Key Takeaways

- Tesla, Toyota, Xiaomi, BYD, and General Motors are the most valuable car companies heading into 2026, thanks to high market caps, strategic positioning, and long-term investments in technology.

- The highest valuations of automakers are determined by factors such as EV leadership, global reach, financial strength, and brand power.

- EV-focused companies generally receive higher valuations, but legacy automakers with strong electrification plans remain highly competitive.

- Your investment strategy should be based on technology pipelines, long-term revenue stability, and global expansion, not short-term performance.

- Using Intellectia AI’s tools, such as the AI Stock Picker, AI Screener, and Swing Trading Center, can help you identify high-quality opportunities in car company stocks.

Introduction

We’re living through one of the most dramatic shifts the automotive world has ever seen. Not too long ago, the biggest car companies were valued mostly by how many vehicles they sold and how many factories they owned. Today, everything has changed. Investors now look at battery technology, autonomous driving systems, software integration, and AI-driven platforms just as much as they look at actual car sales. And as EV adoption accelerates across North America, Europe, and Asia, it’s getting harder to tell which companies are still leading and which are simply riding momentum.

That’s exactly why I wrote this guide. Instead of making you dig through endless financial reports or guess which automaker is actually “valuable,” I’ve gathered everything you need in one place. You’ll see which car companies rank among the most valuable going into 2026, why they hold those positions, and how their market caps reflect deeper trends in innovation, profitability, and global expansion. With the help of Intellectia AI’s insights and tools—including the AI Stock Picker and AI Screener—you’ll walk away knowing exactly how to navigate the auto sector with more clarity, confidence, and consistency.

What Makes a Car Company “Valuable”?

When you’re looking at car company stocks, it’s easy to focus on just how many cars they sell. You might assume the company that sells the most cars is automatically the most valuable. However, that's just the icing on the cake, as the stock market reveals even more details. For investors, what’s "valuable" is less about current production volume and more about the company's future growth potential and its ability to capitalize on new technology.

Market Capitalization as the Primary Measure

Our primary metric for measuring company value is its Market Capitalization, or Market Cap. This value is the cumulative value of a company's outstanding shares and the final scorecard for public companies. It reflects the general sentiment of all investors regarding a company's present value and, more importantly, its future prospects.

Market Cap is calculated using a simple formula:

Market Cap = Current Stock Price × Total Shares Outstanding

A high market cap is a consistent indicator that investors are willing to pay a premium for its stock, typically because they anticipate tremendous growth. This is the main reason you see a large disparity between the top traditional automakers and the leading EV manufacturers.

Revenue Strength, Global Footprint & Brand Power

A robust market cap must be built on solid ground, rather than hype. You'll be interested in examining the revenue strength of a company—how much money they actually receive as a result of car sales and other associated services. Beyond that, their worldwide presence is crucial: where they sell cars, and their local market share determines stability. Finally, their brand strength is important. Firms such as Toyota and Ferrari, among others, have developed brand loyalty that enables them to charge premium prices and remain stable in any economy over the long term.

EV Adoption & Technology Leadership

This is the non-negotiable aspect in the modern auto market. The most highly valued companies are those aggressively implementing and pioneering Electric Vehicles (EVs), advanced battery technology, and autonomous driving software. If a company can demonstrate that it’s a technology company that just happens to make cars, its market cap is likely to skyrocket. The market rewards the possibility of future, high-margin software sales over present, low-margin hardware sales.

Stock Market Performance of Car Companies

The stock performance of these companies is very volatile and usually reflects short-term news about production levels or technological advances. It’s a cyclical industry, so performance tends to rise and fall with the overall economy and the price of raw materials. Because of this high volatility, many sharp investors use tools like AI trading signals to try and time their entries and exits, aiming to capitalize on both the ups and the downs.

Top 5 Most Valuable Car Companies in 2026

The following rankings are calculated using the most recent market capitalization information. It’s important to remember that these numbers keep changing as investors respond to the news and the progress of companies.

| Company Name | Ticker Symbol | Sector | Market Cap (Approx.) | Key Strengths |

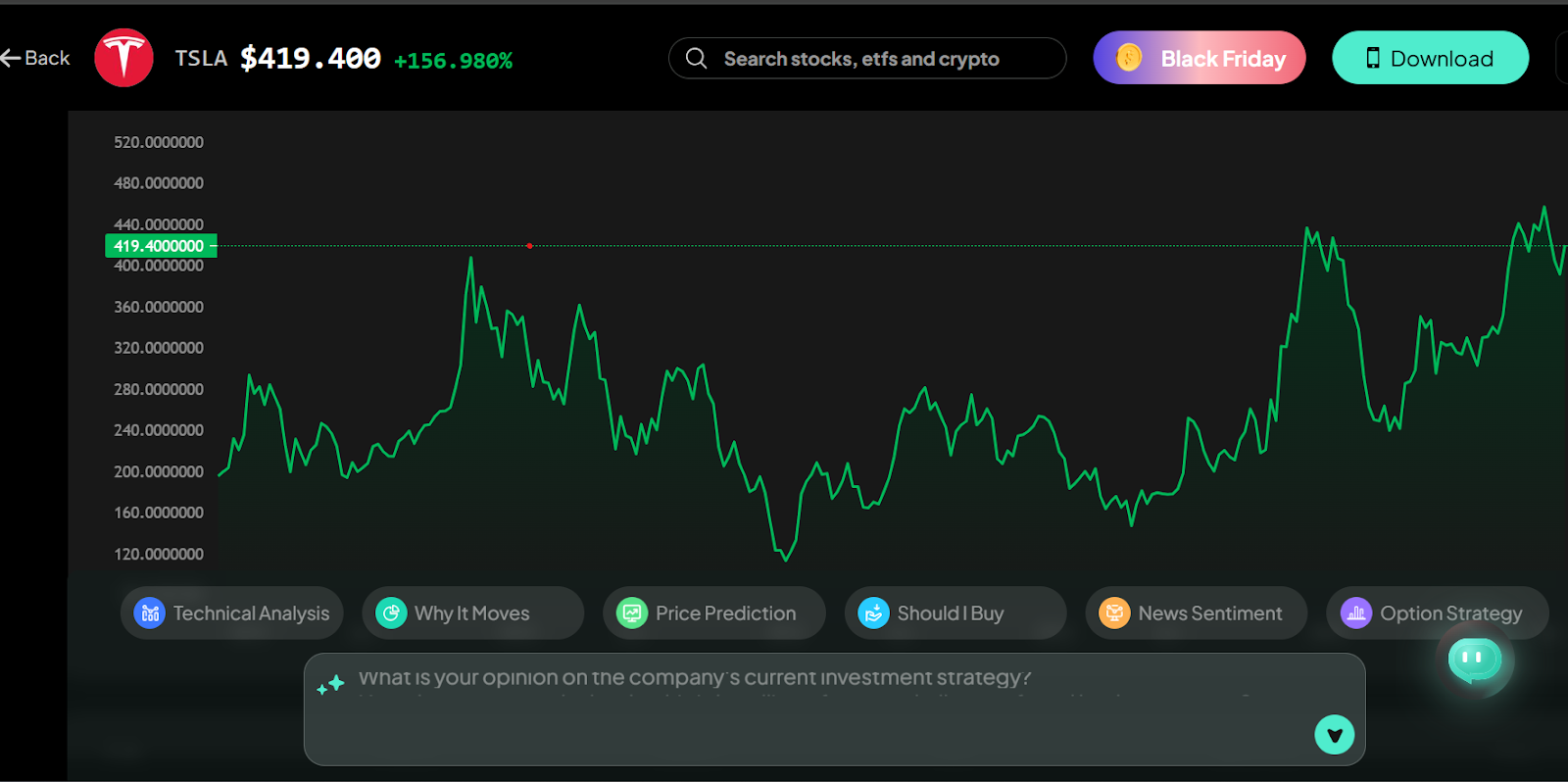

| Tesla | TSLA | EV/Technology | $1.31 Trillion | EV dominance, Battery tech, Autonomous driving software |

| Toyota Motor Corp. | TM | Legacy Auto/Hybrid | $260 Billion | Global sales volume, Legendary reliability, Hybrid leadership |

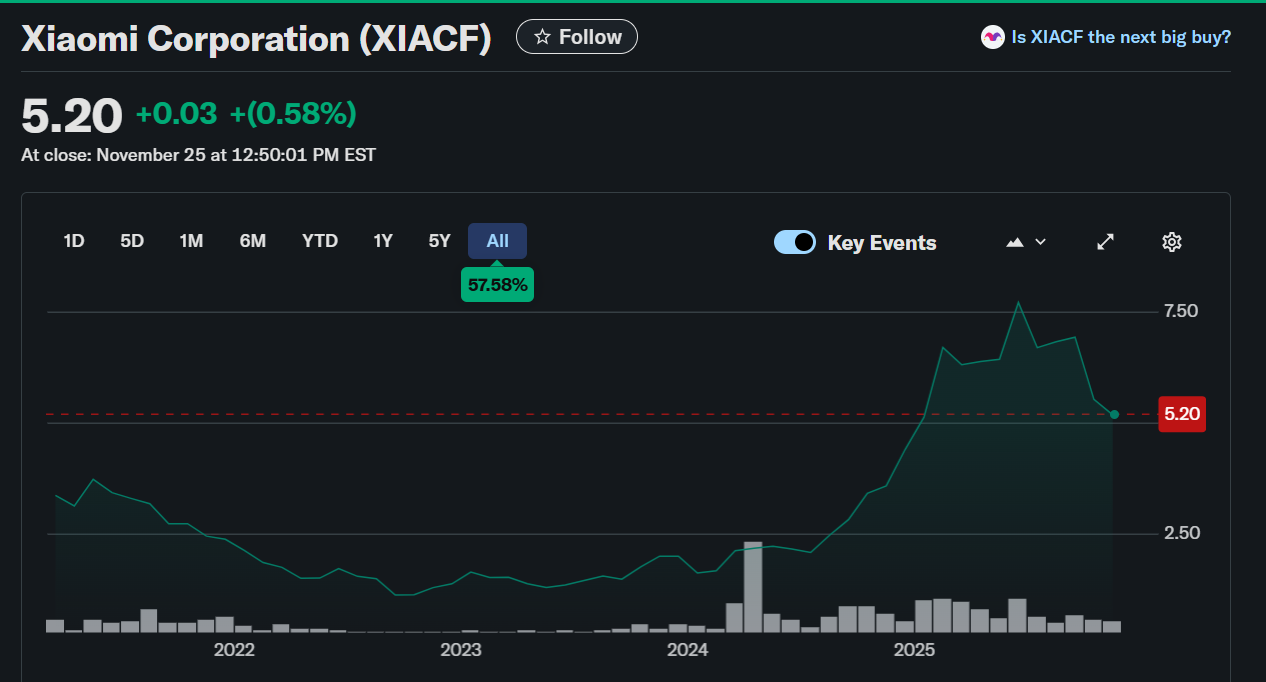

| Xiaomi | XIACF | Tech/EV Challenger | $135.31 Billion | Integration with massive consumer electronics ecosystem, Rapid EV market entry |

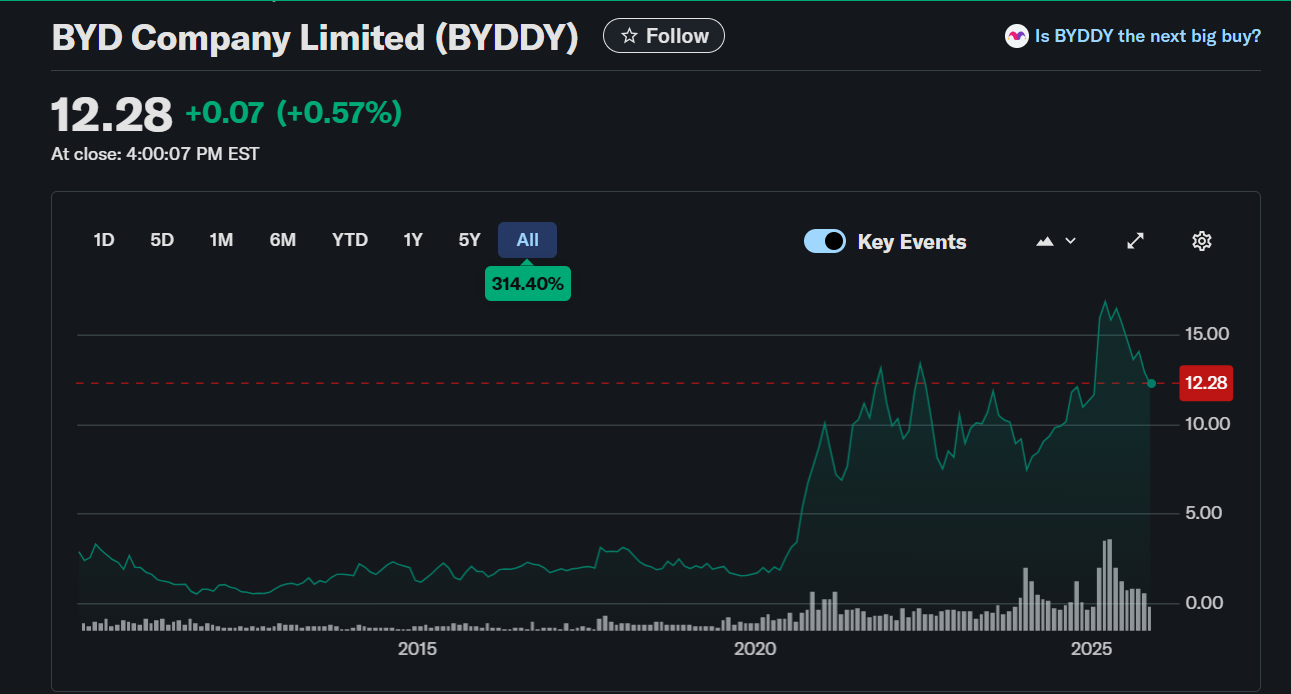

| BYD Co. Ltd. | BYDDY | EV/Battery Tech | $124.86 Billion | Vertical integration (battery production), Strong presence in China/Asia, Wide EV portfolio |

| General Motors | GM | Legacy Auto/EV Pivot | $67.89 Billion | Commitment to all-electric future (Ultium platform), Autonomous driving via Cruise |

Tesla (TSLA)

Tesla remains the market capitalization king of the automotive industry, and it is crucial to understand why. Investors don't see it as just a car company; they see it as an AI, energy, and software enterprise. Tesla's main differentiator is its technology stack, including its battery management systems and Full Self-Driving (FSD) software. This focus on software and recurring revenue is what makes its valuation skyrocket way beyond its output in production.

If you believe that the future of the automotive industry is entirely electric, software-based, and full self-driving, Tesla is a strong stock to include in your portfolio. The market is valuing a future in which Tesla cars will be very profitable, generate recurring revenue (such as robotaxis), and not just involve one-time car purchases. TSLA is definitely a company to monitor if you are a growth investor and can withstand extreme volatility for the potential of huge returns from a disruptive technology leader.

Toyota Motor Corporation (TM)

Toyota is the stable, reliable giant. Although its valuation pales in comparison to Tesla's, Toyota is the global leader in terms of pure sales volume and, in terms of reliability and efficiency, unrivaled. Its competitive advantage lies in its careful production and its long-term, calculated approach to market changes. Their leadership in the hybrid car sector has created an astonishingly successful bridge to the EV age, as hybrids remain one of the best-selling segments worldwide.

If you think that the transition to EVs will be a slow, steady, global, and technology-diverse journey (including a long life for hybrids and hydrogen), then Toyota is a strong candidate for your investment. Their base of legendary dependability and scale gives them the resources and engineering expertise to quickly leapfrog into the pure EV market when they decide to, making them a safer bet for a company stable enough to undertake a cautious transition.

Xiaomi (XIACF)

The fact that Xiaomi has abruptly and dramatically entered the electric vehicle industry is a very interesting story of technology convergence. Primarily known as a global consumer electronics powerhouse (smartphones, home tech), their move into electric cars allows them to leverage their colossal user base and deep expertise in integrating consumer electronics and software. This immediate, seamless connection to their existing ecosystem is what excites investors.

If you are looking for a high-growth tech disruptor aggressively entering the massive Chinese EV market with a built-in advantage, Xiaomi is a compelling, though high-risk, high-reward choice. Their strategy isn't just about selling a car; it's about selling an extension of your smartphone that could redefine the in-car experience and drive their market cap higher.

BYD Co. Ltd. (01211)

BYD is an incredibly powerful competitor, often beating Tesla on local sales volume in China—the world's biggest EV market. Their key strength is vertical integration. Unlike most competitors, BYD manufactures its own batteries (the famous Blade Battery), giving it unparalleled control over its supply chain, costs, and technology innovation. This efficiency allows them to offer a wide range of affordable EVs.

If you're interested in a globally expanding, vertically integrated EV company that is a proven performer in the world's largest market, BYD is an excellent option for you to research. Their self-sufficiency in battery production is a major competitive moat, making them less exposed to global supply chain shocks than most of their rivals.

General Motors (GM)

General Motors is the embodiment of the legacy automaker pivot. They are making a full-scale, multi-billion-dollar commitment to an all-electric future built around their proprietary Ultium battery platform. By investing heavily in its own battery and EV technology, GM aims to recapture the innovative spirit that made it a powerhouse a century ago while using its huge manufacturing scale to drive down costs.

If you believe a legacy giant can successfully execute a full-scale, multi-billion-dollar pivot to an electric future, General Motors offers a more traditional and arguably lower-risk exposure to the US EV market. Their strong portfolio of brands (Cadillac, Chevy, etc.) gives them instant market access and trust that no startup can replicate.

Investment Strategies for Car Company Stocks

The unpredictability of car company stocks, especially EV makers, is why a clear and data-driven approach is necessary on your part as an investor. You can’t just buy and hold and hope for the best; you must use advanced analysis tools to have an advantage.

- Swing Trading the Volatility: The auto industry tends to experience news-driven swings in production, new model releases, or regulatory news. Intellectia.ai's Swing Trading feature helps you find short-term entry and exit points, so you can profit from such price changes. It works best by exploiting the frequent ups and downs in this industry.

- AI-Powered Stock Selection: Our AI Stock Picker is capable of screening hundreds of data points, such as technical indicators and fundamental health, to give you the most promising car company stocks that match your risk profile instead of manually comparing dozens of companies and spreadsheets. This will save you hours of research time as machine learning will do the heavy lifting.

- Technical Analysis for Timing: Timing Your Entry is Important Even in Long-Run Positions. You don't want to buy at the peak. Before you decide to purchase a stock, use the Stock Technical Analysis tools to check important indicators such as the Relative Strength Index (RSI) and Moving Averages to first identify whether a stock is oversold or overbought. This will help you ensure you get the best deal on your investment.

- Monitoring News and Earnings: Valuations can shift dramatically around earnings reports. Our Earnings Trading feature provides key information and potential indicators for reporting dates, ensuring you are ready to respond to any significant market action and implement a strategy before the market reacts.

Conclusion

At this point, you have a far better understanding of which car companies would be the most valuable in 2026—and what actually makes them worth so much in the eyes of global investors. As you already observed, the most valuable car companies in the world are a dynamic combination of old-school and new-age technology companies. And to succeed in this industry, you have to go beyond mere sales numbers and pay close attention to market capitalization, technological adoption (in particular EVs), and a company's global strategy. The biggest risk today is relying on outdated data. It doesn't matter whether you are drawn to Toyota's sheer size or to Tesla and BYD's disruptive nature; data-driven analysis is your co-pilot. Don’t let volatility catch you off guard, and don't miss out on the next big automotive trend. We strongly recommend you sign up and subscribe to Intellectia AI today to receive daily AI stock picks, AI trading signals & strategies, and cutting-edge market analysis delivered straight to your inbox.