Key Takeaways

- Long-term growth ETFs help you build wealth through diversified exposure to high-growth sectors such as technology, AI, and clean energy.

- The optimal ETFs of 2026 combine low fees, strong past performance, and a favorable market outlook.

- Your perfect long-term ETF will be determined by your risk tolerance, sector preference, and your financial objectives.

- Even if you’re starting with small amounts of money, fractional shares and no-commission brokers make long-term ETF investing affordable for all.

- Using AI-driven tools like Intellectia.AI’s AI Stock Picker, AI Screener, and Swing Trading Center can help you select more appropriate ETFs, manage risk, and optimize for the long term.

Introduction

If you’ve ever tried searching for the best ETFs for long-term growth, you have an idea of how daunting the process can become. All the articles seem to suggest different things, and the financial terminology is baffling. And when you finally feel like you’ve figured it out, someone else pops up online saying the exact opposite.

This is the problem many long-term investors face: too much information, not enough clarity. That’s why I want to simplify the entire process for you — without dumbing anything down. Instead of giving you vague or generic recommendations, I’m going to walk you through what actually matters when choosing a long-term growth ETF, what makes an ETF worth holding for 10 to 20 years, and which ones are positioned for strong growth going into 2026 and beyond.

You’ll be able to maneuver this landscape much more confidently with the aid of AI-based tools such as Intellectia.ai, which will offer you real-time ETF information, AI-based stock and crypto forecasts, trend analysis, and intelligent trading tools.

What Is a Long-Term Growth ETF?

Before we dive into the specific tickers, let’s make sure we’re on the same page about what a Growth ETF actually is and why it fits perfectly into a long-term strategy. An ETF, or Exchange-Traded Fund, is a collection of stocks, bonds or other securities, which you can trade on a stock exchange like you would in a single stock. Instead of buying 500 stocks of the S&P 500 separately, you’d simply purchase a single share of an S&P 500 ETF.

Now, a Growth ETF specifically targets companies likely to grow earnings and revenue faster than the market’s average. These are generally younger, innovative companies that pay little to no dividends because they reinvest the majority of their profits in research, development, and expansion. Think of industries such as high-tech, state-of-the-art medical, or renewable energy. These are long-term capital appreciation funds, whose objective is to achieve the greatest growth over a period of 10 or more years, and they are prepared to bear a little more volatility in the short term to accomplish that purpose.

How to Choose the Best ETF for Long-Term Growth

Choosing the right investment isn’t just a matter of selecting a popular ticker symbol; it’s about getting to know the fund’s DNA and how it aligns with your timeline. This section will empower you to look beyond simple performance numbers and analyze the factors that truly matter for the long haul.

Expense Ratios and Fees — Why Low Costs Matter Over 10–20 Years

Fees are your worst enemy when building a long-term portfolio. The expense ratio is the annual fee a fund charges to manage the ETF, expressed as a percentage of your investment. It might seem tiny—say, a 0.5% difference—but thanks to the power of compounding, that small difference can cost you tens of thousands over 20 years. If you think compounding is the single most important factor for building wealth, then keeping your costs as low as possible is absolutely essential to maximizing your final return.

Sector Allocation — Tech, Healthcare, AI, Clean Energy Exposure

For a fund to deliver exceptional long-term growth, it needs to be invested in the sectors that will define the future. Look for ETFs with heavy exposure to areas like technology, specialized healthcare, clean energy infrastructure, and, critically, Artificial Intelligence (AI). These are the engines of multi-decade expansion. If you’re ever unsure about which sectors are poised for the most explosive growth, remember that tools like the AI stock selection and AI screener features on Intellectia.AI are designed to help you identify those future-proof sectors.

Market-Cap Composition — Large-Cap Safety vs. Small-Cap High Growth

This factor is about risk and reward. Large-cap ETFs (investing in huge companies like Apple or Microsoft) offer stability and often a smoother ride. Small-cap ETFs (investing in smaller, younger companies) carry higher risk and volatility but offer the potential for explosive growth if those smaller companies take off. The best ETF portfolio for long-term growth often uses a blend, with large caps providing stability and small caps offering the highest potential returns.

Historical Performance vs. Future Growth Outlook

Now, past performance is not indicative of future results. Just because an ETF had a stellar run over the last five years doesn't guarantee the same for the next five. It’s far more important to analyze the future outlook of the underlying holdings and the fund's specific strategy. Are they positioned to capture the next big market trend, or are they still heavily reliant on last decade's winners? That’s the question your analysis should answer.

Risk Profile — Volatility, Drawdowns & Long-Term Stability

Every investment carries risk, but you need to know what kind of risk you're taking on. Volatility refers to how much the price fluctuates. Drawdowns are the large, sudden drops that can test your nerves. Unless you’re comfortable with these huge drops, you want to invest in an ETF with a lower beta (a measure of volatility relative to the market). The right fund for you is the one you can comfortably hang onto during hard times to achieve that inevitable long-term stability and growth.

Top 5 ETFs for Long-Term Growth in 2026

We've compiled a list of five outstanding ETFs that offer a fantastic mix of diversification, exposure to future-defining technologies, and strategic market plays. These are excellent candidates to be cornerstone holdings in your best long-term growth ETF portfolio.

Comparative Overview Table

| ETF Name | Ticker | Expense Ratio | Dividend Yield | Primary Focus |

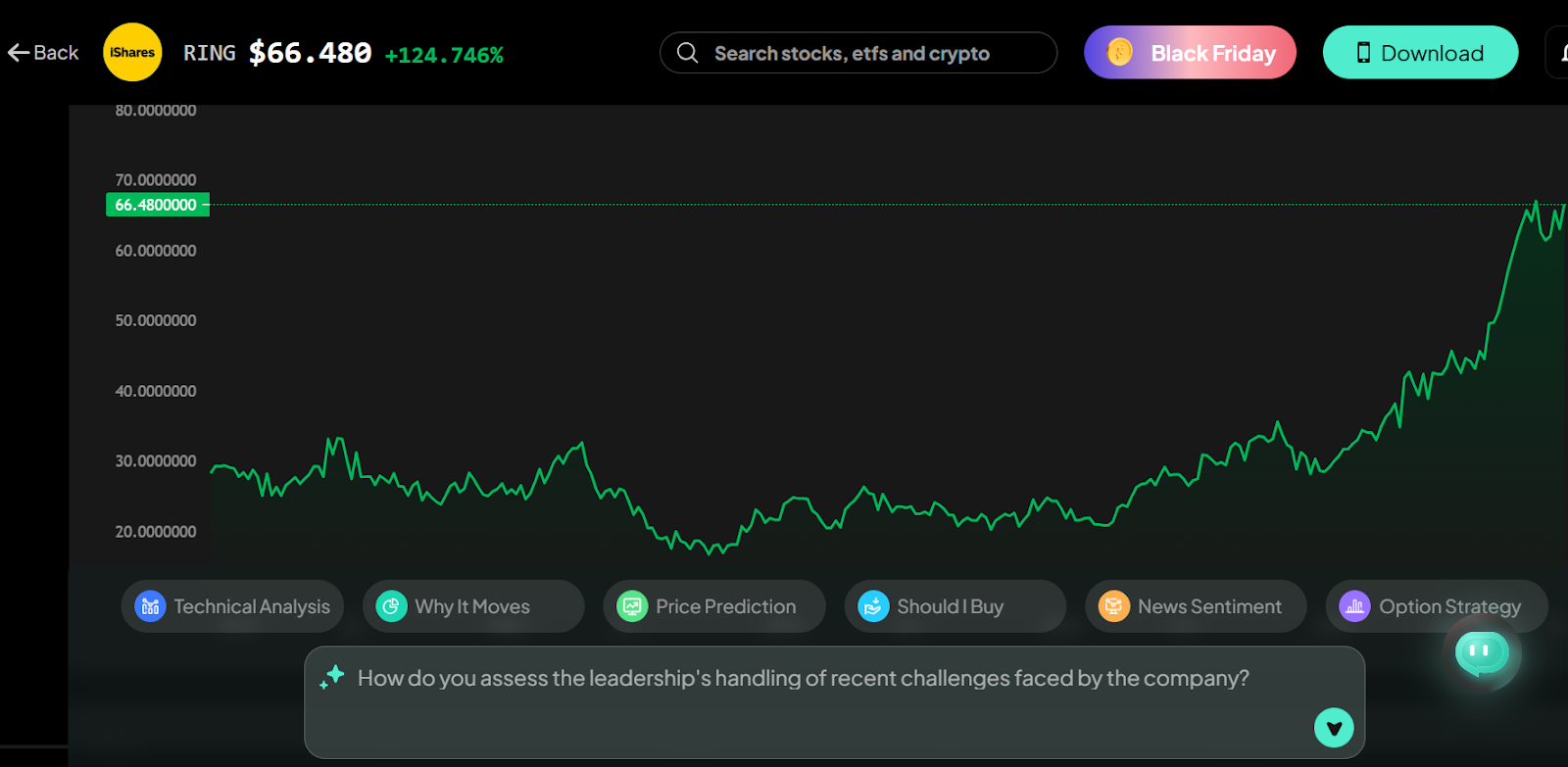

| Global Robotics & AI | RING | 0.39% | 0.72% | Global Tech, AI, Robotics |

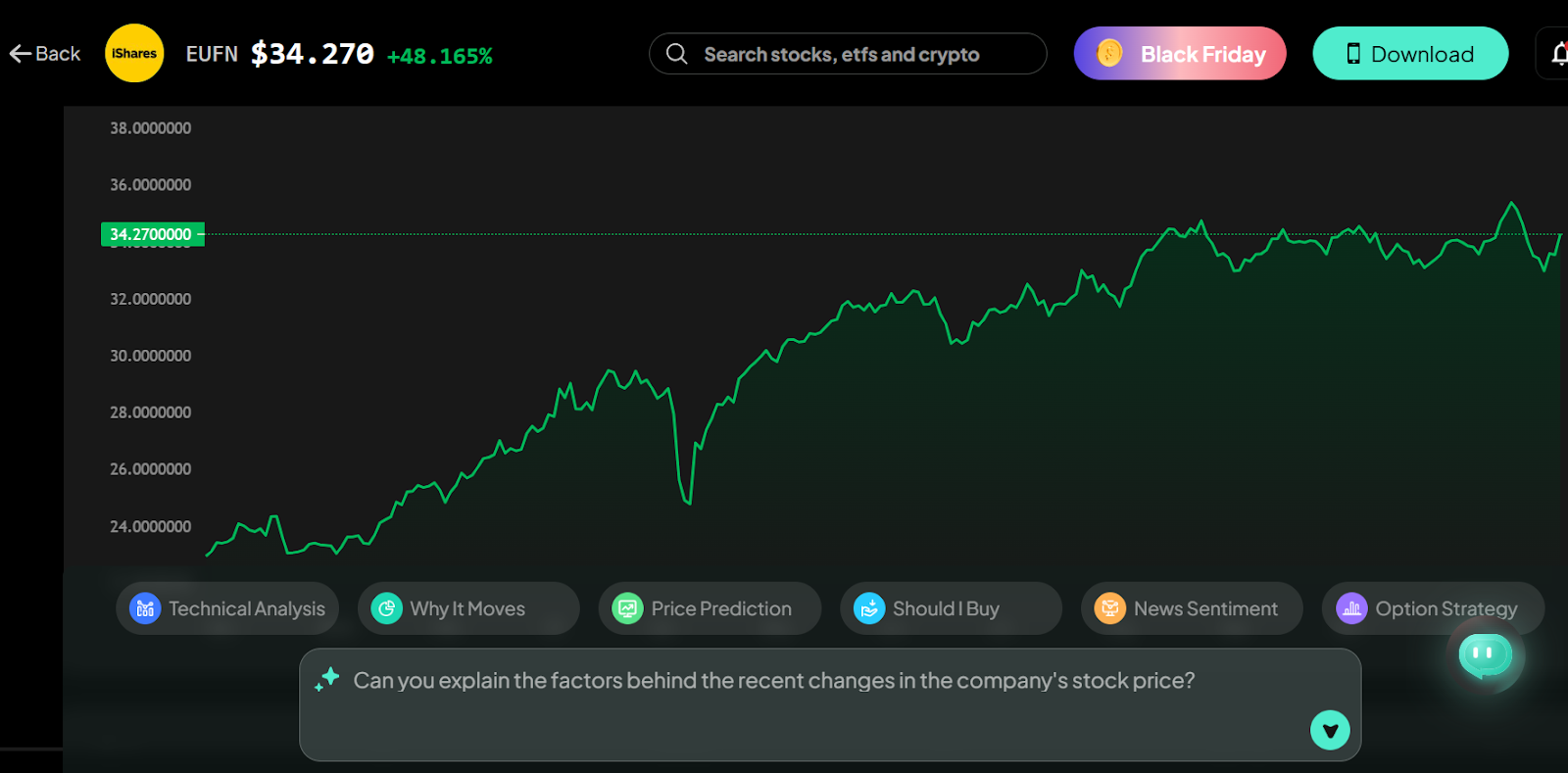

| European Financials | EUFN | 0.48% | 3.75% | European Bank Recovery/Growth |

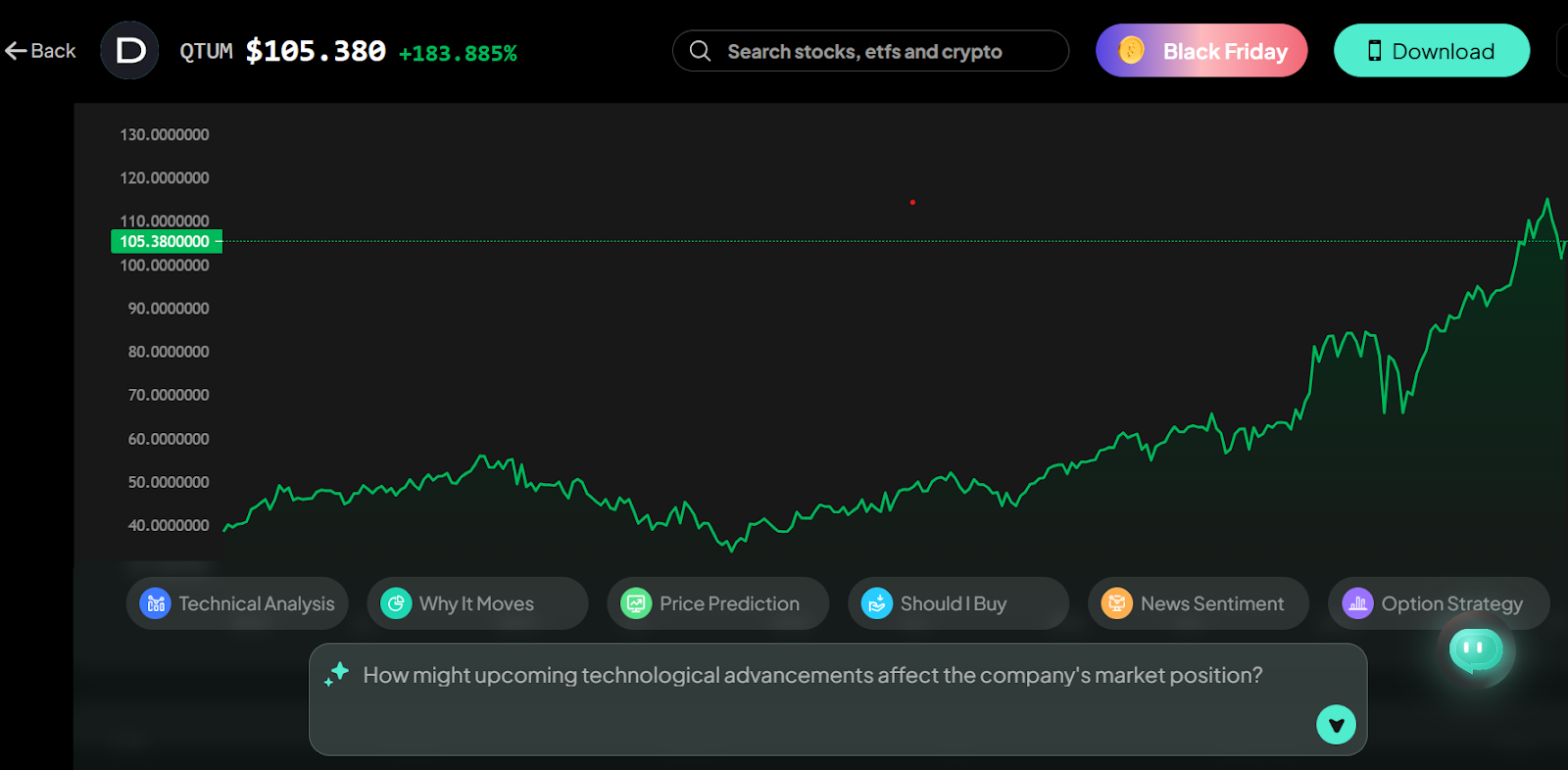

| AI & Quantum Tech | QTUM | 0.40% | 0.95% | Disruptive AI, Big Data, Quantum Computing |

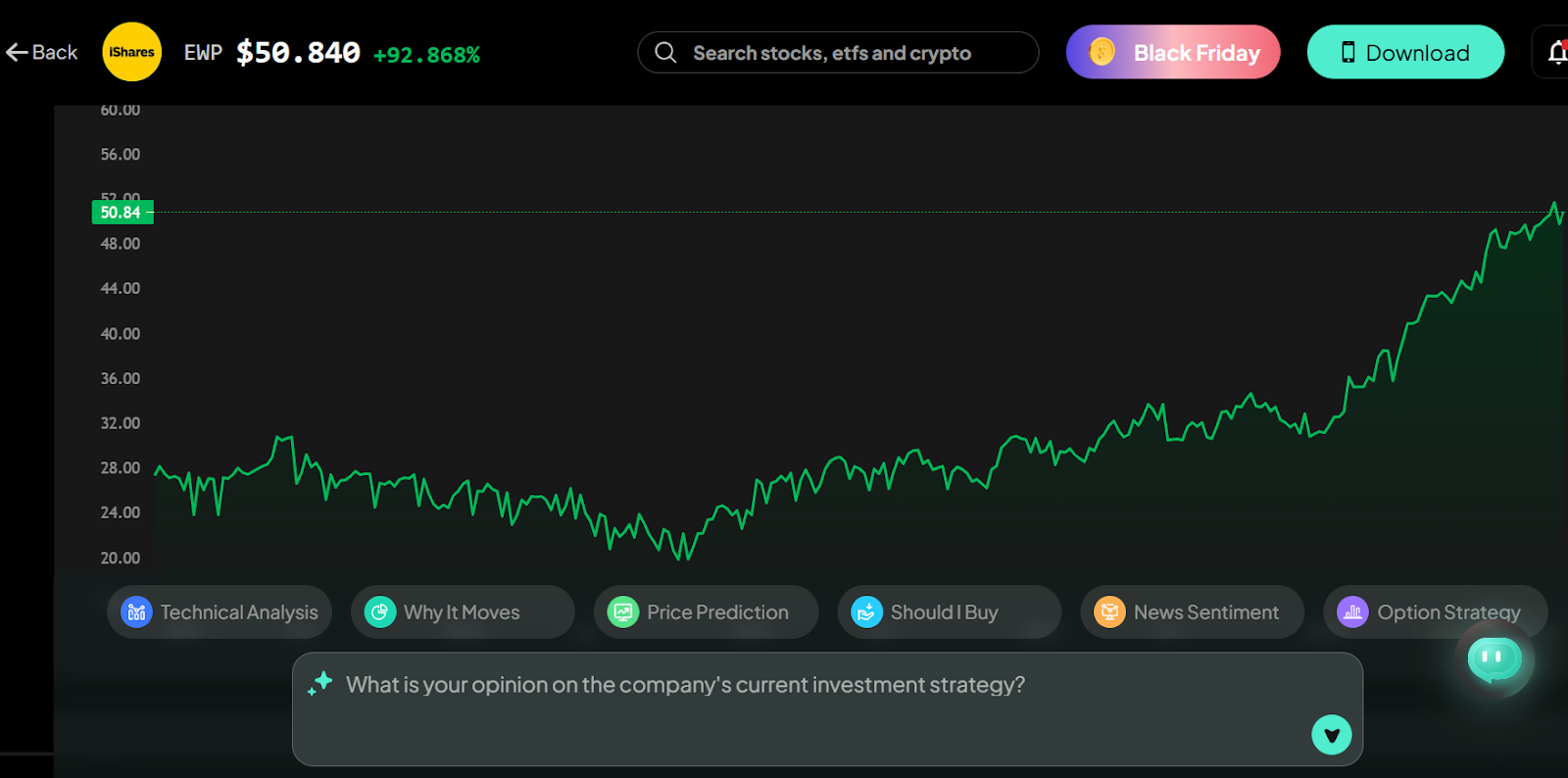

| Spain ETF | EWP | 0.50% | 2.63% | Developed Market Recovery |

| Global Cybersecurity | SHLD | 0.60% | 0.50% | Cybersecurity & Cloud Growth |

1. RING (iShares Robotics and Artificial Intelligence ETF)

RING is an ETF that focuses squarely on companies generating revenue from robotics, automation, and artificial intelligence—the very core sectors on which Intellectia.AI is built. It's truly a global fund, capturing companies from the US, Japan, and Europe. Its differentiation lies in its pure focus on AI infrastructure set to power nearly every industry’s future growth.

If you believe AI and automation are set to revolutionize every single industry over the next 20 years, then this ETF offers the most concentrated and global exposure to that theme. The future is automated, and this fund is positioned to benefit directly from that trend.

2. EUFN (iShares MSCI Europe Financials ETF)

EUFN ETF is a more specialized pick, offering targeted exposure to European banks and financial companies. The European market, particularly the financial sector, often trades at a significant discount compared to its American peers. This makes it a potential value play with strong long-term growth potential if you believe in a global economic recovery.

Its differentiation is that it acts as a contrarian play, betting on a recovery in developed markets and a return to normal interest-rate environments that benefit banks.

If you anticipate a strong economic recovery and normalization in European markets, especially in the banking sector, the EUFN ETF could deliver outsized returns as it catches up to global valuations.

3. QTUM (First Trust NASDAQ CEA Cybersecurity ETF)

QTUM is a thematic ETF that targets the advanced growth areas of technology: quantum computing, machine learning, data processing, and cloud services. This fund invests in companies building the engine of the modern, data-driven economy.

Its differentiation lies in its focus on the bleeding edge of technology, offering pure-play exposure to highly disruptive themes that broader tech funds often dilute.

If you're looking for the next multi-bagger category outside of traditional, massive tech stocks, this ETF’s specialized focus on the digital infrastructure of tomorrow makes it a highly appealing part of your best long-term growth ETF portfolio.

4. EWP (iShares MSCI Spain ETF)

Another single-country focus, EWP provides broad exposure to Spanish equities, which are traditionally tied to sectors such as financials, utilities, and tourism. While perhaps not as flashy as a tech fund, it offers excellent geographic diversification and can benefit strongly from cyclical recovery.

Its differentiation is that it provides a specific, single-country, developed-market play, offering diversification away from the standard North American and Asian markets.

If you think select European economies (like Spain) offer better value and recovery potential post-macro headwinds, EWP could be a key diversifier in your global strategy for the best ETF portfolio for long-term growth.

5. SHLD (First Trust NASDAQ Cybersecurity ETF)

SHLD ETF invests in companies focused solely on cybersecurity and cloud-based security solutions. Every single day, data security becomes more critical, and companies worldwide—regardless of economic climate—are forced to increase their spending on protection. This makes cybersecurity a non-negotiable growth area.

Its differentiation is that cybersecurity is a perpetual necessity for all businesses globally, ensuring steady, defensive, long-term growth demand regardless of the economic cycle.

If you believe the accelerating shift to the cloud and the rising threat of cyber attacks guarantee perpetual, consistent growth in this sector, SHLD is a fundamentally sound and essential bet for the coming decades.

How to Invest in the Best ETFs for Long-Term Growth

Picking the right ETF is only half the battle; the other half is implementing a smart, disciplined investment strategy. Here’s how you can optimize your approach.

How to Buy ETFs With Little Money (Fractional Shares, Zero-Commission Brokers)

You absolutely don't need thousands of dollars to start investing in the best ETFs for long-term growth. Most major brokerage platforms now offer fractional share investing. This means you can buy a portion of an ETF share for as little as one dollar. When you combine this with the zero-commission trading now standard at most brokers, buying into high-quality funds becomes incredibly accessible. When you're ready to make a purchase, the AI Agent or AI Trading Signals on Intellectia.ai could even help flag optimal entry points, giving you an extra edge.

Lump-Sum vs. Dollar-Cost Averaging (DCA)

You have two main ways to put your cash to work. Lump-sum investing means investing all your capital at once. Dollar-Cost Averaging (DCA) means investing a fixed amount of money at regular intervals (e.g., $200 every month). While studies show lump-sum sometimes performs better, DCA is the most practical and least stressful method for the average investor. We generally recommend DCA for long-term ETF investing because it smooths out market volatility and removes the stress of trying to time the market. Tools like Intellectia’s Swing Trading Center and ETF Screener can help you monitor price trends and optimize your DCA entries.

Using Tax-Advantaged Accounts (IRA, Roth IRA, 401k)

This is one of the most important steps you can take. For long-term compounding, nothing beats the efficiency of a tax-advantaged account. Investing your growth ETFs inside a Roth IRA means you pay no taxes on the growth ever when you retire. Putting them in a traditional IRA or 401(k) means your contributions are tax-deductible now. The best growth strategy is one that minimizes the government’s cut. Intellectia’s Technical Analysis tools can help you identify which ETFs are best suited for tax-efficient growth.

When to Rebalance Your Long-Term ETF Portfolio

Rebalancing means selling some of your big winners and buying more of your relative losers to bring your portfolio back to its original target allocation. For instance, if you wanted 10% in RING but it grew to 15%, you’d sell the excess 5% and buy more of another asset that may have lagged. For a long-term growth ETF portfolio, it’s usually adequate to rebalance annually or semi-annually, or when a certain allocation exceeds its target by more than 5% or 10%. You can use Intellectia’s Stock Monitor and AI Screener to track performance and rebalance with precision.

Conclusion

Building a winning investment portfolio that has long-term potential does not need to be complicated. Once you understand what drives growth, how sector allocation works, and which ETFs match your personal goals, you can build a long-term portfolio with confidence.

The ETFs we explored — RING, EUFN, QTUM, EWP, and SHLD — each bring something different to the table. Whether you want high-tech growth, geographic diversification, or stable defensive expansion, there’s an ETF here that fits your profile.

And if you want deeper insights, real-time AI trading signals, ETF analysis, or smart stock-picking recommendations, you can always sign up and subscribe to Intellectia.ai. Our AI-driven models help you invest smarter, reduce risk, and stay ahead of market trends — which is exactly what long-term success is all about.