Key Takeaways

- Nvidia reported record Q3 revenue of $57.0 billion, up 62% year-over-year, driven by massive Data Center demand.

- The company provided strong Q4 guidance of $65.0 billion, signaling continued momentum for the Blackwell architecture.

- Data Center revenue alone hit $51.2 billion, confirming the AI infrastructure boom is still in its early stages.

- Despite volatility, analysts maintain a "Strong Buy" rating with price targets averaging around $250.

- Nvidia continues to dominate the S&P 500 and Dow Jones, acting as a bellwether for the entire tech sector.

Introduction

Have you ever stared at a stock chart after a major earnings report, unsure if the dip is a buying opportunity or a warning sign? You aren't alone. The volatility surrounding Nvidia earnings can be paralyzing, even for experienced traders. When the world's most important AI chipmaker releases its financial results, it doesn't just move a single ticker—it shakes the entire S&P 500 and Dow Jones.

Traders and investors constantly face the challenge of filtering signals from noise. You see the headlines about "record revenue," yet the Nvidia stock price might drop in after-hours trading due to lofty expectations. This disconnect between fundamental performance and market sentiment is exactly where opportunities lie.

By analyzing the hard numbers from the latest Nvidia earnings report and understanding the market's reaction, you can make data-driven decisions rather than emotional ones. In this guide, you will get a complete breakdown of the results, the forecast for NVDA stock, and how to position your portfolio for the next phase of the AI revolution.

Source: Intellectia.ai

Why Nvidia Earnings Matter (NVDA, Dow Jones, S&P 500)

When you look at the current financial landscape, few events carry as much weight as the quarterly release of Nvidia results. It is no longer just about a single company; it is about the health of the entire artificial intelligence ecosystem and the broader stock market.

Why Nvidia Earnings Move the Entire Market

You might wonder why a single semiconductor company dictates the direction of global indices. The answer lies in the "AI Revolution." Nvidia provides the picks and shovels for this technological gold rush. When Nvidia earnings beat expectations, it validates the capital expenditure of other tech giants like Microsoft, Meta, and Google. If Nvidia sneezes, the entire tech sector catches a cold. Consequently, trading around these earnings requires precise timing and an understanding of market sentiment, something you can track using Intellectia’s News Monitor.

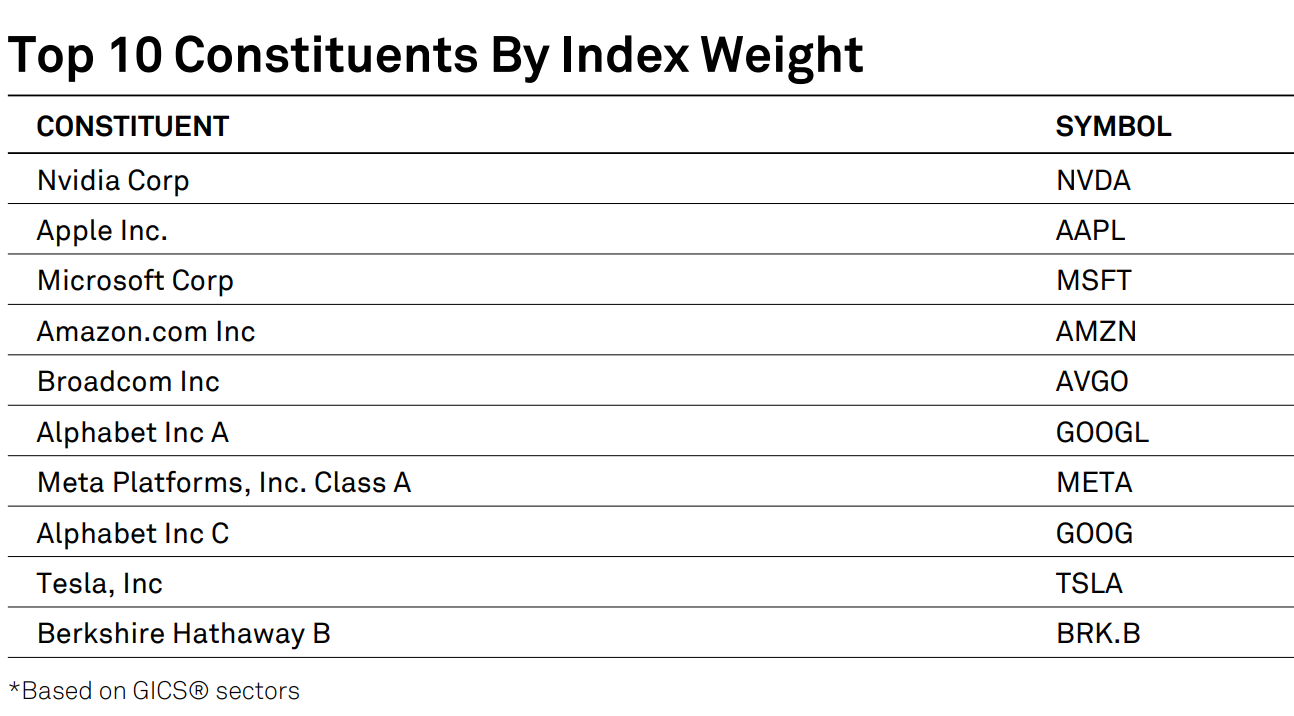

Nvidia’s Weight in the S&P500 and Nasdaq

Nvidia stock has grown to become one of the most influential components of major indices. With a market cap hovering near $4 trillion, movements in the NVDA share price have a mathematical impact on the S&P 500 (SP500) (7.5% is Nvidia stock) and the Nasdaq 100 (9.9% is Nvidia stock). When you hold an index fund, you are implicitly holding a significant amount of Nvidia. A 5% move in NVDA can drag the entire index up or down, affecting your retirement accounts and passive investments regardless of whether you own individual shares.

Source: S&P Global

How NVDA Earnings Influence AI Stocks, Chipmakers & Dow Jones

Nvidia recently joined the Dow Jones Index, replacing Intel, which further cements its status as a blue-chip leader. Its earnings report acts as a bellwether for the semiconductor industry. Positive NVDA earnings typically lift peers like AMD and Broadcom, while also boosting the "AI trade" across software and utility companies providing power to data centers. Conversely, any sign of slowing demand in an Nvidia earnings report can trigger a sell-off across the board. To stay ahead of these sector-wide moves, utilizing an AI Stock Screener can help you identify correlated assets that are moving in sympathy with Nvidia.

Nvidia Earnings Results — A Complete Breakdown

To understand where the stock is going, you must first understand where the business stands today. The Q3 FY26 Nvidia earnings report was nothing short of historic, shattering records and reinforcing the company's dominance.

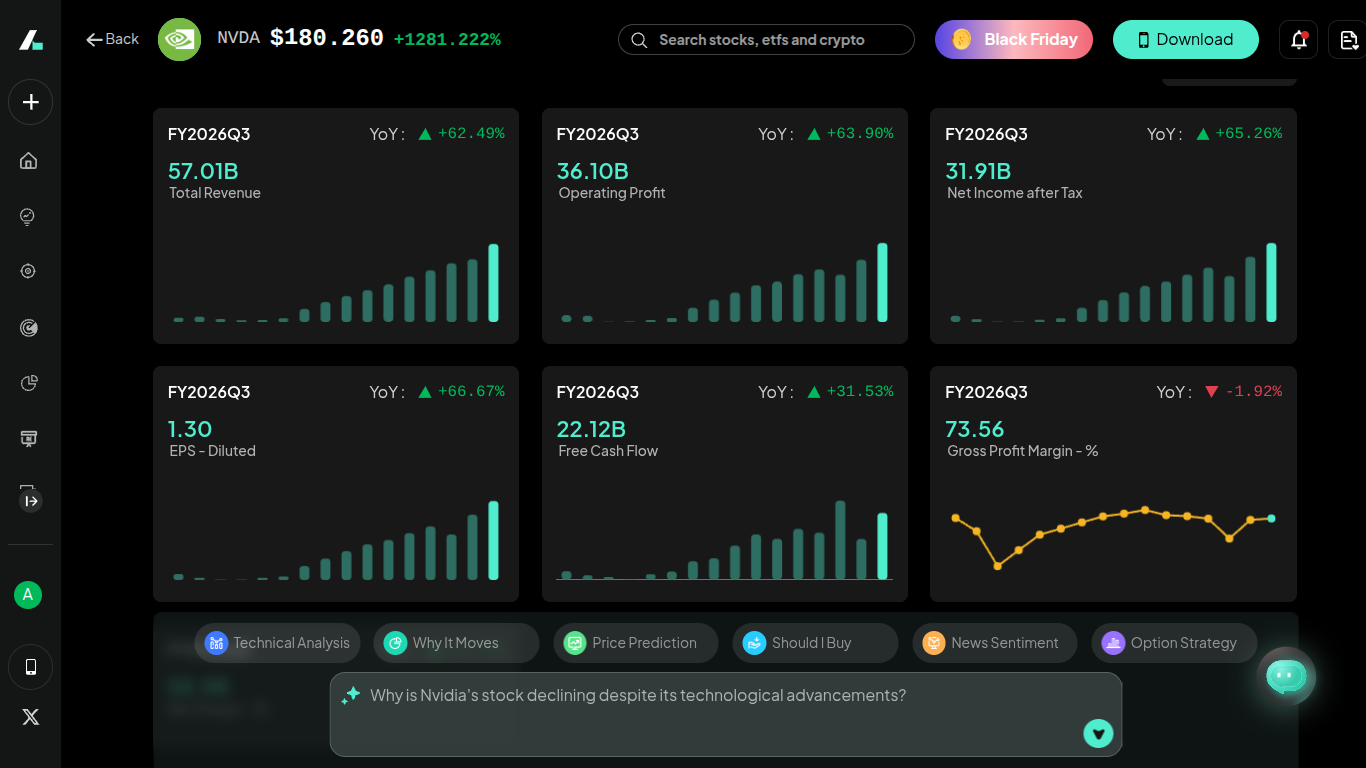

Revenue & EPS: How Did Nvidia Perform vs Expectations?

In the latest quarter, Nvidia delivered total revenue of $57 billion, a staggering increase of 62% year-over-year. This beat analyst expectations and represented a record sequential growth of $10 billion. On the bottom line, the Non-GAAP Earnings Per Share (EPS) came in at $1.30, beating estimates of $1.26.

For you as an investor, this consistency is vital. Beating both top and bottom-line estimates proves that the company is managing its explosive growth efficiently. The gross margin remained healthy at 73.6%, indicating that despite supply chain complexities, Nvidia maintains incredible pricing power.

Source: Intellectia.ai

AI & Data Center Growth — Main Driver of NVDA Earnings

The engine behind the NVDA stock rally is undeniably the Data Center segment. This segment alone generated $51.2 billion in revenue, up 66% from a year ago. This growth is driven by insatiable demand for the Hopper architecture (H200) and the initial ramp of the Blackwell chips.

Demand for AI infrastructure is coming from everywhere—cloud service providers, sovereign nations building their own AI clouds, and enterprises integrating generative AI. Management noted that demand for Blackwell is "off the charts," with supply expected to be constrained well into fiscal 2026. This supply-demand imbalance is a bullish signal for the Nvidia stock price moving forward.

Gaming, Automotive & Edge AI Segments

While AI steals the headlines, you should not ignore the other segments. Gaming revenue reached $4.3 billion, up 30% year-over-year, driven by normal seasonal demand for GeForce GPUs. The Automotive sector also showed strength, with revenue of $592 million, up 32% year-over-year, fueled by self-driving platforms. These segments provide a stable foundation, diversifying the revenue stream beyond just the data center boom.

Nvidia’s Earnings Guidance for Next Quarter

Markets look forward, not backward. The catalyst for the post-earnings movement was the guidance. Nvidia forecasts Q4 revenue to be $65.0 billion (plus or minus 2%). This implies continued sequential growth, driven by the rollout of the Blackwell architecture.

If you are trading NVDA stock, this guidance is the most critical metric. It confirms that the "peak AI" narrative is false and that infrastructure spending is accelerating, not slowing down.

Comparison With Previous Earnings Cycles

Comparing this quarter to previous cycles, you see a maturing growth story. While the percentage growth rates are normalizing (dropping from triple digits to high double digits), the absolute dollar amount of growth is unprecedented. Adding $10 billion in revenue in a single quarter is a feat rarely seen in financial history. To visualize these trends effectively, you can use Stock Technical Analysis and Quant AI tools to overlay past earnings reactions on current price action.

Source: Intellectia.ai

Nvidia Stock Reaction After Earnings

Once the numbers are released, the market votes with its wallet. The reaction to Nvidia earnings can be volatile, often defying immediate logic.

Immediate NVDA Share Price Movement

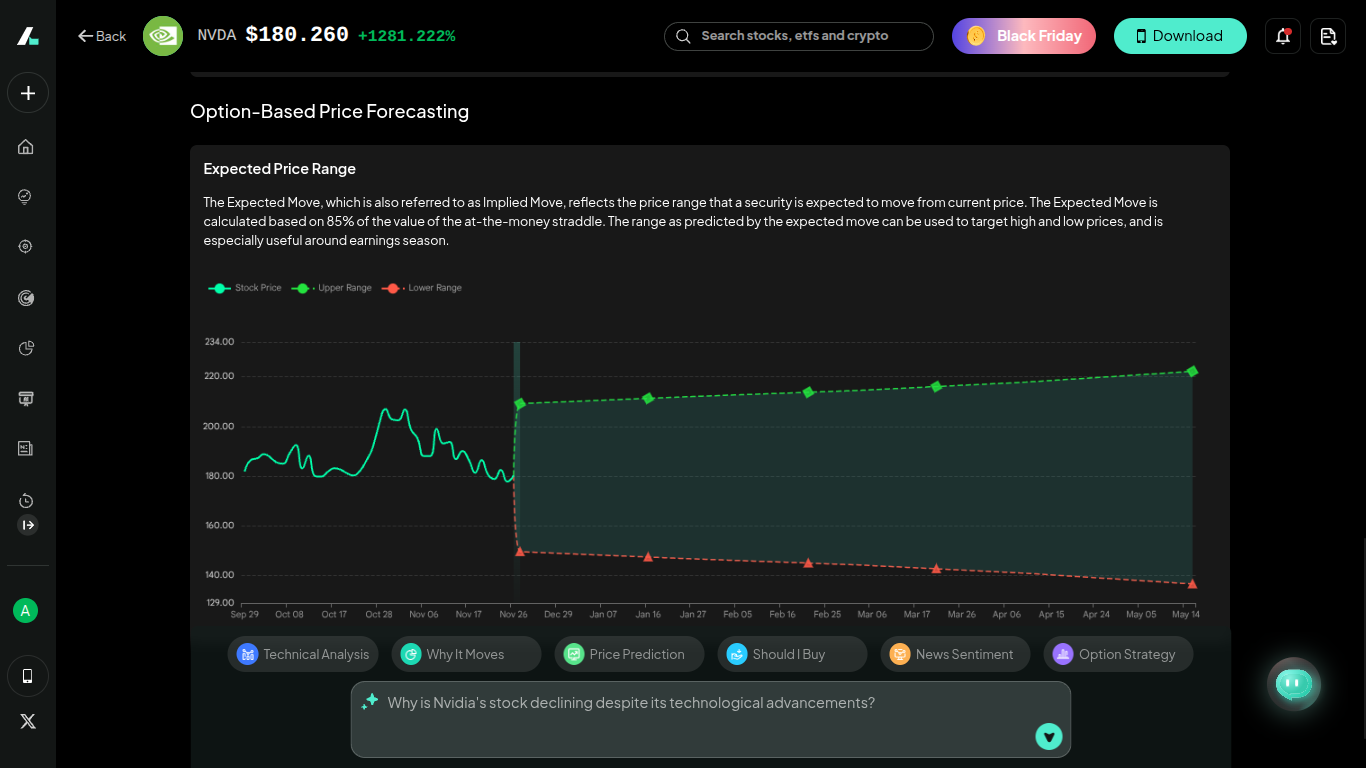

Following the release, the Nvidia share price often experiences significant volatility. In the most recent cycle, shares saw initial fluctuations in after-hours trading. Despite a beat on both top and bottom lines, the stock initially dipped—a classic "sell the news" reaction—before buyers stepped in. Options markets had priced in an 8% swing, highlighting the uncertainty and high stakes involved.

You must be prepared for this. When a stock is priced for perfection, even a massive beat can result in a short-term pullback if the "whisper numbers" (unofficial expectations) were even higher.

Historical Patterns — How NVDA Stock Reacts After Earnings

Historically, NVDA stock tends to be volatile immediately after the report but finds a direction within 3 to 5 days. Pattern recognition is crucial here. Often, a post-earnings dip is bought up aggressively by institutional investors who missed the initial entry.

Conversely, if the guidance is merely "in line" rather than a "beat and raise," the stock can consolidate for weeks. Using Intellectia’s Stock Chart Patterns, you can identify support levels where institutional buy orders are likely sitting, helping you time your entry better than the retail crowd.

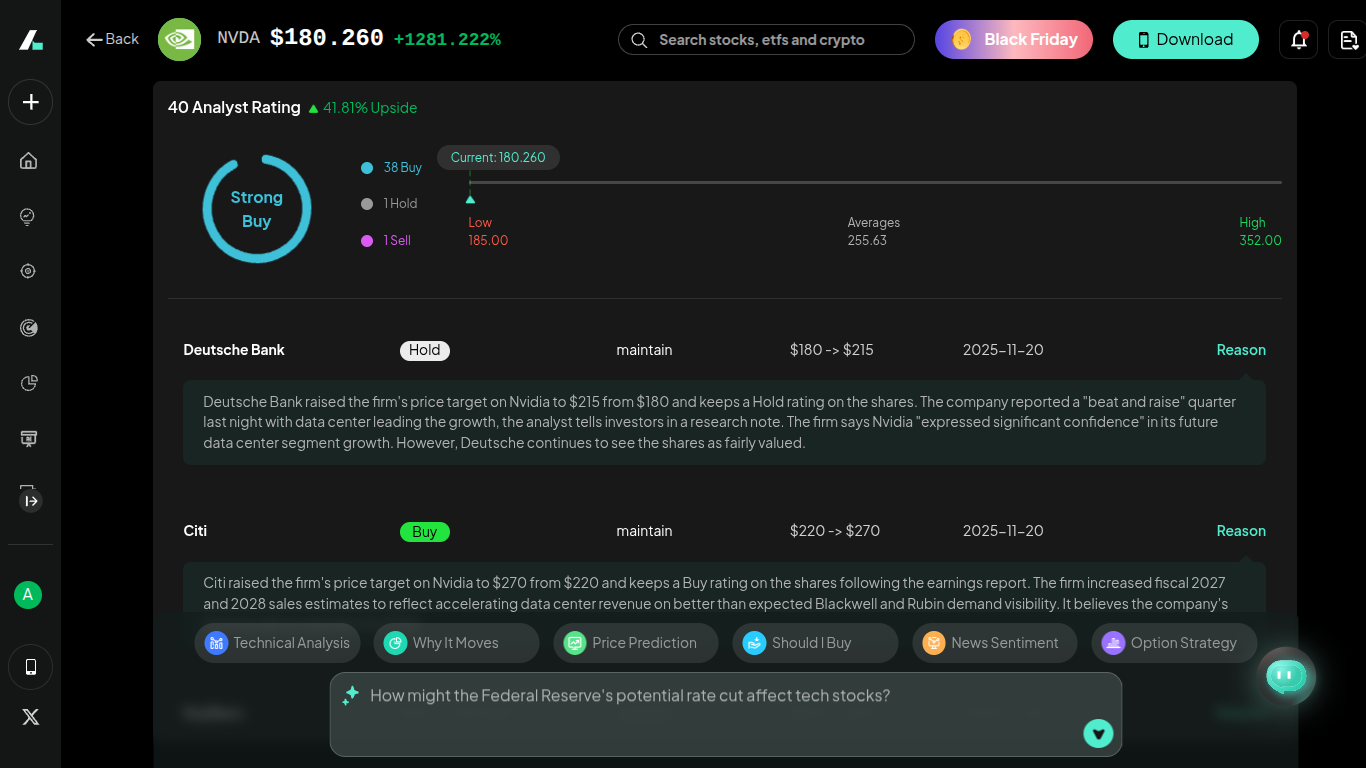

Analyst Upgrades, Price Targets & Ratings After Earnings

Post-earnings, the analyst community rushes to update their models. Currently, the average analyst rating remains a "Strong Buy" with a score of 4.67 out of 5. Price targets have been consistently revised upward, with averages hovering around $255.

Why does this matter to you? Because institutional capital often follows these price targets. When major banks raise their targets, it gives permission for mutual funds and pension funds to increase their allocation, creating sustained buying pressure on the Nvidia stock price.

Source: Intellectia.ai

Nvidia Earnings Forecast — What’s Next for NVDA?

Looking beyond the current quarter, you need to understand the long-term trajectory to decide if NVDA stock belongs in your portfolio for the long haul.

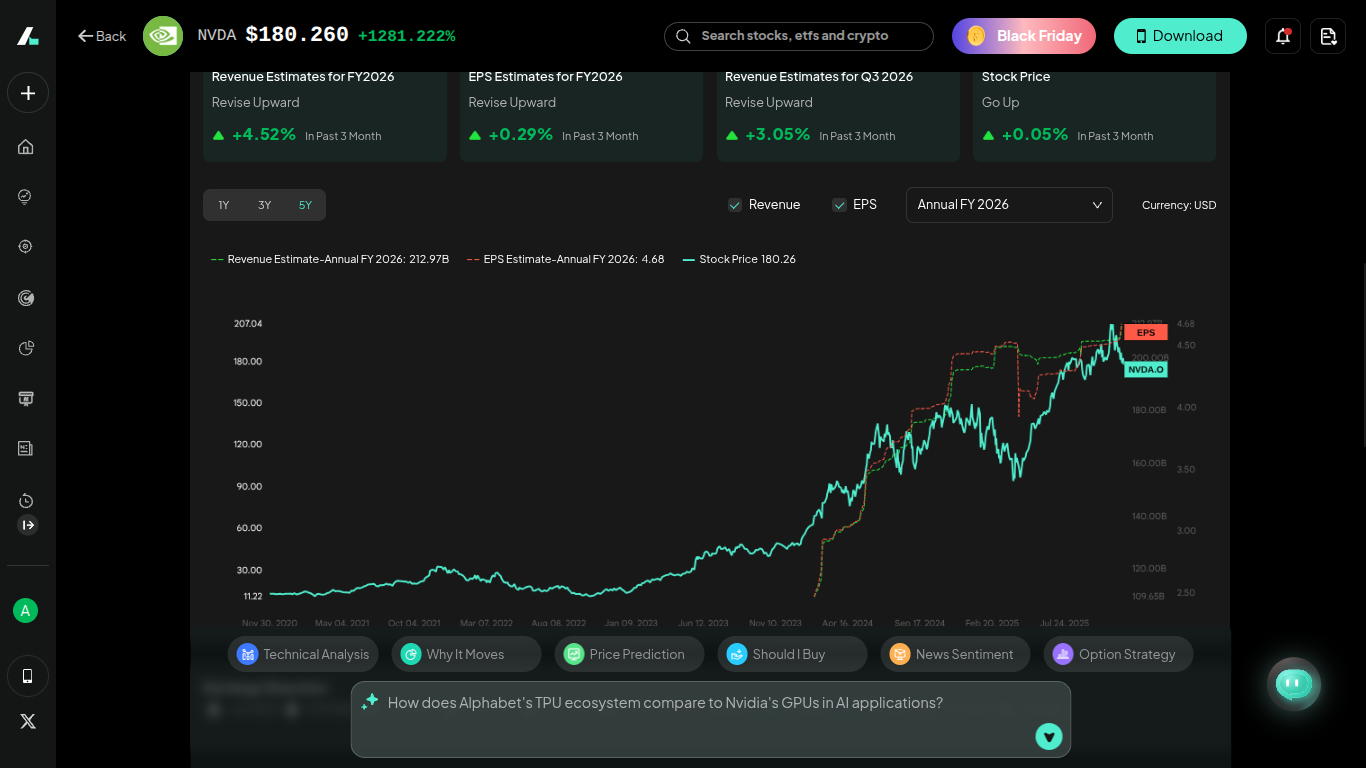

Analyst Expectations for Future Nvidia Earnings Cycles

Analysts project that the data center build-out is a multi-year trend. Management has stated they have visibility into $500 billion of Blackwell and Rubin revenue through the end of 2026. This forward visibility is rare in the semiconductor industry and suggests that earnings will continue to grow, albeit at a stabilizing rate.

Analysts expect Nvidia results to continue beating estimates as supply chain constraints ease, allowing the company to ship more units of its high-margin Blackwell chips.

Source: Intellectia.ai

Risks Investors Should Watch: Supply Chain, Regulation, Competitors

No investment is without risk. You should monitor three key areas:

1. Supply Chain: Can TSMC and packaging partners keep up with demand? Any hiccups here could stall revenue growth.

2. Regulation: The U.S. government restricts sales of high-end chips to China. While Nvidia has created compliant chips (like the H20), further restrictions could impact billions in revenue.

3. Competitors: AMD and custom silicon from hyperscalers (Google, Amazon) are trying to eat into Nvidia's margins. While Nvidia dominates now, the gap may narrow.

You can stay updated on these risks in real-time by using the News Wire feature, which filters noise and delivers only impactful updates.

Source: Intellectia.ai

NVDA Stock Price Forecast for 2026

Based on the current trajectory of the S&P 500 and the broader AI market, many forecasts place NVDA significantly higher by 2026. If the company hits its roadmap targets for the Rubin architecture, earnings power could support a stock price well above current levels. However, valuation compression is a risk if interest rates remain high.

To navigate this, utilizing AI Stock Price Prediction models can give you a probabilistic view of where the price might head based on varied economic scenarios.

Is Nvidia Stock a Buy After Earnings?

So, the big question: Is now the time to buy?

When NVDA Earnings Create Buying Opportunities

If you are looking for an entry, volatility is your friend. Post-earnings dips often flush out weak hands. If the fundamental thesis—AI growth—remains intact (which the $65B guidance suggests it is), then pullbacks are typically buying opportunities. Look for the stock to retest key moving averages (like the 50-day line) as potential entry points.

Long-Term vs Short-Term Nvidia Investing Strategy

Long-Term Investor: Focus on the 3-5 year horizon. The transition to accelerated computing is a trillion-dollar shift. Dollar-cost averaging into NVDA stock ignores the short-term noise of Nvidia earnings volatility and captures the secular trend.

Source: Intellectia.ai

Short-Term Trader: Focus on the implied volatility and momentum. Use Swing Trading Strategies to capitalize on the post-earnings drift. Do not marry the position; trade the chart setup.

How to Compare NVDA With Other AI Leaders Using Data-Driven Tools

You shouldn't view Nvidia in isolation. How does it compare to Broadcom (AVGO) or AMD? Is the valuation stretched compared to the Dow Jones average?

Using Intellectia’s AI Stock Picker, you can run comparative analyses. Look at metrics like Price-to-Earnings Growth (PEG) and Free Cash Flow yield. Often, you will find that despite the high price, Nvidia's growth rate makes it "cheaper" than slower-growing competitors.

Conclusion

The latest Nvidia earnings report confirms that the AI supercycle is far from over. With record revenue, strong guidance, and a dominant position in the S&P 500 and Dow Jones, Nvidia remains the most critical stock in the market. However, high expectations bring volatility.

To navigate this, you need more than just headlines—you need data-driven insights. Whether you are a long-term investor or a swing trader, having the right tools is essential to protect your capital and capture upside.

Ready to trade smarter?

Stop guessing and start using institutional-grade data. Sign up for Intellectia.AI today to get daily AI stock picks, real-time trading signals, and in-depth market analysis delivered straight to your dashboard. Don't just watch the market—master it.