Key Takeaways

- The recent volatility in the lithium market is not a permanent failure, but rather a cyclical adjustment, and the current downturn presents a good opportunity to make strategic investments.

- The prospects for lithium mining stocks in the long run are promising, as the world is expected to continue demanding Electric Vehicles (EVs) and grid-scale Energy Storage Systems (ESS).

- Market analysts are forecasting a severe supply-demand imbalance in 2026, which is expected to lead to a significant price rebound and increased profits for established miners.

- You should focus on well-established, low-cost producers, such as Albemarle (ALB) and SQM, in their portfolio, and allocate a smaller portion to high-growth, domestically oriented players, such as Lithium Americas Corp. (LAC) or Sigma Lithium (SGML).

- To succeed in this industry, you’ll need to employ intelligent methods and applications, such as Intellectia.ai Stock Picker (for selecting the best investments) and the AI Screener (for finding diversified ETFs or screening specific growth stocks).

Introduction

The lithium market has been an absolute roller coaster lately. After a massive surge, prices took a steep dive, leaving many investors wondering if the entire electric vehicle (EV) boom is starting to run out of steam. It’s a completely fair question, but if you look past the noise, this downturn is really just a cyclical adjustment, not the end of the story.

We believe the long-term trend for lithium mining stocks is firmly heading upward, particularly as most analysts project a significant shift in supply and demand around 2026. That’s when demand is expected to accelerate well past current production capabilities. At Intellectia.ai, we utilize advanced AI stock and crypto analysis to cut through short-term fear and identify companies with significant, long-term growth potential. This guide provides a comprehensive breakdown of the top lithium mining stocks to buy in 2026 and beyond, helping you position your portfolio for the next major surge.

What Are Lithium Mining Stocks and Why Do They Matter?

In simple terms, lithium mining stocks represent companies that find, extract, and process lithium, often referred to as "white gold" because it’s the key ingredient in rechargeable batteries powering our world. Think of everything from your smartphone and laptop to, most importantly, electric cars and grid-scale Energy Storage Systems (ESS).

You'll find two main types of miners here: those that extract lithium from hard rock (like spodumene) and those that extract it from brine, essentially evaporating mineral-rich saltwater in vast ponds. Both methods have different cost structures and environmental footprints, but they both feed the massive, growing demand for lithium-ion batteries.

Now, if you’ve been watching this space, you know lithium is volatile. The surge we saw a couple of years ago was driven by supply panic, and the recent drop was triggered by an oversupply of the raw commodity. But here’s what's truly interesting: analysts project the market will rebalance strongly by 2026. The increasing ramp-up of EV production globally, combined with booming demand for those large energy storage batteries to stabilize renewable energy grids, will quickly outstrip current mining capabilities. That’s why, right now, while prices are depressed, it is the best time to consider lithium mining stocks to buy.

Criteria for Selecting Top Lithium Stocks

When you’re looking to invest in this sector, you can’t just pick a name out of a hat. You have to pay attention to what makes a lithium miner strong and ready to develop.

- Production Capacity and Projects: The first thing you should look at is whether the company has substantial, established reserves and a distinct way to production. The discovery itself is easy to announce; however, it’s far more difficult to actually produce lithium on a large scale. Look for companies that have secured funding and are actively building out their sites.

- Cost Position: This is critical. Miners who can produce lithium at the lowest cost globally are the ones that survive when prices crash, and they’re the ones that generate massive profits when prices go up. This normally works in favor of brine operations or large, high-grade hard-rock mines.

- Offtake Agreements: Identify companies that have already signed long-term deals (so-called offtake agreements) with battery manufacturers or major car manufacturers. This visibility drastically reduces risk and guarantees revenue for years to come. It tells you the market already trusts their product.

- Jurisdictional Risk: The location of a mine is important. A deposit in a politically stable economy, such as Australia, Canada, or the U.S., is usually less risky than one in a politically unstable territory; however, the latter can offer better cost benefits in some cases.

Top Lithium Mining Stocks to Buy in 2026

| Company Name | Ticker Symbol | Sector | Market Cap | Key Strengths |

|---|---|---|---|---|

| Albemarle | ALB | Specialty Chemicals / Mining | $14.16 Billion | World's largest lithium producer, diversified assets. |

| SQM | SQM | Specialty Chemicals / Mining | $16.43 Billion | Low-cost brine operations in Chile, diversified revenue. |

| Lithium Americas Corp. | LAC | Development-Stage Mining | $1.13 Billion | Key U.S. domestic asset (Thacker Pass) exposure. |

| Sigma Lithium | SGML | Hard Rock Mining | $1.24 Billion | High-grade, low-cost operations in Brazil. |

| Rio Tinto | RIO | Diversified Mining | $116.27 Billion | Massive scale and capital, expanding into lithium. |

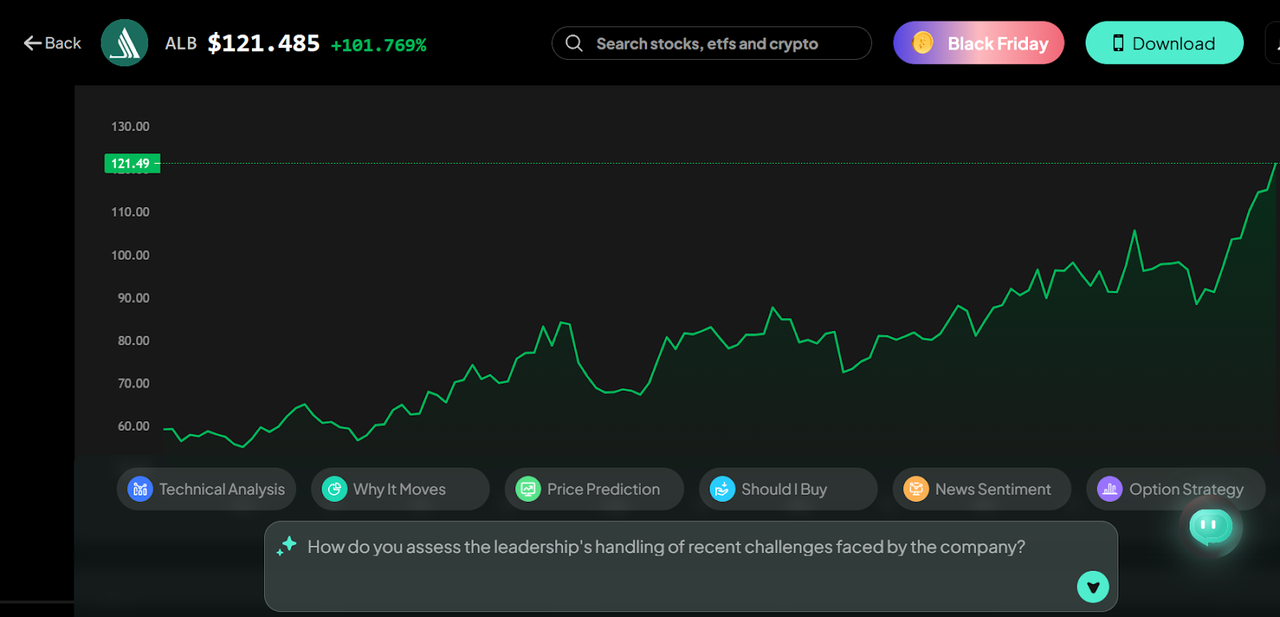

Albemarle (ALB)

ALB is the undisputed global leader. They operate across the globe, from brine in Chile and the U.S. to hard rock in Australia. They’re involved in almost every corner of the lithium world.

If you're looking for the single safest bet to capture the sector's long-term growth, this is it. If you believe that the best way to weather market volatility is through sheer scale and diversification, then ALB's global operations and massive resource base provide that unmatched stability. It's the bedrock for any long-term investment in lithium mining stocks.

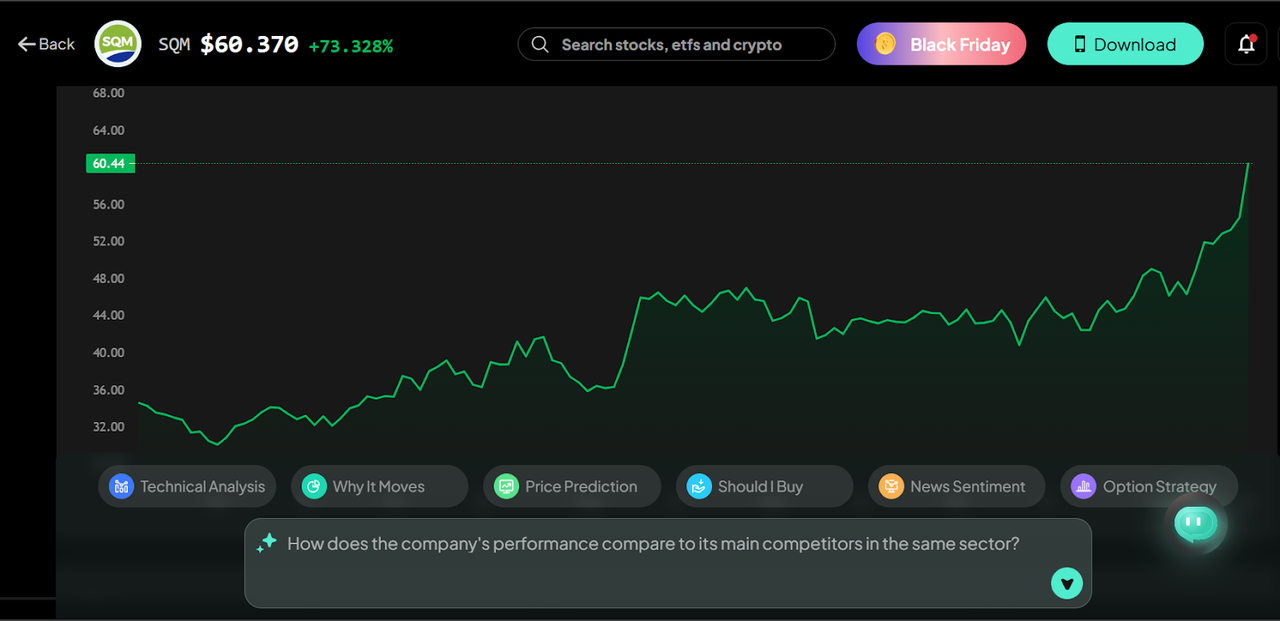

Sociedad Química y Minera (SQM)

This Chile-based powerhouse focuses heavily on low-cost brine operations in the legendary Atacama Salt Flats, although it is expanding elsewhere. They’re a significant player in other specialty chemicals as well, which helps stabilize their revenue.

If you prioritize profitability and resilience above all else, SQM’s advantage lies in its lower production costs. It benefits from some of the lowest lithium extraction costs globally—a massive competitive edge when prices drop. If you think that the recent long-term agreement with the Chilean government secures its future, then SQM’s cost position makes it a long-term winner.

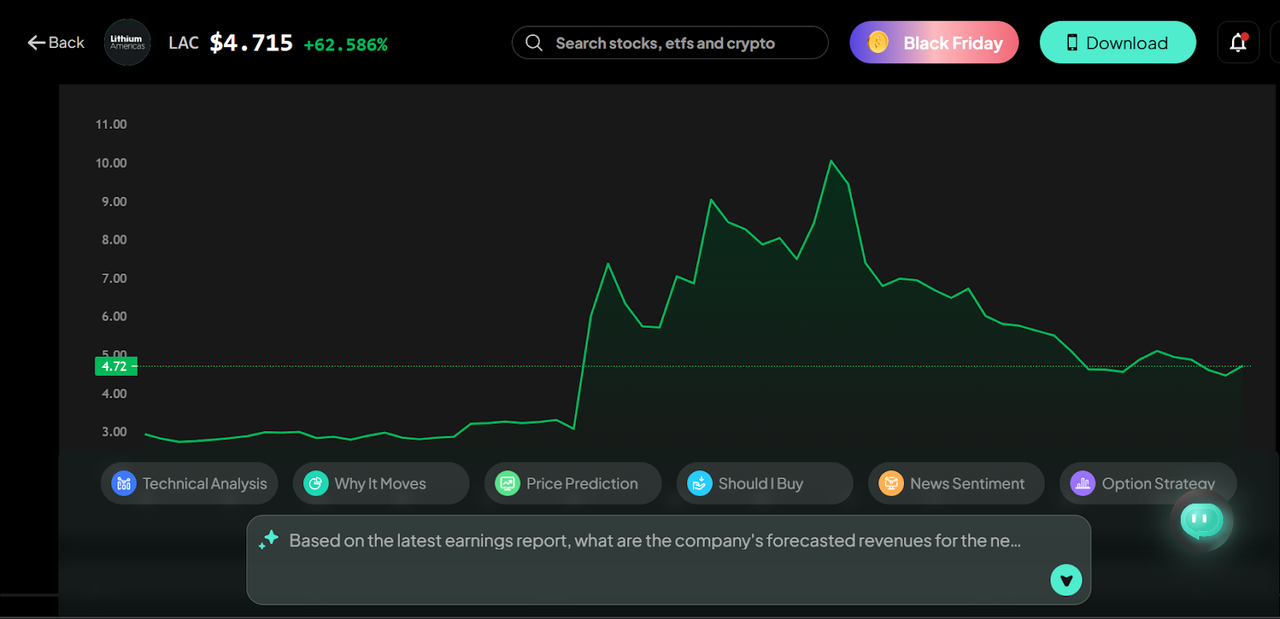

Lithium Americas Corp. (LAC)

LAC has primarily been focused on developing the massive Thacker Pass project in Nevada, U.S.—one of the largest known lithium resources in the world. They recently executed a strategic corporate separation to better focus on their different assets.

If you're willing to take on higher risk for potentially massive, policy-driven rewards, LAC offers direct exposure to the crucial U.S. domestic supply chain. If you believe that the U.S. government's incentives for local production will give Thacker Pass an essential geopolitical advantage, then this high-risk, high-reward stock is a strong candidate for your growth allocation. Its success hinges on timely development.

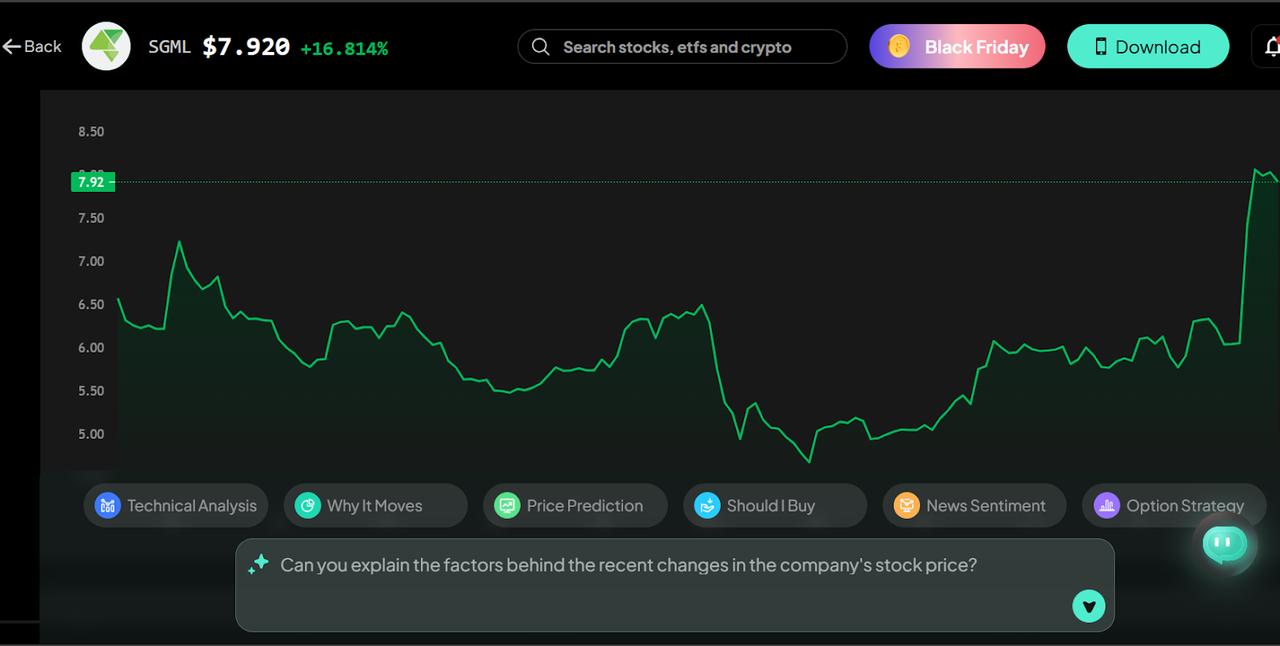

Sigma Lithium (SGML)

Operating out of Brazil, Sigma has gained attention for its high-grade, low-cost hard-rock lithium project. They are focused on producing an environmentally superior "green lithium" product.

If you think that the future of lithium demand will increasingly favor high-grade, sustainable sourcing, Sigma is perfectly positioned. If you're seeking one of the fastest-growing producers that is quickly ramping up supply, this company could command a premium with environmentally conscious battery makers in 2026 and beyond. This makes it an excellent choice for high-growth portfolios.

Rio Tinto (RIO)

RIO is one of the world's largest diversified mining companies, known for its iron ore and copper operations. However, they are committing massive resources and capital to expanding into materials critical for the energy transition, including lithium.

If you're hesitant about the volatility of pure-play miners, RIO offers lithium exposure backed by the stability of a colossal, diversified conglomerate. In case you value deep pockets and a massive global logistics network to manage the capital-intensive nature of mine development, RIO has the necessary scale to execute these projects efficiently. This makes it a strong candidate for stability within the sector.

Should You Buy Lithium Mining Stocks in 2026? (Pros & Cons)

Deciding whether to enter this sector isn’t a straightforward decision. You need to weigh the huge potential against the very real risks.

Pros of Investing in Lithium Miners

The shift to EVs and renewable energy is a megatrend that cannot be overlooked, even in the short term. All major economies are determined to electrify their transportation. This spurs the long-term EV demand. When the market rebalances (projected for 2026), prices can rebound aggressively, offering huge commodity leverage to miners. Additionally, government policies promoting domestic supply chains—such as infrastructure spending—are actively subsidizing certain mining projects, significantly de-risking them.

Cons / Risks

On the flip side, you must accept the price volatility. It’s a commodity market, and prices may soar and fall more quickly than in most other markets. Environmental and regulatory obstacles can extend the timeframe for revenue collection and exacerbate investor concerns, as new mines can take years to obtain permits. Finally, it’s a Capex-intensive business model. It takes billions of capital expenditure (CapEx) to develop a mine, implying that numerous companies, particularly junior miners, continually raise money and dilute shareholders until production is achieved.

Investment Strategies for Lithium Mining Stocks

Navigating this volatile sector requires a smart strategy, and that’s where Intellectia AI's tools can make a huge difference in your success.

Understand Lithium Mining Stocks Sector Fundamentals

First, know your assets. Is the company focused on brine, which tends to be a lower-cost option but slower to scale? Or hard rock, which is faster to build but often more expensive to run? Understanding these nuances will help you assess their financial health.

- Long-Term Growth Investing vs. Short-Term Trading: Be honest about your goals. If you're a long-term investor, you buy top-quality names like ALB and hold them, focusing on the 2030 outlook rather than next quarter. In case you want shorter swings, our AI Trading Signals option can assist you in identifying the technical entry and exit points of that short-term volatility, and take advantage of the price swings.

- Consider ETFs for Broader Exposure: If picking individual stocks is too risky, an ETF (such as LIT or others) is diversified across the entire value chain. Our AI Screener will help you identify the most suitable ETFs with high lithium exposure and fit your risk and geographical criteria. It’s a simpler method to gain exposure without having to bet on the success of a single company.

- Leverage Intellectia.ai's Features: Don’t just rely on news headlines. Utilize our AI Agent to track real-time market news, sentiment analysis, and regulatory updates that may impact these volatile stocks. This will enable you to stay ahead of the curve and respond faster than the average investor.

Conclusion

The lithium market is currently in a challenging phase, but shrewd investors understand that sometimes the best returns are made when you purchase assets when everyone is afraid. The general consensus is that a major supply-demand squeeze is expected in 2026, as the need to supply EV batteries and, more importantly, grid-scale energy storage accelerates. This presents an excellent entry point for investors looking beyond the current volatility.

With a focus on time-tested, low-cost manufacturers and Intellectia.ai's applied insights to identify undervalued opportunities and manage risk, you can confidently prepare your portfolio to take the next step in the electric revolution. Sign up and subscribe today to get alerts and notifications about daily AI stock picks, AI trading signals, and strategies, along with market analysis by Intellectia AI.