Key Takeaways

- Best stocks under $5—also known as cheap stocks, penny stocks, or stocks under 5 dollars—let investors buy more shares with less capital, offering the potential for outsized percentage gains.

- Although volatile, the most active stocks under $5 can deliver strong returns when supported by solid fundamentals, analyst upgrades, or catalysts.

- Our top picks—KULR, BCAB, CATX, OPTT, and LODE—span high-growth sectors such as tech, healthcare, clean energy, and materials.

- Tools like Intellectia.AI can help predict price movements, analyze trends, and build safer trading strategies for cheap stocks.

- Penny stocks carry risks such as low liquidity and limited financial history—always research before investing.

What Are Best Stocks Under $5?

Stocks under $5 are shares of companies trading at less than $5 per share, often classified as penny stocks by the Securities and Exchange Commission (SEC). These stocks are typically issued by small-cap companies or startups with lower market capitalization. Key characteristics include:

- Volatility: Prices can swing dramatically due to low trading volume or market sentiment.

- Growth Potential: Some companies are in emerging sectors like tech or healthcare, offering high reward potential.

- Risks: Limited liquidity, financial instability, or lack of institutional investor interest can make them risky.

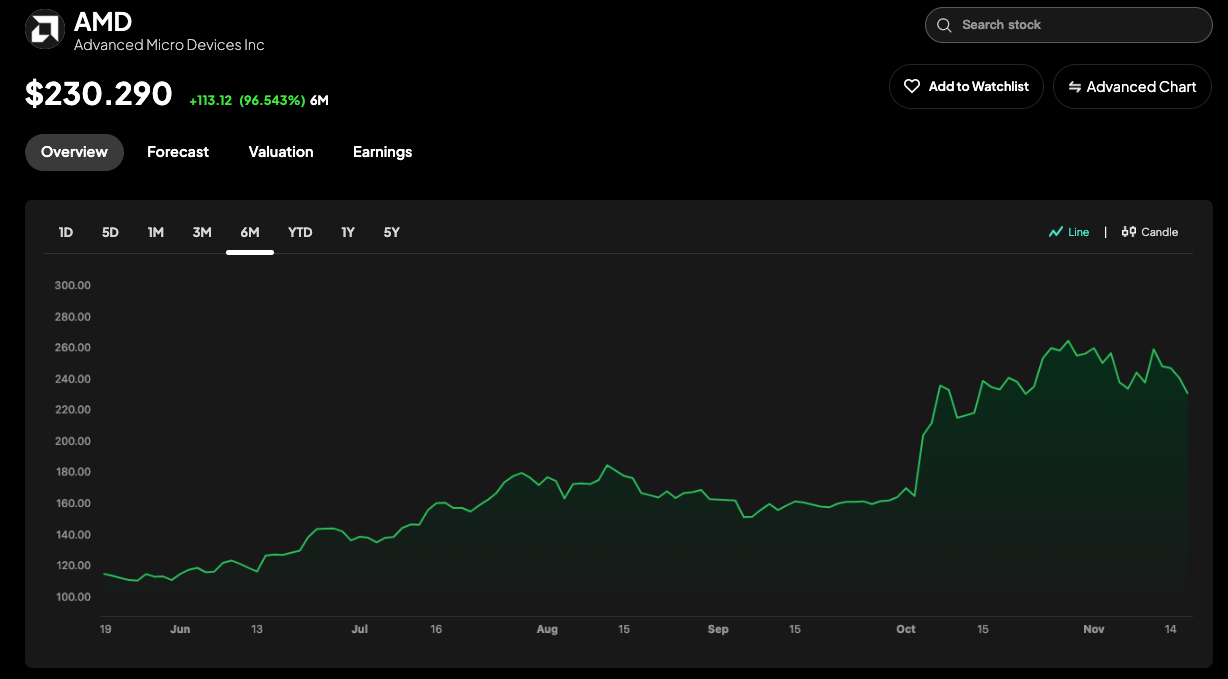

Quality companies may trade under $5 because they’re small, overlooked, or recovering from challenges. For instance, Advanced Micro Devices (AMD) once traded below $5 but grew significantly, showing that some penny stocks can become success stories.

Why Invest in Top Stocks Under $5?

Stocks under 5 dollars, commonly referred to as penny stocks, are shares priced below $5. But in 2026, they’re not just micro-cap gambles—many belong to innovative companies in:

- Affordability: With a small budget, you can buy hundreds of shares, making it easier to diversify.

- High Percentage Gains: A price increase from $2 to $4 doubles your investment, offering outsized returns compared to pricier stocks.

- Psychological Comfort: Owning more shares feels rewarding, even if the total value is modest.

- Access to Emerging Companies: Many stocks under $5 are in innovative sectors like renewable energy or biotech, giving you early exposure to potential leaders.

However, the risks are real—volatility, low liquidity, and potential for loss require careful consideration.

Criteria for Best Stocks Under $5

To find the best stocks under $5, you should look for specific qualities that indicate potential for growth and stability. Here are key criteria:

- Earnings Per Share (EPS): Positive or improving EPS suggests profitability or progress toward it.

- Trading Volume: Higher volume ensures liquidity, making it easier to buy or sell shares.

- Market Capitalization: A market cap above $50 million often indicates a more established company.

- Growth Potential: Companies in resilient or emerging sectors like tech, healthcare, or green energy are more likely to grow.

- Financial Health: Look for manageable debt and positive cash flow, even if profits are not yet consistent.

5 Best Stocks Under $5

Below is a comparative overview of five top stocks under $5, followed by detailed profiles for each. These companies were selected based on their growth potential, recent developments, and alignment with emerging market trends.

| Company Name | Ticker | Sector | Stock Price | Market Cap | Key Strengths |

|---|---|---|---|---|---|

| KULR Technology Group, Inc. | KULR | Technology | $1.28 | $378M | Positive analyst ratings, revenue growth |

| BioAtla, Inc. | BCAB | Healthcare | $1.25 | $75M | progressing trials; improved cash efficiency. |

| Perspective Therapeutics, Inc. | CATX | Healthcare | $2.43 | $189.6M | Strong buy ratings, innovative cancer treatments |

| Ocean Power Technologies, Inc. | OPTT | Industrials | $0.50 | $73.7M | Innovative wave energy tech, successful testing |

| Comstock Inc. | LODE | Basic Materials | $2.58 | $64.6M | Focus on decarbonization technologies |

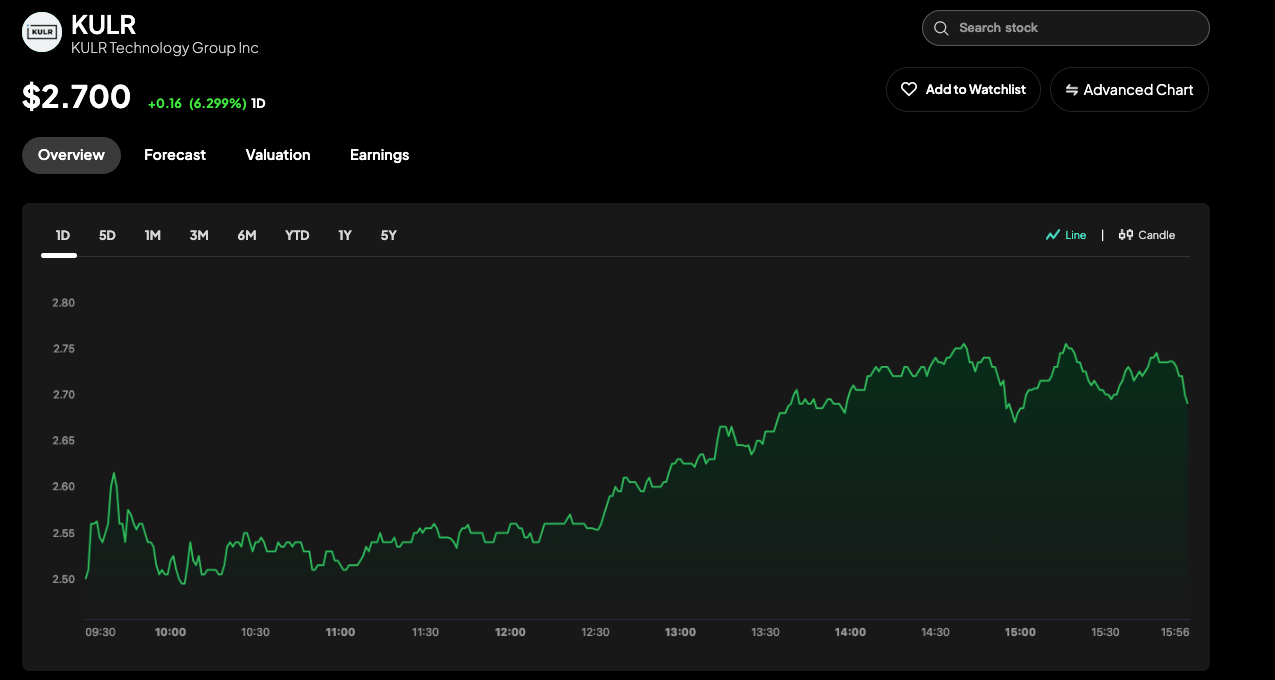

KULR Technology Group, Inc. (KULR)

KULR Technology Group, Inc. develops thermal management technologies for batteries and electronics, critical for electric vehicles, energy storage, and 5G communications. Their solutions, like SafeCASE and thermal runaway shields, enhance safety and efficiency. Analysts have upgraded KULR to a Strong Buy, with a 1-year price target of $5.00, suggesting a 290.63% upside from its current $1.28 price.

The company recently reported a 44.42% year-over-year revenue increase for FY2024Q4, reaching $3.37 million. Its market cap of $378 million reflects investor optimism about its role in high-growth sectors. With one Buy rating and no Hold or Sell, KULR has a Moderate Buy consensus. The $5.00 target indicates strong growth potential.

KULR stands out for its innovative thermal management solutions, which are increasingly vital as electric vehicles and energy storage grow. If you’re interested in tech with real-world applications, KULR is a compelling pick.

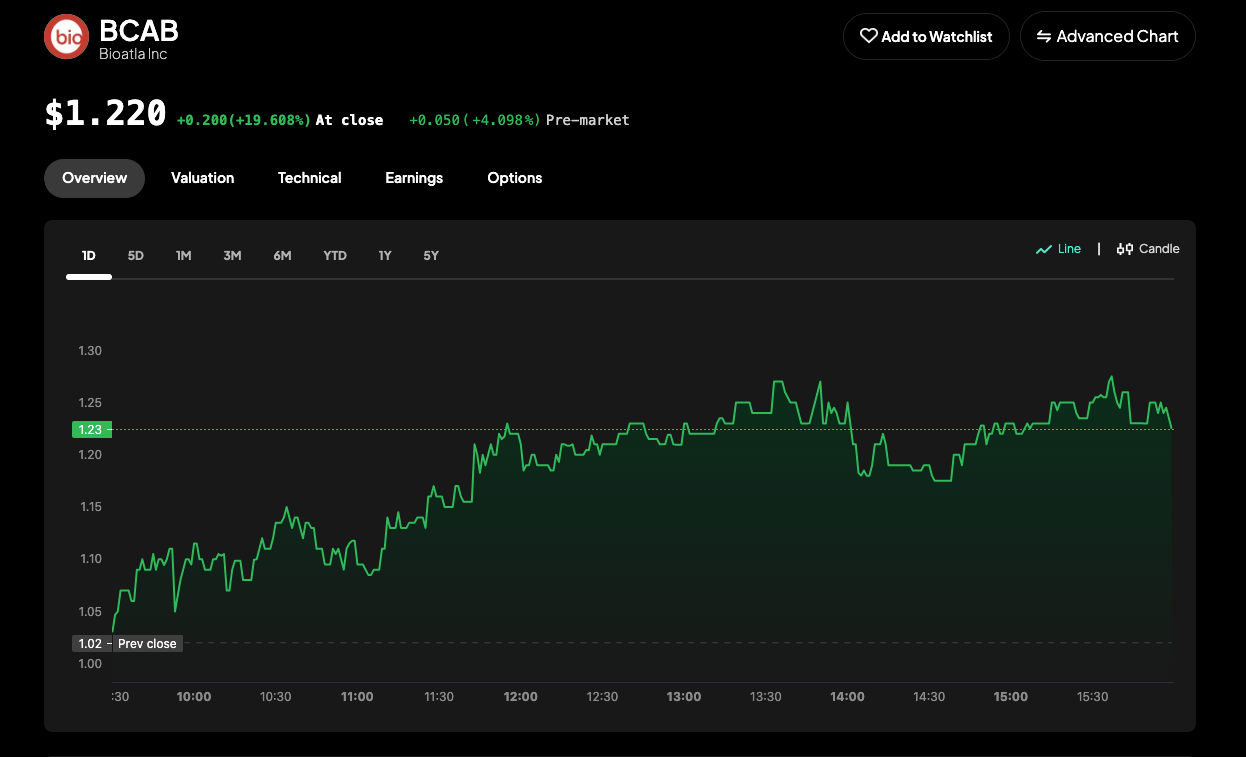

BioAtla, Inc.(BCAB)

BioAtla, Inc. develops conditionally activated biologics (CABs), a new class of targeted antibody therapies designed to treat solid tumors more effectively and safely. The company is advancing several CAB candidates in clinical trials, showing encouraging early results in difficult-to-treat cancers.

BioAtla has streamlined operations and reduced costs in 2024, extending its cash runway and focusing on its most promising programs. With its differentiated technology platform and growing clinical data, BCAB offers a unique opportunity within biotech penny stocks—especially for investors interested in innovative cancer treatments.

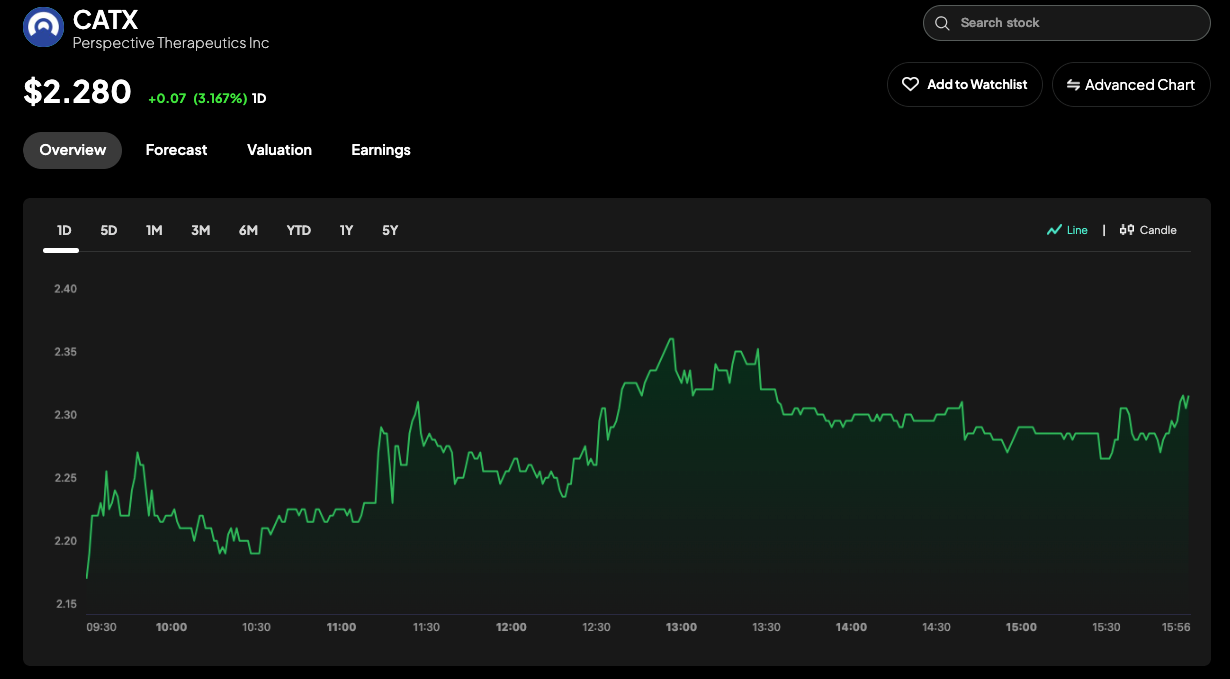

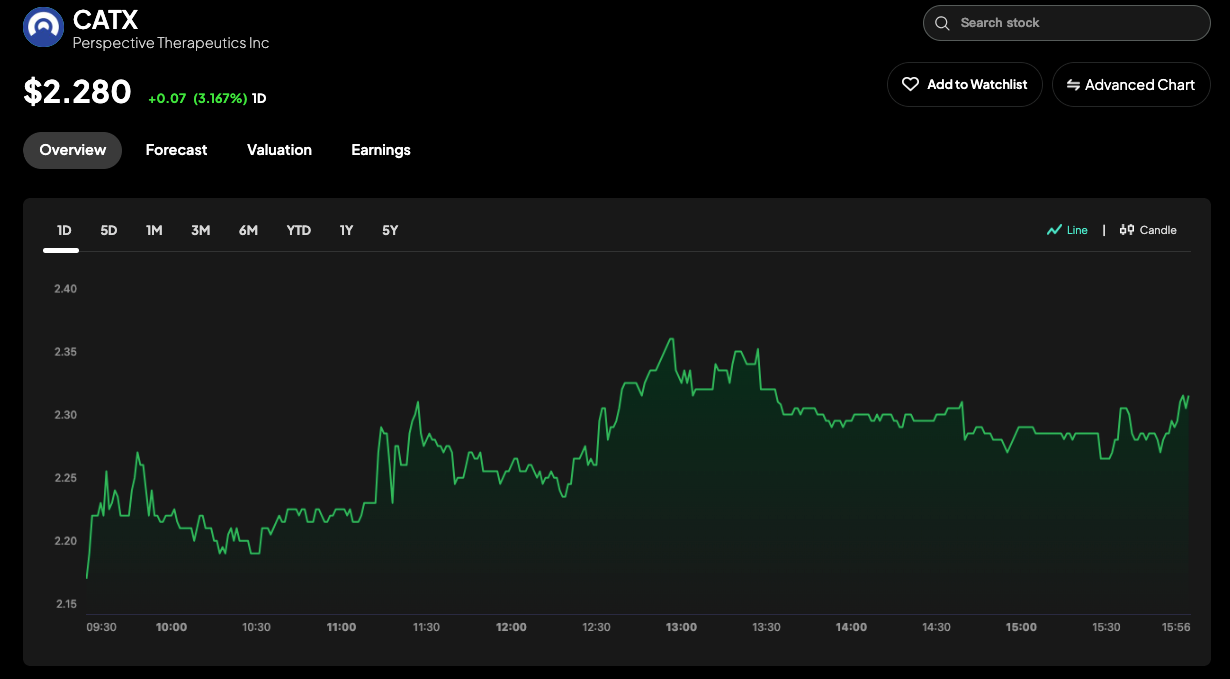

Perspective Therapeutics, Inc. (CATX)

Perspective Therapeutics, Inc. is a precision oncology company developing alpha-particle therapies and diagnostic imaging agents for cancer treatment, focusing on innovative solutions like Cesium-131 brachytherapy seeds. CATX has a Strong Buy rating from analysts, with an average 1-year price target of $13.56, implying a 458.02% upside from its $2.43 price. The company is advancing its clinical trials, boosting investor confidence.

In FY2024Q4, CATX reported $234,000 in revenue but significant losses, typical for biotech firms in development stages. Its $179.94 million market cap reflects its growth potential in healthcare. With nine Buy and one Hold rating, CATX enjoys strong analyst support, making it a standout in the penny stock space. CATX is ideal if you’re excited about healthcare innovation, particularly in cancer treatment. Its high analyst ratings make it a top contender.

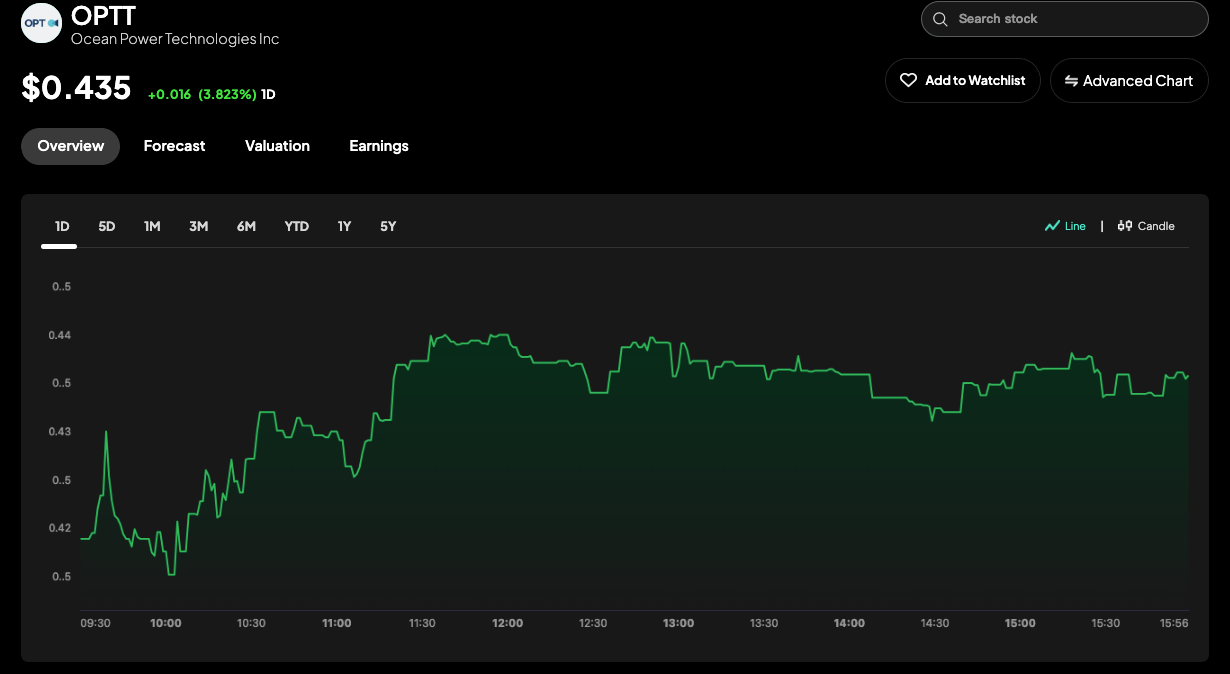

Ocean Power Technologies, Inc. (OPTT)

Ocean Power Technologies, Inc. (OPTT)

Ocean Power Technologies, Inc. develops wave energy platforms like the PB3 PowerBuoy, generating electricity for offshore applications. It also offers AI-capable maritime solutions. OPTT completed over four months of offshore testing for its Next Generation PowerBuoy, achieving 100% data uptime even during hurricanes. The company recently shipped an AI-capable PowerBuoy for defense applications.

OPTT’s FY2025Q3 revenue was $825K. Its $86.30 million market cap has massive upside potential amid booming renewable energy market outlook. OPTT’s focus on renewable wave energy and AI-driven maritime solutions appeals to those interested in green tech.

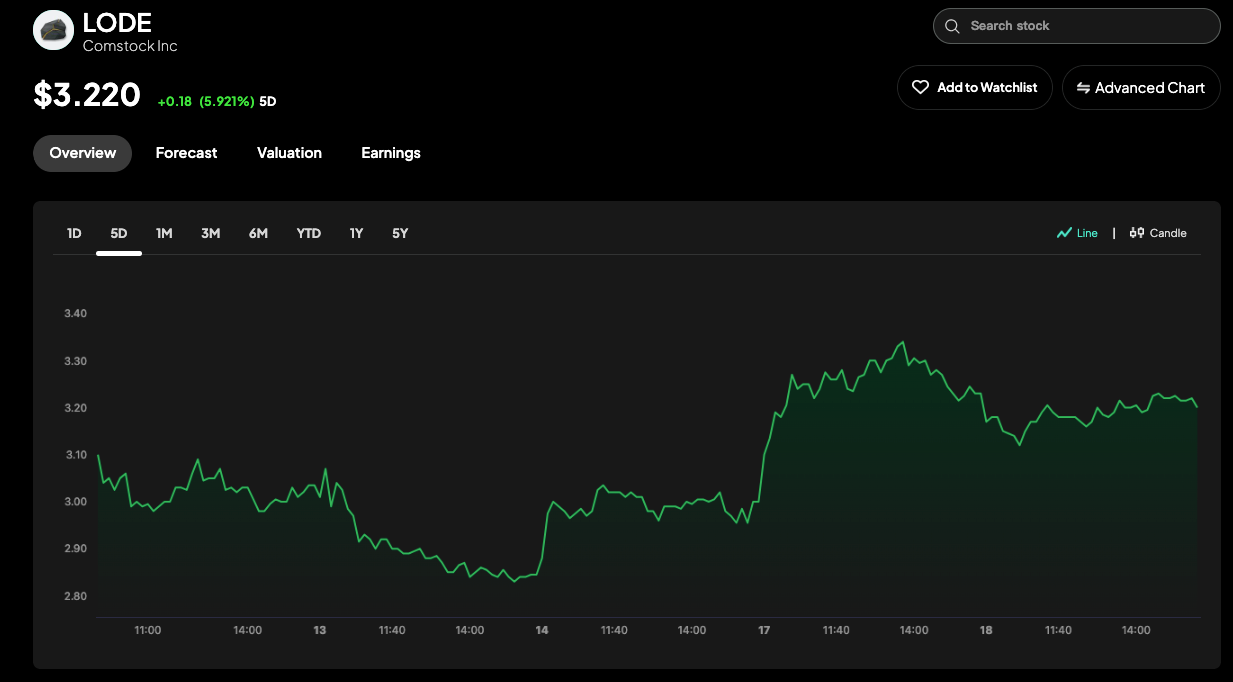

Comstock Inc. (LODE)

Comstock Inc. commercializes decarbonization technologies, converting natural resources into renewable energy products and using AI for mineral discovery. Comstock is actively presenting at investor conferences to highlight its sustainability solutions. Its focus on decarbonization aligns with global environmental trends.

In FY2024Q4, Comstock’s revenue surged 257.20% year-over-year to $1.60 million. Its $69.41 million market cap reflects its emerging status. LODE is a great pick if you’re passionate about sustainability and decarbonization.

How to Invest Safely in Stocks Under $5 with Intellectia.AI

Investing in stocks under $5 can be rewarding, but it requires caution due to their volatility. Intellectia.AI offers a suite of AI-powered tools to help you navigate this space safely:

- AI Stock Picker: Identify promising stocks under $5 based on your criteria, such as sector or growth potential.

- Price Predictions: Use AI-driven forecasts to anticipate price movements and time your trades.

- Trading Signals: Get real-time buy or sell signals to optimize your strategy.

- Real-Time Monitoring: Track stock performance with tools like the stock monitor and chart patterns.

By leveraging these tools, you can make data-driven decisions, reducing the risks associated with penny stocks.

Conclusion

Stocks under $5 offer an exciting opportunity to invest in emerging companies with high growth potential, but they come with risks that require careful analysis. KULR, BCAB, CATX, OPTT, and LODE stand out as top picks for 2026, each offering unique strengths in tech, healthcare, and sustainability. Whether you’re drawn to KULR’s battery solutions, CATX’s cancer therapies, or OPTT’s wave energy, these stocks could boost your portfolio if chosen wisely. To invest safely, use Intellectia.AI’s AI-driven tools to analyze, predict, and monitor these stocks.