Key Takeaways

- A high-risk, high-reward stock is one that swings aggressively by more than 20-30% within a short period of time

- High-risk stocks are highly influenced by investor sentiment toward news or comments from industry leaders

- Before investing in high-risk stocks, you should consider your risk-reward ratio to mitigate against substantial losses

Introduction

Have you ever looked at your portfolio and thought: “Maybe I should allocate a small portion toward higher-risk, higher-reward stocks”? Many investors do, including myself. I often follow a 70/20/10 rule — where about 10% of my portfolio is reserved for speculative ideas. In some cases, these high-risk plays yield spectacular returns. But if you allocate too much, the losses can be just as staggering.

In this piece, we’ll explore how you can identify and evaluate high-risk stocks, why they might fit into your portfolio, and show you how to choose wisely in 2026.

What are considered high-risk stocks?

In a nutshell, high-risk stocks generally have extreme volatility and are mostly driven by investment sentiment. A good rule of thumb is if a stock raises or drops by more than 20-30% within a few hours, we can consider these to be high-risk stocks.

List of high-risk, high-return reward stocks

- Meme stocks - driven mostly by investor sentiment

- Penny stocks - much lower trading volumes

- Biotech stocks - highly influenced by new trial approvals

- Quantum stocks - high speculation on future technology

Meme stocks

Meme stocks are a type of stock that is heavily influenced by investor sentiment compared to a stock's fundamental value. These types of stocks are often highly volatile and are driven by social forums and communities, most notably Reddit's WallStreetBets.

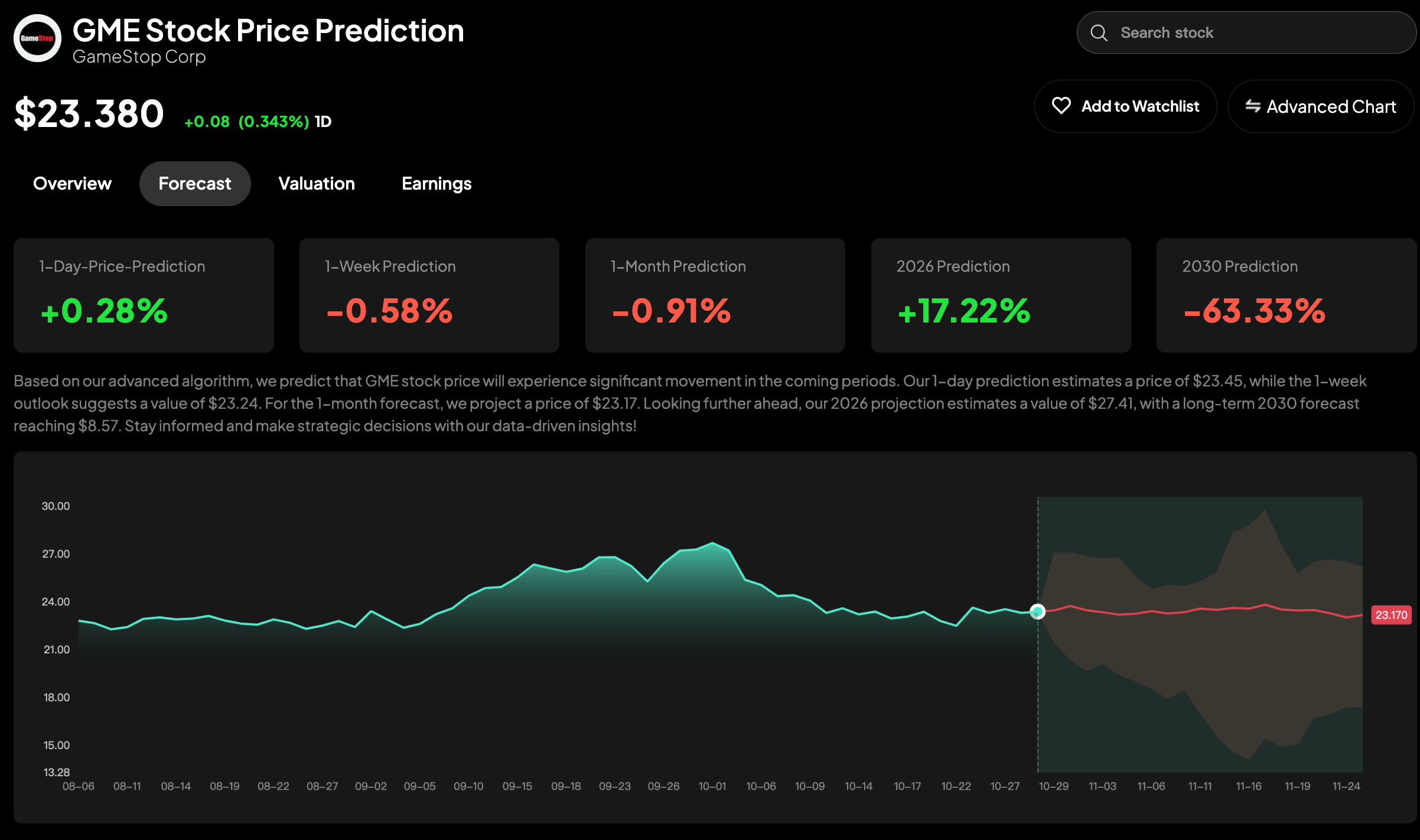

GameStop (GME)

GameStop is one of the most iconic meme stocks, best known for the 2021 short squeeze that sent its price soaring over 1,500%. In 2024, the stock surged again by more than 300% after Keith Gill (Roaring Kitty) returned to social media, reigniting retail investor enthusiasm. While highly volatile, GME remains a symbol of high-risk, high-reward trading.

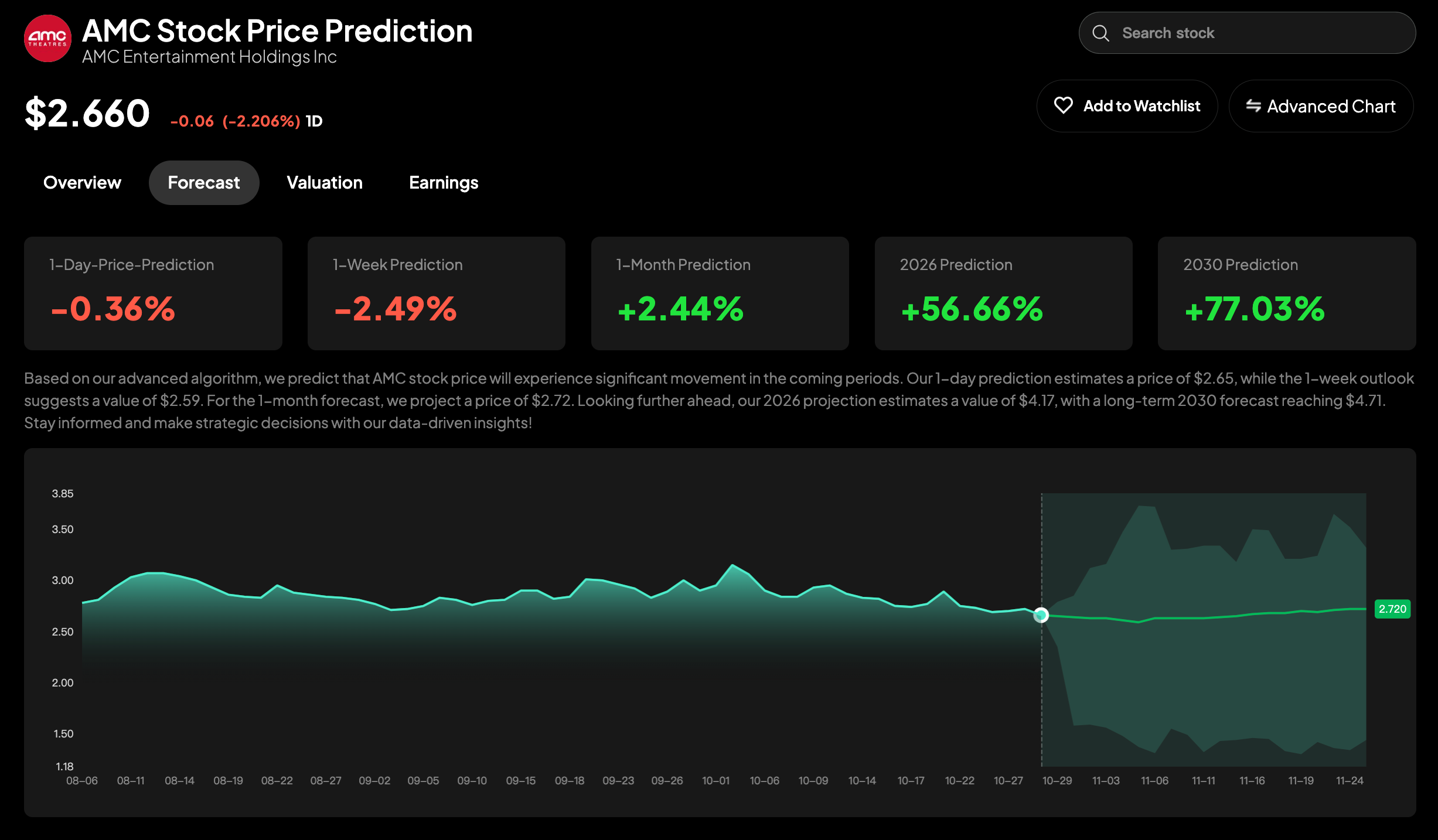

AMC Entertainment (AMC)

AMC remains one of the most recognized meme stocks, fueled by retail investors and social media buzz. After its massive rally during the 2021 meme stock craze, AMC has faced ongoing volatility. In 2024, renewed retail attention briefly lifted its price again, but the stock continues to trade at a fraction of its peak. Despite its risks, AMC still attracts speculative traders looking for potential short squeezes.

Penny stocks

Penny stocks provide extreme volatility and are considered very high-risk stocks. Penny stocks can see extreme growth by 100's of percent within several hours only to lose its value by 99% hours later. Penny stocks are also more susceptible to pump-and-dump schemes and market manipulation.

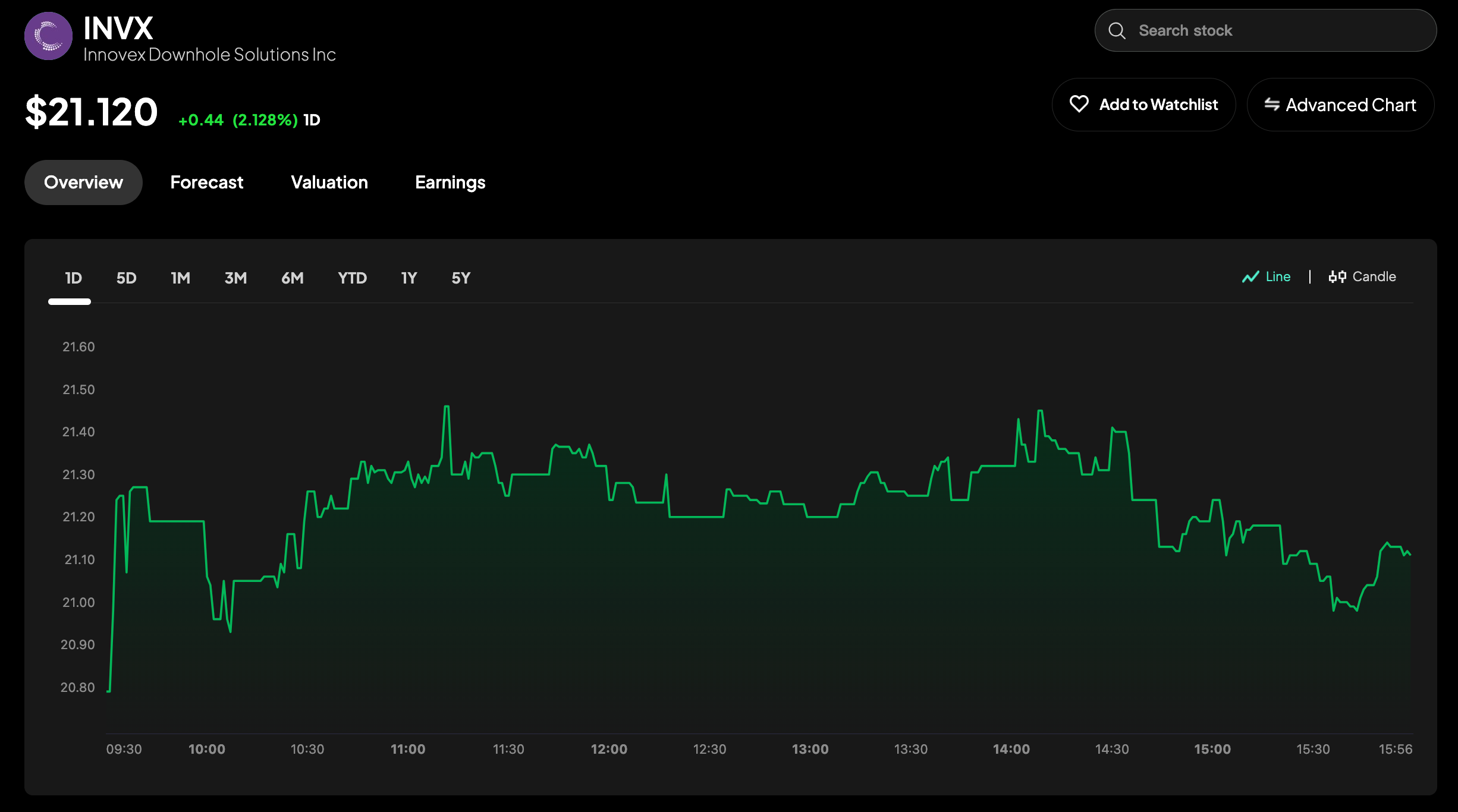

nvivix Inc. (INVX)

Invivix is a small-cap biotech company specializing in next-generation immunotherapy treatments for cancer. The firm recently announced a promising Phase 1 trial result showing tumor-shrinkage in 40% of participants, which triggered a 300%+ spike in its stock. Analysts upgraded the company’s outlook, moving it into the ‘strong buy’ category. Despite its low share price today, the upside potential is high — but so is the risk if the subsequent trials don’t deliver.

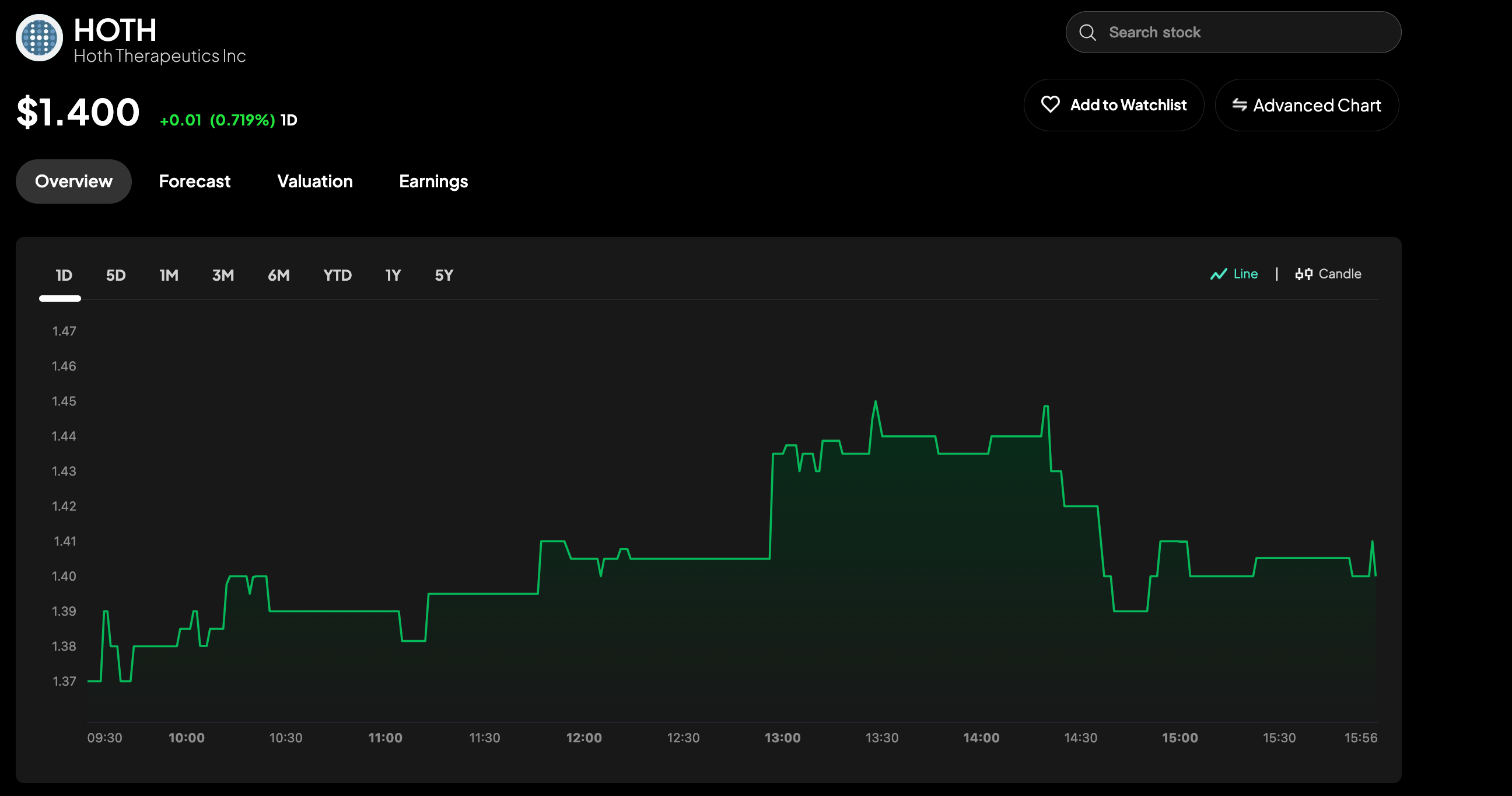

Hoth Therapeutics (HOTH)

Hoth Therapeutics is a clinical-stage biopharmaceutical company developing innovative treatments for dermatological, neurological, and oncological diseases. Its diverse pipeline includes HT-001, a topical treatment for cancer therapy–related rashes, and HT-ALZ, a preclinical program aimed at reducing neuroinflammation associated with Alzheimer’s disease. Although the company remains in early development stages and not yet profitable, positive clinical milestones or partnership announcements could significantly move the stock. Trading below $5, HOTH represents a classic high-risk, high-reward penny stock—one that could deliver substantial upside if its experimental drugs achieve regulatory success.

Biotech stocks

The latest medical news, such as new FDA-approved trials or drugs, closely influences biotech stocks. When news such as this is announced, some biotech stocks begin skyrocketing. These are great high-risk, high-reward stocks.

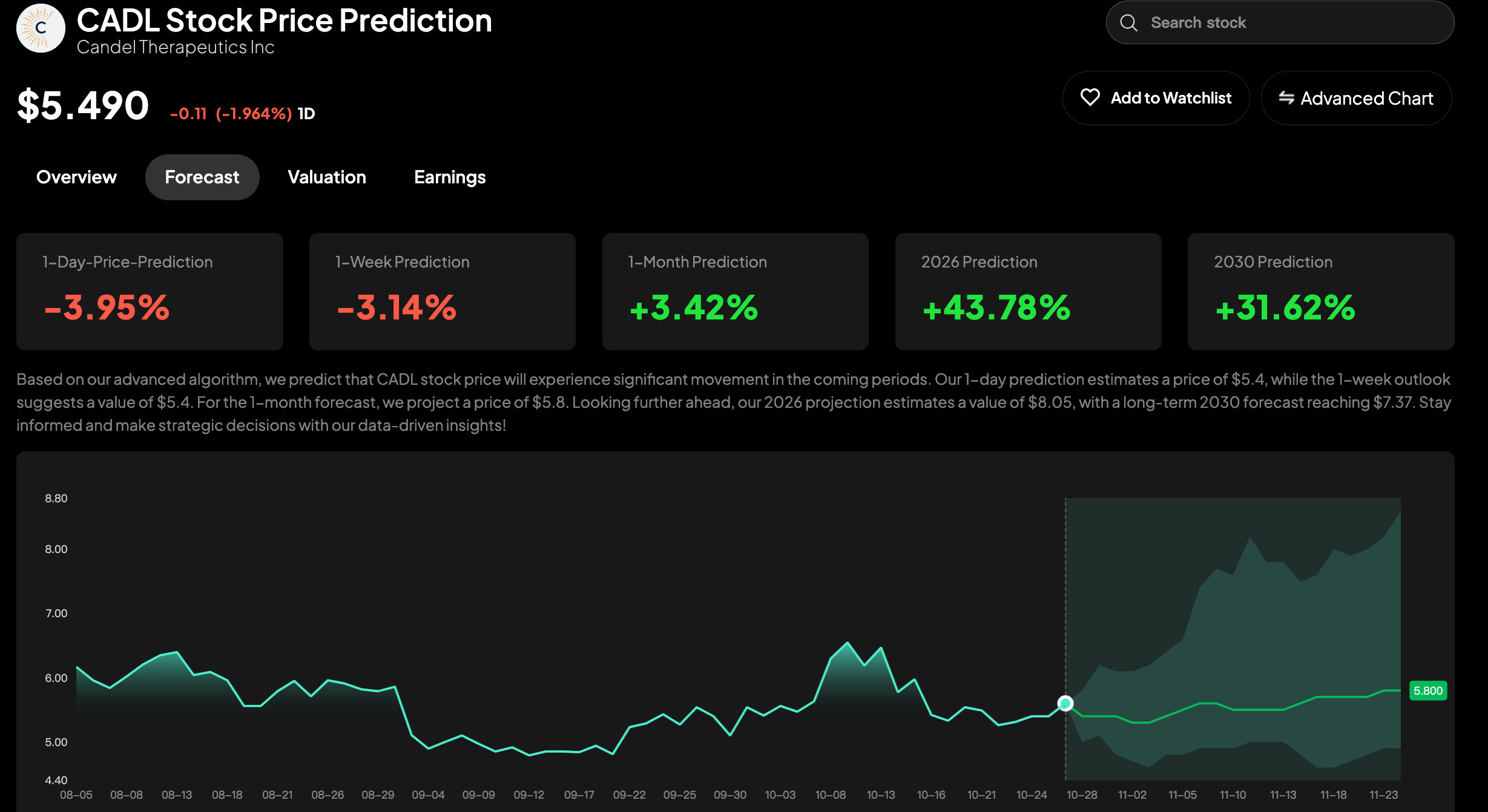

Candel Therapeutics (NASDAQ: CADL)

Candel Therapeutics is a small-cap biotech company focused on immuno-oncology treatments for rare and aggressive cancers. Its lead candidate, CAN-2409, is in a Phase 2/3 trial for localized prostate cancer and pancreatic cancer, and positive interim data (reported in 2024) triggered a sharp share price rise from under $10 to over $14. With its low share price, high clinical upside and significant risk of trial failure, CADL serves as another strong example of a speculative biotech pick worth including in your “high-risk, high-reward stocks” category.

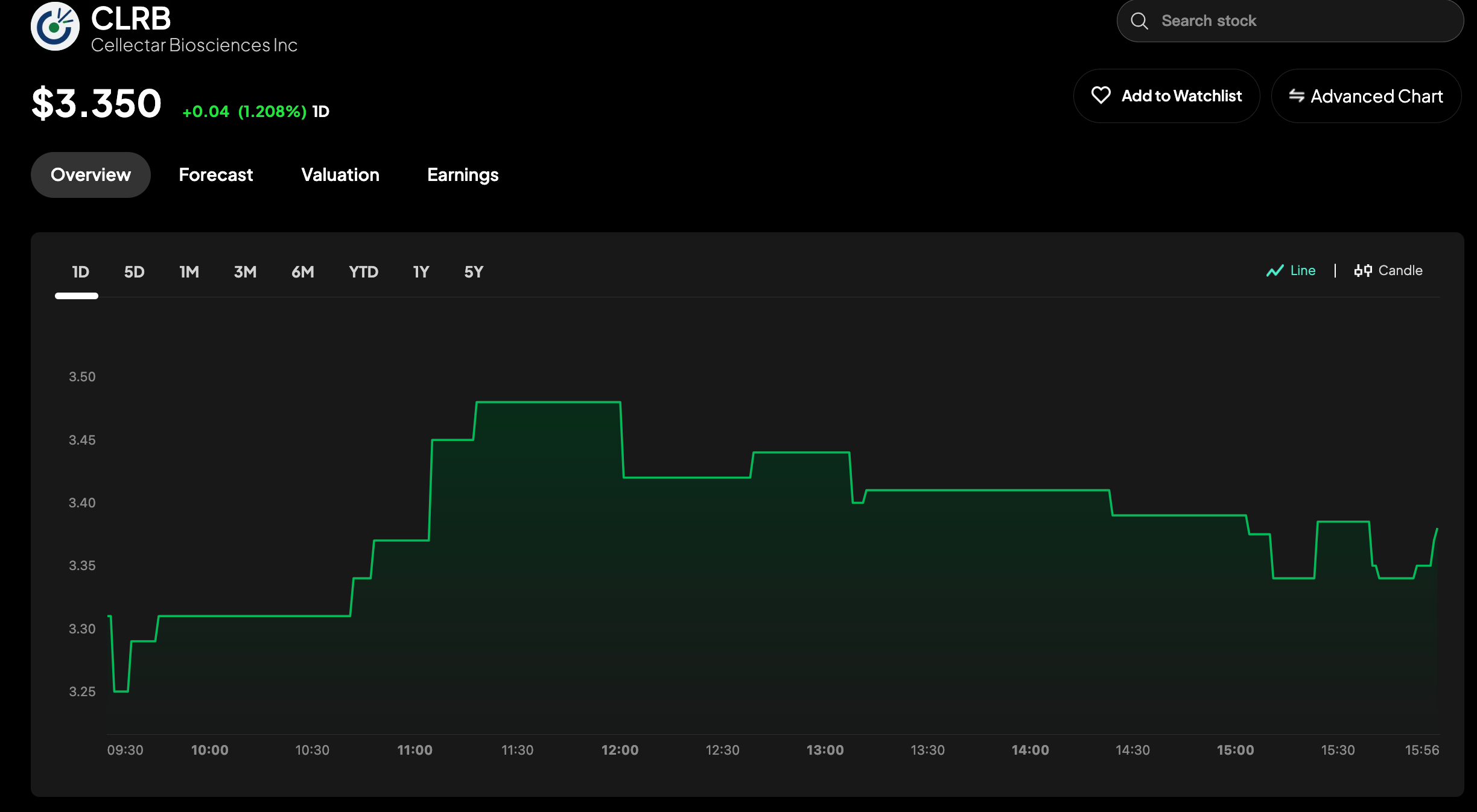

Cellectar Biosciences (NASDAQ: CLRB)

Cellectar Biosciences develops targeted phospholipid drug conjugates (PDCs) for cancer treatment. Its flagship candidate iopofosine I-131 targets hematologic malignancies such as Waldenström’s macroglobulinemia and multiple myeloma.

As of October 2025, shares trade around $2.10, and analysts expect major catalysts from its upcoming NDA submission.

Quantum stocks

Arguably one of the most prominent high-risk high-return future potential stocks. With the growing popularity and speculation of quantum technology, quantum stocks may offer great long-term returns as the industry matures.

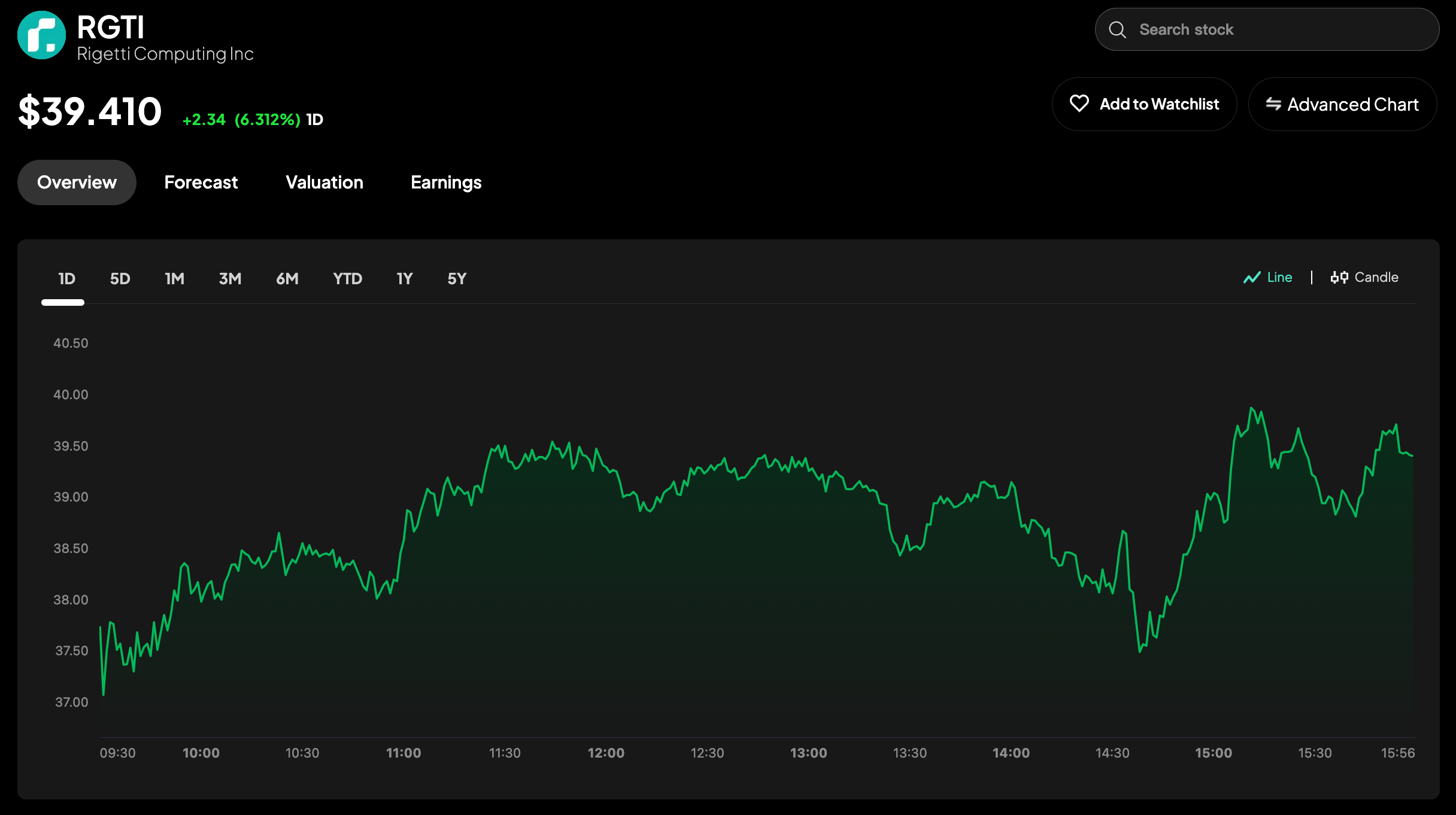

Regetti (RGTI)

The company builds quantum computers and the superconducting quantum processors that power them. In 2024, Regetti stock saw a stock surge of over 540% largely driven by the announcement of Google's quantum chip breakthrough, leading many to speculate on the release of quantum computing.

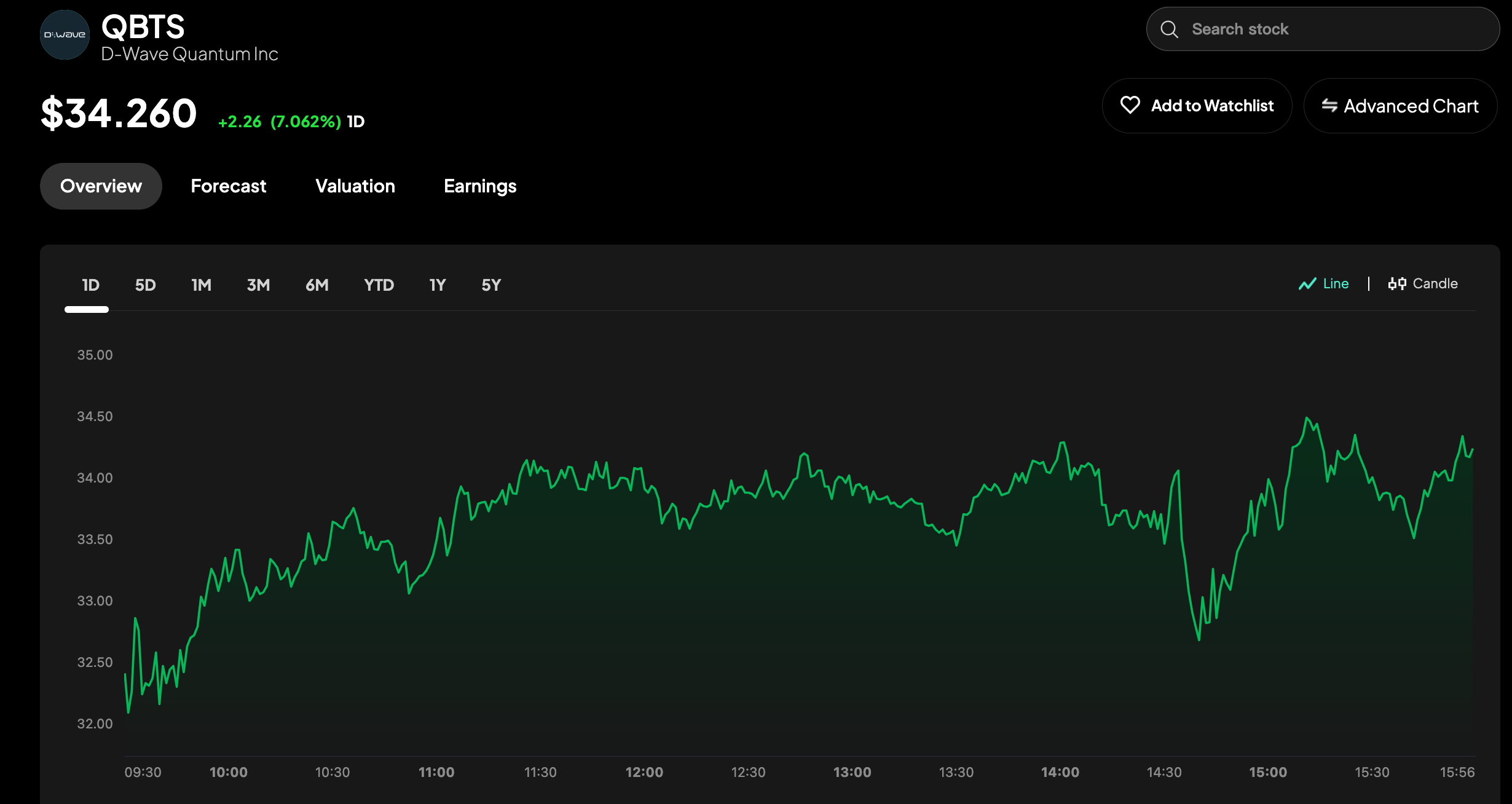

D-Wave Quantum (QBTS)

D-Wave Quantum Inc. develops and delivers quantum computing systems, software, and services worldwide. Unlike Regetti, D-wave also provides a full suite of open-source programming tools. In 2024, D-wave saw a stock surge of over 300%, again following the announcement of Google's quantum breakthrough.

Best Alternative Methods for High-Risk, High-Reward Exposure

Although the above stocks can provide a high reward-to-risk ratio, I have also included other areas for you to consider. If investing in the stock market is less favorable, you can consider these alternative high-risk, high-reward investment methods.

Cryptocurrencies

Crypto is infamously known to be a highly risky investment, with numerous stories of people losing their life savings. However, there have also been many overnight success stories. My general rule with crypto is to place 5% or less of my investment portfolio toward it. I do this to ensure my risk-to-reward ratio remains balanced.

Angel Investing

Angel investing is less about the financial markets and more about ownership of companies at their early stages. A staggering 90% of startups fail, with only 10% of them successfully exiting. If you invest in a startup from its onset and it's successful, the returns can be staggering.

Conclusion

As you can see, there are multiple options available for high-risk, high-reward investing. It ultimately comes down to how risk-tolerant you are and which area of investing you want to undertake.

It might be best to start with an initial small investment instead of risking large sums of your portfolio. Another method could be the dollar cost average high-risk investments, whereby you invest a small sum regularly over several months. Regardless of which you choose, remember to fully research any financial instrument thoroughly.