Key Takeaways

- AI stock prediction tools leverage artificial intelligence to analyze market data, identify patterns, and forecast price movements, helping you make smarter, data-driven decisions.

- Selecting the right tool depends on your trading style, experience level, and budget; key criteria include accuracy, available features, ease of use, and customer support.

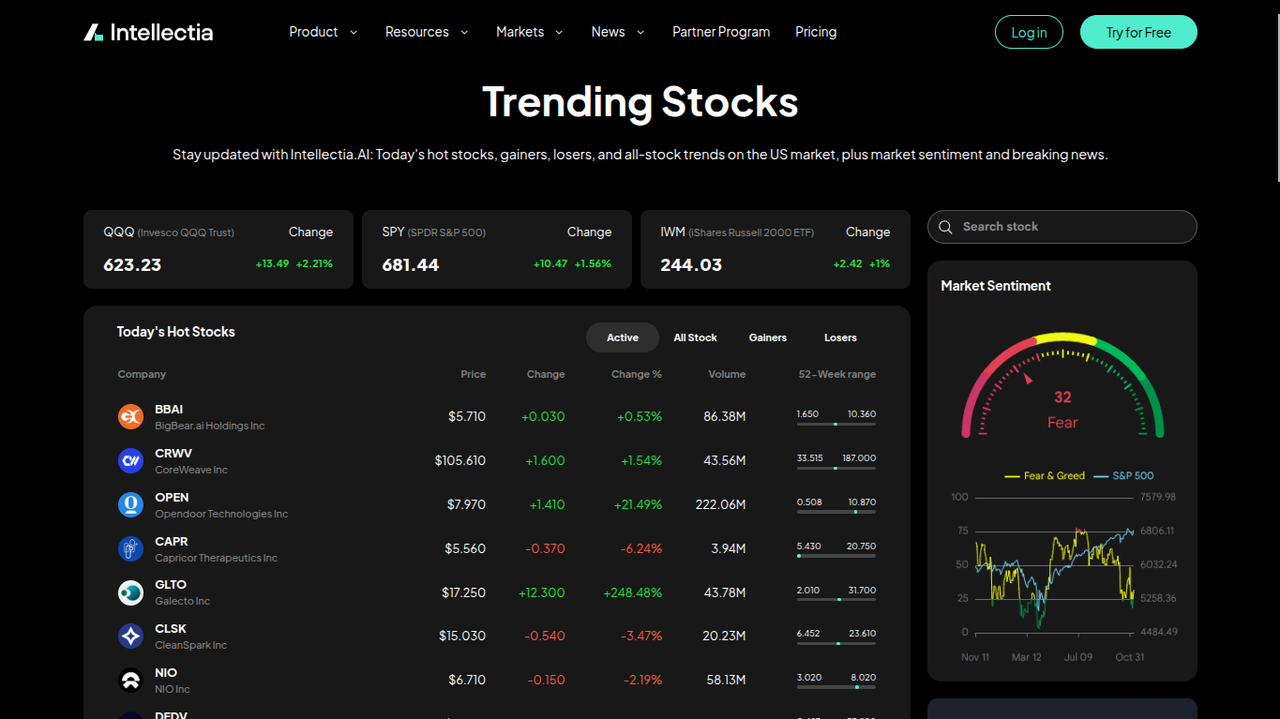

- Top platforms for 2026 include specialized tools for automated technical analysis like TrendSpider, AI-driven scanners like Trade-Ideas, and comprehensive platforms like Intellectia.ai.

- Social and copy trading platforms like Zignaly and StockHero offer a different approach, allowing you to mimic the strategies of professional traders.

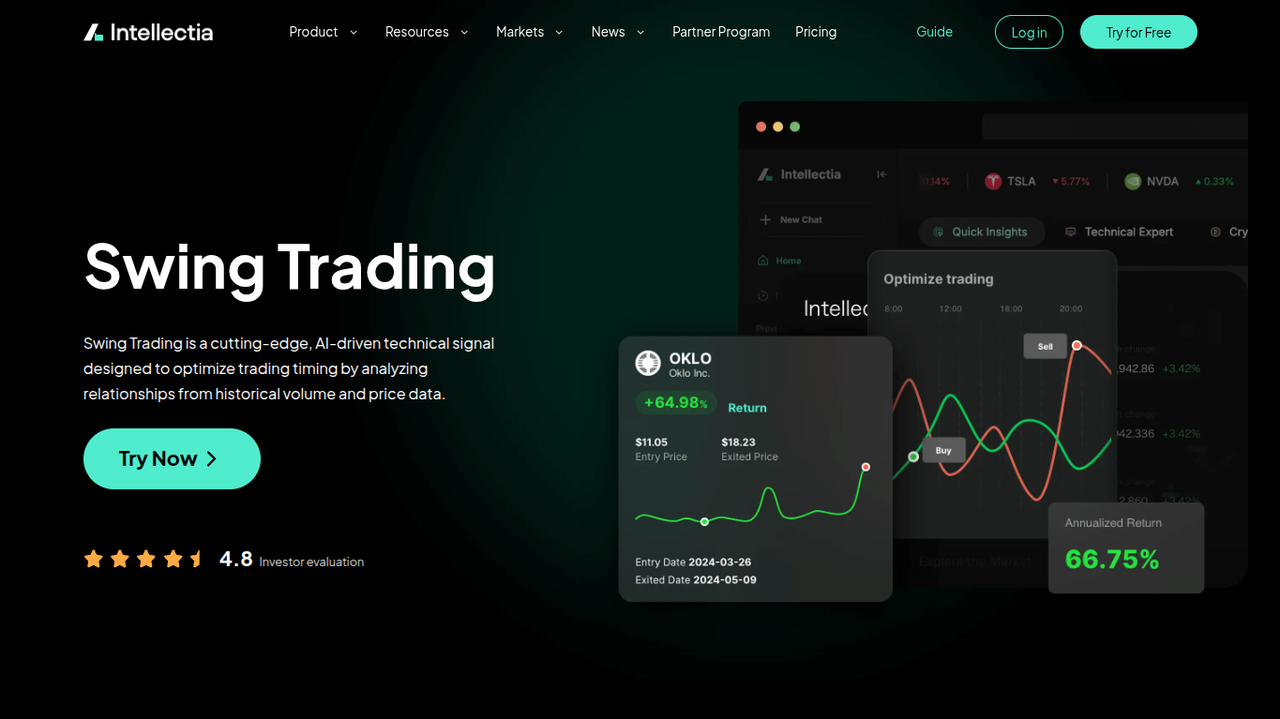

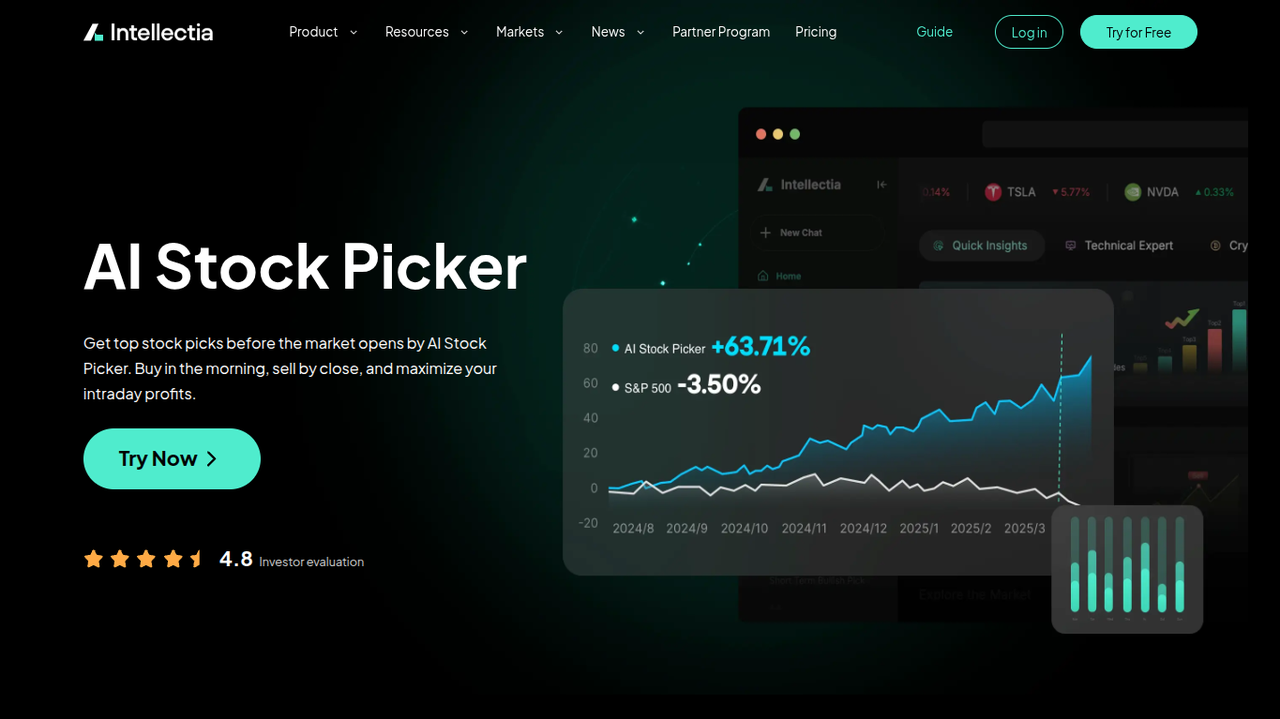

- Intellectia.ai stands out by offering a suite of AI-powered tools for various strategies, including the AI Stock Picker for day traders and Swing Trading signals for mid-term investors.

Introduction

Have you ever felt like you're constantly one step behind the market, struggling to make sense of endless charts and news updates? You're not alone. Many traders find themselves overwhelmed by the sheer volume of data, leading to emotional decisions and missed opportunities.

The key isn't to work harder but to trade smarter by analyzing market sentiment and complex data points in real time. This is where an AI stock prediction tool comes in, designed to give you a powerful analytical edge and level the playing field.

Why Consider Using AI Stock Prediction Software

In today's fast-paced markets, making informed trading decisions requires processing a staggering amount of information. An AI stock prediction tool can be your secret weapon, tirelessly analyzing data to uncover insights that are nearly impossible for a human to spot.

First, these tools excel at recognizing complex patterns across historical and real-time data. They can identify subtle trends and correlations that signal a potential price move, giving you a head start. Whether you're into day trading or a long-term investor, this capability helps you find promising opportunities.

Second, AI removes the emotional guesswork from trading. Fear of missing out (FOMO) and panic selling are two of the biggest hurdles to consistent profitability. An AI stock prediction app operates purely on data and logic, providing unbiased signals that help you stick to your strategy. This disciplined approach is often what separates successful traders from the rest.

Finally, these platforms offer incredible efficiency. Instead of spending hours manually scanning charts and reading reports, you can let the AI do the heavy lifting. Tools like an AI Screener can filter through thousands of stocks and cryptocurrencies in seconds to find assets that match your exact criteria. This frees you up to focus on strategy and execution, transforming the way you approach the market.

Criteria to Select the Best AI Stock Prediction Tools

Choosing the right stock prediction AI tool can feel overwhelming with so many options available. To find the best fit for your needs, you should focus on a few key criteria that will directly impact your trading experience and success.

First and foremost, consider the accuracy and performance of the tool. Look for platforms that are transparent about their prediction models and provide backtested results or performance metrics. While no tool can be 100% accurate, a proven track record of reliable signals is a must.

Next, evaluate the features and toolset. Are you a technical trader who needs advanced charting, pattern recognition, and indicators? Or are you looking for automated trading bots and signal providers? Some platforms, like TrendSpider, are built for deep technical analysis, while others, like StockHero, focus on deploying trading bots. Ensure the features align with your specific trading strategy.

Ease of use is another critical factor. A powerful tool is useless if its interface is clunky and confusing. Look for a platform with an intuitive design and a smooth user experience. Many services offer free trials or demos, which are excellent opportunities to test the software before committing.

Finally, don't overlook cost and customer support. Subscription fees can range from affordable monthly plans to expensive premium packages. Determine your budget and ensure the value provided justifies the price. Additionally, reliable customer support can be a lifesaver, especially when you're learning a new system.

Top Best AI Stock Prediction Tools to Consider in 2026

Here’s a breakdown of some of the best AI stock prediction software options available, each catering to different types of traders.

| Platform/Bot | Key Features | Ideal User | Cost (Starting Price) |

|---|---|---|---|

| Trade-Ideas | AI-powered market scanner, Holly AI assistant, backtesting, simulated trading. | Active day traders and momentum traders. | $118/month (Standard) |

| Intellectia.ai | AI Stock Picker, Swing Trading signals, AI Screener, Daytrading Center, news analysis. | All-in-one solution for day traders, swing traders, and long-term investors. | $14.95/month (Basic) |

| Tickeron | AI-powered pattern recognition, trend prediction, AI robots, and active portfolios. | Pattern traders and those seeking automated "robot" trading. | Free basic tools, premium from $15/month. |

| TrendSpider | Automated technical analysis, multi-timeframe analysis, dynamic alerts, strategy tester. | Technical traders and chart analysts. | $44/month (Premium) |

| StockHero | Pre-set trading bots, bot marketplace, paper trading, strategy designer. | Beginners and busy traders looking for automated bot solutions. | $4.99/month (Lite) |

| Zignaly | Social copy trading, profit-sharing model, AI-powered trader scoring (Z-Score). | Investors who want to copy pro traders, especially in crypto. | No monthly fees, profit-sharing model. |

1. Trade-Ideas

Trade-Ideas is a powerhouse for serious day traders who need to find opportunities in real time. Its core strength lies in its AI-driven scanner, "Holly," which runs millions of simulations overnight to identify high-probability trading strategies for the next market open.

- Key Features: Holly AI trading assistant provides entry and exit signals, real-time stock racing for momentum visualization, and a powerful backtesting engine to test your own strategies.

- Pros: Exceptional at finding in-market momentum and providing actionable, real-time ideas. Highly customizable scanners.

- Cons: The platform can have a steep learning curve for beginners, and the subscription cost is higher than many competitors.

Rating: 4.5/5

2. Intellectia.ai

Intellectia.ai offers a comprehensive suite of AI tools designed to cater to a wide range of trading styles, making it an excellent all-around AI stock prediction app. It's built to simplify complex analysis and deliver clear, actionable insights.

- Key Features: The AI Stock Picker provides daily pre-market picks for day traders. The Swing Trading feature offers clear buy/sell signals for mid-term trades on both stocks and crypto. The platform also includes an AI Screener that understands natural language queries and a Daytrading Center to master intraday moves.

- Pros: Versatile toolset for multiple trading strategies, intuitive and user-friendly interface, very affordable pricing tiers, and covers both stocks and crypto.

- Cons: Newer platform compared to some legacy competitors.

Rating: 4.8/5

3. Tickeron

Tickeron is a multifaceted platform that combines AI-driven pattern recognition with community-based features. It aims to provide traders with AI-generated predictions and allows them to follow AI "robots" with viewable track records.

- Key Features: AI Pattern Search Engine identifies chart patterns automatically. Its Trend Prediction Engine forecasts price movements with confidence levels. It also offers a marketplace for trading ideas and AI-managed portfolios.

- Pros: Strong focus on pattern recognition and providing confidence scores for its predictions. Good mix of tools for both traders and investors.

- Cons: The sheer number of features can be overwhelming for new users, and some of the best tools are locked behind higher-tier subscriptions.

Rating: 4.2/5

4. TrendSpider

TrendSpider is the go-to tool for traders who live and breathe technical analysis. It uses AI to automate the process of drawing trendlines, identifying support/resistance levels, and spotting chart patterns, saving you hours of manual charting.

- Key Features: Automated chart analysis, multi-timeframe analysis on a single chart, dynamic price alerts that trigger on indicator movements, and a no-code strategy tester. It also features an AI assistant named Sidekick to help with chart analysis.

- Pros: Unmatched automation of technical charting. The multi-timeframe analysis is a game-changer for seeing the bigger picture.

- Cons: Primarily focused on technical analysis, so it may lack fundamental data or news-driven signals. Can be complex for non-technical traders.

Rating: 4.6/5

5. StockHero

StockHero is designed for those who want to put their trading on autopilot. It’s a bot-focused platform that lets you deploy pre-configured bots from a marketplace or design your own without writing any code.

- Key Features: A marketplace with bots for various strategies, paper trading to test bots risk-free, a user-friendly bot creation interface, and integration with major brokerages.

- Pros: Very beginner-friendly and makes automated trading accessible. The bot marketplace is great for getting started quickly.

- Cons: Your success is dependent on the bot's performance, which can be inconsistent. Less focused on providing predictive insights and more on execution.

Rating: 4.0/5

6. Zignaly

Zignaly takes a different approach by focusing on social investing, specifically copy trading and profit sharing. Instead of predicting stocks, its AI helps you find and copy successful traders, primarily in the cryptocurrency space.

- Key Features: A profit-sharing model where you only pay fees on successful trades. The Z-Score, an AI algorithm, vets and ranks traders based on performance and risk.

- Pros: Low barrier to entry for new investors. The profit-sharing model aligns the interests of the expert trader and the investor. Strong focus on risk management.

- Cons: Heavily focused on crypto markets. Your returns are entirely dependent on the skill of the traders you choose to copy.

Rating: 4.1/5

Conclusion

Choosing the right AI stock prediction software can revolutionize your trading by giving you a data-driven edge, saving you time, and helping you control emotional decision-making. Whether you are a technical analyst, a day trader, or someone who prefers to automate their strategy, there is a tool on this list for you.

For those looking for a versatile platform that adapts to various strategies without a hefty price tag, Intellectia.ai provides a powerful and accessible solution.

Ready to transform your trading? Sign up for Intellectia.ai today and subscribe to receive daily AI stock picks, advanced trading signals, and market analysis to stay ahead of the curve.