Key Takeaways

- Nvidia has increased its reputation recently through the announcement of its AI semiconductor chips

- Nvidia has very strong fundamentals, but some technical indicators may indicate something else

- Top analysts are sticking with their 'buy' positions, with some analysts suggesting a stock price of $220

- The company's stability and historically strong financials suggest it may not be too late to buy Nvidia stock.

Introduction

You might be asking, is it too late to buy Nvidia stock, because you may be concerned that the stock's price is overvalued? This has been my concern for quite some time, and that's why I deconstruct a stock's financials following the below process before I start investing.

After uncovering Nvidia's key fundamentals and technical analysis, Nvidia is showing strong signs of continuing growth, meaning as an investor, if you wanted to buy Nvidia now, there is still potential returns to be made.

What is Nvidia?

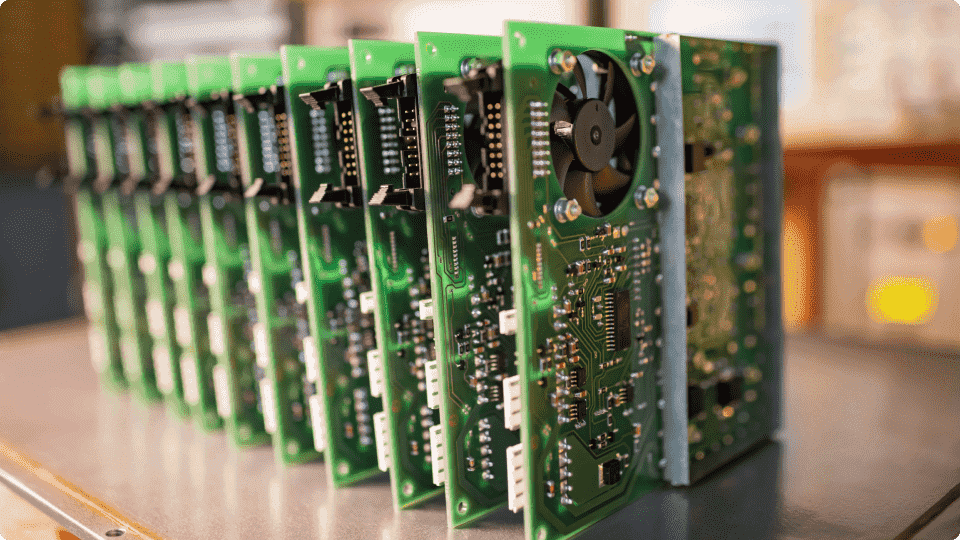

Nvidia is a semiconductor foundry. Founded in 1993, Nvidia is one of the world's leaders in computer graphic cards, designed to render 3D visuals for gaming. Most recently, Nvidia has risen in popularity from the announcement of their AI-ready semiconductor processing units. Making Nvidia one of the world's most valuable companies.

Key features of Nvidia

3D Graphics cards: Famously known for their graphics cards for consumer desktops and laptops, with some of their latest cards begin the RTX30/40/50 series.

AI-ready chips: More recently, Nvidia has unveiled a series of AI-ready semiconductor chips, announcing their smallest chip yet in the series.

Jensen Huang CEO: Nvidia's CEO, Jenson Huang, has been making headlines and appearing more publicly to drive up the brand image of Nvidia.

Market share: As of 2025, Nvidia's market share across the gaming industry has hit 80% market dominance, a remarkable hold over its competition.

Nvidia's stock performance

Market cap: $3.26 Trillion

Revenue: $60.90 billion

52-week range: $54.74 - 153.13

Industry: Semiconductors

Nvidia's fundamentals tell us an interesting story. Compared to 2023, Nvidia has reportedly increased its revenue by 125.8%, an almost unheard-of revenue increase from a billion-dollar company. More astonishingly, Nvidia's profit margin increased by 681.2% within the same time period.

Currently, Nvidia's profit-to-earning P/E ratio is hovering around 55 with an EV/EBITDA at around 46. This indicates Nvidia is undervalued, especially compared to AMD, with a P/E ratio of 105. However, Nvidia's price-to-sales ratio is around 30, which indicates the stock is closing in on being overvalued.

When we consider the moving averages of Nvidia, we can see the stock is currently below its SMA-5 and SMA-20 day moving average but remains higher than its SMA-200. This indicates Nvidia could be heading for a long-term bullish trend.

For a deeper analysis of Nvidia's stock price, I have been using Intellectia's AI tool. It helps me completely decode a company's performance and automatically conducts a technical analysis on any stock or crypto I ask it to. I highly recommend you try Intellectia before investing.

What market analysts are saying about Nvidia?

| Analyst | Rating | Action | Price Target | Date |

|---|---|---|---|---|

HSBC Frank Lee | Strong Buy | Maintains | $195 - $185 | 2025-01-13 |

Rosenblatt Hans Mosesmann | Strong Buy | Maintains | $220 | 2025-01-08 |

Benchmark Cody Acree | Strong Buy | Maintains | $190 | 2025-01-07 |

Phillip Securities Yik Ban Chong | Strong Buy > Buy | Downgrades | $155 - $160 | 2024-11-22 |

DA Davidson Gil Luria | Hold | Maintains | $90 - $135 | 2024-11-22 |

Future Prospects and Considerations

With the launch of Nvidia's new processing units for supercomputers and the development of AI, it certainly seems there is no slowing down for Nvidia's sales. Nvidia has solidified itself as the global supplier of high-quality semiconductor chips.

However, external factors may impact Nvidia in the long term. For example, geopolitical issues between the US and China may disrupt Nvidia's supply chain causing a loss in global sales.

Furthermore, the Trump administration's tariffs may hurt Nvidia's sales margins, which could make Nvidia a less affordable option for US businesses, again hurting Nvidia's overall sales and profit margins.

Conclusion

After reviewing Nvidia's core financials and identifying its overall trend patterns, Nvidia is well-positioned to continue driving its sales and increasing its profit margins, making Nvidia still a good stock to buy. It might be worth considering adding Nvidia to your portfolio.

However, if you're still unsure about Nvidia, or want more suggestions on what stock to buy in 2025, you can check out our blog, as it contains more stock breakdowns and insights into the stock markets.

Frequently Asked Questions

Is Nvidia stock a buy, sell, or hold?

According to the latest analyst ratings from renowned analysts, 37 analysts suggest a 'strong buy' or a ‘buy' action whereas 3 analysts suggest investors ‘hold’. No analysts have suggested selling Nvidia.

Is Nvidia worth buying in 2025?

Yes, Nvidia has shown strong fundamentals and has positive sentiment toward its stock. Nvidia's sales and revenue seem to be growing and may continue to do so throughout 2025.

Does Nvidia have a future?

Yes, there is a substantial amount of evidence that indicates Nvidia, as a company, is stable and will continue to increase its sales and profit margins over the next few years.