Key Takeaways

- Coal stocks offer investment potential due to sustained global demand and high dividend yields.

- Top picks include Peabody Energy (BTU), Alpha Metallurgical Resources (AMR), Alliance Resource Partners (ARLP), Warrior Met Coal (HCC), and Core Natural Resources (CNR).

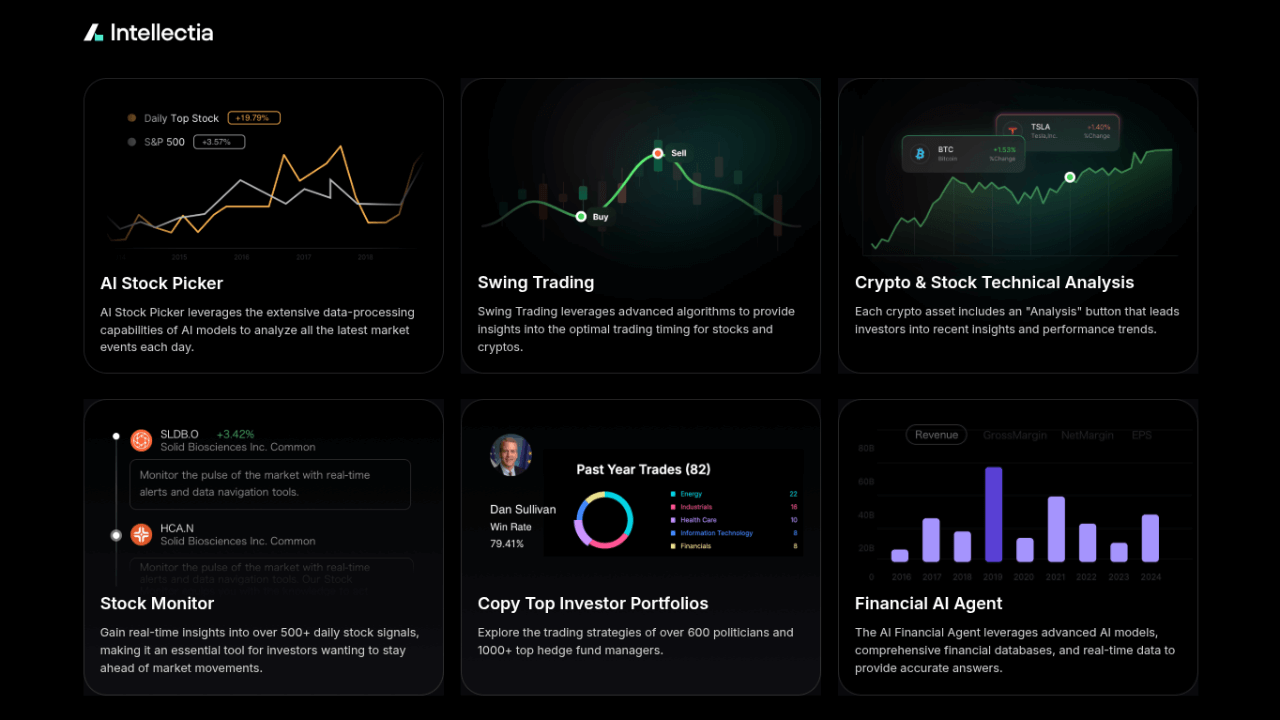

- Intellectia’s AI tools, like the AI screener, help identify promising coal stocks.

- Environmental concerns require careful consideration, but coal’s energy role persists.

- Diversified strategies, including dividend-focused and swing trading, enhance returns.

Introduction

Have you ever wondered if coal stocks are still worth your investment, given the push for renewable energy? While the energy sector evolves, coal remains a critical power source in developing economies like India and China. Supply constraints and geopolitical tensions often support coal prices, making certain stocks attractive.

Using Intellectia’s AI tools, you can navigate this complex market to find the best coal stocks for your portfolio. This article explores why coal stocks matter, how to select them, and the top picks for 2025.

Source: intellectia.ai

What Are Coal Stocks

Coal stocks represent companies involved in mining, processing, and distributing coal. These firms fall into several categories:

- Mining Companies: Extract coal from underground or surface mines.

- Coal Operators: Manage logistics and processing facilities.

- Royalty/Partnership Firms: Own coal reserves and lease them to miners.

Coal types include thermal (for power generation) and metallurgical (for steel production), each with distinct market dynamics. Understanding these distinctions helps you choose stocks aligned with your goals.

Why Invest in Coal Stocks

Despite environmental concerns, coal stocks offer compelling reasons for investment:

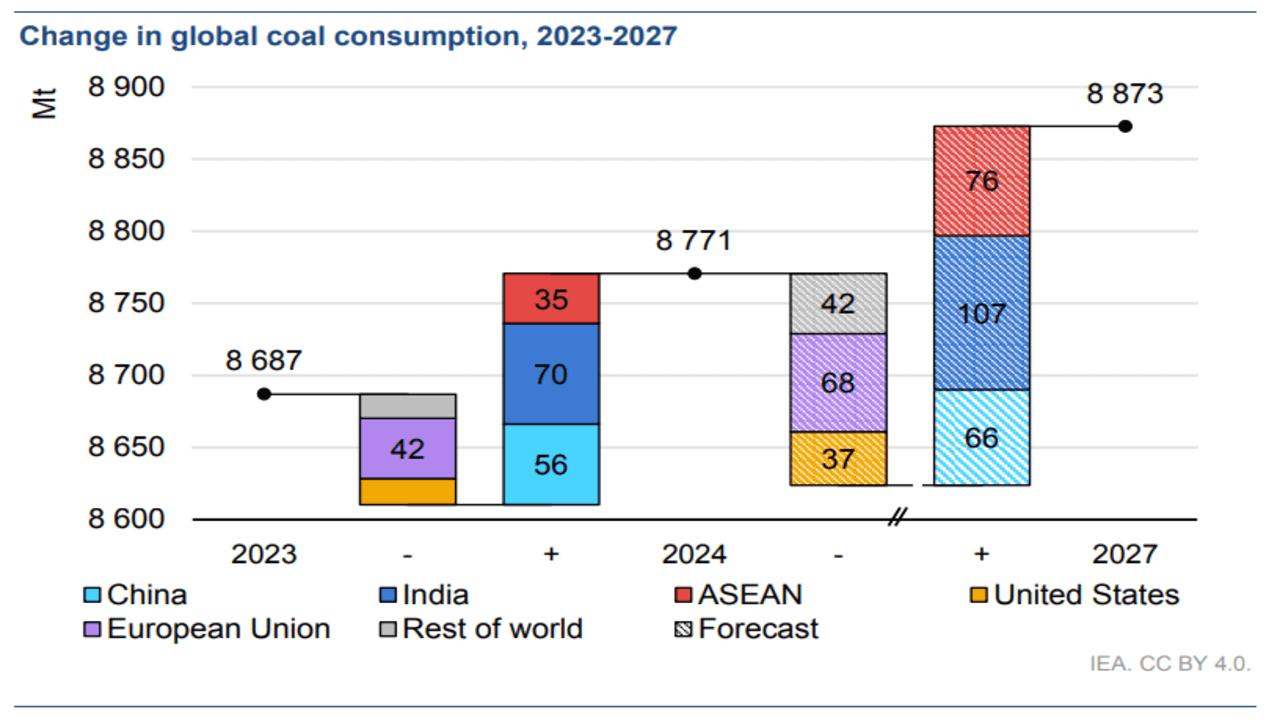

- Global Reliance: Coal powers base-load electricity in many countries, with demand strong in Asia.

- Supply Constraints: Geopolitical tensions and reduced mining capacity can drive coal prices higher, as seen with prices at $106.60 USD/T in June 2025.

- Dividend Yields: Many coal companies, like Alliance Resource Partners, offer yields up to 8.08%, ideal for income-focused investors.

- Inflation Resistance: Coal stocks often provide stable cash flows, hedging against inflation.

While environmental regulations pose risks, coal’s role in energy and steel production ensures its relevance, making it a viable option for diversified portfolios.

Source: iea.org

Criteria for Selecting Best Coal Stocks

Choosing the right coal stocks requires evaluating key factors:

- Type of Coal Exposure: Metallurgical coal (used in steel) often has stronger demand than thermal coal.

- Profitability and Cash Flow: Look for companies with positive free cash flow and low debt.

- Dividend Sustainability: Ensure dividends are supported by earnings, as with ARLP’s 8.08% yield.

- Export Capabilities: Firms with access to international markets, like Core Natural Resources, benefit from global demand.

- Operational Efficiency: Companies with low-cost operations are more resilient to price fluctuations.

Using Intellectia’s AI screener, you can filter stocks based on these criteria, ensuring data-driven decisions.

5 Best Coal Stocks to Buy

Here are five top coal stocks for 2025, selected for their financial strength and market position.

| Company Name | Ticker | Market Cap (B) | Dividend Yield | Key Strengths |

|---|---|---|---|---|

| Peabody Energy | BTU | 1.62 | 2.3% | Global scale, diversified coal types |

| Alpha Metallurgical Resources | AMR | 1.4 | 0% | Metallurgical coal focus, cost efficiency |

| Alliance Resource Partners | ARLP | 3.34 | 11% | High dividend, stable customer base |

| Warrior Met Coal | HCC | 2.3 | 0.8% | Strong balance sheet, export focus |

| Core Natural Resources | CNR | 3.67 | 0.6% | Export terminal, operational efficiency |

Peabody Energy (BTU)

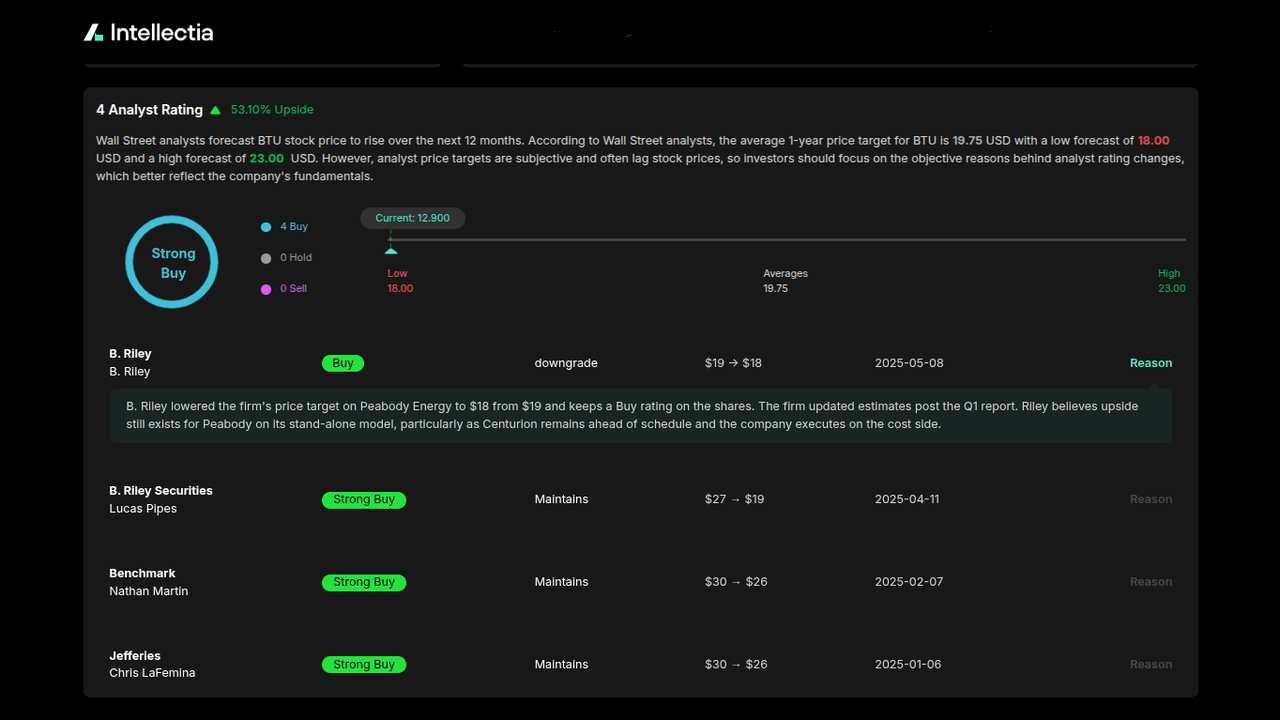

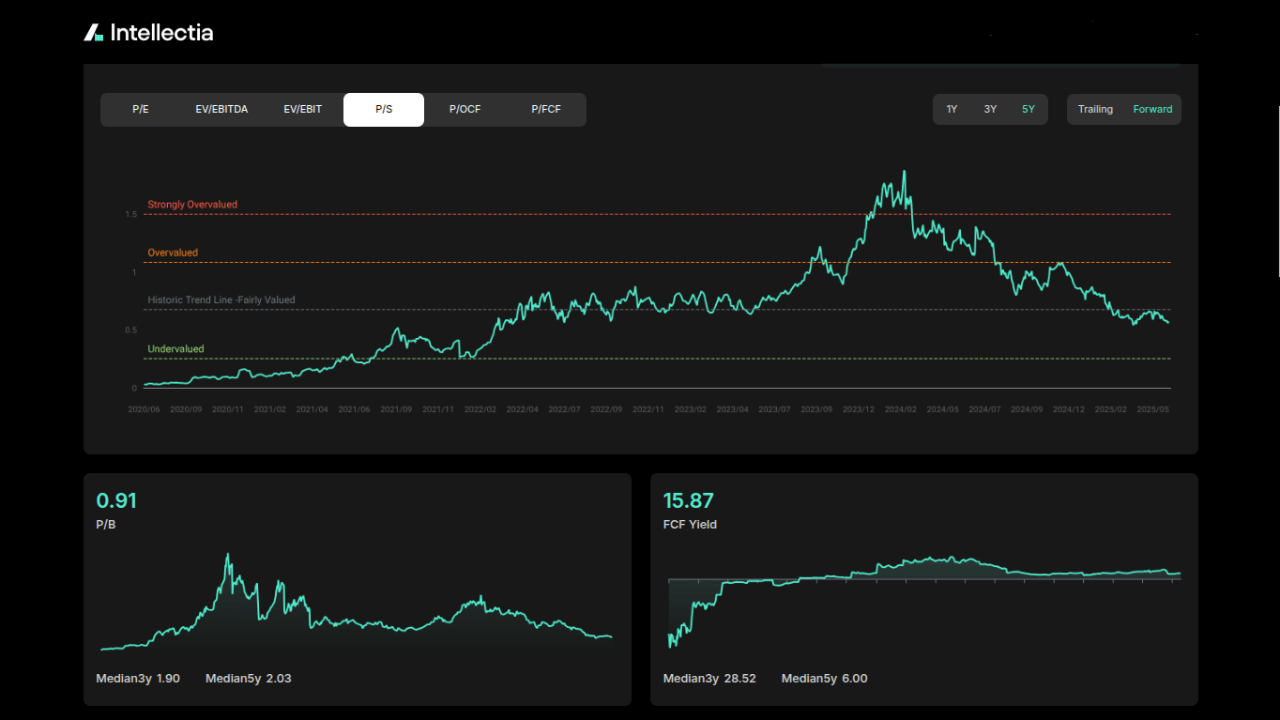

Peabody Energy (BTU) stands as a global leader in coal production, operating mines in the U.S. and Australia, with a focus on both thermal and metallurgical coal. As of June 24, 2025, BTU trades at approximately $22.50, boasting a market cap of $1.68 billion and a low price-to-earnings (P/E) ratio of 5.12, suggesting potential undervaluation.

The company offers a dividend yield of 2.25%, making it attractive for income-focused investors. Financials show a trailing twelve-month net income of $369.1 million, with a robust balance sheet reflecting $696.5 million in cash against $402.1 million in debt, indicating financial stability.

Peabody is actively expanding its metallurgical coal portfolio through strategic moves, including the Wards Well acquisition and a $3.78 billion deal for Anglo American’s Australian coal assets, expected to close by mid-2025.

Its diversified operations and proactive growth strategy make BTU a compelling choice for broad coal exposure.

Source: intellectia.ai

Alpha Metallurgical Resources (AMR)

Alpha Metallurgical Resources (AMR) specializes in metallurgical coal, crucial for steel production, with operations across Virginia and West Virginia. Alpha Metallurgical Resources is operating over 14 underground and six surface mines in Central Appalachia and has a market cap of $1.4 billion.

While it does not currently pay dividends, its focus on high-quality metallurgical coal positions it for significant growth, driven by rising global steel demand, particularly in emerging markets like India and Southeast Asia.

AMR’s streamlined operations and its cost-efficient production methods may boost its profitability, even in volatile markets. Its strategic focus on metallurgical coal differentiates it from peers with broader exposure, making it a top choice for growth-oriented investors seeking exposure to the steelmaking sector.

Source: intellectia.ai

Alliance Resource Partners (ARLP)

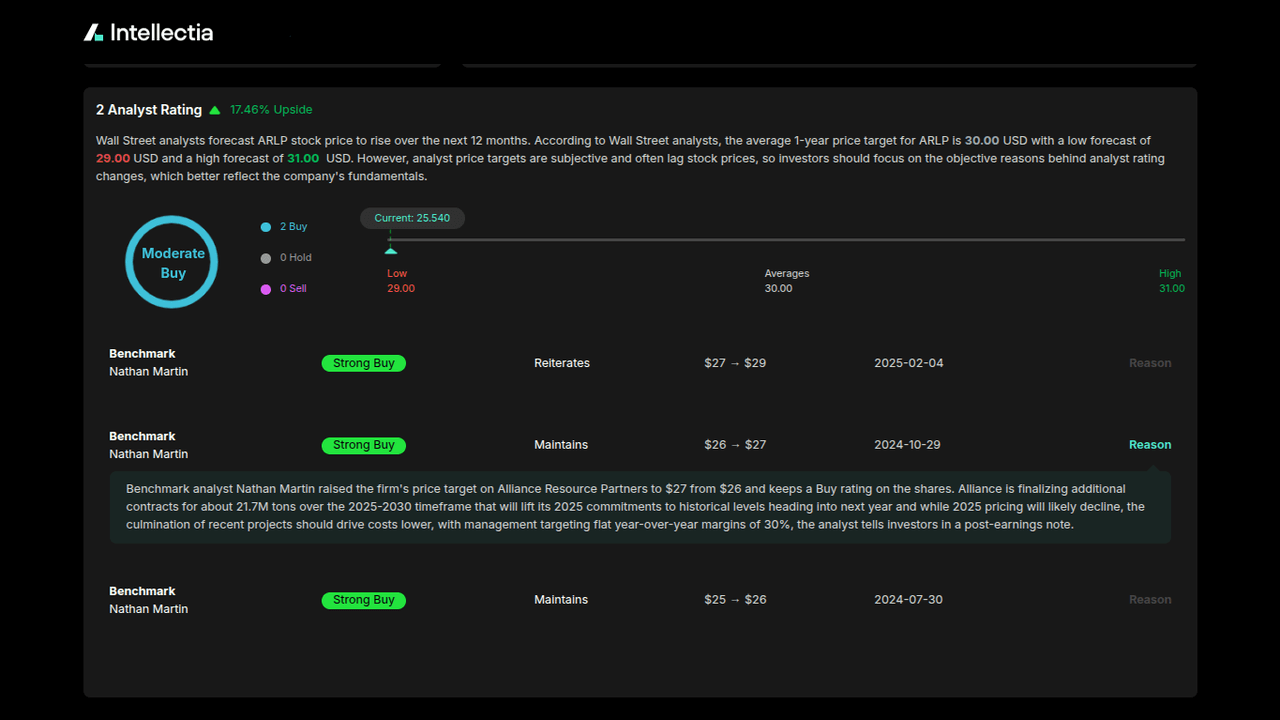

Alliance Resource Partners (ARLP), a diversified coal producer and master limited partnership (MLP), serves U.S. utilities and industrial users.

Trading at $25.77 as of June 24, 2025, ARLP has a market cap of $3.31 billion and a P/E ratio of 12.10. Its standout feature is a high dividend yield of 10.87%, driven by a quarterly distribution of $0.70 per unit. Analysts maintain a target price of $30.00, suggesting upside potential.

ARLP’s stable customer contracts and strong market position make it a top pick for income-focused investors, though caution is advised due to payout risks.

Source: intellectia.ai

Warrior Met Coal (HCC)

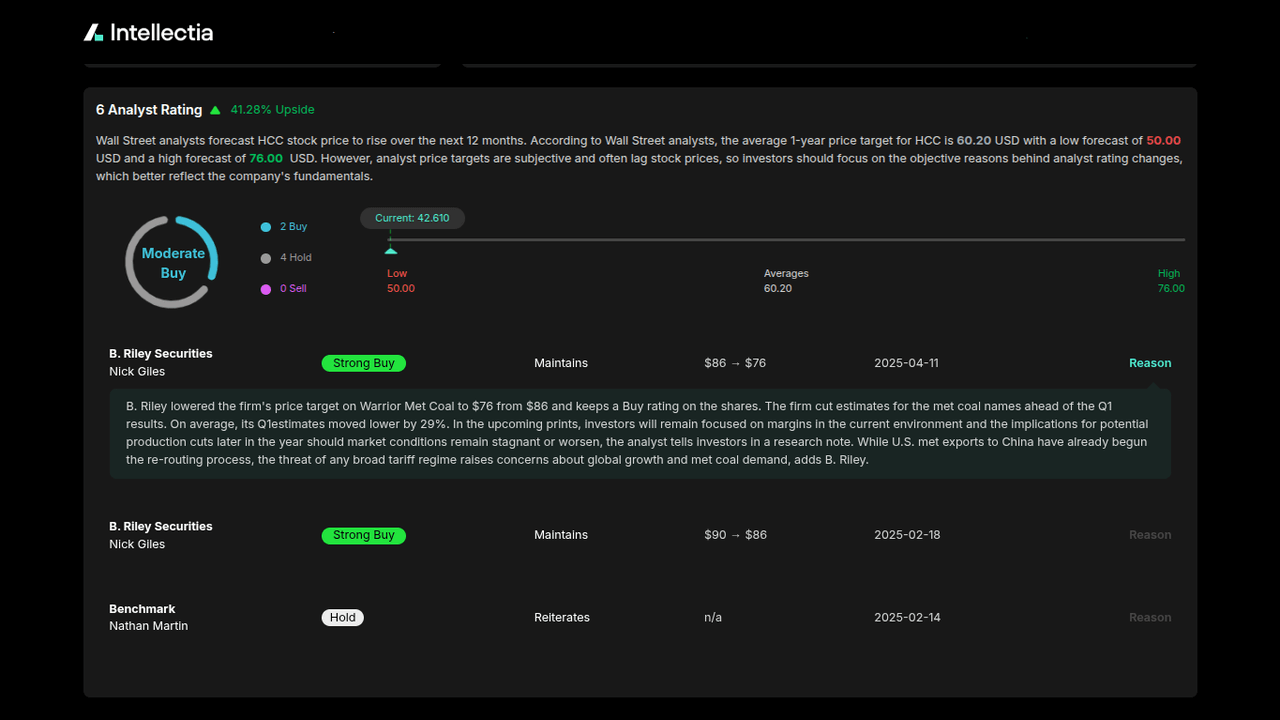

Warrior Met Coal (HCC) is a leading supplier of metallurgical coal, focusing on export markets with a strong balance sheet.

The company has shown resilience in tough market conditions, reporting positive margins and operating cash flows in Q1 2025 despite weak steelmaking coal prices. In 2024, HCC exceeded guidance targets, achieving high sales and production volumes.

Its efficient operations and access to the Port of Mobile ensure competitive delivery to global steel producers. HCC’s focus on cost management and strategic expansion makes it a strong contender for investors betting on metallurgical coal demand.

Source: intellectia.ai

Core Natural Resources (CNR)

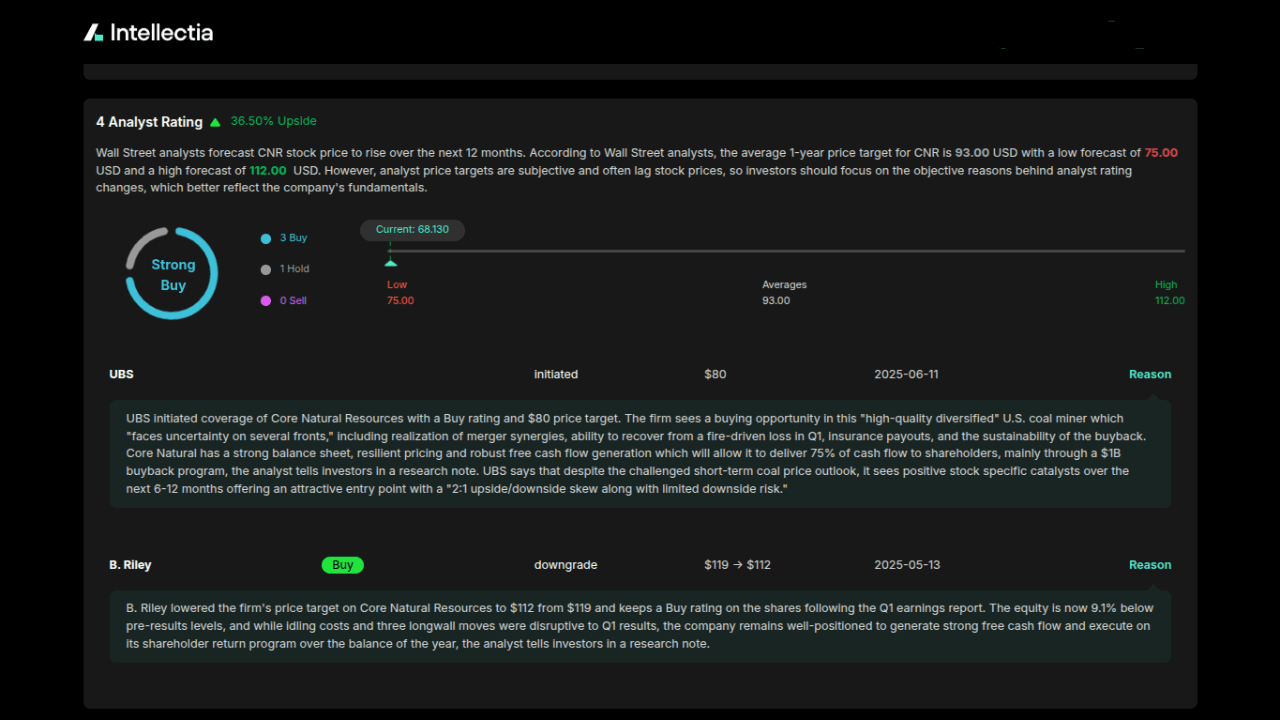

Core Natural Resources, formed through the merger of Arch Resources and CONSOL Energy, is a powerhouse in both metallurgical and thermal coal production. CNR stands out for its extensive operational footprint and strategic infrastructure investments.

The company owns stakes in key marine export terminals, enabling efficient access to high-demand international markets like Asia and Europe. CNR’s diversified portfolio includes high-quality metallurgical coal for steelmaking and thermal coal for power generation, positioning it to capitalize on global energy needs (86% YoY revenue growth in Q1-FY25).

Its focus on cost discipline and operational efficiency enhances its resilience against market fluctuations. For investors seeking a balance of growth and modest income, CNR stock is a compelling choice.

Source: intellectia.ai

Investment Strategies for Coal Mining Stocks

Maximize your returns with these strategies, enhanced by Intellectia’s AI tools:

- Income-Focused Strategy: Target high-dividend stocks like ARLP.

- Global Diversification: Invest in firms with export capabilities, like CNR, to hedge against domestic risks. Intellectia’s AI screener identifies such opportunities.

- Blend with Energy Stocks: Combine coal with other energy sectors for balance. Intellectia’s stock monitor tracks portfolio performance.

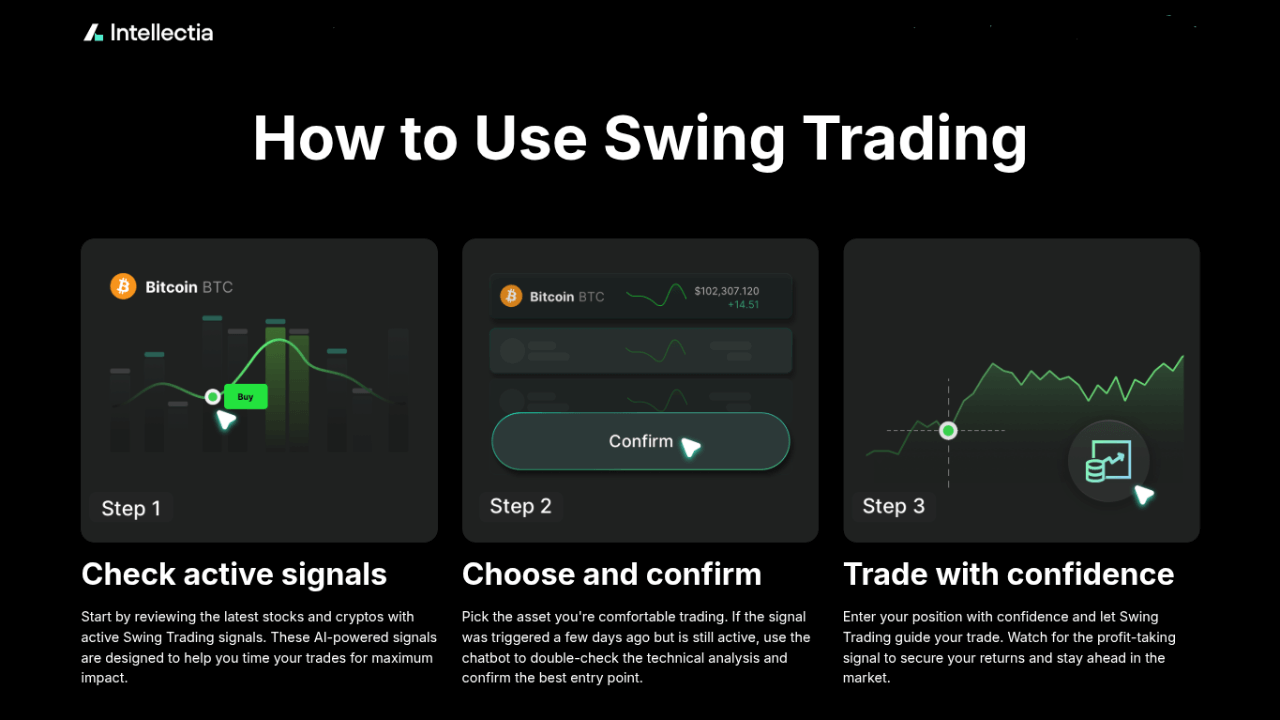

- Swing Trading: Capitalize on short-term price movements using Intellectia’s swing trading signals, ideal for volatile coal stocks.

Source: intellectia.ai

Conclusion

Coal stocks, while controversial, offer unique opportunities due to global energy needs and high dividends. Stocks like BTU, AMR, ARLP, HCC, and CNR stand out for their financial strength and market roles. By leveraging Intellectia’s AI-powered platform, you can make informed decisions to optimize your investments.

Sign up now for daily AI stock picks, trading signals, and market analysis to stay ahead in 2025.