Key Takeaways

- United Parcel Service (UPS), Enterprise Products Partners (EPD), AstraZeneca (AZN), Anglogold Ashanti PLC (AU), and Carnival Corporation (CCL), all stocks under $100, offering a blend of growth, income, and recovery potential.

- Choose stocks under $100 based on financial health, competitive advantages, growth prospects, dividend yields, and reasonable valuations to ensure long-term success.

- UPS provides reliable dividends, EPD offers high yields, AZN drives innovation, AU dominates global gold mining company, and CCL is poised for a strong travel recovery.

- Tools like Intellectia.ai’s AI Stock Picker & AI Screener help you discover undervalued U.S. stocks under $100 instantly.

- Spread investments across industrials, energy, healthcare, technology, and consumer discretionary to minimize risk and maximize returns in 2026.

Introduction

Have you ever felt overwhelmed by the high prices of popular stocks, wondering how to start investing without a huge budget? You’re not alone—many investors face the challenge of finding quality stocks that don’t break the bank. Stocks under $100 offer an accessible entry point to build a diversified portfolio with strong growth potential.

These affordable shares can deliver significant returns, whether you’re chasing capital gains, steady dividends, or undervalued gems. Here, we’ll dive into the best stocks under $100 for 2026, highlighting companies with robust fundamentals and promising futures.

What Are Best Stocks Under $100?

Stocks under $100 are shares of companies trading below $100 per share, making them affordable for investors with varying budgets. These stocks span a wide range, offering something for everyone:

- Growth Stocks: Companies with high potential for expansion, often reinvesting profits to fuel innovation.

- Dividend Stocks: Firms that pay regular dividends, providing a steady income stream for investors.

- Value Stocks: Undervalued businesses with strong fundamentals, offering a chance to buy low before prices rise.

- Blue-Chip Stocks: Established companies with stable earnings, occasionally trading below $100 due to market fluctuations or sector trends.

This diversity allows you to tailor your portfolio to your financial goals, whether you’re a beginner or a seasoned investor. By using tools like Intellectia.ai’s Stock Monitor, you can track these stocks and seize opportunities as they arise.

Why Invest in Stocks Under $100?

Investing in stocks under $100 is a smart way to enter the market without needing substantial capital. Here’s why they’re worth considering:

- Affordability and Accessibility: Lower share prices mean you can buy more shares or invest in multiple companies, spreading your risk.

- Potential for Significant Growth: Many stocks under $100 belong to emerging companies or undervalued giants, offering substantial capital appreciation as they grow or recover.

- Diversification Without Large Capital: With limited funds, you can invest across sectors like technology, healthcare, or energy, reducing portfolio risk.

- High-Quality Companies at a Discount: Established firms may trade below $100 due to temporary market conditions, allowing you to buy quality stocks at a bargain.

By leveraging Intellectia.ai’s AI Screener, you can identify stocks that align with your goals, ensuring you don’t miss out on these opportunities.

Criteria for Selecting Best Stocks Under $100

Choosing the best stocks under $100 requires careful analysis to ensure long-term success. Here are the key factors to consider:

- Financial Health: Look for companies with consistent revenue growth, strong profit margins, and manageable debt levels to ensure stability.

- Strong Competitive Advantages: Seek firms with unique products, strong brand loyalty, or dominant market positions that set them apart.

- Growth Potential: Evaluate companies with clear plans for expansion, such as new products, markets, or strategic partnerships.

- Dividend Yield: For income-focused investors, a reliable dividend yield provides steady cash flow.

- Positive Analyst Sentiment: Strong analyst ratings and optimistic price targets indicate market confidence in the stock’s future.

- Reasonable Valuation: Metrics like low price-to-earnings (P/E) or price-to-sales (P/S) ratios suggest the stock is undervalued relative to its peers.

Intellectia.ai’s AI Agent can streamline this process by analyzing these factors and delivering personalized stock recommendations.

5 Best Stocks Under $100

Below is a detailed overview of our top five stock picks under $100 for 2026, each offering unique strengths:

| Company | Ticker | Sector | Market Cap | Dividend Yield | Key Strengths |

|---|---|---|---|---|---|

| United Parcel Service | UPS | Industrials | $83B | 4.50% | Global logistics leader, reliable dividends, strong brand |

| Enterprise Products Partners | EPD | Energy | $60B | 7.00% | Stable cash flows, high yield, critical energy infrastructure |

| AstraZeneca | AZN | Healthcare | $240B | 2.00% | Innovative pipeline, leadership in oncology and rare diseases |

| Aurora Cannabis Inc. | AU | Materials | $9B | 2% | Global gold mining company player, scalable business model |

| Carnival Corporation | CCL | Consumer Discretionary | $20B | N/A | Leading cruise operator, strong post-pandemic recovery |

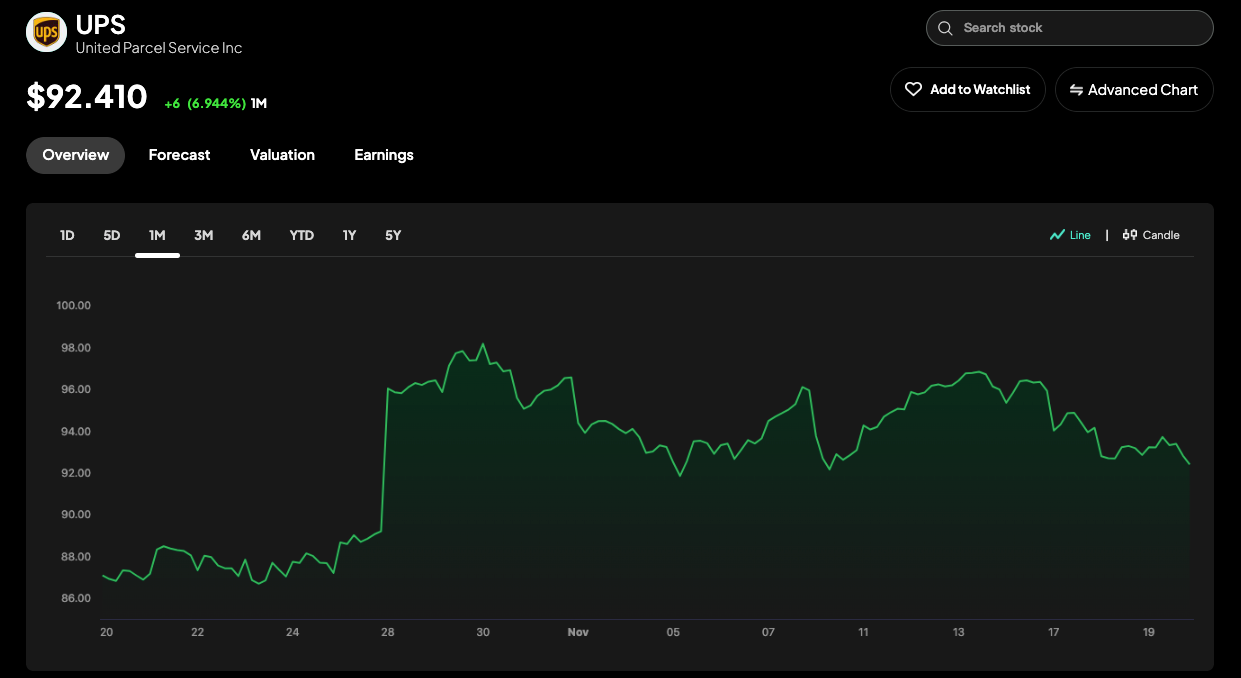

United Parcel Service (UPS)

United Parcel Service, Inc. is a global powerhouse in package delivery and logistics, serving millions of customers across the U.S. and beyond. Its extensive network ensures efficient delivery of letters, packages, and freight.

In Q1 2025, UPS reported a 6.65% increase in net income and a 7.69% rise in EPS year-over-year, despite a slight revenue dip. Analysts rate it a “Moderate Buy” with a price target suggesting 14.96% upside . The company’s focus on cost efficiency and digital transformation strengthens its outlook.

UPS’s global reach and essential services provide stability, while its 4.5% dividend yield attracts income investors. Its ability to adapt to e-commerce growth makes it a solid long-term investment.

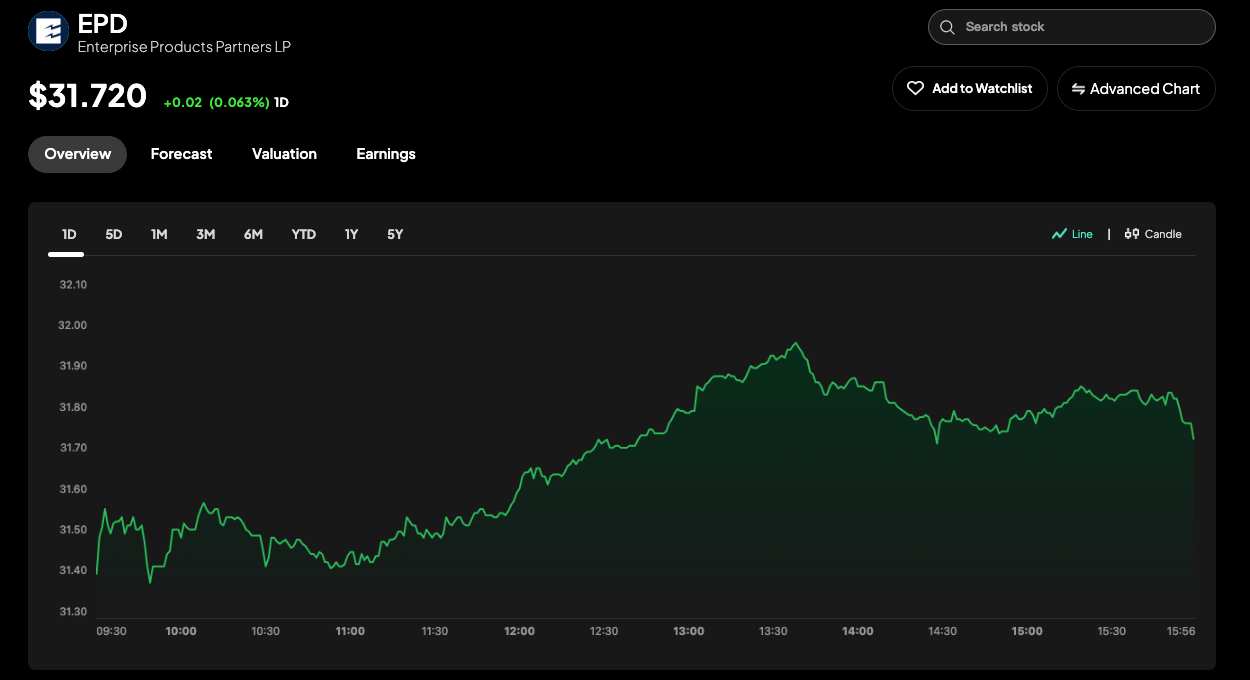

Enterprise Products Partners (EPD)

Enterprise Products Partners L.P. is a leading midstream energy company, managing pipelines, storage, and transportation for natural gas, crude oil, and petrochemicals.

EPD’s stable cash flows and strategic assets ensure consistent dividend payments. Its operational efficiency and long-term contracts provide resilience against energy market volatility.

With a 7% dividend yield, EPD is a top choice for income investors. Its critical role in energy infrastructure supports steady growth.

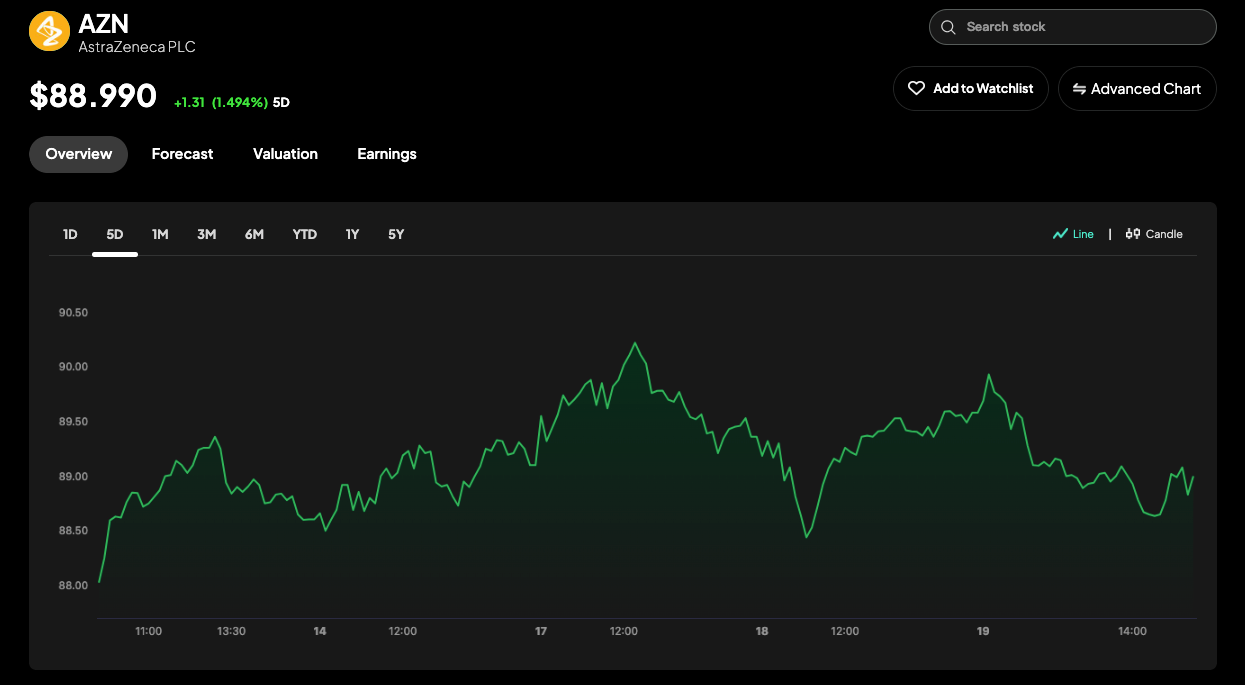

AstraZeneca (AZN)

AstraZeneca PLC is a global biopharmaceutical leader focusing on oncology, cardiovascular, renal, metabolism, and respiratory diseases, with a strong presence in emerging markets.

AZN’s pipeline boasts innovative drugs, particularly in oncology and rare diseases. Strategic acquisitions and partnerships have bolstered its market position, driving revenue growth.

AstraZeneca’s innovation and diverse portfolio make it a standout in healthcare. Its growth potential in high-demand therapeutic areas offers significant upside.

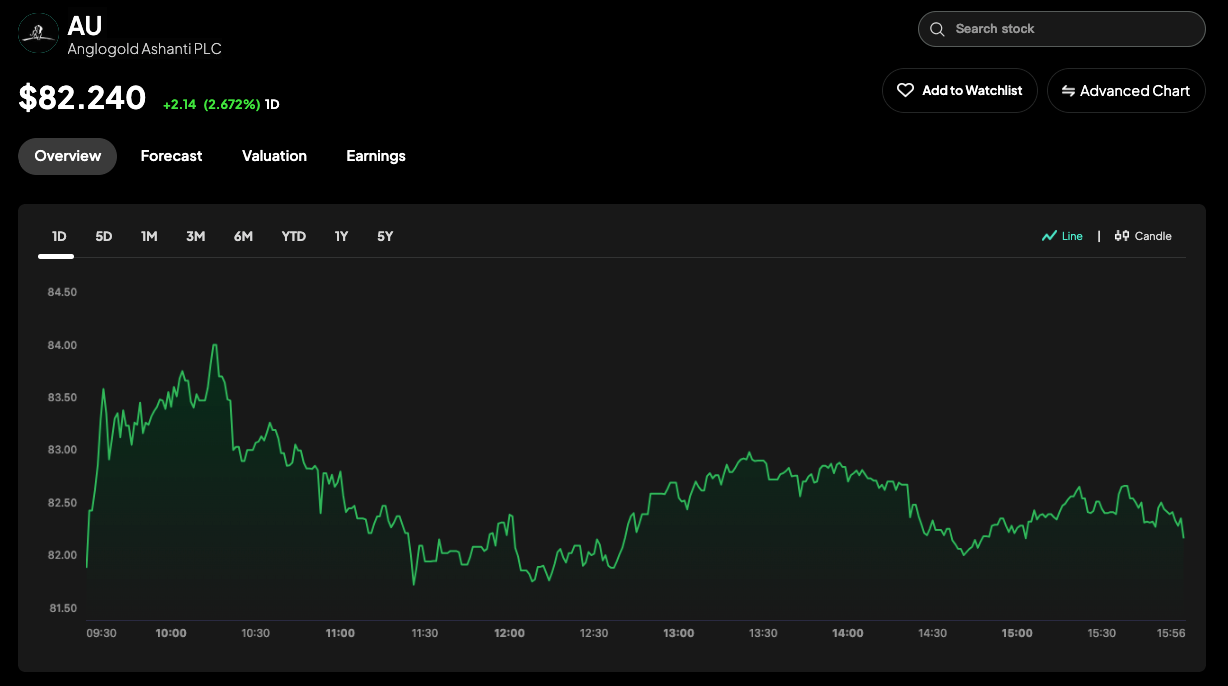

AngloGold Ashanti PLC (AU)

AngloGold Ashanti is a leading global gold producer with operations across Africa, the Americas, and Australia. The company benefits from strong gold prices, disciplined cost controls, and a diversified mining portfolio that reduces geopolitical risk. Its ongoing expansion projects and efficiency improvements support steady production growth. As investors seek safe-haven assets amid market uncertainty, AU’s stable output and global presence make it a compelling choice for those looking to hedge against inflation and economic volatility.

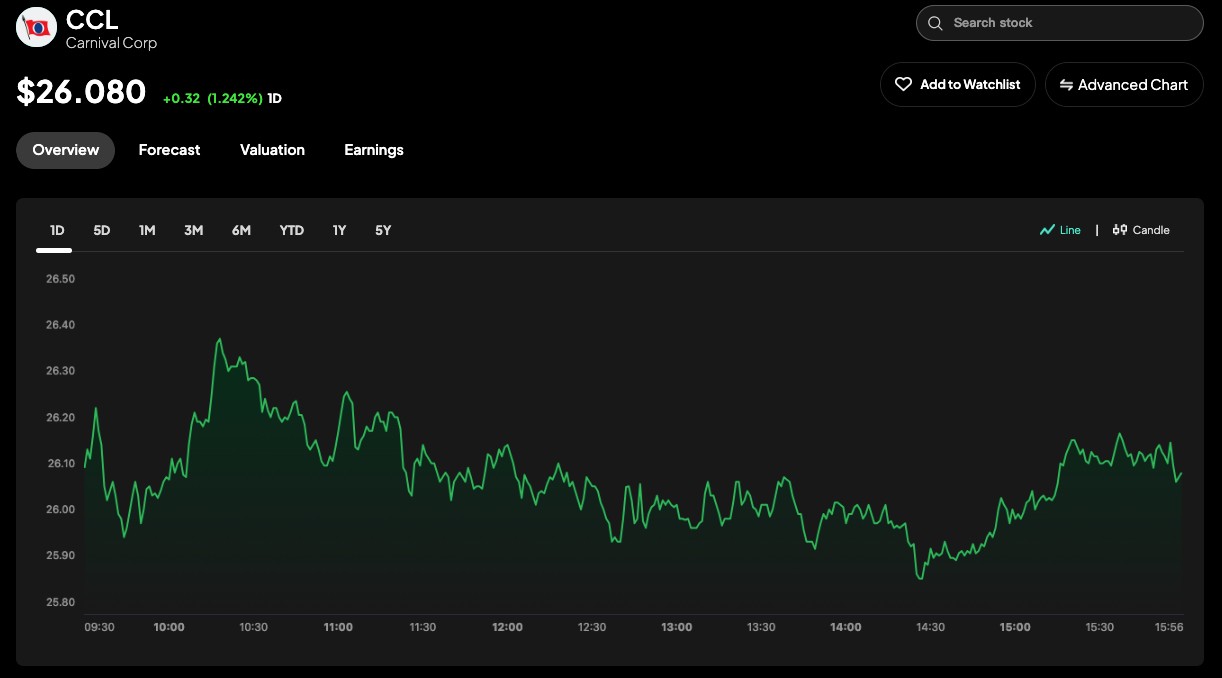

Carnival Corporation (CCL)

Carnival Corporation & plc is the world’s largest cruise operator, managing brands like Carnival Cruise Line, Princess Cruises, and Holland America.

CCL is rebounding from pandemic challenges, with rising bookings and fleet reactivation. Improved cost management and strong demand for cruises are boosting profitability.

As travel demand surges, Carnival’s brand strength and global presence position it for a robust recovery. It’s ideal for investors seeking growth in consumer discretionary.

Investment Strategies for Best Stocks Under $100

To make the most of stocks under $100, adopt these strategies:

- Diversify Across Sectors: Spread your investments across industrials, energy, healthcare, technology, and consumer discretionary to mitigate risk and capture varied growth opportunities.

- Monitor Regularly: Stay updated on market trends and stock performance using tools like Intellectia.ai’s Stock Monitor.

- Think Long-Term: Hold stocks to benefit from compounding growth and potential price appreciation over time.

- Use AI-Powered Insights: Leverage advanced analytics to identify undervalued stocks and optimize your portfolio.

- Incorporate Technical Analysis: Study price patterns and trends to time your trades effectively.

Intellectia.ai offers a suite of tools to enhance your strategy, including:

- AI Stock Picker: Identifies top stocks using advanced algorithms.

- AI Screener: Filters stocks based on financial metrics, growth potential, and more.

- Day Trading Center: Provides real-time signals for active traders looking to capitalize on short-term movements.

- Swing Trading: Offers strategies for short- to medium-term gains.

- Stock Technical Analysis: Analyzes chart patterns to inform your trading decisions.

Ready to take control of your investments? Sign up at Intellectia.ai to access these powerful tools and start building your portfolio today.

Conclusion

Stocks under $100 are a fantastic way to grow your wealth without a large upfront investment. Companies like UPS, EPD, AZN, UBER, and CCL offer a compelling mix of growth, income, and recovery potential, making them ideal for 2026. By focusing on financial health, competitive advantages, and reasonable valuations, you can select stocks that align with your goals.

To stay ahead of the market, subscribe to Intellectia.ai for AI-powered stock picks, trading signals, and in-depth market analysis. Don’t miss out—visit Intellectia.ai’s Sign-Up Page to start your journey to smarter investing today!