Key Takeaways

- The DeepSeek AI model caused market volatility while achieving high performance at a fraction of the training cost of proprietary US models, refuting the assumption of high AI infrastructure expenditure.

- The market is experiencing a Value Shift from AI Enablers (hardware/chips) to AI Integrators (software/applications), enabling them to exploit cheaper, more efficient AI models to achieve better margins.

- Infrastructure stocks dedicated to networking, cooling, and data center capacity (e.g., Arista Networks, Equinix) are also good investments, as the underlying demand for physical AI space is growing faster worldwide.

- Cloud Providers such as Amazon (AWS) and Oracle (OCI) will benefit directly, as lower-cost models will motivate businesses to scale up AI workloads, leading to higher overall cloud usage.

- Investors should adopt real-time applications such as Smart Alerts, Sentiment Analysis, and AI trading tools (such as the AI Screener and AI Stock Picker) offered by Intellectia.ai to track current volatility and adjust their strategies faster than the broader market.

Introduction

If you’ve been watching the markets lately, you’ve probably noticed one thing: the DeepSeek AI model came out of nowhere and instantly grabbed the attention of investors worldwide. And let’s be honest — when you see headlines about a foreign AI model that’s cheaper, faster, and more efficient, you immediately wonder whether that might put pressure on U.S. tech stocks.

But instead of guessing how this all plays out, you can look at what the data is already showing. At Intellectia, we track AI-driven market movements in real time. So in this article, you’ll get a clear breakdown of what DeepSeek actually is, how it affects U.S. stocks, which companies might benefit from the model’s rise, and how you can monitor stock reactions using Intellectia’s AI-powered tools. By the time you finish reading, you’ll know exactly what to watch and how to position yourself in a market that’s changing faster than ever.

What Is the DeepSeek AI Model?

If you’re hearing about DeepSeek for the first time, you might assume it’s just another AI model thrown into the already crowded market. But it’s not. DeepSeek stands out because of one thing: efficiency. It uses a highly optimized architecture that drastically reduces training costs and inference costs while still delivering performance that competes with — and sometimes beats — much more expensive U.S.-based models.

This matters because AI development has been dominated by companies like OpenAI, Google, Meta, and Anthropic. These companies spend billions on GPUs, data centers, and fine-tuning processes. DeepSeek, on the other hand, relies on clever optimization techniques that make it far cheaper to run. And when something becomes cheaper, the entire market takes notice.

Investors have already started asking whether a lower-cost model could put pressure on U.S. tech valuations. After all, if AI becomes more affordable, margins might shrink, and companies with expensive models could face competitive challenges. That's exactly why several major tech stocks have seen volatility spikes tied directly to DeepSeek-related headlines.

If you want to break down the technical side further, Intellectia’s tools, such as the AI Technical Analysis feature and the AI Agent, provide a clearer picture of how AI-driven narratives influence market patterns. But for now, the important thing to understand is that DeepSeek can shift investor expectations — and that’s where its market impact truly begins.

How DeepSeek AI Model Impact US Stocks

The sudden arrival of DeepSeek on the global stage triggered what we can call the Great Value Shift in the AI investment world, pitting Enablers against Integrators.

The Great Value Shift: Enablers vs. Integrators

First, let's look at the stocks that were initially affected. Companies that provide chips and core infrastructure—the AI Enablers, such as Nvidia and key semiconductor manufacturers—saw an immediate sell-off. The concern was straightforward: if future AI models can be trained on significantly less hardware, does that mean the frantic, endless demand for ultra-high-end chips will slow? That doubt alone was enough to wipe billions from their valuations.

However, where some see a threat, others see an opportunity. The DeepSeek breakthrough is a massive tailwind for the AI Integrators. These are the companies that use AI models to build actual applications and services—enterprise software firms, cloud providers, and consumer tech giants. If the cost of running and training AI drops off a cliff, these businesses instantly benefit from better margins, faster product cycles, and the ability to integrate AI into every single product they offer. This makes their business models more scalable and profitable for you as an investor.

Which Stocks Might Benefit from DeepSeek?

The market is rewarding flexibility and application. Since the cost of foundational AI is dropping, the value moves up the stack to companies that can deploy that AI cheaply and at massive scale. The shift favors those who can rapidly integrate cost-efficient AI into their existing, profitable platforms.

| Company Name | Ticker Symbol | Sector | Market Cap | Key Strengths/DeepSeek Benefit |

|---|---|---|---|---|

| Microsoft | MSFT | Cloud, Software | Current | As a key cloud provider (Azure), its customers will use more AI services if they are cheaper to run. A key AI integrator in enterprise software. |

| Meta Platforms | META | Social Media, OpenAI | Current | Strong proponent of open-source AI (Llama), which is validated by DeepSeek's success. Lower model costs improve its cost-per-user for AI features. |

| Apple | AAPL | Consumer Tech, Edge AI | Current | If you believe the cost-efficient models accelerate the move to "Edge AI" (AI on your device, like an iPhone), Apple is positioned as the ultimate hardware platform. |

| ServiceNow | NOW | Enterprise Software | Current | If you think cheaper AI models lead to better margins and more integrated AI features in enterprise solutions, ServiceNow's AI-driven platform will see a boost. |

AI Infrastructure & Data Center Beneficiaries

Even with more efficient models, the sheer volume of global AI development is exploding. That means the "picks and shovels" that build data centers remain incredibly valuable. While chip demand might be volatile, demand for high-speed networking, cooling, and specialized data center capacity is not. These stocks are the non-negotiable foundations of the AI economy.

Arista Networks (ANET): If you’re focused on the enormous need for high-speed, congestion-free networking that links all these GPUs, Arista is a fundamental supplier of the AI data center fabric. Its high-performance switches are essential for moving data across the millions of servers that make up the AI cloud.

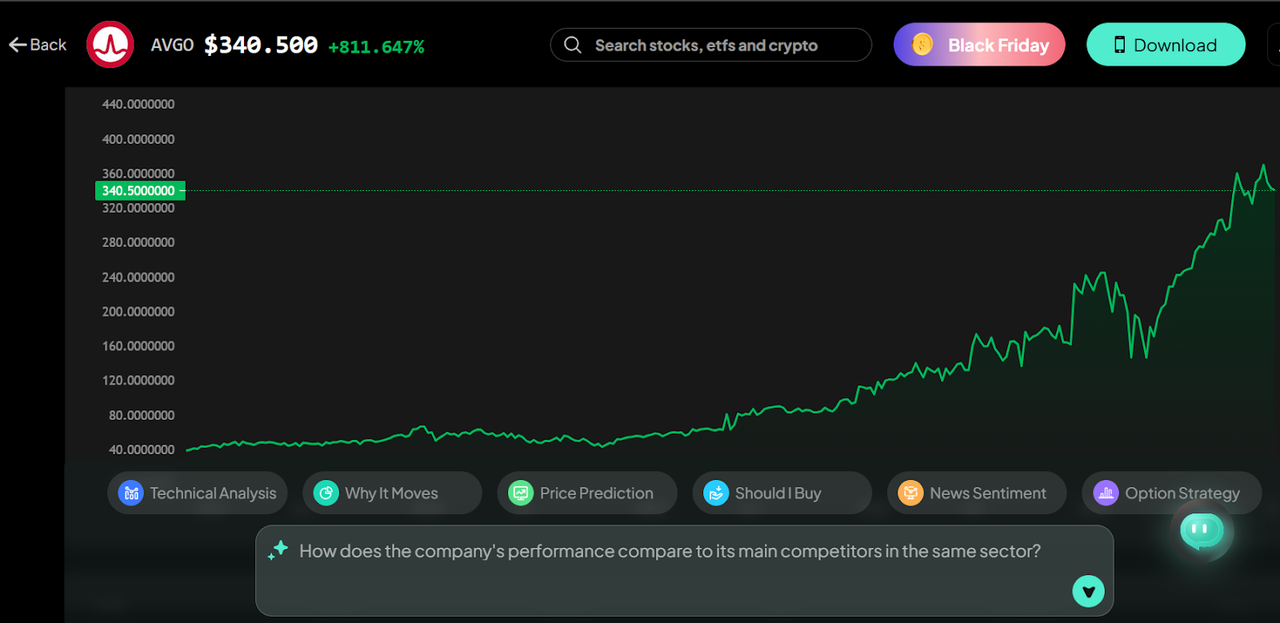

Broadcom (AVGO): If you think the future of AI chips is moving towards custom, specialized silicon (ASICs) for specific tasks, Broadcom's custom silicon and networking portfolio remains a superb investment. Their chips play a key role in delivering the high-bandwidth connection and dedicated computing capabilities required to execute AI at scale.

Equinix (EQIX): If you believe that the AI boom requires worldwide, high-density physical sites to serve all the new servers, the global net of interconnected information centers provided by Equinix is set to triumph. They provide the physical foundation where all this new, efficient computing power actually lives.

Cloud Providers Who Gain from Higher AI Workloads

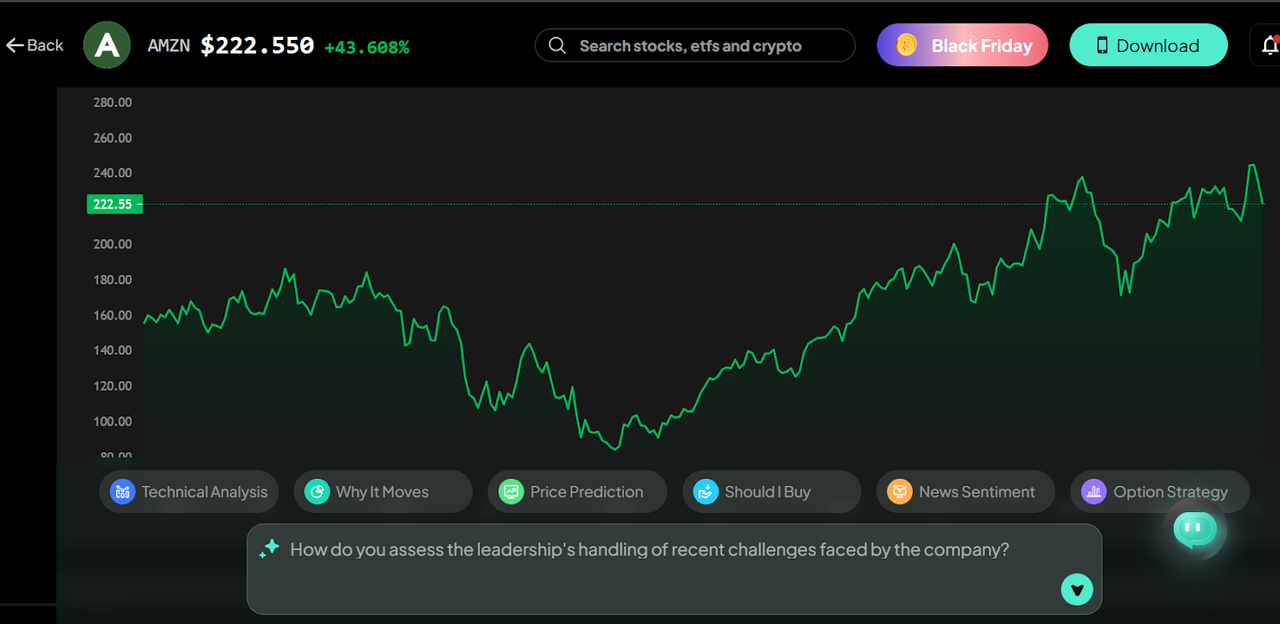

This is a key area of opportunity. Simply put, if the cost to run AI models drops, companies will use them more. They will deploy more AI features in their software, run more analyses, and generally consume more total cloud compute hours. This is a huge victory for the firms that sell the underlying cloud platform.

Amazon (AMZN) - AWS: AWS is also positioning itself as the most flexible artificial intelligence cloud, supporting the most popular models in the US and new, cost-effective ones, such as DeepSeek. Reduced model prices will only hasten the aggregate count of compute hours run on the platform and each hour of usage generates revenue to Amazon.

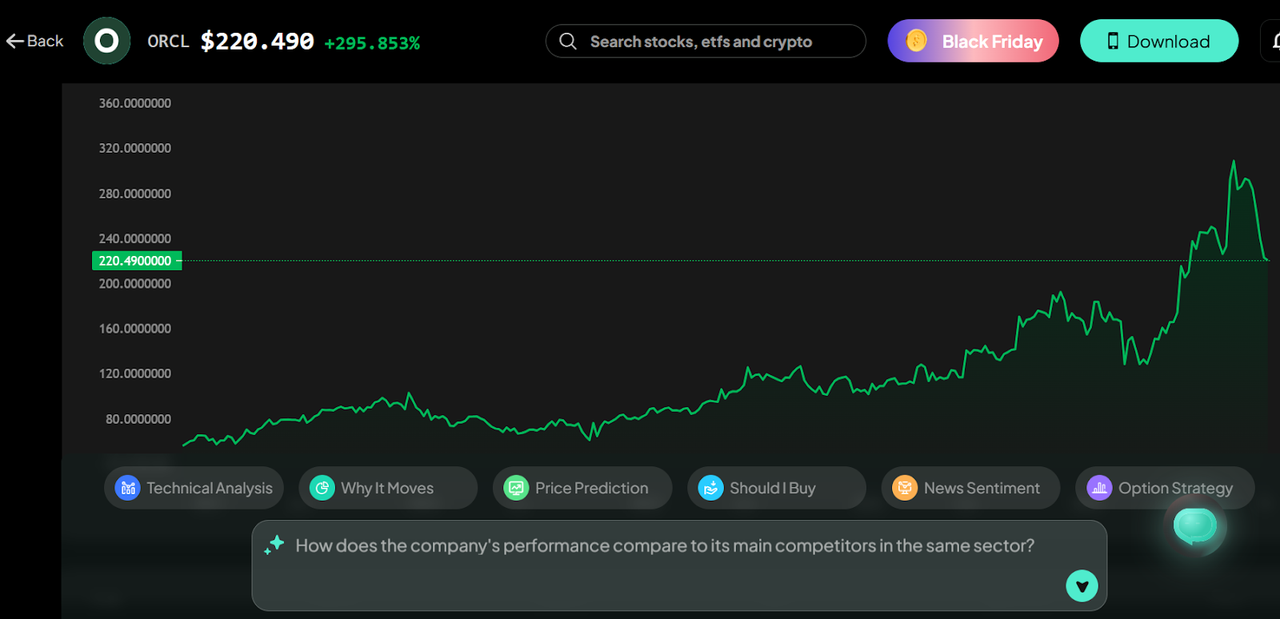

Oracle (ORCL): Oracle's cloud infrastructure (OCI) has become a key partner for major AI innovators. Their specialized, high-performance cloud for compute-intensive workloads scales to handle surges in demand, regardless of the efficient model in use. If more models are being trained or run globally, OCI is well-positioned.

Real-Time Monitoring of Stocks Impacted by DeepSeek

The biggest challenge for you right now is not what DeepSeek did, but how to trade on the ensuing market volatility. The pace of news in the AI sector is simply too fast for manual analysis, and waiting for traditional news reports means you’ve already missed the move. This is where real-time, AI-driven tools from Intellectia.ai become your much-needed competitive advantage.

How Intellectia Tracks AI-Driven Market Movements

Our platform is designed to cut through the noise and provide actionable data points during major events like the DeepSeek launch.

- Smart alerts: Our system can track abnormal volume and volatility in specific stocks, such as Nvidia, Arista, or ServiceNow, the moment a significant AI news event occurs. This real-time alert gives you a crucial window to decide whether to enter, exit, or maintain a position before the mass-market panic or euphoria hits.

- Real-time sentiment analysis: You should be aware of whether market sentiment is changing. The AI-driven sentiment analysis tool by Intellectia can compile thousands of news articles, social media posts, and reports to indicate to you that the market mood around an AI Integrator (such as MSFT) is changing swiftly to positive, or an AI Enabler (such as NVDA) is encountering negative sentiments.

- AI stock heatmaps: Our heatmaps visually categorize the impact. You can see at a glance whether the sell-off is confined to semiconductors only or is sweeping through the entire tech industry, and this will help you keep your head in the game and avoid making emotional trading choices.

Example: DeepSeek Volatility Signals for U.S. Tech Stocks

To demonstrate the difference, we shall examine a hypothetical scenario. Suppose that DeepSeek V3 was announced at 9:00 AM. While traditional investors were still Googling the name, Intellectia’s signals would have flagged NVDA for a High Volatility Alert due to spiking trading volume and a rapid price dip. Simultaneously, the platform might show a stable or rising sentiment trend in MSFT and GOOGL, indicating a consensus shift among smart money toward 'AI Integrators' and away from raw hardware. This rapid, dual-sided signal is exactly what you need.

Why Intellectia Helps Investors Respond Faster

The pace of AI development is too fast for manual research. Intellectia’s suite of tools—including AI stock & crypto analysis, AI stock and crypto price prediction tools, and its AI stock and crypto selection/picker—rapidly integrates new information (like the DeepSeek breakthrough) into its models. This gives you updated AI trading signals and AI trading strategies that factor in the most recent shifts. Using tools like our AI Agent and detailed features for Swing Trading, you gain a competitive advantage to position your portfolio for the companies that are set to thrive in the new, more efficient AI landscape.

Conclusion

The DeepSeek AI model has sent a clear message to the US market: efficiency and cost-effectiveness are now just as important as raw power. The initial shockwave in stocks like Nvidia and Broadcom highlights a potential long-term shift in value toward companies that can best leverage cheaper, high-performing AI—the AI Integrators like Microsoft and the core, non-chip AI Infrastructure providers. To navigate this new landscape, you need tools that can instantly process the implications, identify volatility signals, and adjust your strategy. That’s why we recommend you sign up and subscribe to Intellectia AI today for real-time alerts, notifications on daily AI stock picks, AI trading signals & strategies, and market analysis that keeps you ahead of the curve.