Key Takeaways

- The market focus is shifting from building AI infrastructure (training) to the profitable application of AI (inference) by 2026.

- Software and SaaS companies successfully converting AI capital expenditure into revenue will offer superior ROI compared to pure hardware plays.

- Edge AI is driving a massive hardware replacement cycle for smartphones and PCs, benefiting memory and power-efficient chip manufacturers.

- Power constraints are creating a "utilities supercycle," making liquid cooling and modular nuclear energy critical investment themes.

The 2026 Pivot: From Training Infrastructure To The Era Of Inference

The initial AI gold rush was defined by a scramble for graphical processing units. If you were paying attention in 2024, the strategy was simple: buy the shovel sellers. However, as we look toward the landscape of ai stocks to buy 2026, the narrative is undergoing a fundamental shift. The infrastructure phase, characterized by massive capital expenditure on training Large Language Models (LLMs), is maturing.

You are now entering the "Inference Era." This is the phase where the models built over the last few years are put to work. The value is migrating from the companies that manufacture the chips to the companies that run the applications. While the hardware giants will remain relevant, the explosive growth percentages are likely to be found elsewhere.

For your portfolio, this means looking for companies that are optimizing efficiency. Running these massive models requires immense computational power, and the market will reward companies that can do it cheaper and faster. You need to identify the software platforms that are sticky enough to retain customers once the novelty of generative AI wears off.

This transition changes how you should analyze potential investments. Revenue growth from mere "AI integration" is no longer enough. You must look for tangible Return on Investment (ROI) and margin expansion driven by AI adoption. Tools like the Intellectia AI stock picker can help you filter through the noise to find these high-utility players.

Valuation Matrix: The Top AI Software & SaaS Contenders For 2026

When evaluating ai stocks to buy 2026, the software sector presents a compelling valuation argument. Many hardware stocks are priced for perfection, but select SaaS (Software as a Service) companies are just beginning to monetize their AI features. The key metric you should focus on here is the Forward PEG (Price/Earnings-to-Growth) ratio.

You want to find companies where the AI narrative has not fully compressed the multiple yet. These are businesses that have integrated generative AI not as a gimmick, but as a core productivity driver that allows them to raise prices. This pricing power is the ultimate moat in a high-inflation environment.

Look for companies with massive proprietary data sets. An LLM is only as good as the data it is fed. Legacy software providers that hold decades of customer data have an insurmountable advantage over startups. They can train specific, highly accurate models that generic bots cannot replicate.

| Ticker | Company | 2026 Est. Rev Growth | 2026 Forward P/E | FCF Yield | Intellectia Verdict |

| META | Meta Platforms | 17.9% | 21.7x | 2.7% | Best Value: Low multiple with massive open-source AI moat. |

| MSFT | Microsoft | 16.0% | 29.1x | 2.2% | Core Holding: The safest play on both infrastructure and software. |

| PLTR | Palantir | 43.3% | 172.3x | 0.5% | Growth Pick: High premium, but dominant in "real-world" AI application. |

| NOW | ServiceNow | 18.6% | 36.2x | 2.5% | Efficiency King: Leading the internal enterprise AI automation wave. |

| SNOW | Snowflake | 28.4% | 184.8x | 1.1% | Data Play: Essential for AI data storage, but priced for perfection. |

| CRWD | CrowdStrike | 21.5% | 122.8x | 1.0% | Security Moat: Critical as AI-generated cyber threats escalate. |

| DDOG | Datadog | 21.0% | 57x | 1.8% | Observability: "Picks and shovels" for monitoring AI software performance. |

| ADBE | Adobe | 9.6% | 14.1x | 6.9% | Creative AI: Monetizing Firefly, though facing open-source pressure. |

| ORCL | Oracle | 16.6% | 26.1x | -2.3% | Cloud Value: Gaining share in AI training workloads vs. AWS/Azure. |

| PATH | UiPath | 11.5% | 23.9x | 3.1% | Automation: High ROI potential if AI agents replace legacy RPA tasks. |

To spot these opportunities before the broader market does, you can utilize an AI screener. By filtering for high free cash flow yield and moderate forward P/E ratios, you can build a watchlist of software giants poised for a breakout.

The Vertical AI Winners: Healthcare And Finance

General-purpose chatbots are impressive, but the real profitability in 2026 lies in "Vertical AI." These are models trained specifically for a single industry, offering deep expertise rather than broad, shallow knowledge. Two sectors stand out for their potential: healthcare and finance.

In healthcare, AI is moving from administrative tasks to core drug discovery. The timeline for bringing a new drug to market is being slashed by years thanks to predictive modeling. You should look for biotech firms that are partnering with tech giants to accelerate their pipelines. The stickiness here is incredibly high; once a pharmaceutical company integrates an AI platform into its FDA approval workflow, they rarely switch.

Finance offers a similar moat. Fraud detection and algorithmic trading are being revolutionized by AI agents that can process market sentiment in milliseconds. You can track how institutional investors are positioning themselves in these sectors using a hedge fund tracker, giving you insight into "smart money" flows before they hit the headlines.

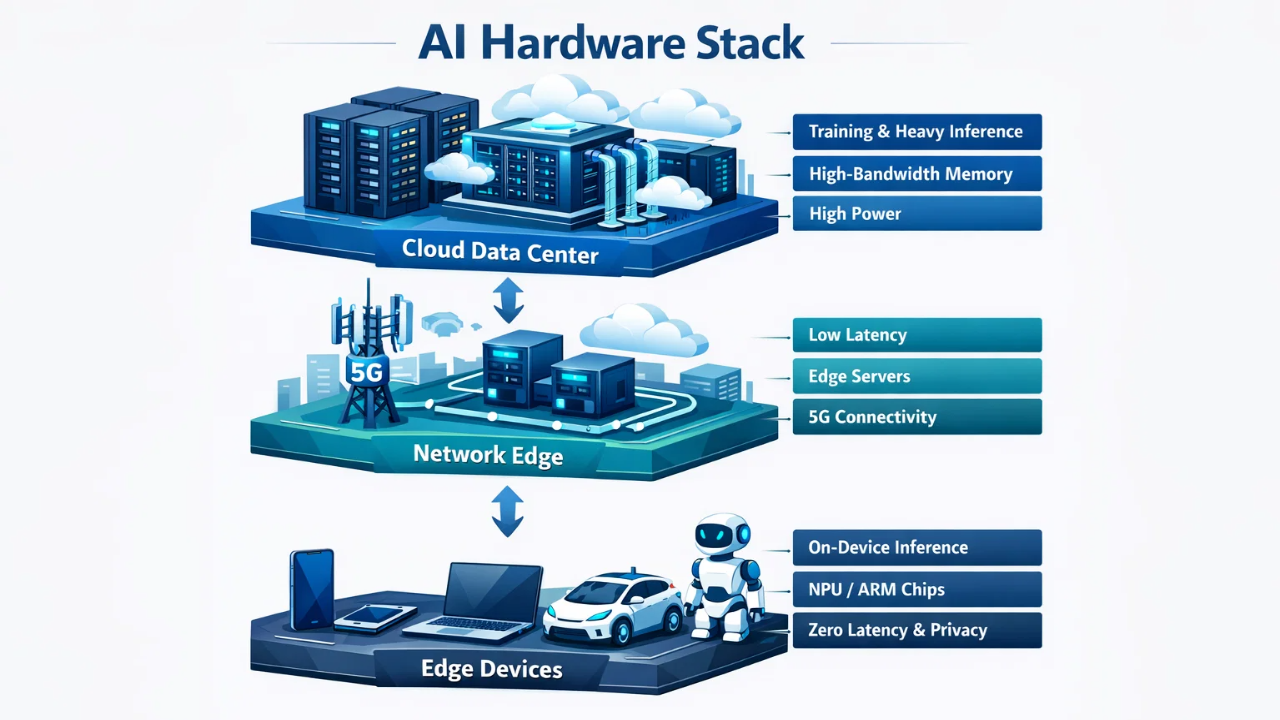

Edge AI: Why 2026 Is The Year Of Local Hardware Intelligence

The cloud cannot handle everything. As AI models become ubiquitous, latency and privacy concerns are forcing processing power back to the device in your pocket. This trend, known as Edge AI, is a critical theme for your list of AI stocks to buy 2026.

We are on the cusp of a massive hardware replacement cycle. Consumers will need new smartphones and laptops capable of running small language models (SLMs) locally, without an internet connection. This protects user data and speeds up response times for tasks like real-time translation or photo editing.

This shift benefits a different set of hardware players. While data center GPUs dominated previously, you should now look at companies specializing in power-efficient mobile architecture and high-bandwidth memory. If a device needs to run AI locally, it needs significantly more RAM and a Neural Processing Unit (NPU) optimized for battery life.

This cycle is predictable. Just as the rollout of 5G spurred a wave of device upgrades, on-device AI will force a global refresh of consumer electronics. Keeping an eye on stock chart patterns for major consumer hardware manufacturers can help you time your entry into this cyclical upswing.

Source: Analyst’s compilation

Energy & Cooling: Solving The 2026 Data Center Bottleneck

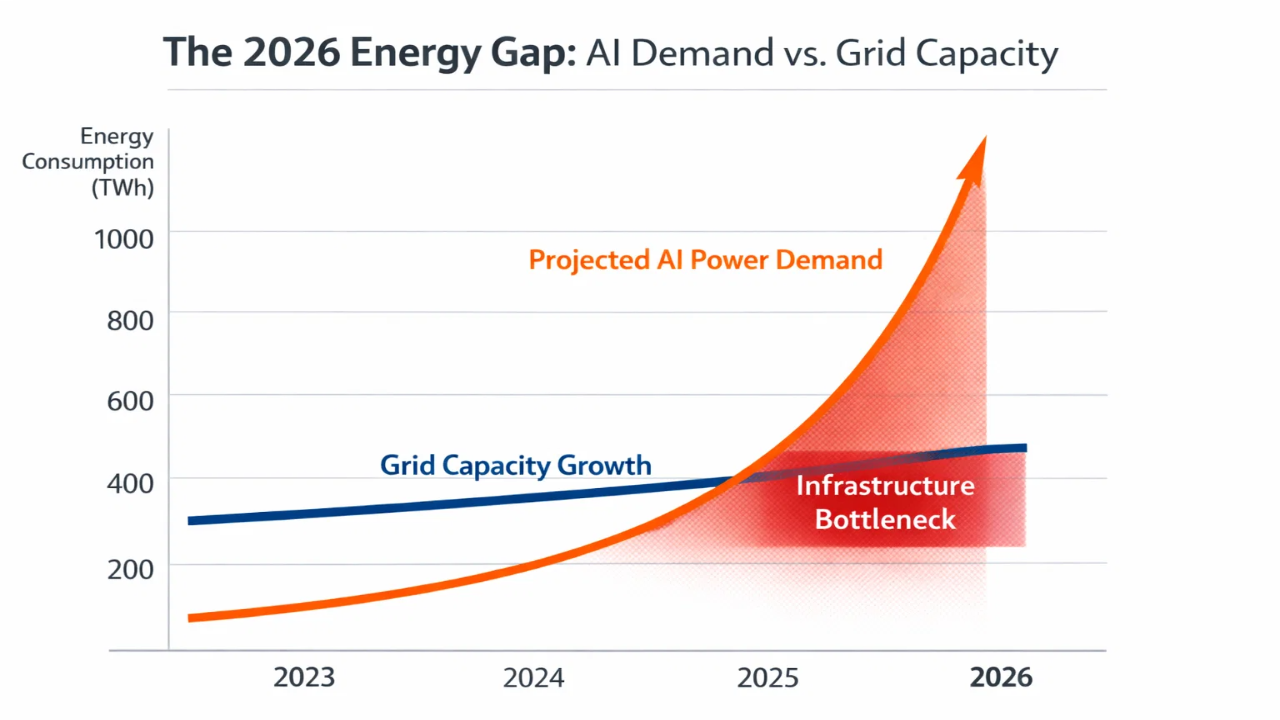

There is a physical limit to the AI revolution, and it isn't code—it's electricity. The data centers required to run inference at a global scale are power-hungry beasts. By 2026, the demand for power from data centers is projected to double in many regions, straining existing grids.

This bottleneck creates a "utilities supercycle." You should consider energy companies as a derivative play on AI. However, not all energy stocks are equal. Renewable energy is variable, but data centers need baseload power—energy that is on 24/7. This reality is renewing interest in nuclear energy and Small Modular Reactors (SMRs).

Investing in the companies that build the grid infrastructure, transformers, and transmission lines is a defensive way to play the AI boom. Even if a specific software company fails, the demand for the electricity to run the sector will only increase. You can monitor news related to energy regulations and infrastructure spending via a dedicated news wire to stay ahead of regulatory shifts.

Source: Analyst’s compilation

The Liquid Cooling Renaissance

As chips become more powerful, they generate more heat. The traditional method of blowing air through a server rack is reaching its physical limits. For the high-performance chips of 2026, air cooling is simply insufficient. This is ushering in the renaissance of liquid cooling.

Liquid cooling involves submerging servers in non-conductive fluids or bringing liquid directly to the chip plate. This technology allows data centers to pack more compute power into smaller spaces while reducing electricity usage for cooling by up to 40%.

Companies that specialize in thermal management solutions are becoming essential partners for the hyperscalers. This is a "pick and shovel" play for the second phase of the AI build-out. Identifying these niche industrial players requires deep technical analysis, which you can streamline using stock technical analysis tools.

Risk Management: Is The AI Premium Sustainable In 2026?

While the potential is vast, you must remain vigilant. The "AI premium"—the higher valuation the market assigns to anything related to artificial intelligence—will face tests in 2026. You need to ask yourself if the growth rates justify the prices.

Macro factors will play a huge role. If interest rates remain elevated, the discount rate applied to future cash flows will punish high-growth, unprofitable tech stocks. You cannot simply buy a basket of "AI stocks" and hope for the best as you might have in 2023.

Differentiation is key. By 2026, investors will likely suffer from "AI fatigue," becoming skeptical of companies that sprinkle "AI" into their earnings calls without showing revenue impact. You must distinguish between pretenders and contenders.

Using tools like AI earnings prediction can help you verify if a company's financial reality matches its hype. Protecting your downside is just as important as capturing upside. Diversification across the layers of the AI stack—semiconductors, software, energy, and edge hardware—is the prudent approach for the long term.

Conclusion

The landscape for ai stocks to buy 2026 is vastly different from the early days of the boom. The easy money in pure infrastructure plays has likely been made. Now, you must pivot toward the practical application of this technology. The winners of 2026 will be the software companies that monetize usage, the edge hardware makers that enable local processing, and the energy firms that keep the lights on.

Navigating this rotation requires more than just following the headlines. You need data-driven insights and advanced analytics to spot the shift before the crowd.

Ready to build a smarter portfolio? Sign up for Intellectia.AI today. Subscribe to get alerts on daily AI stock picks, leverage our institutional-grade AI trading signals, and access comprehensive market analysis that keeps you one step ahead of the 2026 curve.