Key Takeaways

- Black Friday is a significant indicator of consumer health, often setting the tone for the stock market's fourth-quarter performance.

- Historically, the market sees a "pre-holiday rally" around Thanksgiving, but recent years show increased volatility due to economic factors like inflation.

- Key sectors like Retail, E-commerce, Payments & Fintech, and Logistics typically see the most significant impact from Black Friday sales.

- Leveraging AI-powered tools can help you cut through the emotional hype and make data-driven decisions based on real-time signals and analysis.

- A successful holiday trading strategy involves focusing on long-term fundamentals, diversifying your portfolio, and using data for entry and exit points.

Introduction

Have you ever watched the Black Friday shopping frenzy and wondered if it translates into actual stock market gains? It's a common question that crosses the mind of every investor as the holiday season kicks into high gear.

You're not alone in this. Many traders see the reports of massive consumer spending and question how to position their portfolios. They wonder whether to buy into the hype, if it's just a temporary blip, or how to find the real opportunities amidst the noise.

Understanding the historical data and market dynamics is crucial. The "Black Friday effect" isn't just about a spike in retail sales; it’s a powerful barometer for consumer confidence that sends ripples across multiple sectors of the economy.

This guide will break down exactly how Black Friday affects stocks, from deep-diving into historical trends to identifying the best-performing sectors. More importantly, it will show you how to use powerful AI-driven tools to make informed, data-backed decisions instead of just guessing.

Do Stocks Go Up on Black Friday? Historical Trends

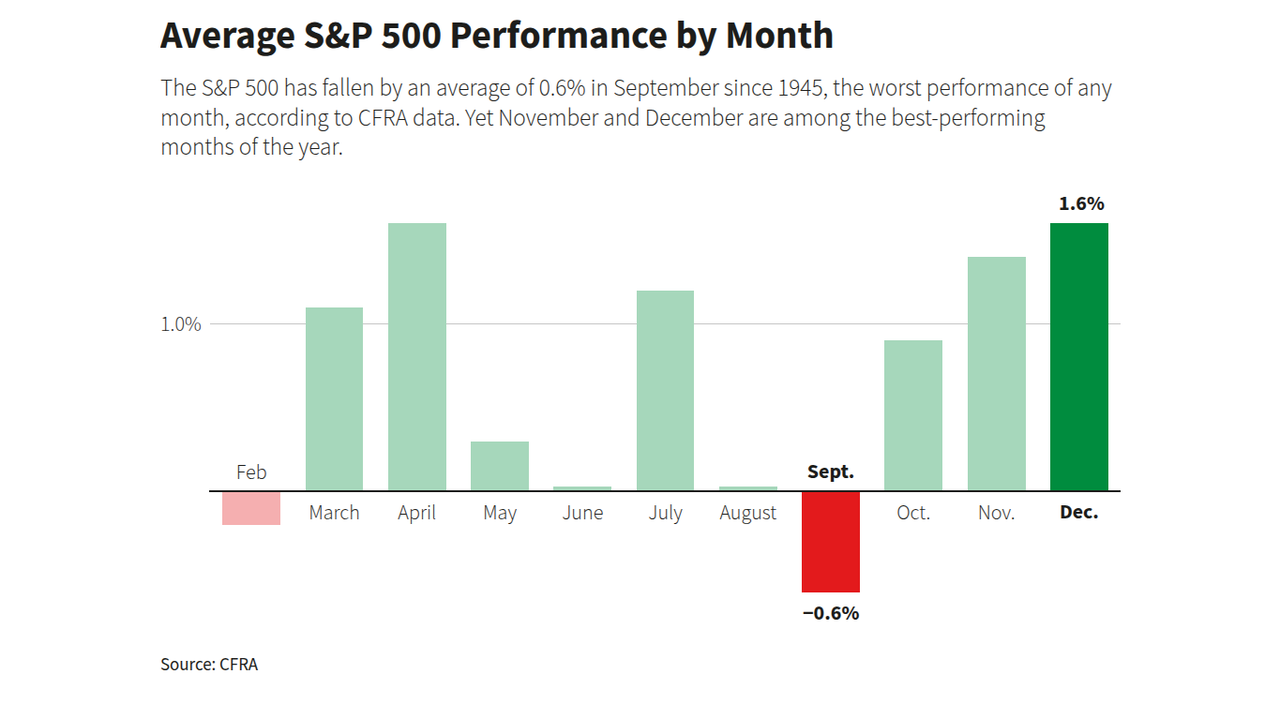

The idea that stocks rally during the holidays isn't just a feeling; it’s a well-documented phenomenon often called the "Santa Claus Rally." This period of year-end optimism frequently kicks off around Thanksgiving week, creating what many traders refer to as a "pre-holiday rally." Looking back at the S&P 500 over the last 5–10 years, there's often a bullish sentiment in the days leading up to and following Black Friday. This is largely fueled by positive expectations for the fourth-quarter earnings season, driven by a surge in consumer spending.

However, relying solely on past performance can be misleading. While the historical pattern suggests a general upward trend, recent years have introduced significant volatility. Factors like high inflation, fluctuating interest rates, and global supply chain disruptions have made the market's reaction more unpredictable. For instance, a strong Black Friday sales report might traditionally send retail stocks soaring, but if that strength is fueled by deep discounts that erode profit margins, the market's reaction could be lukewarm.

Furthermore, the shift from in-store doorbusters to the dominance of digital commerce has changed the game. The "Black Friday" effect is no longer a single-day event but a week-long (or even month-long) online shopping season. This diffusion of sales can sometimes flatten the dramatic single-day stock market spikes of the past. So, while history gives you a useful map, you need modern tools to navigate the current terrain. Keeping an eye on both the historical patterns and the present economic climate is key to understanding if stocks will go up on Black Friday in any given year.

Why Black Friday Matters to Investors

Beyond the immediate sales numbers, Black Friday offers a crucial glimpse into the health of the economy and consumer behavior. For savvy investors, this period is rich with data and signals that can inform trading decisions for the remainder of the year and beyond.

Consumer Spending as a Market Signal

Think of Black Friday and Cyber Monday as the first major test of consumer confidence for the holiday season. The results are a powerful, real-time indicator of the economy's health. Strong spending suggests consumers are feeling financially secure and optimistic, which is a bullish signal for the broader market. The Federal Reserve and market analysts watch these numbers closely, as they can influence everything from future interest rate decisions to corporate earnings forecasts.

Sector Impact Breakdown

The ripple effect of Black Friday extends far beyond just retail. E-commerce giants, payment processors, and shipping companies all experience a massive surge in activity. This creates distinct opportunities across various sectors. Analyzing which sectors are outperforming can give you clues about shifting consumer priorities and technological trends that will continue to shape the market long after the holiday decorations come down.

Short-Term vs. Long-Term Stock Reactions

It’s easy to get caught up in the short-term hype. A stock might jump on news of record-breaking sales, but that doesn't always guarantee long-term growth. Often, these gains are already priced in by the market. A smart investor learns to distinguish between a temporary, sentiment-driven rally and a company's solid underlying fundamentals. You should ask: are these sales profitable, and do they contribute to the company's long-term value?

Best Performing Sectors During Black Friday Season

As shoppers rush to grab the best deals, certain sectors are positioned to benefit more than others. Keeping an eye on these industries can help you identify potential investment opportunities.

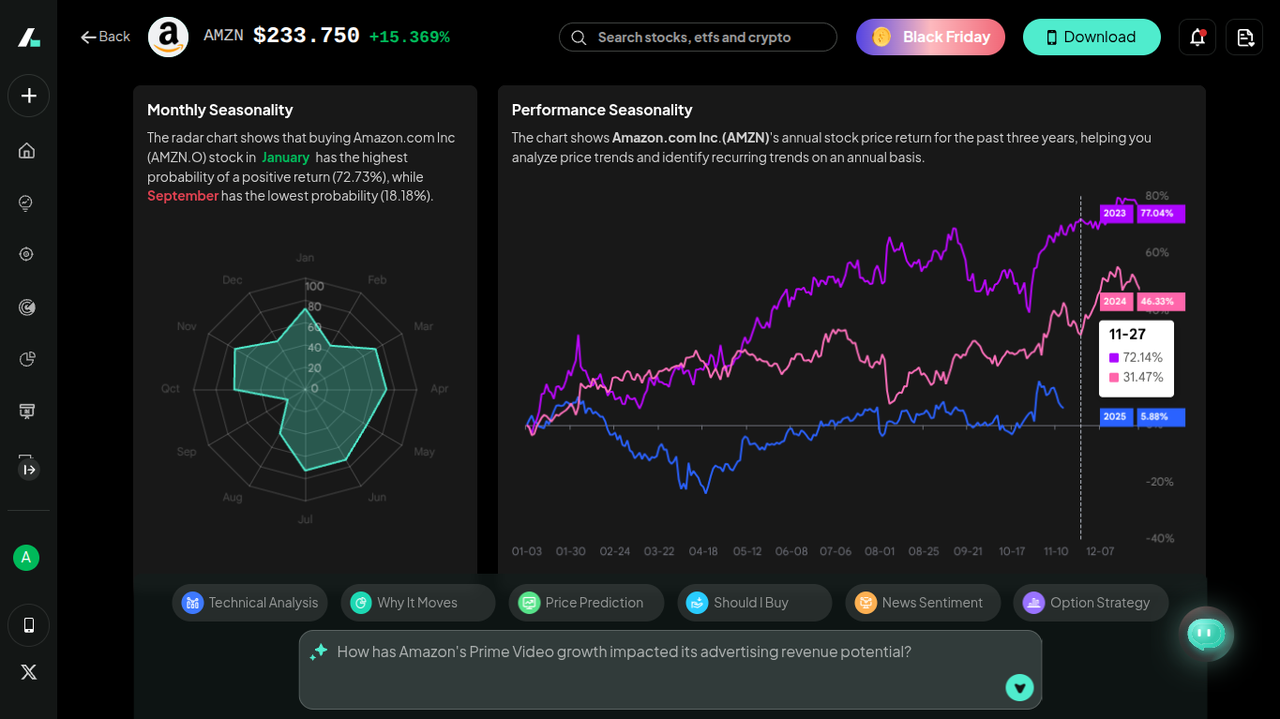

- Retail & E-commerce: This is the most obvious winner. Giants like Amazon (AMZN) and Walmart (WMT) see enormous sales volume. You can monitor their performance using a stock monitor to track momentum and news.

- Payments & Fintech: Every online and in-store transaction is processed through a payment network. Companies like PayPal (PYPL), Square (SQ), and major credit card providers see a massive spike in transaction volume, directly boosting their revenue.

- Logistics: All those online orders need to be delivered. Logistics and shipping companies like FedEx (FDX) and UPS are the backbone of the e-commerce boom, making them prime beneficiaries of the holiday shopping spree.

- Advertising & Social Media: Where do shoppers discover the best deals? On platforms like Meta (Facebook/Instagram) and Google. Retailers pour money into digital advertising to attract customers, leading to a surge in ad revenue for these tech giants.

How AI Trading Signals & Strategies Can Help You Trade the Black Friday Rally

Navigating the fast-paced, news-driven volatility of the Black Friday season can be overwhelming. Emotions can run high, leading to impulsive decisions. This is where leveraging artificial intelligence can give you a significant edge. Instead of guessing, you can use data-driven insights to guide your strategy.

Imagine knowing which stocks have the highest potential before the market even opens. Intellectia.ai's AI Stock Picker is designed for this, delivering daily picks so you can capitalize on intraday movements. For traders who prefer holding positions for a few days to weeks, the Swing Trading signals identify key entry and exit points, helping you ride the holiday trend with greater confidence.

Furthermore, you can cut through the noise with tools like the AI Screener, which allows you to find stocks that match your exact criteria—for example, retail stocks showing bullish momentum and strong trading volume. If you're managing a fast-paced strategy, the Daytrading Center offers real-time technical signals and tracks event-driven market movers, ensuring you never miss an opportunity.

This holiday season, Intellectia.ai is running a special Black Friday campaign. It’s the perfect opportunity to equip yourself with powerful AI tools and turn market volatility into your advantage. Stop trading on emotion and start trading with precision.

Investing Tips for the Black Friday Stocks

While the holiday season presents unique opportunities, it's crucial to stick to sound investment principles. Here are some evergreen tips to help you navigate the Black Friday market with a level head.

Focus on fundamentals over temporary hype. A company's stock might pop due to a press release about record sales, but you should look deeper. Is the company consistently growing its earnings? Does it have a healthy balance sheet? A tool like the Financial AI Agent can help you get answers to these critical questions quickly.

Diversify across sectors with long-term potential. Don't put all your eggs in the retail basket. The holiday rally also impacts fintech, logistics, and tech. Spreading your investments helps mitigate risk if one sector underperforms. For broader market analysis, check out insights on both stocks and crypto.

Use data-based entry/exit signals. Emotions are your enemy during volatile periods. Instead of buying on FOMO (fear of missing out), use data-driven signals to guide your decisions. Rely on platforms that provide clear technical analysis to define your entry and exit points before you even place a trade.

Monitor macro factors. The Black Friday effect doesn't happen in a vacuum. Keep an eye on macro-economic indicators like interest rates, inflation reports, and consumer sentiment data. These factors can either amplify or mute the rally, and staying informed through financial news is essential.

Conclusion

Black Friday is more than just a shopping event; it’s a critical period for investors that offers valuable insights into the economy's direction. While historical trends point toward a holiday rally, the modern market is filled with complexities that demand a smarter, more disciplined approach. By focusing on strong fundamentals, diversifying your portfolio, and leveraging powerful AI-driven tools, you can move beyond the hype and identify genuine trading opportunities.

Are you ready to trade smarter, not harder, this holiday season? Sign up for Intellectia.ai to receive daily AI stock picks and gain access to advanced trading signals and strategies. Explore the pricing plans to unlock the tools you need to succeed.