Key Takeaways

- Commercial Reality: 2025 marks the shift from R&D burn to unit-economic breakeven for major players like Waymo and Pony.ai.

- Geographic Arbitrage: Investors must choose between the high-valuation software moats of US tech giants and the rapid commercialization speed of Chinese leaders.

- Hardware Margins: The "picks and shovels" trade is evolving; chipmakers remain strong, but the battle between LiDAR and vision-only systems is redefining hardware profitability.

- Valuation Metrics: Traditional P/E ratios fail here; you need to look at "R&D-to-Mile" efficiency and software licensing potential to find the best autonomous driving stock.

- Regulatory Moats: Safety data is becoming the new barrier to entry, favoring companies with massive accumulated miles over new entrants.

The 2025 AV Landscape: From Testing To Revenue Breakeven

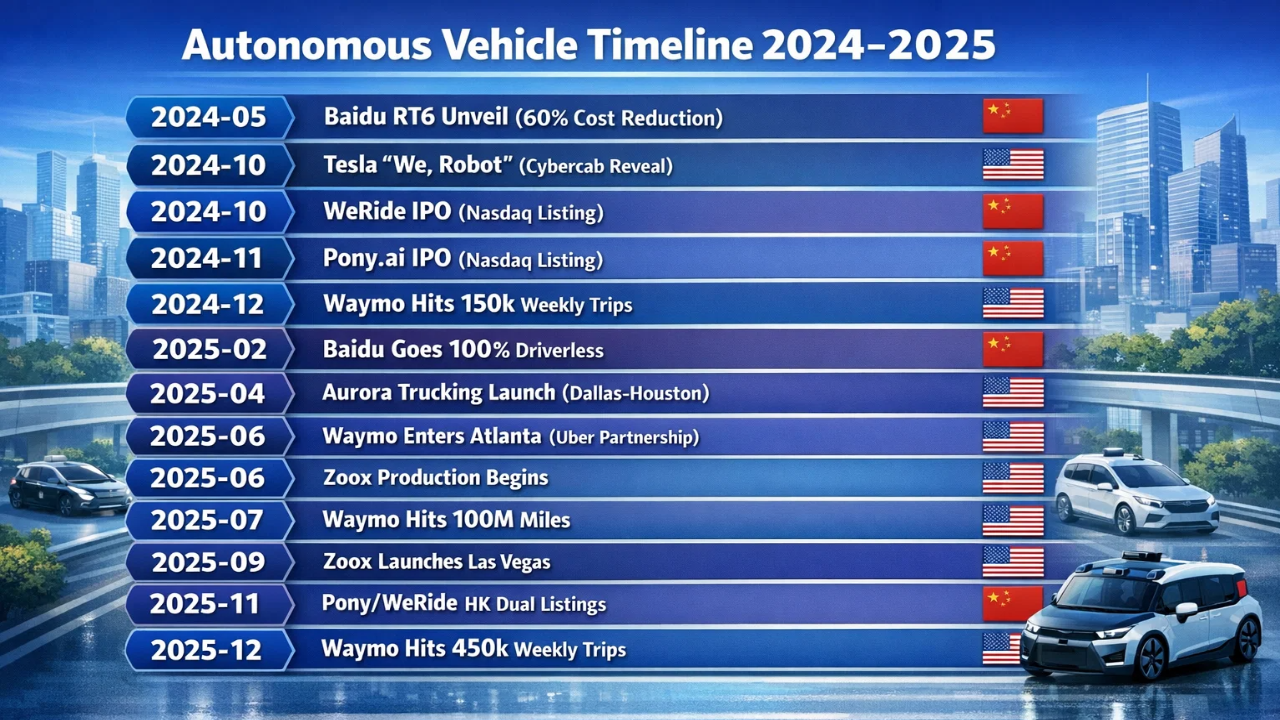

For years, investing in an autonomous driving stock felt like buying a lottery ticket. You were betting on a sci-fi future that always seemed five years away. In 2025, that narrative has shifted completely. The technology is no longer just "promising"; it is operational, carrying passengers, and, most importantly, generating tangible revenue.

The focus for investors has moved from "does it work?" to "does it make money?" Major players are reaching unit-economic breakeven in specific high-density cities. This means the revenue generated by a robotaxi in San Francisco or Beijing now covers its daily operating costs. This is the critical inflection point that separates a speculative gamble from a viable growth investment.

You need to look at companies that have graduated from safety drivers to fully driverless commercial fleets. It is not just about the technology anymore; it is about the ability to scale operations without exponentially increasing losses. As you analyze the market, keep a close eye on the transition from R&D heavy financials to early-stage commercial margins.

Source: Analyst’s compilation

To stay updated on which companies are hitting these milestones, you can use the Intellectia News Wire to track real-time announcements regarding fleet expansions and city approvals.

West Vs. East: Comparing The Two Titans Of Autonomy

When selecting an autonomous driving stock, you are essentially choosing between two distinct ecosystems: the United States and China. Both regions are racing toward Level 4 autonomy, but their approaches, regulatory environments, and valuations differ wildly. Understanding this geopolitical divide is essential for a balanced portfolio.

In the West, the market is dominated by massive tech conglomerates that treat autonomy as a feature of a larger ecosystem. In the East, rapid commercialization and government support are creating pure-play giants that are listing publicly at an aggressive pace. You cannot simply buy one and ignore the other if you want global exposure to this sector.

| Company | Region | Fleet Size (Est. Late 2025) | Operational Cities (Key Markets) | Public Listing Status |

| Waymo | 🇺🇸 US | ~2,500 Robotaxis | San Francisco, Phoenix, LA, Austin, Atlanta | Subsidiary of Alphabet (GOOG/GOOGL) |

| Tesla | 🇺🇸 US | ~30–50 (dedicated Robotaxi test fleet) | Austin, SF Bay Area (Pilot Testing) | Public (TSLA) |

| Cruise | 🇺🇸 US | ~140 (Supervised Test Fleet) | Phoenix, Dallas, Houston (Testing only) | Subsidiary of GM (GM) |

| Pony.ai | 🇨🇳 CN | ~1,160 Robotaxis | Beijing, Shanghai, Guangzhou, Shenzhen | Public (PONY) |

| WeRide | 🇨🇳 CN | ~1,600 Total AVs (~750 Robotaxis) | Guangzhou, Abu Dhabi, Singapore, Riyadh | Public (WRD) |

| Baidu (Apollo Go) | 🇨🇳 CN | ~1,000+ Robotaxis | 16 Cities | Public (BIDU) |

Utilizing tools like the Intellectia Stock Monitor can help you compare the relative strength and volatility of US-based tickers against their Chinese counterparts, giving you a clearer picture of global momentum.

US Dominance: The Software-First Approach

The American approach is defined by data supremacy and computing power. Companies like Alphabet (parent of Waymo) and Tesla have built incredible moats around their software stacks. For Tesla, the investment thesis revolves around the Dojo supercomputer and the sheer volume of real-world miles collected by its consumer fleet.

When you look at a US-based autonomous driving stock, you are paying a premium for this data advantage. The software-first approach means these companies aim to solve general autonomy anywhere, rather than geofenced autonomy somewhere. This requires massive upfront capital for compute clusters, but it promises a winner-take-most outcome.

However, this approach faces strict scrutiny. Regulatory bodies like the NHTSA are aggressive, meaning stock prices can be volatile based on safety recalls or investigation announcements. You should use the Intellectia AI Agent to monitor sentiment shifts related to US regulatory news.

China's Momentum: The Commercialization Speed-Run

China is moving at a blistering pace. Companies like WeRide and Pony.ai are not just testing; they are operating commercially in complex urban environments. The regulatory tailwinds in China are significant, with local governments actively designating large zones for robotaxi operations to foster industry growth.

Recent IPOs from these Chinese firms offer you a chance to invest in pure-play autonomy. Unlike buying Google to get Waymo, buying a dedicated Chinese autonomous driving stock gives you direct exposure to the technology. Revenue growth for these companies has been explosive, with some reporting triple-digit year-over-year increases.

However, you must be aware of the geopolitical risks. Trade restrictions on chips or data security concerns can impact these stocks. Despite this, the commercialization "speed-run" they are executing makes them an attractive, albeit riskier, component of an AV portfolio.

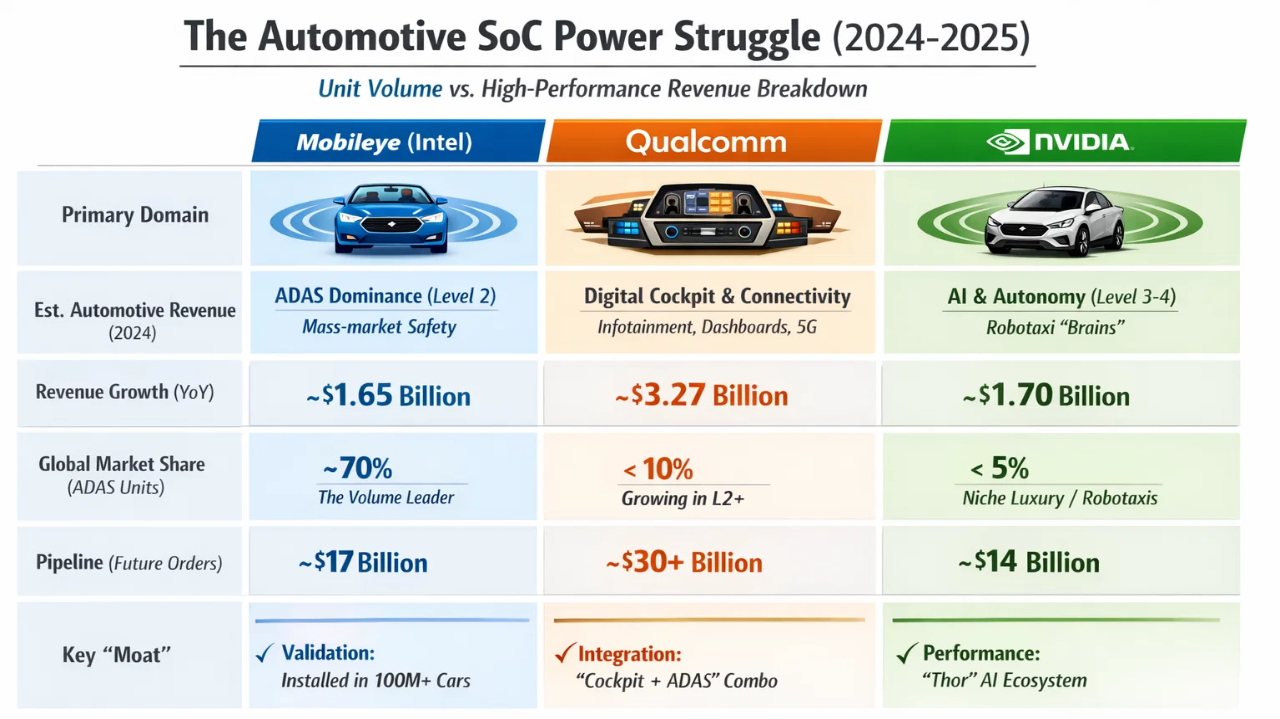

Investing In The Backbone: Chips, Sensors, And Connectivity

Sometimes the best way to play a gold rush is to sell shovels. In the AV world, the "shovels" are the semiconductors, sensors, and connectivity modules that allow cars to see and think. This sector offers a way to invest in the trend without betting on a specific robotaxi operator.

Nvidia and Qualcomm are the obvious titans here, providing the System-on-a-Chip (SoC) architectures that power virtually every major AV platform. However, the market is expanding beyond just central compute. You should look at the specialized component makers that are surviving the industry consolidation.

To find these component manufacturers, you can utilize the Intellectia AI Stock Picker, which can filter for semiconductor and hardware companies with strong exposure to the automotive sector.

Source: Analyst’s compilation

The LiDAR Vs. Vision Battle: Financial Stakes

One of the most heated debates in the industry—and one that directly impacts your wallet—is the choice between LiDAR and Vision-only systems. LiDAR (Light Detection and Ranging) provides precise 3D mapping but has historically been expensive. Vision-only systems, championed by Tesla, rely on cameras and AI, significantly reducing hardware costs.

For the investor, this is a margin story. If Vision-only proves sufficient for Level 4 safety, companies relying on expensive sensor suites will have a hard time competing on vehicle cost. However, if regulators mandate LiDAR for redundancy, the sensor stocks could see a massive resurgence.

You need to watch the cost-per-vehicle metrics. As LiDAR costs drop below $500 per unit, the argument for excluding them becomes weaker. Keep an eye on imaging radar technology as well, which offers a middle ground. This technical battle will determine the hardware winners of the next decade.

The Investor’s Scorecard: How To Value Pre-Profit AV Stocks

Valuing an autonomous driving stock is difficult because traditional metrics like P/E ratios often do not apply. Many of these companies are still burning cash to build their networks. You need a new framework to evaluate their potential before they hit mass profitability.

Do not just look at revenue; look at efficiency. A great metric to consider is the "R&D-to-Mile" ratio. This measures how much research and development spending is required to achieve a disengagement-free mile. You want to see this cost decreasing rapidly over time.

Additionally, analyze their cash runway. This is a capital-intensive game. You can check the financial health of these companies using Intellectia’s Quant AI features to ensure they have enough liquidity to survive until they reach positive free cash flow.

The 2025 AV Viability Scorecard:

| Category | Evaluation Criteria | 0-3 Points (High Risk) | 4-7 Points (Strong Contender) | 8-10 Points (Market Leader) |

| 1. Financial Resilience | Cash Runway: How long can they survive without raising funds? | < 12 Months: High risk of stock dilution; relying solely on public markets. | 18-24 Months: Burn rate is declining; backed by strategic partners (Tier-1s or OEMs). | 3+ Years / Profitable: Unit economics are positive; backed by a Mega-Cap (e.g., Alphabet) or massive cash pile. |

| 2. IP Portfolio & Tech | Moat: Do they own the data and the "brain"? | Commodity Tech: Relies on simulation data; uses off-the-shelf software; weak patents. | Innovator: 10M+ real-world miles; proprietary sensor suite or unique chip architecture. | Standard Setter: 100M+ to Billions of miles (Data Network Effect); full vertical integration; licensing to others. |

| 3. Regulatory Status | Permissions: Can they drive without a human babysitter? | Testing Phase: Safety driver required at all times; restricted to closed courses; recent safety probes. | Early Commercial: Driverless permits in 1-2 cities; daylight/fair weather operations only. | Full Scale: Full commercial Robotaxi licenses in multiple metros (SF, Beijing); 24/7 operations including highways. |

Pure-Play Startups Vs. Legacy Hedging

You have two main choices for exposure: buying a dedicated startup or buying a legacy automaker that is hedging its bets. Pure-play stocks (like a dedicated robotaxi firm) offer the highest potential upside but come with the risk of total failure. If they run out of cash or fail certification, the equity can go to zero.

Legacy automakers (like GM or Ford) offer a safety net. If their AV division stumbles, they still sell millions of gas and electric cars to prop up the stock. However, their AV divisions are often a drag on earnings rather than a boost.

Your choice depends on your risk tolerance. A balanced approach might involve holding a core position in a legacy player or big tech firm while allocating a smaller percentage to a high-growth, pure-play autonomous driving stock.

Software Licensing: The Hidden High-Margin Play

The holy grail of the autonomous vehicle industry is not manufacturing cars; it is licensing the "driver." Manufacturing vehicles is a low-margin, capital-heavy business. selling software is the opposite. This is why companies pivoting to a "Driver-as-a-Service" model are so attractive.

Imagine a company like Mobileye or a future iteration of Tesla’s FSD. They develop the software and sell it to ten different car manufacturers. They collect a licensing fee or a subscription revenue stream without ever worrying about stamping metal or managing a supply chain.

This recurring revenue model commands a much higher valuation multiple. When researching an autonomous driving stock, check if they have plans to license their tech to others. That scalability is where the massive compounding returns will eventually come from.

The following chart illustrates the Lifetime Value (LTV) and profit potential of a traditional vehicle sale versus a recurring autonomous driving software subscription over a 10-year vehicle lifecycle.

| Metric | Traditional Auto Sale | AV Software Subscription |

| Transaction Type | One-time Hardware Sale | Recurring License / SaaS |

| Price Point | $40,000 (at purchase) | $5,000 / year |

| Gross Margin % | ~15% (Industry Avg) | ~80% (SaaS Standard) |

| Profit Year 1 | $6,000 | $4,000 |

| Profit Year 5 | $0 | $20,000 (Cumulative) |

| Profit Year 10 | $0 | $40,000 (Cumulative) |

| Total Lifetime Profit | $6,000 | $40,000 |

| Valuation Multiple | 5x - 8x Earnings | 20x - 50x Earnings |

You can track earnings calls for these strategic pivots using Intellectia’s Earnings Trading tools.

Risk Audit: Regulatory Hurdles And Liability Moats

Technology is only half the battle; permission is the other half. In 2025, the regulatory environment is solidifying with standards like FMVSS 127 in the US. These regulations create a high barrier to entry. A new startup cannot just write code and hit the road anymore; they need to prove compliance with rigorous safety standards.

This regulatory moat actually protects the incumbents. The companies that have already logged millions of miles and have established relationships with regulators are safer bets. They have the data to prove their safety cases, whereas new entrants face a "cold start" problem.

You must stay vigilant regarding safety probes. A single high-profile accident can ground a fleet and tank a stock overnight. Use the Intellectia Stock Monitor to set alerts for regulatory news specifically related to the autonomous sector.

The Insurance Revolution

As computers take the wheel, liability shifts from the human driver to the system provider. This is a massive disruption for the insurance industry, but an opportunity for AV stocks. Companies that self-insure or offer their own insurance products (because they trust their data) can capture the premiums that used to go to Geico or State Farm.

This internalizes a huge profit center. If an AV company claims their car is 10x safer than a human, they should be willing to insure it for a fraction of the cost. Watch for insurance bundles as a sign of confidence and a new revenue stream for your chosen autonomous driving stock.

Conclusion

The year 2025 is the year autonomy gets real for investors. The separation between the science projects and the businesses is becoming clear. You have the opportunity to invest in US software giants, Chinese commercial leaders, or the critical hardware backbone that powers them all.

Remember to look beyond the hype. Focus on unit economics, licensing potential, and regulatory standing. The winners of this race will likely become the most valuable companies in the world over the next decade, but the volatility will be high.

To navigate this complex market with confidence, make sure you have the best data at your fingertips. Sign up for Intellectia.AI today to get access to advanced AI stock picks, real-time trading signals, and deep market analysis that will help you find the best autonomous driving stock for your portfolio.