Key Takeaways

- The release of Google Gemini 3 is a landmark in the AI arms race, spurring immediate stock gains and helping Alphabet (GOOGL) regain its competitive edge.

- Investors can respond to this trend with a balanced approach, either by investing in the direct winner (Alphabet) or by diversifying into an infrastructure provider (Nvidia) and specialized cloud firms such as CoreWeave.

- To take advantage of this high-speed environment, it is important to position your portfolio to access instant, data-driven research to keep up with market shifts.

- Tools such as the Intellectia.ai AI Stock Picker and AI Stock Monitor can provide you with a large, automatic advantage of cashing in on the short-term fluctuations and long-term patterns made by the new AI boom.

Introduction

Do you ever feel like AI is moving so fast that you can’t tell what’s actually investable anymore? See, every few months, a massive new model drops, and the entire stock market landscape shifts. And while excitement around AI keeps increasing, most investors still find themselves wondering what’s actually worth paying attention to. When Google announced Gemini 3, that uncertainty multiplied. Everyone wanted to know how this new model compared to everything else, how it changed the competitive landscape, and most importantly, which stocks stood to benefit the most. But how do you actually translate that technological leap into real gains for your portfolio?

We’ve put in the work to analyze the true market implications of this launch. At Intellectia.ai, our focus is on using AI ourselves to identify the crucial financial data and trends you need to see. What you’ll find in this guide is a complete, easy-to-understand breakdown of what Gemini 3 actually is, how it works, why it matters for the market, and the stocks that are best positioned for the growth that’s coming. By the time you finish reading, you’ll know exactly how to approach the Gemini 3 AI boom more confidently than ever.

What Is Gemini 3 and What’s New

Unless you’ve been keeping up with the AI revolution, you may be wondering: “What is Gemini 3, and why should I, as an investor, care about it?” In simple terms, Gemini 3 is the biggest and most aggressive move in the AI war that Google has ever made. It's their decisive answer to competitors like OpenAI and essentially represents the new frontier of what an AI model can do.

The reason this matters for the stock market is because of its incredible performance capabilities. We’re talking about an AI that performs at a near-PhD level on complex, multi-step tasks. Crucially, Gemini 3 has a stunning level of deep multimodal understanding. It can process text, images, video, and audio simultaneously and fluidly. Such a huge integration capability unlocks massive new enterprise and developer use cases, driving demand for more infrastructure.

Another important consideration is that it can be deployed fast. As soon as Alphabet announced Gemini 3, it was instantly integrated into Google Search, the Gemini app, and the Google Cloud platform. Such rapid adoption promises rapid monetization. Ultimately, Google has a massive full-stack advantage. They own the entire ecosystem, including proprietary TPU chips, the cloud service, and end-user applications. The combined control is a significant competitive edge and a critical cost advantage.

Top Stocks That Could Benefit from the Gemini 3 AI Boom

| Company Name | Ticker Symbol | Sector | Market Cap (Approx.) | Key Strengths |

| Alphabet (Google) | GOOGL / GOOG | Technology | $3.91 Trillion | Owner of Gemini 3, full-stack AI control, dominant search & cloud ecosystem. |

| Nvidia | NVDA | Technology | $4.15 Trillion | Dominant provider of AI GPUs, essential for training and running models like Gemini 3. |

| CoreWeave | CRWV | Technology (Cloud Infra) | $33.31 Billion | Specialized high-performance cloud provider, rapidly scaling GPU infrastructure. |

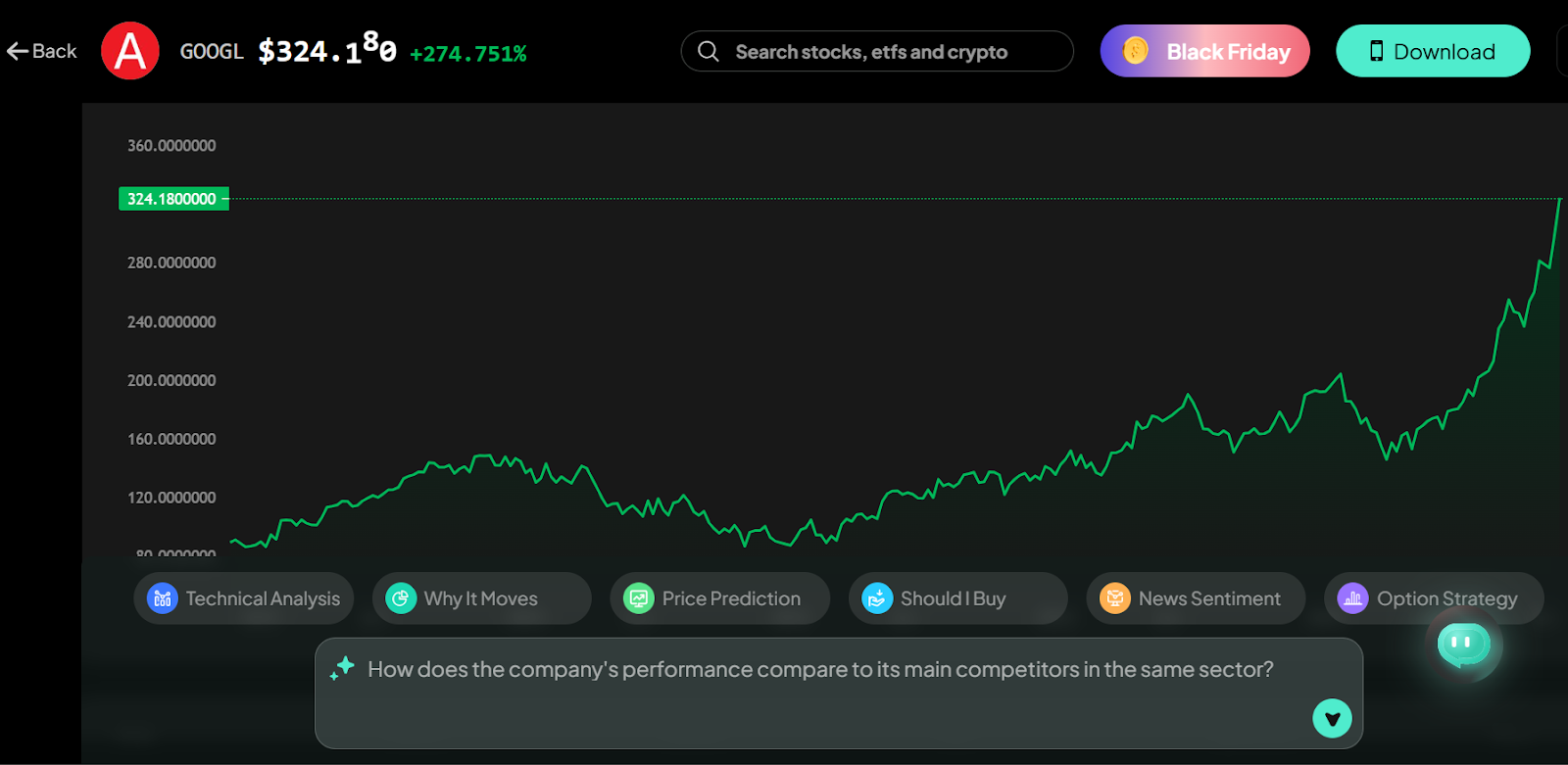

Alphabet (GOOGL / GOOG)

Alphabet is the most direct and straightforward way to invest in Gemini 3 because it owns the model, deploys it across its products, and monetizes it through cloud services, enterprise tools, and advertising enhancements. The company already has years of experience building massive AI systems, but Gemini 3 is the first model to bring everything together into a unified platform that businesses can adopt at scale. With Gemini integrated into Google Cloud, Workspace, and Search, Alphabet is positioned to make AI a recurring revenue driver rather than just a marketing buzzword.

Recent developments show how seriously Google is investing in AI infrastructure and enterprise-grade reliability. Gemini 3 delivers faster inference times, deeper context analysis, and more accurate reasoning than its predecessors. These advancements go hand in hand with their implementation in corporate settings where companies require consistency and reliability. Long-form analysis is also no longer a weakness of the model, allowing companies to apply it to financial analysis, summarizing medical research, understanding legal contracts, and high-level data aggregation.

If you believe Google’s integrated, full-stack approach will allow it to capture the lion’s share of the AI value chain for the next decade, then this stock is a core, essential holding for your portfolio. The built-in stability of its massive advertising and search business provides a safe foundation as the AI transition continues to ramp up across its other divisions.

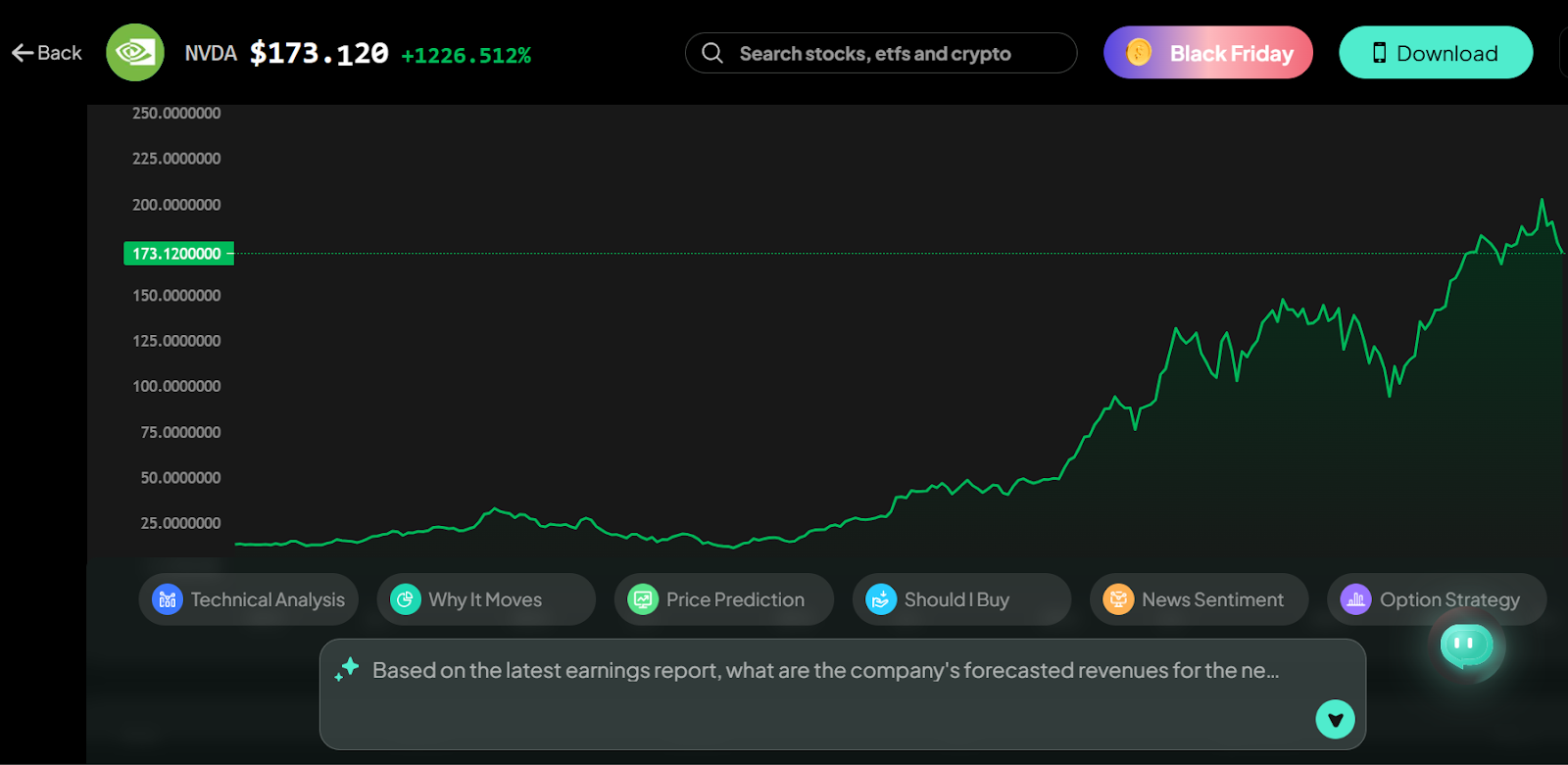

Nvidia (NVDA)

If Alphabet is the gold miner, Nvidia is selling the picks and shovels—and in this case, the shovels are the most advanced GPUs on the planet. Every large model—from Gemini to GPT to Claude to Llama—relies heavily on Nvidia GPUs for training, optimization, and inference. Even with new competitors entering the market, Nvidia maintains its dominance thanks to its hardware performance, its CUDA ecosystem, and its long-standing relationships with major cloud providers.

Gemini 3 increases demand for Nvidia hardware in several ways. First, its improved multimodal reasoning and data processing require massive computational resources. Second, enterprise adoption of AI tools increases the need for cloud compute capacity, and most of that capacity is still powered by Nvidia chips. Third, Google’s own training clusters use Nvidia hardware extensively, which means each new Gemini generation directly expands Nvidia’s revenue potential.

In case you see the entire global AI arms race as the primary, most powerful investment driver—rather than just Google’s success alone—then Nvidia offers the most robust way to capture the spending from every tech giant in the world. Its sheer dominance in AI infrastructure makes it a necessary part of this theme.

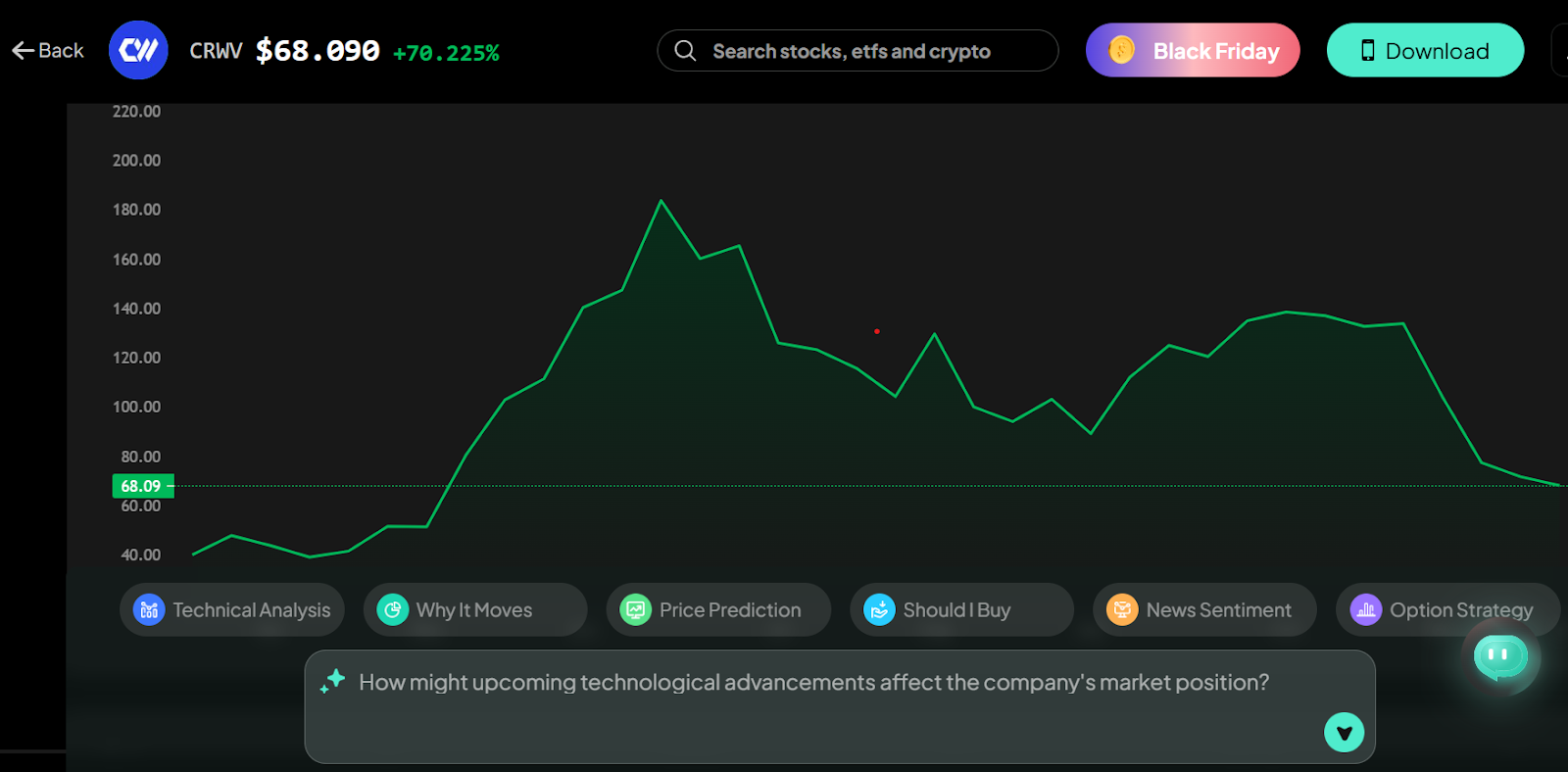

CoreWeave

If you're looking for a slightly more aggressive, pure-play investment in the AI infrastructure layer, CoreWeave is a name to track. The firm is the lesser-known but extremely promising infrastructure play in the Gemini ecosystem. Unlike traditional cloud providers, CoreWeave focuses exclusively on AI workloads and high-performance compute. It features an optimized network infrastructure, a high-speed memory architecture, and dense GPU clusters, making it suitable for large AI models such as Gemini. The growing adoption of Gemini 3 will likely accelerate the shift of enterprise workloads to AI-optimized cloud vendors, particularly when companies require lower latency or faster training times. CoreWeave also operates in a space where demand already exceeds physical hardware capacity, leaving significant room to scale as more companies adopt AI.

If you’re looking for a company with the potential for explosive, high-beta growth directly linked to the need for advanced AI computing—a need that models like Gemini 3 amplify exponentially—this is one for your watchlist. Its eventual IPO will be a huge moment for the cloud infrastructure market.

How to Invest in the Gemini 3 AI Boom

Now that you know the key players, how can you actually make money out of it? You have a couple of distinct paths to choose from, depending on your risk tolerance and your overall investment strategy.

Direct Play – Alphabet

The simplest method is to purchase Alphabet shares, listed under GOOGL or GOOG. What you are betting on here is that Google will successfully monetize Gemini 3 in its Cloud, Search, and subscription services. The route has diversification potential due to its legacy business, yet it implies that its performance is closely tied to execution against other tech giants.

Thematic AI Infrastructure Portfolio

This strategy aims to mitigate company-specific risk through diversification. Instead of putting all your eggs in Google's basket, you invest across the essential backbone of the AI industry. This means holding companies like Nvidia alongside Google Cloud competitors and specialized providers like CoreWeave. It’s a way to ensure you profit regardless of which AI giant—Google, Nvidia, or Microsoft—wins the ultimate model war.

Use AI-Powered Research Tools

The market reacts instantly to news like the Gemini 3 release. To succeed here, you need to get important information before everyone else. This is where AI-powered research tools come in, and they are essential for your success. You should leverage automation to stay ahead.

A great starting point is the Intellectia.ai AI Screener. You can use it to instantly filter the entire market for companies that show the clearest signs of benefiting from the Gemini 3 trend—perhaps by identifying suppliers to Google or competitors that are ramping up their chip orders. Furthermore, for those looking for concise daily recommendations, the AI Stock Picker provides data-driven, actionable insights.

And if you prefer trading on shorter timescales, our specialized features, like the AI Trading Strategies and AI Trading Signals (perfectly suited for the insights provided by our Swing Trading and Daytrading Center features) can help you capitalize on the short-term volatility and market fluctuations that major tech news inevitably causes.

Conclusion

The release of Gemini 3 confirms that the AI revolution is not going to slow down; it will continue accelerating, and Google is aggressively moving to challenge for market dominance. You now have a clear, data-driven roadmap to participate in this surge, whether you prefer a stable, foundational investment in Alphabet or a more aggressive thematic play in the underlying infrastructure companies. To make the most of this volatile, fast-moving environment, you need to rely on the best available tools and data. If you want to stay updated on Gemini-related stock movements and take advantage of daily signals, research tools, and real-time market analysis, sign up and subscribe to Intellectia AI. You’ll also receive real-time alerts on daily AI stock picks, advanced AI trading signals, and expert market analysis, so you don’t miss out on anything important.