Key Takeaways

- Circle Internet Group (CRCL) operates in the fintech and blockchain payment sector, best known for issuing the USD-backed stablecoin USDC.

- Circle stock price surged after its IPO in June 2025 but remains volatile as the stablecoin market evolves.

- Daily CRCL stock price updates show mixed investor sentiment, with both bullish and short-term correction phases.

- Investors can use Intellectia.ai to access live Circle stock data, AI-driven insights, and sentiment analysis before investing.

Introduction

The fintech industry has been booming amid the ongoing demand for blockchain technology. Circle Internet Group has become one of the prominent digital payment solutions using blockchain technology, offering stablecoins pegged with traditional currencies such as the United States dollar (USDC) and Euros (EURC). The recent Circle IPO from Circle Internet Group Inc. drew significant investor attention from speculative investors to institutions as the price surpassed the expected range.

However, when investing in any investment asset in the secondary market, especially in the post-IPO period, it is mandatory to check various factors like price performance, funding, organisations behind the business, business type, growth, valuation, etc. In the following section, we will introduce you to the Circle Internet Group, reveal the Circle Stock IPO details, key drivers, challenges, potentialities, and how to invest in Circle Stock successfully.

What is Circle Internet Group?

Circle Internet Group is a blockchain-based fintech company offering payment infrastructure, digital asset issuance, and liquidity services. Its main product, USDC (USD Coin), is a regulated stablecoin fully backed by cash and short-term U.S. Treasuries.

Founded in 2013 by Jeremy Allaire and Sean Neville, Circle has become a trusted name in digital finance. Its mission is to make global payments faster, cheaper, and borderless.

Circle’s ecosystem now includes:

USDC and EURC stablecoins

Circle Payments Network (CPN) for cross-border transfers

Developer APIs and SDKs for integrating stablecoin payments

Circle Mint — for institutional USDC issuance

💡 Quick Fact: Circle reported over $1.6 billion in revenue in 2025, supported by rising interest income and institutional adoption of stablecoins.

Business Model of Circle

Circle Internet Group Inc. (NYSE: CRCL) issues the USD-pegged stablecoin USDC, which has become a prominent player in the digital finance industry. The company reported revenue of more than $1.5 billion in 2024. The company operates in the fintech industry and the cryptocurrency sector. The business model differs from traditional players in the industry due to its focus on blockchain infrastructure and stablecoin.

The company's revenue primarily relies on strategic partnerships, interest on reserves, and financial services rather than trading volume and transaction fees.

Circle Stock IPO Details

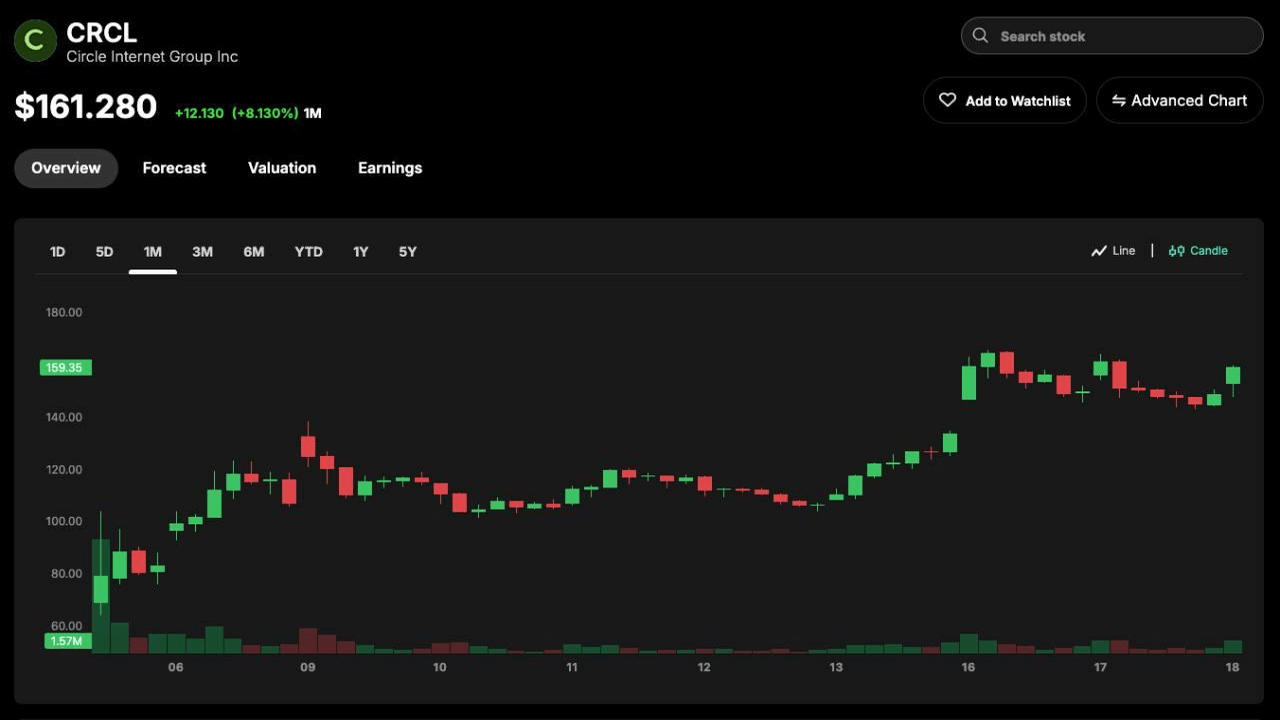

Circle recently went public on 5 June 2025, with significant movement since the first day. The initial price offerings occurred at $31 per share, where the anticipation was between $27 and $28. So, it occurred above the predicted range, which is a sign of significant investor attention. The company was listed on the New York Stock Exchange (NYSE) with the ticker CRCL.

The price shows a significant surge after the Circle IPO, more than five times since the initial offering price, which is currently floating near $146.78, slightly below the ATH of $165.60. During the IPO period, the Circle valuation was pegged at $6.9 billion, and the number of shares offered was 34 million.

Circle's product, USDC, is currently ranked seventh on Coinmarketcap; its current supply and valuation are 61.58 billion.

Key Drivers Behind Circle Stock’s Growth

Circle Internet Group Inc. (NYSE: CRCL) has become a prominent player in the crypto ecosystem. Circle's Stock price shows a significant price pump after the IPO, and there are some key drivers behind the price pump. The key drivers behind the growth of Circle Stock are as follows:

Increasing Stablecoin Adoption

The stablecoin market has exploded from $20B in 2020 to $245B by Q4 2025. With over 170M active stablecoin addresses worldwide, Circle’s share of this expanding ecosystem continues to rise.

Strategic Partnerships

In 2025, Circle launched the Circle Payments Network (CPN), integrating with fintechs like Tazapay, OpenPayd, and RedotPay to enable instant on-chain payments. These collaborations have strengthened Circle’s foothold in Asia and Europe.

Institutional Support & Regulation

Circle operates under strict compliance, backed by U.S. Treasury bills and third-party audits. Its transparent reserves make it the most regulated stablecoin issuer — a key trust factor for global banks and regulators.

Multi-Chain Expansion

USDC now runs on Ethereum, Solana, Avalanche, and XRPL, improving accessibility and liquidity. This multi-chain strategy enhances Circle’s resilience and growth potential.

Should I Invest in Circle Stock?

When investing in stocks, several unavoidable factors, such as performance, opportunities, risks, etc., must be considered. In the following section, we will cover all these factors for better understanding and evaluation.

Future Outlook for Circle Stock and the Stablecoin Market

In the pre-market trading, the Circle stock price gained approximately 10.51% on June 16, confirming notable demand and investor attention. The A-class share prices reached 330.8% upside from the Circle IPO price of $31, reflecting significant investor interest after the IPO event.

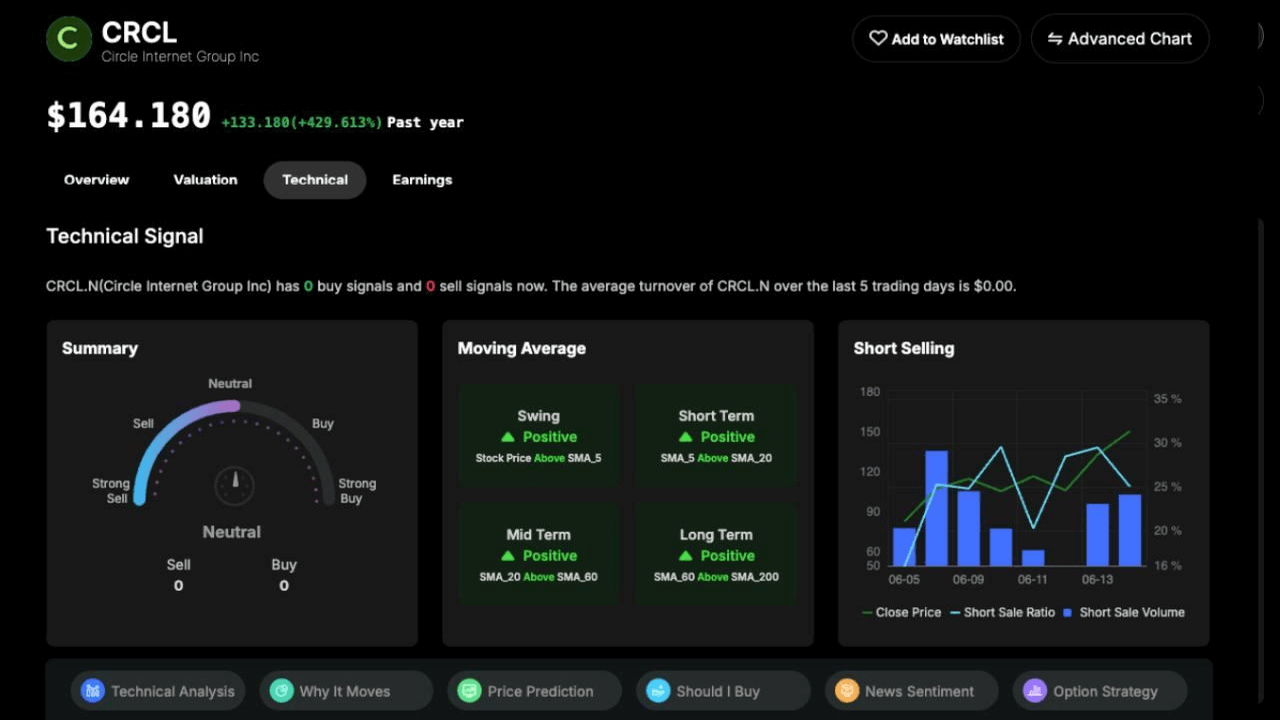

According to Intellectia.ai's technical signal, the stock is in a “Neutral” mode.

The stablecoin market valuation has already grown more than 10% in the past five years, reaching $239 billion from $20 billion, which can hit $500 billion to $750 billion in the upcoming years, as many banks and financial institutions are seeking efficient cross-border payment alternatives. The funding amount reached $1.05 billion rather than the target of $624 million, indicating significant institutional demand for Circle shares. The positive regulatory support from the United States Government suggests the company's future potential.

The total transaction volume of stablecoin reached $27.6 trillion, surpassing the transaction volume of Mastercard and Visa by 7.68%. Most of these transactions came from decentralised and centralised exchanges, as these platforms use stablecoins for primary trading pairs. These data suggest increasing adoption and potential of the Circle and its services.

The impressive business model of Circle helps give it a competitive edge over other competitors, and USDC becomes one of the giants, positioning itself only after Tether (USDT). As the stablecoin market is rapidly growing, Circle can be an asset manager like BlackRock in the future, which has a current valuation of more than $150 billion and manages over $11.6 trillion in assets.

Risks and Challenges

There are some uncertainties and challenges for Circle Stock's growth, for instance:

- Volatility Risk: Circle's share price has already posted significant volatility after post-IPO trading, indicating volatility risk for the asset. Stablecoin demand is somehow related to the broader crypto market, so overall negative crypto market sentiment can negatively impact Circle Stock growth.

- Regulatory Uncertainty: Outside the United States, regulatory challenges can negatively impact the company's growth due to regulators' concerns about key factors like money laundering, systemic risks, and monetary sovereignty.

- Macroeconomic and Geopolitical Factors: Microeconomic factors like a declining global interest rate can negatively impact the company's growth, as Circle generates most of its revenues from interest. Again, geopolitical factors like sanctions and banning crypto in different regions can also negatively impact the company's growth.

- Competitions: There are already giants in the stablecoin sector. For instance, Tether (USDT) already has 150 billion tokens in circulation, and several other stablecoin issuers backed by financial institutions can pose risks for Circle's expansion or growth.

Investing in Circle shares can be speculative now as the stablecoin market is rapidly growing. It remains now in the post-IPO phase, making it a high-risk, high-reward asset. Several positive factors might drive the company's growth in the future, but there are also some risk factors that moderate investors should consider while making investment decisions. We suggest investing after the price reaches a sustainable support zone to beat the resistance.

How to Invest in Circle Stock

This part reveals step-by-step guidelines for successfully investing in Circle stock.

- Open Account: When investing in Circle stock, you must choose a brokerage or platform that enables trading of CRCL. After selecting the platform, investors must open an account with the broker. After opening an account, it is time to complete the verification process, which often involves ID and address verification by providing supporting documents. When the verification process is done, investors might deposit funds to trade target assets.

- Research the Stock Before Buying: Conduct sufficient research before investing. You can use the “Should I buy” feature from Intellectia AI to determine when you should invest in Circle stock.

- Place Your Trade and Do Deeper Analysis: After placing your trade on Circle stock, you can use features such as intellectia.ai technical analysis or patterns, swing trading, and day trading for smart analysis and signals.

- Monitor and reassess: Investors should monitor and reassess their positions to maximise profits. You can utilize the latest news, stock monitor and earning trading to reduce risks and maximise your gains.

Conclusion

Now you know all the basics about Circle Internet Group Inc. stock, IPO details, risks, potential, and how you can successfully invest in Circle Stock. Data and analysis suggest that the Circle stock can be a speculative investment asset if you follow the guidelines appropriately and place trades efficiently using proper money management.

You can utilise market analysis, trading signals, and AI-driven stock picks features from Intellectia AI to enhance your trading experiences. Sign up today and explore AI tools to improve your investment decisions.