Key Takeaways

- Stock screeners are essential tools for filtering stocks based on specific criteria, saving you time and aligning with your investment strategy.

- Top free stock screeners in 2025 include Yahoo Finance, TradingView, Zacks, Finviz, and Intellectia AI, each catering to different investor needs.

- Intellectia AI’s AI-driven screener offers natural language processing and real-time market scanning, ideal for day and swing traders.

- Using an AI stock screener like Intellectia AI provides smarter insights, automation, and strategy optimization for better decision-making.

- The best screener depends on your trading style, with options for beginners, technical analysts, and AI enthusiasts.

Introduction

Have you ever felt overwhelmed by the vast number of stocks in the market, unsure where to begin your investment journey? You’re not alone. With thousands of stocks to choose from, finding the ones that fit your strategy can feel like searching for a needle in a haystack.

Stock screeners are powerful tools that help you cut through the noise, filtering stocks based on criteria like price, earnings, or volume. In this article, we’ll dive into what stock screeners are, why they’re essential, and spotlight Intellectia AI, an innovative AI-powered screener that’s transforming how investors like you approach the market.

Source: intellectia.ai

What Is a Stock Screener?

A stock screener is a financial tool that lets you filter stocks based on specific parameters, such as market cap, dividend yield, or earnings growth. By setting your criteria, you can quickly identify stocks that match your investment goals. Key features include:

- Filtering Criteria: Set parameters to narrow down stocks, like price or sector.

- Customization: Create personalized screens tailored to your strategy.

- Real-Time Data: Access up-to-date stock performance information.

- Backtesting: Test your strategies using historical data for better insights.

Source: intellectia.ai

Why Use a Stock Screener?

Stock screeners offer several benefits that make them indispensable:

- Efficiency: Save time by filtering thousands of stocks in seconds.

- Strategy Alignment: Find stocks that match your investment goals, whether growth or value.

- Hidden Opportunities: Uncover lesser-known stocks with high potential.

- Backtesting: Validate your strategies using past data to improve outcomes.

Criteria for Choosing the Best Stock Screener

When picking a stock screener, consider these factors to ensure it meets your needs:

- Range of Filters Available: Look for a wide variety of filters, from technical to fundamental metrics.

- Real-Time vs Delayed Data: Real-time data is critical for timely decisions, especially for day traders.

- Ease of Use / User Interface: A user-friendly design makes navigation intuitive for all skill levels.

- Data Export / Save Options: Save your screens or export data for further analysis.

- Customization and Pre-Built Screens: Balance custom filters with pre-built screens for quick starts.

Source: intellectia.ai

5 Best Free Stock Screeners

Here’s a comparison of the top free stock screeners in 2025:

| Name | Free Features | Best For |

|---|---|---|

| Yahoo Finance | Basic screening with filters like price change, volume; covers stocks, ETFs, mutual funds | General investors |

| TradingView | Over 100 fundamental and technical filters; global coverage; interactive chatrooms | Active traders, global markets |

| Zacks | Custom screening with over 130 data points; includes Zacks Rank; free and paid versions | Value investors, research |

| Finviz | Wide range of technical and fundamental filters; chart patterns; free and elite versions | Technical analysts, swing traders |

| Intellectia AI | AI-driven screening with natural language processing; real-time scanning; covers stocks, crypto, ETFs | Long-Term Investors, Day Traders, Swing Traders, Growth Investors |

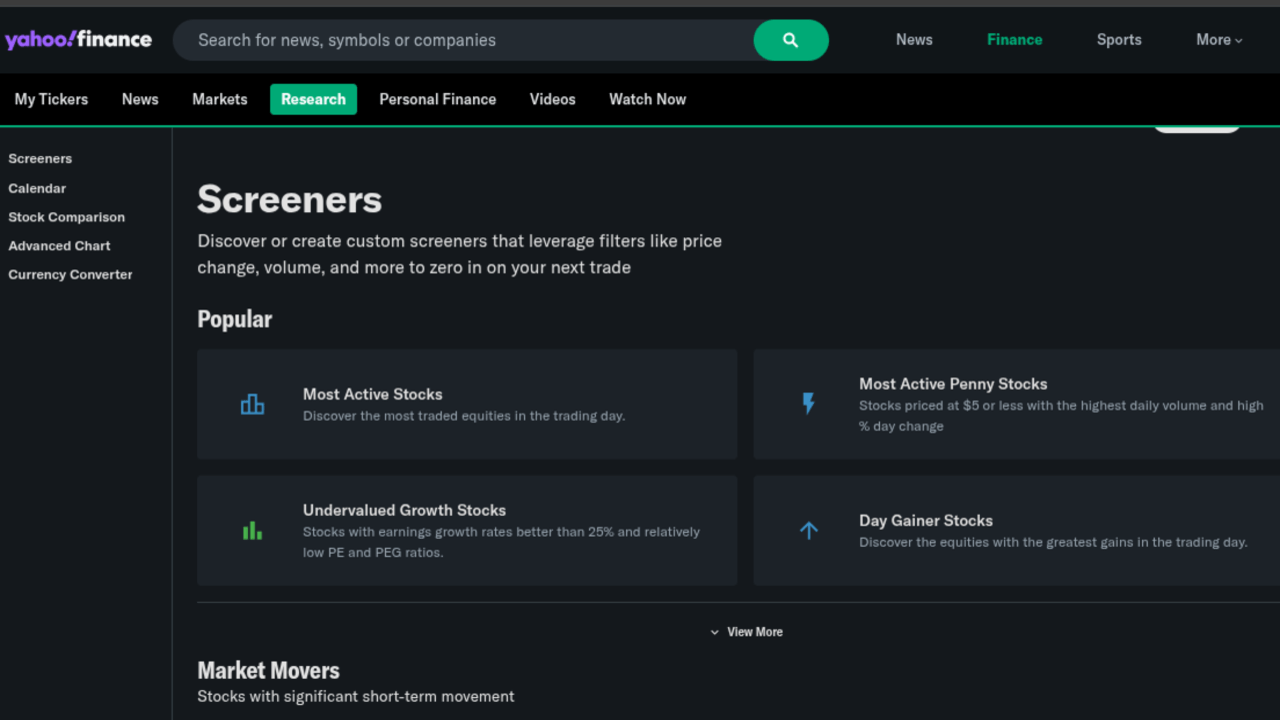

Yahoo Finance

Yahoo Finance offers a clean, user-friendly interface with filters like price change, volume, earnings growth, PE, PEG ratios, and short interest. It covers equities (stocks, penny stocks, small/large caps), mutual funds, bonds, and conservative investments.

You can use predefined screens like “Most Active” or create custom ones. However, some advanced screeners, such as those for analyst ratings, require a premium subscription, which may limit functionality for free users.

Source: Yahoo Finance

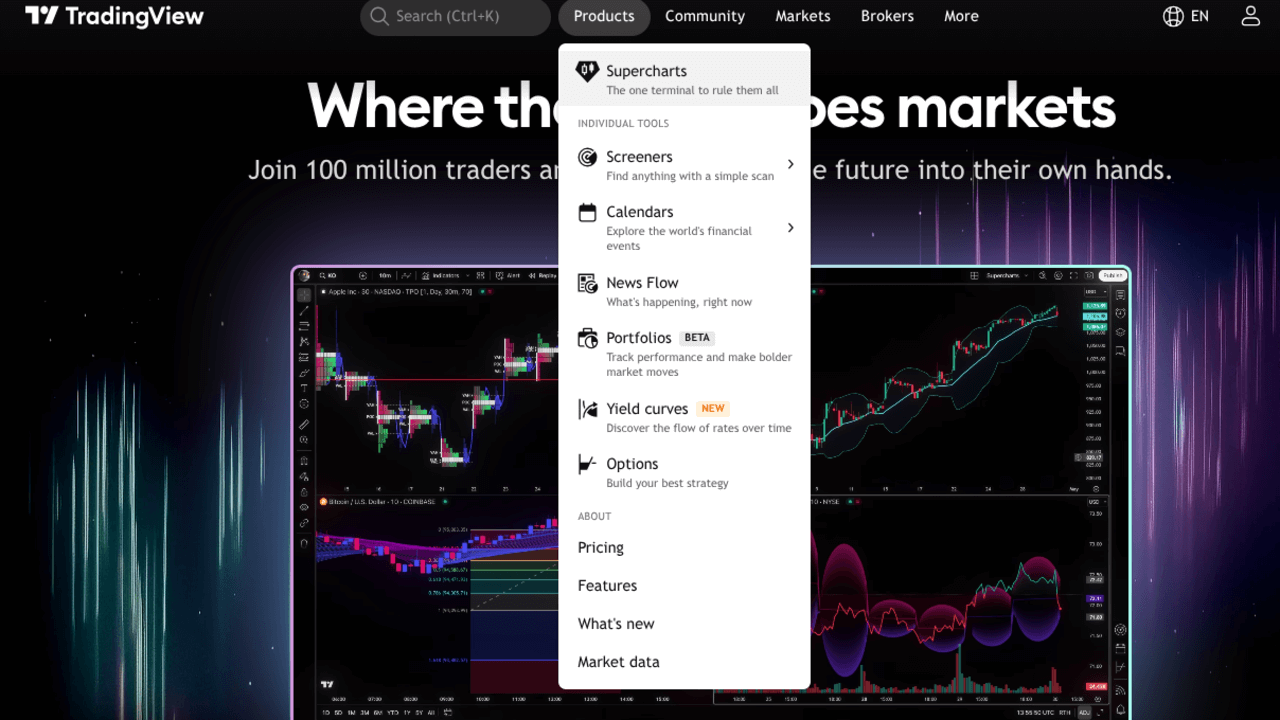

TradingView

TradingView is renowned for its powerful, user-friendly interface, boasting over 90 million active users. It provides over 100 fundamental and technical filters, including market cap, dividend yield, and volume, with unique features like mapping economic indicators to financials.

It covers global markets, including stocks, ETFs, forex, and crypto. While the free version is robust, advanced features like intraday screeners or data exports require a paid plan, which may be a drawback for some users.

Source: tradingview

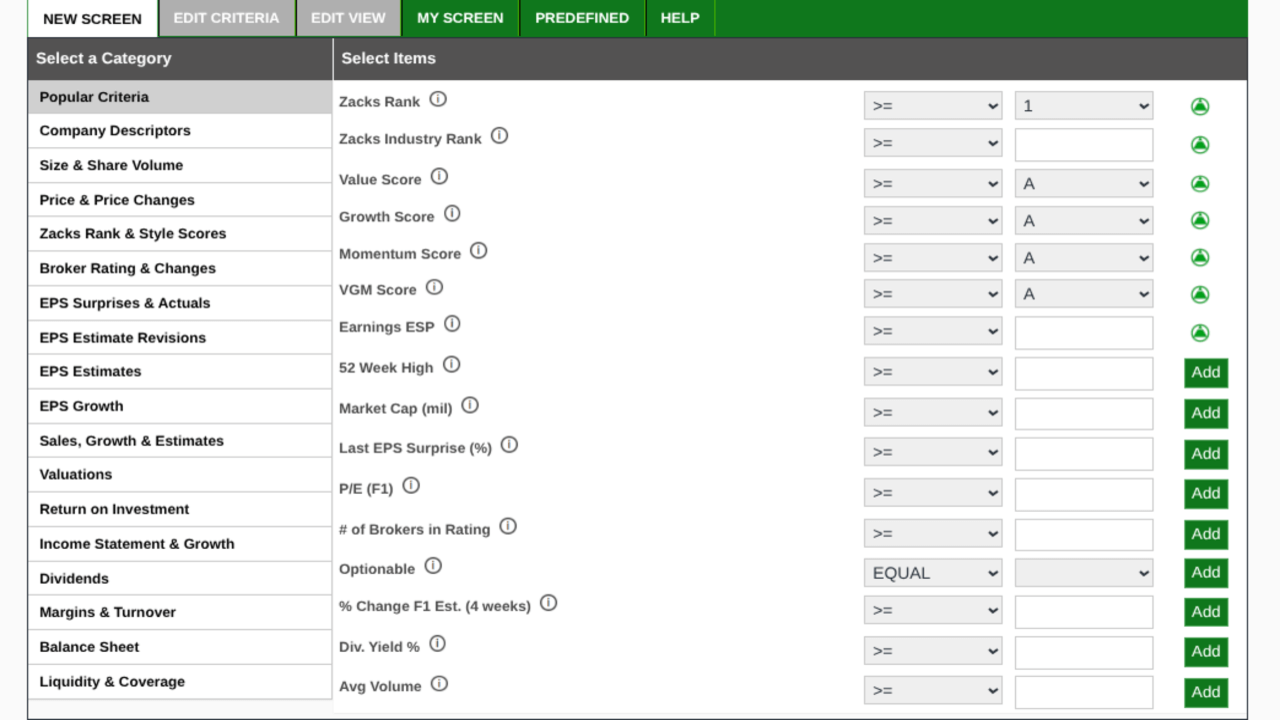

Zacks

Zacks offers a free screener with over 130 data points, including its proprietary Zacks Rank, which focuses on earnings revisions. It’s ideal for value investors, covering primarily U.S. stocks with some international options.

The free version supports basic screening, but advanced features like premium screens or weighted criteria are locked behind Zacks Premium ($249/year). Limitations include the inability to rank criteria by percentile or use complex logic beyond AND operations.

Source: Zacks

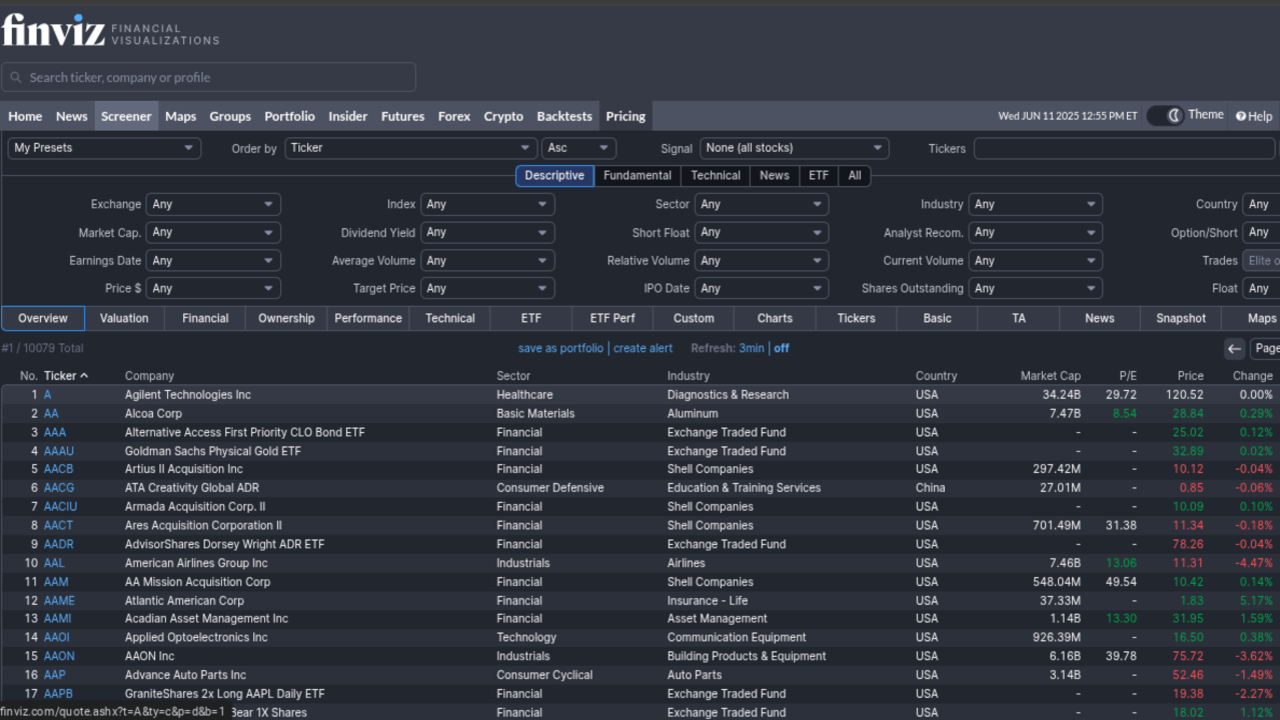

Finviz

Finviz excels in technical analysis, offering filters for chart patterns, top gainers, insider trading, and news events. It covers U.S. stocks, some international markets, futures, forex, and bonds. The interface displays tickers with price, volume, and signals in organized tables, though the free version includes ads.

The elite version ($39.50/month) adds real-time quotes and backtesting, which free users miss out on. It’s a top choice for swing traders due to its pattern recognition.

Source: Finviz

Intellectia AI

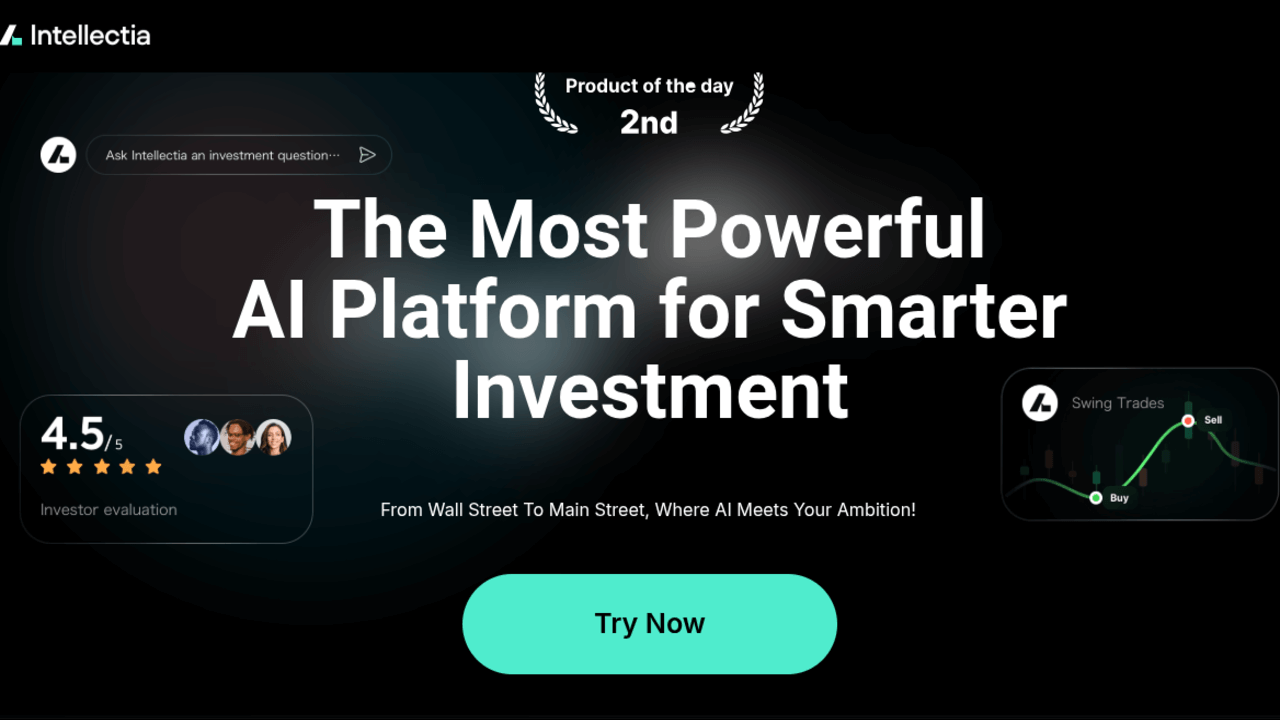

AI stock screener leverages AI to analyze vast datasets, providing insights beyond traditional filtering. Intellectia AI’s screener uses natural language processing and real-time scanning to deliver tailored results, making it a game-changer for modern investors and traders.

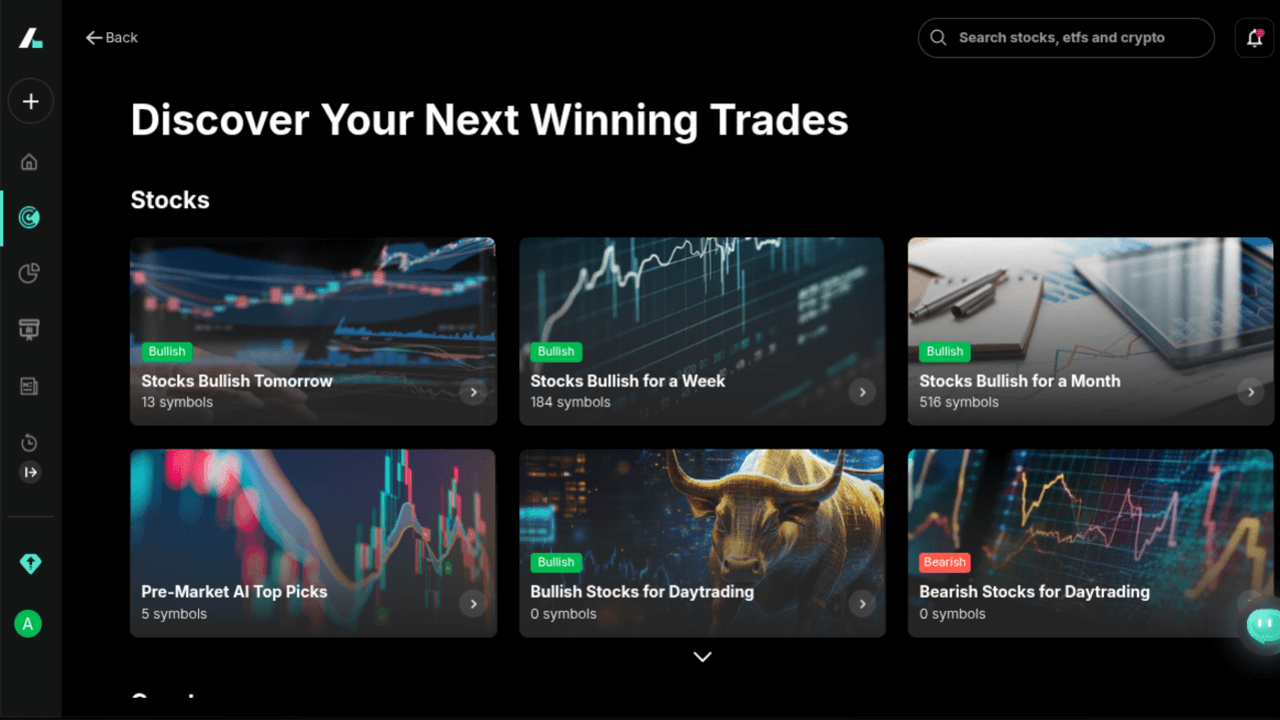

Intellectia AI’s screener covers stocks, crypto, and ETFs, forecasting potential price movements. It’s particularly suited for day and swing traders, offering unique features like Pre-market AI Top Picks and Best Stocks for Day Trading. The interface is simple, fast, and visual, breaking down data into charts for beginners and pros alike.

It supports specific queries (e.g., “ROE > 15%, PE < 20”) and general ones (e.g., “best penny stocks”), with real-time adjustable filters for price, market cap, turnover, and revenue. No explicit limitations are noted, and user feedback praises its accuracy and speed.

Why Use an AI Stock Screener like Intellectia AI

Intellectia AI’s screener offers distinct advantages:

- Smarter Insights, Not Just Filters: AI analyzes market trends for deeper insights.

- Natural Language and Sentiment Analysis: Input queries conversationally and leverage sentiment data.

- Customization with Intelligence: Tailors screens based on your preferences.

- Time-Saving Automation: Automates repetitive tasks, freeing you to focus on strategy.

- Backtesting and Strategy Optimization: Test and refine your trading plans.

Beyond the screener, Intellectia AI provides features like AI stock picker, enhancing its versatility.

Source: intellectia.ai

How to Use Intellectia AI Screener: Step-By-Step Guide

Create an account at Intellectia AI Sign-Up or log in.

Check pre-built screens

1. AI Stock Screener

- Free Features: Bullish/Bearish Stocks for Tomorrow, a Week, or a Month; Stocks for Option Selling; Stocks with Bullish Option Sentiment.

- Unique Features: Pre-market AI Top Picks, Best Stocks for Day Trading.

- Screening Principles: Uses price trends and parameters like price, market cap, turnover, and revenue.

Source: intellectia.ai

2. AI Crypto Screener

- Free Features: Bullish/Bearish Cryptos for Tomorrow, a Week, or a Month.

- Unique Features: Best Cryptos for Day Trading.

- Screening Principles: Based on price trends, similar to the stock screener.

3. ETFs and Thematic Investment Screener

- Screening Parameters: Filters for ETFs and thematic investments, such as sector or performance metrics.

Create a Customized Screener

- Type a natural language request, e.g., “Find undervalued stocks with high dividend yields.”

- Run the AI screener for instant results, displayed with visuals.

- Example: To find undervalued stocks, ask, “Show me stocks with low PE ratios and high dividend yields.” The screener will list matches with adjustable filters.

For a detailed tutorial, visit Intellectia AI Screener Tutorial.

Conclusion

Stock screeners are vital for navigating the complex world of investing, and free options like Yahoo Finance, TradingView, Zacks, Finviz, and Intellectia AI make it accessible to all. Intellectia AI shines with its AI-driven insights, natural language queries, and real-time scanning, making it a top choice for day and swing traders.

Whether you’re a beginner or a seasoned investor, Intellectia AI can elevate your strategy. Sign up today at Intellectia AI and subscribe for AI stock picks, trading signals, and market analysis to stay ahead in 2025.