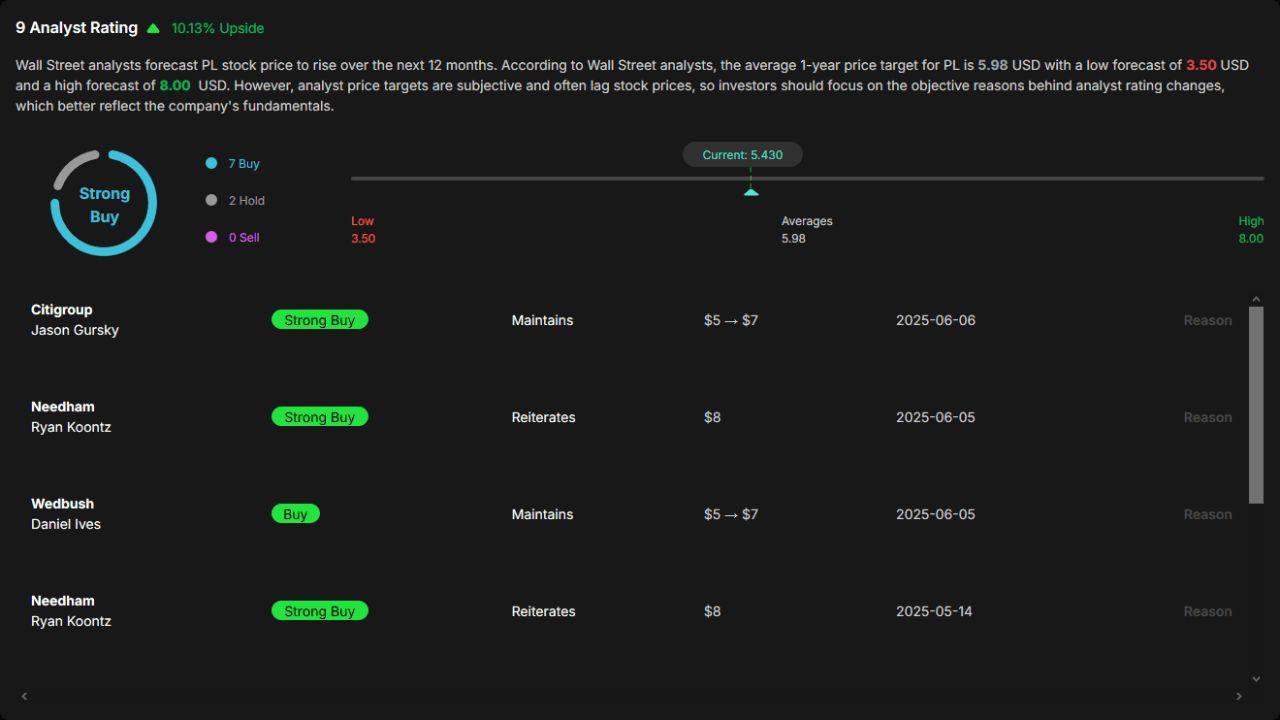

Planet Labs (PL)

Planet Labs (PL) produces and operates a broad network of Earth observation satellites to deliver high-quality pictures and insights. In their Q1 report, they earned a breakeven adjusted profit on slightly more than $66 M revenue (+10% YoY). They reported their first profit on free cash flow. Shares increased a staggering 49% to reach $5.96.

Its business model mainly revolves around working with data, which is a significant strength. Unlike companies that only sell one product, Planet Labs dependably earns revenue from its data and subscriptions, making it a reliable way for investors to get involved in commercial satellite data.

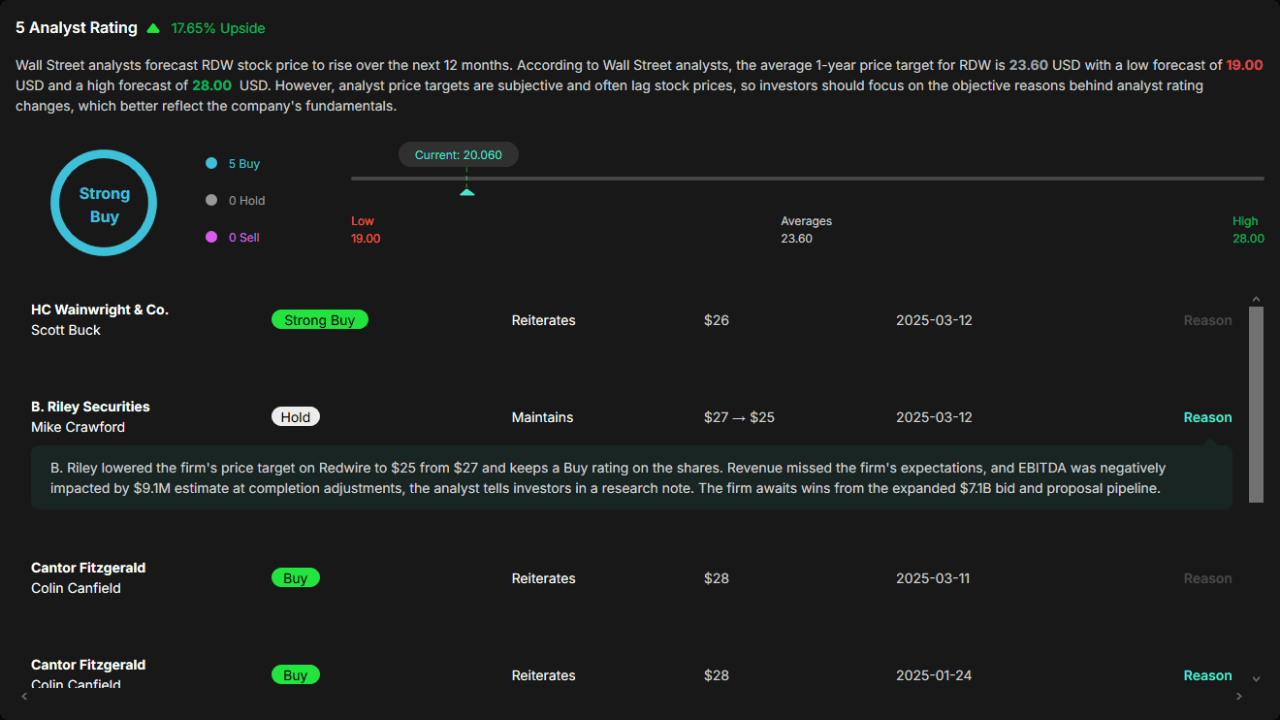

Redwire (RDW)

Redwire (RDW) is a leading space infrastructure firm that builds advanced parts and equipment for satellites, spacecraft, and human habitats at a $1.4 billion market cap. At the moment, shares are trading at $18.45 and have trended upwards by 4% in the past week.

The fact that RDW supports infrastructure for spacecraft with its power systems and structures makes the company vital to the space business. Its emphasis on advanced technologies and its support for plans for space stations and lunar operations draw in investors who see the future clearly.

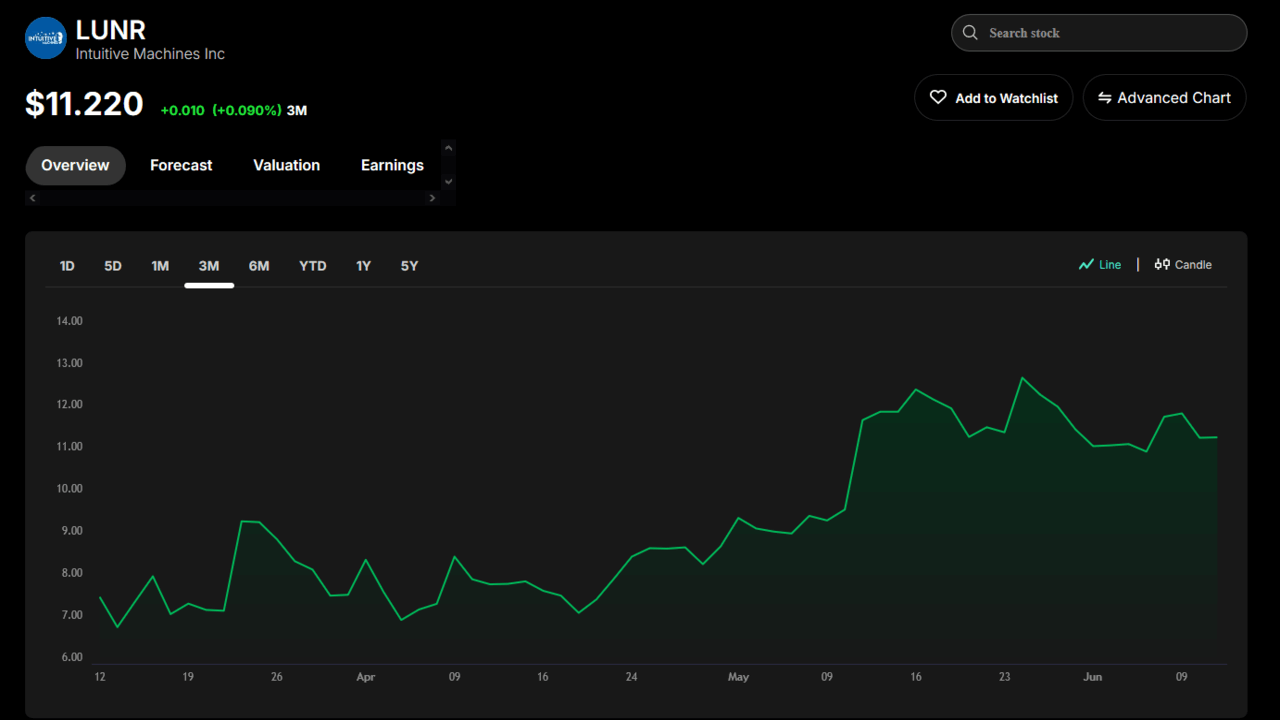

Intuitive Machines (LUNR)

Intuitive Machines (LUNR) is a company involved in NASA’s Artemis program dedicated to exploring the Moon. Currently, LUNR is valued at $11.79, and its 52-week range is from $3.15 to $24.95. The stock experienced moderate daily ups and downs, with its highest price at $12.16 and lowest at $11.36

What makes LUNR unique is its strong involvement in lunar logistics and participation in moon exploration projects led by the government. Intuitive Machi is worth considering if you are interested in the field of space that extends past Earth’s orbit.

How to Invest in Space Stocks with Intellectia AI

Intellectia AI suite, which includes AI Stock Picker, AI Screener, Swing Trading, Daytrading Center, and Technical Analysis, offers real-time news, technical signals, pattern recognition, and price predictions to help you time entries and exits efficiently.

Intellectia gives you vital resources for every step of your investing journey:

Price Prediction & Technical Analysis: Monitor predictions and watch for moving averages (such as the bullish technical data for RKLB stock)

Stock Monitor & Pattern Detection: Be informed about events such as breakouts, the trend of the RSI, and emerging chart patterns.

AI Stock Picker & Screener: You can filter space plays based on their contracts, metrics, or forecasts.

Day Trading/Swing Trading Strategies: Simplified applications that provide trading signals, giving alerts on market movements and recommending specific actions.

Earnings & Trading News Feed: Don’t miss out on essential developments with up-to-date reports about earnings reports or new technological achievements.

Thanks to Intellectia AI Trading Signals, Swing Trading, and Technical Analysis, you never have to guess; you can base your decisions on facts.

Conclusion

The space industry is seeing a time of significant advancement thanks to satellite broadband, reusable rockets, and attention from the global defense sector. These space stocks, like RKLB and ASTS, provide investors with many opportunities. With Intellectia’s AI-assisted market analysis, you can make better decisions before you invest in the stock market.

Feeling prepared to get your space portfolio off the ground? Register at Intellectia.ai to receive regular AI updates and trade suggestions and get access to the latest stock-picking tools.