Key Takeaways

- Copper stocks may offer strong investment opportunities due to rising demand in clean energy and electric vehicles.

- Top copper stocks with dividends include Freeport-McMoRan (FCX), Southern Copper (SCCO), Rio Tinto (RIO), BHP Group (BHP), and Teck Resources (TECK).

- Selecting the best copper stocks involves considering market cap, operational efficiency, and environmental practices.

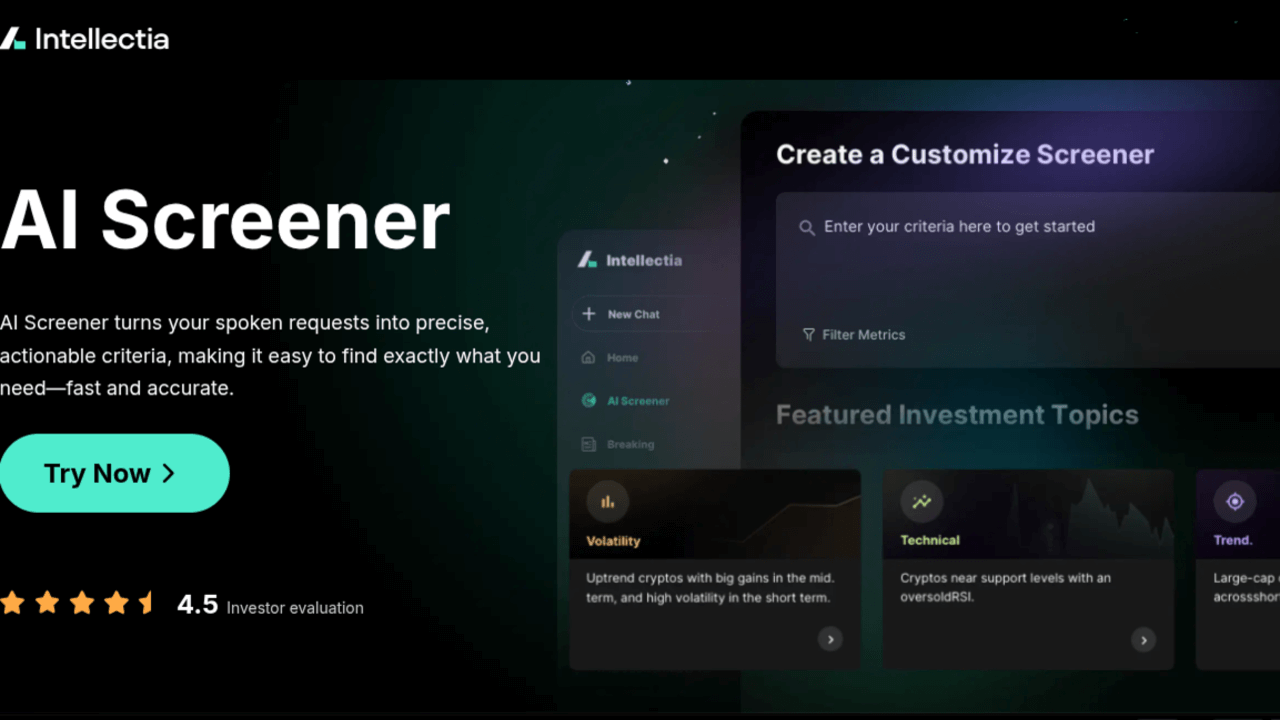

- AI tools, like those from Intellectia.AI, can assist in analyzing and picking copper stocks.

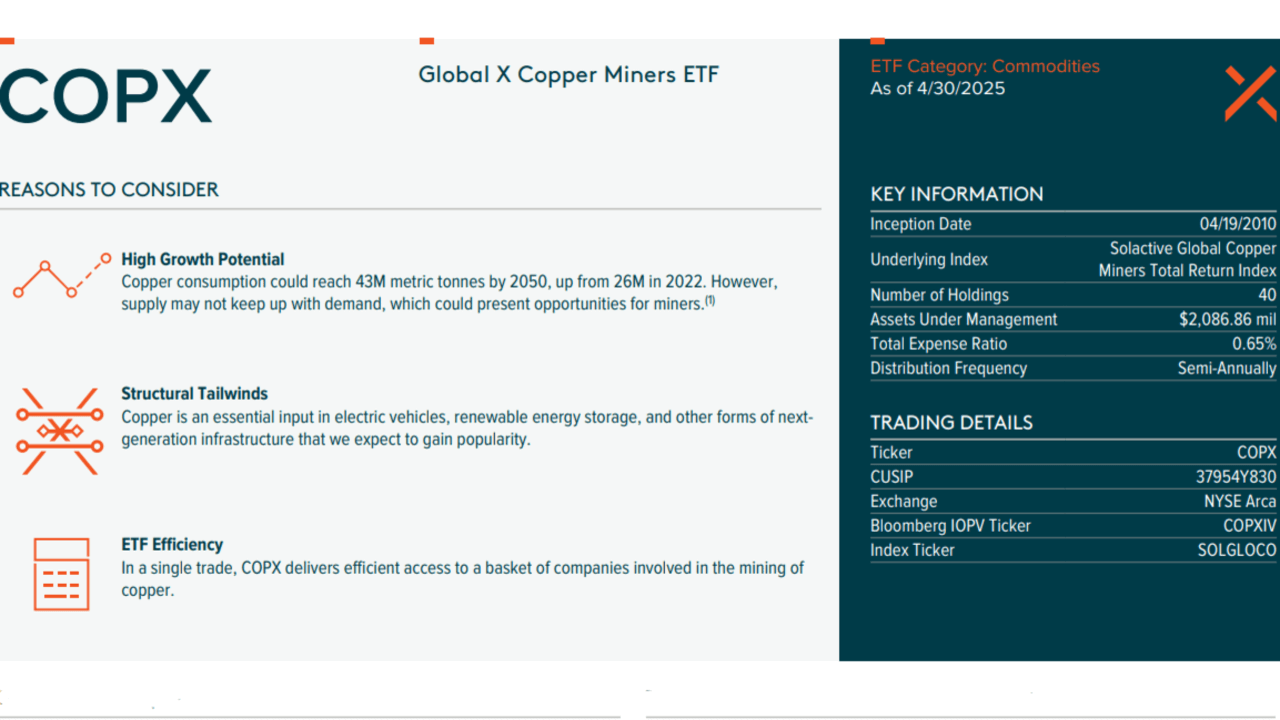

- Copper ETFs provide a diversified alternative for investors cautious about individual stock risks.

Introduction

Have you ever wondered why copper stocks are gaining so much attention lately? With the global push towards clean energy and electric vehicles, the demand for copper is skyrocketing. But with so many options out there, how do you pick the best copper stocks to invest in? That’s where Intellectia.AI comes in.

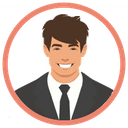

Intellectia AI’s AI-powered platform simplifies the investment process by providing comprehensive analysis and insights into copper stocks. Whether you’re looking for AI stock and crypto analysis, price predictions, or trading strategies, Intellectia.AI has got you covered. In this article, we’ll explore what copper stocks are, why they’re a smart investment, and highlight the top five copper stocks with dividends that you should consider for your portfolio in 2025.

Source: Intellectia AI

What Are Copper Stocks

Copper stocks are shares of companies involved in the exploration, mining, production, or distribution of copper. These companies can be categorized into three main types:

- Pure-Play Copper Miners: Companies primarily focused on copper production, such as Southern Copper.

- Diversified Mining Companies: Firms that mine copper alongside other metals like gold, silver, or zinc, such as Rio Tinto and BHP Group.

- Junior/Exploration Companies: Smaller companies focused on discovering new copper deposits, often with higher risk and reward potential.

Investing in copper stocks allows you to gain exposure to the copper market without directly purchasing the metal, offering a way to capitalize on price movements and industry trends.

Why Invest in Copper Stocks

Copper, often called “Dr. Copper” for its ability to predict economic trends, is a vital commodity with several compelling reasons to invest in its stocks:

- Critical Commodity: Copper is essential for industries like construction, electronics, and transportation, ensuring steady demand.

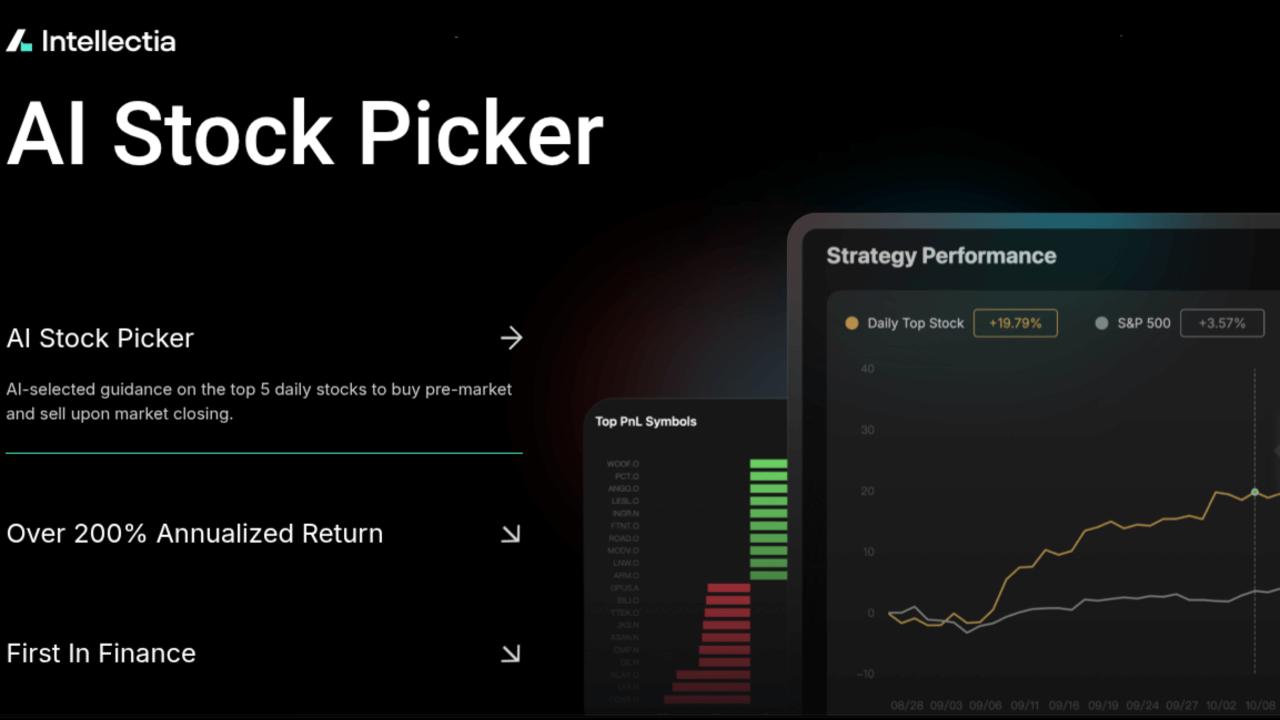

- Clean Energy Transition: The shift to renewable energy and electric vehicles is expected to increase copper demand significantly, with electric vehicles using four times more copper than traditional cars.

- Supply Constraints: Limited new discoveries and declining ore grades create challenges in meeting future demand, potentially driving prices higher.

- Inflation Hedge: Commodities like copper can protect your portfolio against inflation.

- Portfolio Diversification: Adding copper stocks can reduce risk by diversifying your investments across different asset classes.

Historical performance data suggests copper-related equities have provided solid returns during periods of economic growth, making them an attractive option for 2025.

Source: iea.org

Criteria for Selecting Best Copper Stocks

Choosing the best copper stocks requires careful consideration of several factors:

- Market Capitalization: Larger companies, like BHP Group, tend to offer more stability due to their scale and resources.

- Operational Efficiency: Companies with low production costs, such as Southern Copper, are better positioned to maintain profitability.

- Reserve Size: Firms with large, high-quality copper reserves, like Freeport-McMoRan, ensure long-term production capacity.

- Mining Jurisdictions: Operations in politically stable regions, such as Australia or Canada, reduce geopolitical risks.

- ESG Practices: Companies with strong environmental, social, and governance practices, like Rio Tinto, are more sustainable and appealing to modern investors.

- Exposure to Copper: Pure-play miners offer direct exposure to copper price movements, while diversified miners provide stability through other commodities.

Using Intellectia.AI’s AI screener, you can filter stocks based on these criteria to find the best fit for your investment goals.

5 Top Copper Stocks with Dividends

Below is a comparative overview of five top copper stocks that offer dividends, based on their market capitalization, dividend yield, and key strengths:

| Company | Ticker | Market Cap | Dividend Yield | Key Strengths |

|---|---|---|---|---|

| Rio Tinto | RIO | $94.82B | 6.93% | Global presence, diversified portfolio, strong financials |

| BHP Group | BHP | $124.08B | 5.07% | Largest mining company, diversified commodities, commitment to sustainability |

| Southern Copper | SCCO | $77.55B | 2.95% | One of the largest copper producers, low-cost operations, strong balance sheet |

| Freeport-McMoRan | FCX | $60.19B | 1.43% | Large-scale operations, significant reserves, geographically diverse assets |

| Teck Resources | TECK | $19.48B | 0.93% | Leading producer of metallurgical coal, significant copper production |

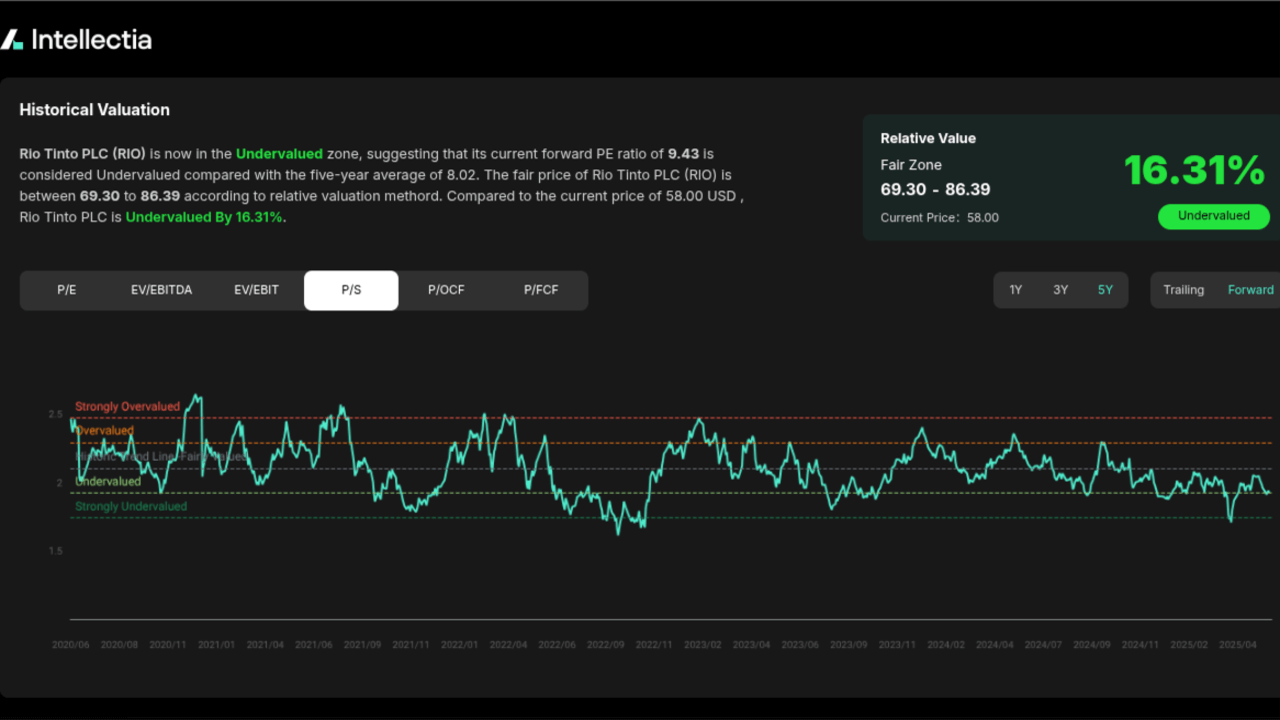

Rio Tinto (RIO)

Rio Tinto is a British-Australian multinational mining company operating in 35 countries. Its diversified portfolio includes copper, iron ore, aluminum, and minerals, with major copper operations in the U.S., Chile, and Mongolia.

Rio Tinto’s strong financial position and high dividend yield of 6.93% make it a top choice for income-focused investors. Recent highlights include its focus on sustainable mining and development of battery materials like lithium.

Why it’s a top pick: Its global reach and diversified revenue streams provide stability in volatile markets.

Source: Intellectia AI

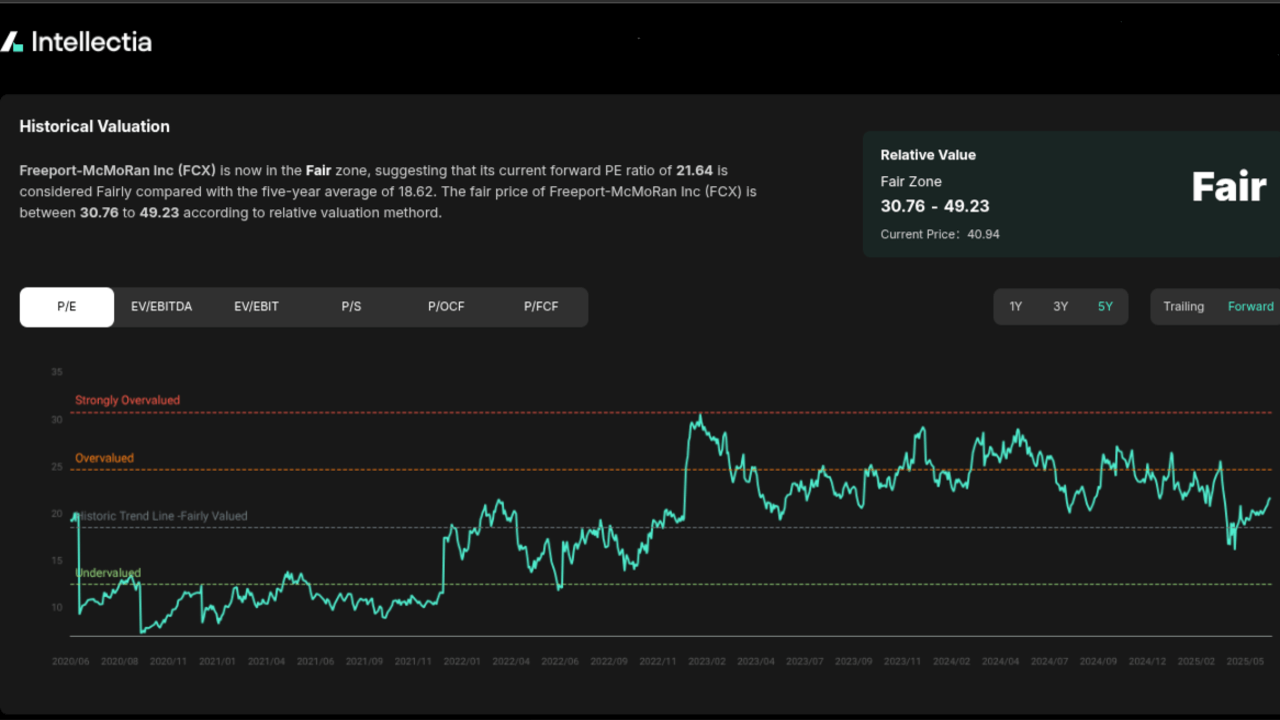

Freeport-McMoRan (FCX)

Freeport-McMoRan is a leading international mining company with significant copper, gold, and molybdenum reserves. Its assets include the Grasberg mine in Indonesia, one of the world’s largest copper and gold deposits.

With a dividend yield of 1.43%, it appeals to investors seeking growth alongside income. Recent analyst upgrades highlight its strong market position.

Why it’s a top pick: Its large-scale operations and geographic diversity ensure long-term growth potential.

Source: Intellectia AI

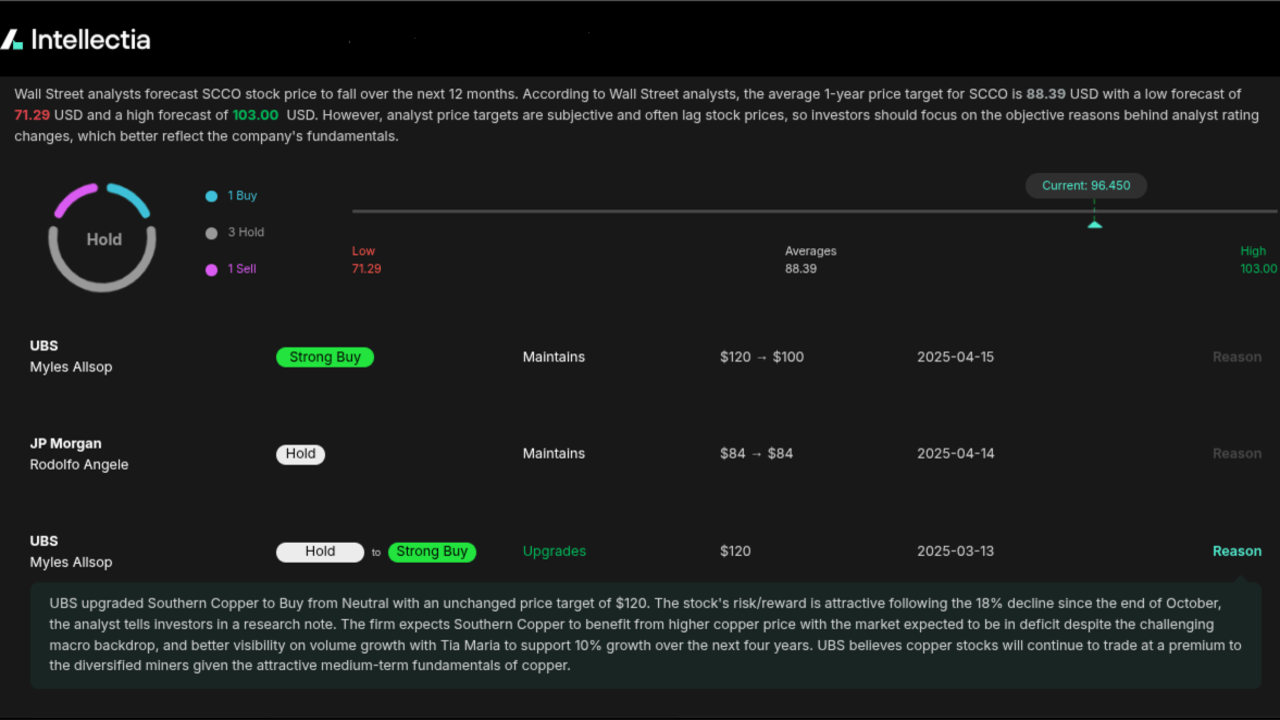

Southern Copper (SCCO)

Southern Copper, one of the largest integrated copper producers, operates mines in Peru and Mexico. Known for its low-cost production and high-quality assets, it offers a dividend yield of 2.95%. Analysts expect volume growth from projects like Tia Maria to drive future performance.

Why it’s a top pick: Its focus on copper provides direct exposure to price increases, ideal for investors seeking pure-play opportunities.

Source: Intellectia AI

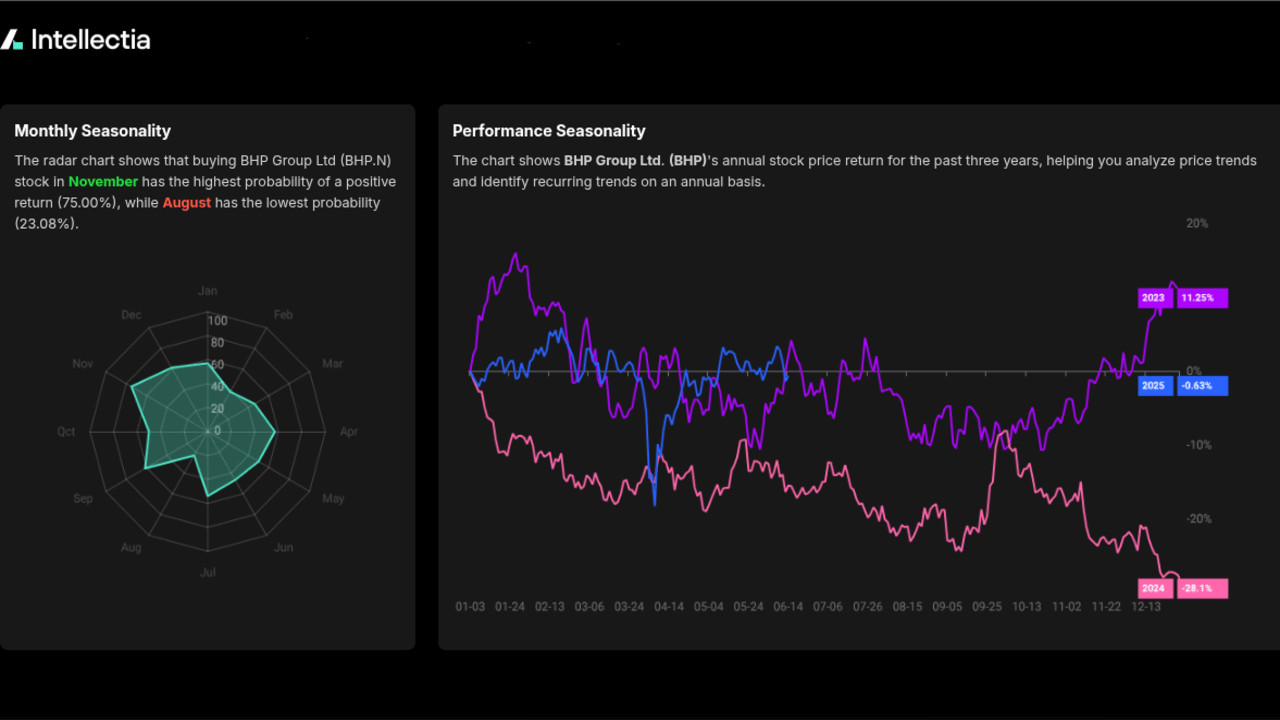

BHP Group (BHP)

BHP Group, the world’s largest mining company by market cap, produces copper, iron ore, nickel, and coal. Its copper operations include the Olympic Dam and Escondida mines, among the largest globally.

With a dividend yield of 5.07%, BHP offers a balance of income and growth potential. Its commitment to sustainability and focus on commodities for the energy transition make it a strong contender.

Why it’s a top pick: Its scale and diversified portfolio reduce risk while capitalizing on copper demand.

Source: Intellectia AI

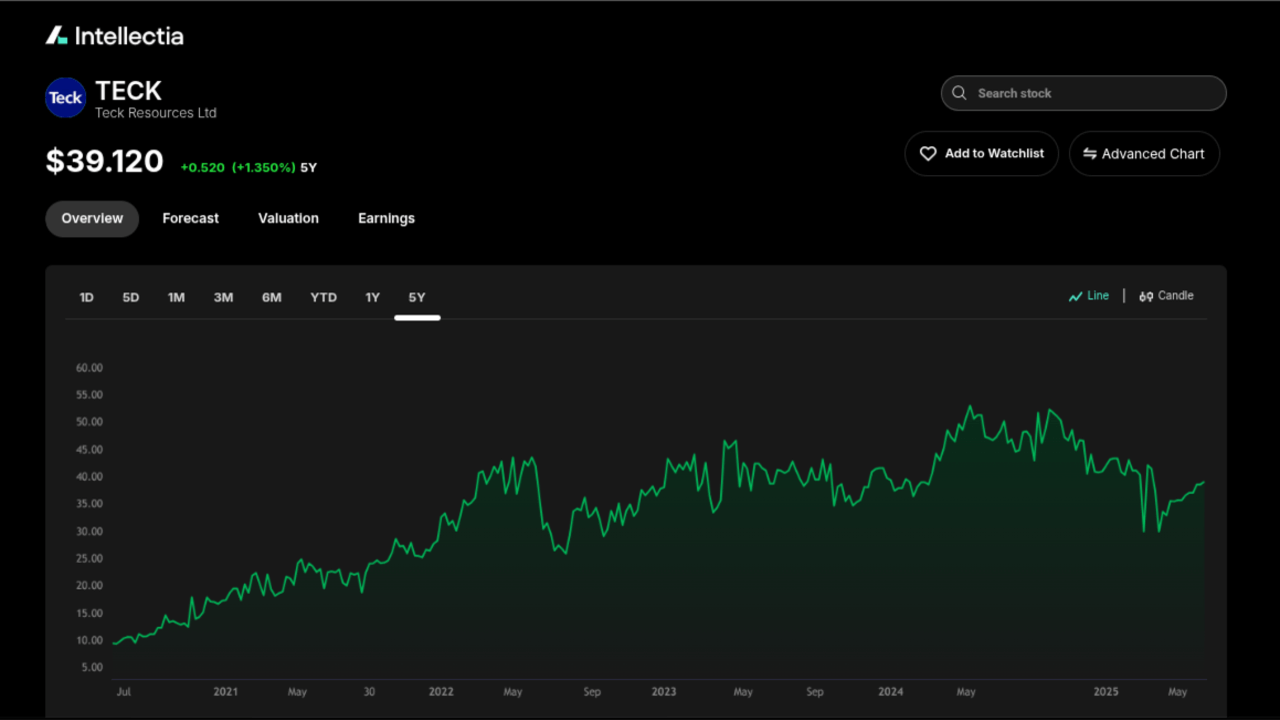

Teck Resources (TECK)

Teck Resources, a Canadian mining company, is a leading producer of metallurgical coal with significant copper operations. Its copper projects, like Quebrada Blanca, position it for growth in the clean energy sector. Despite a lower dividend yield of 0.93%, its diversified operations offer stability.

Why it’s a top pick: Its exposure to both copper and coal appeals to investors seeking diversified commodity exposure.

Source: Intellectia AI

How to Invest in Copper Mining Stocks Smartly

Investing in copper mining stocks requires a strategic approach to maximize returns and manage risks. Here are key steps to invest smartly:

- Understand Copper Market Fundamentals: Monitor supply and demand dynamics, price trends, and geopolitical factors affecting copper. Resources like Intellectia.AI’s news section provide real-time updates.

- Choose the Right Type of Copper Stock: Decide between pure-play miners for direct exposure or diversified miners for stability. Use Intellectia.AI’s AI stock screener to filter based on your preferences.

- Diversify and Set a Strategy: Diversify your portfolio with a mix of copper stocks and other assets. Choose a trading strategy, such as day trading, based on your goals.

- Consider Copper ETFs: For lower risk, invest in ETFs like the Global X Copper Miners ETF (COPX), which offers broad exposure to the sector.

Source: Global X Mirae Asset

Intellectia.AI’s platform enhances your investment strategy with:

- AI Stock Picker: Identifies daily top stocks premarket.

- Swing Trading Signals: Provides AI-driven signals for optimal entry and exit points.

- Stock Monitor: Tracks real-time performance of copper stocks.

- Technical Analysis: Offers insights into stock chart patterns and trends.

By leveraging these tools, you can make data-driven decisions and stay ahead in the copper market.

Source: Intellectia AI

Conclusion

Copper stocks present a compelling investment opportunity in 2025, driven by the metal’s critical role in clean energy and electric vehicles. Companies like Rio Tinto, BHP Group, Southern Copper, Freeport-McMoRan, and Teck Resources offer attractive dividend yields and strong growth potential, making them top picks for your portfolio.

To navigate this dynamic market, Intellectia.AI’s advanced AI tools provide stock analysis, price predictions, and trading strategies tailored to your needs. Sign up today at Intellectia.AI’s sign-up page to receive daily AI stock picks, trading signals, and market analysis, ensuring you make informed investment decisions.