Key Takeaways

- Power is the New Gold: Owning land is irrelevant without grid connectivity; companies with secured power queues like Core Scientific and Applied Digital hold a massive time-to-market advantage.

- Valuation Shift: Investors must move beyond P/E ratios and evaluate "Enterprise Value per Megawatt" to find true value among AI data center stocks.

- Cooling is Critical: As rack densities skyrocket, "pick and shovel" plays like Vertiv and Eaton are essential for liquid cooling and power management.

- Risk vs. Reward: Choose between the stability of REIT dividends (Equinix, Digital Realty) and the explosive growth potential of converted crypto-miners.

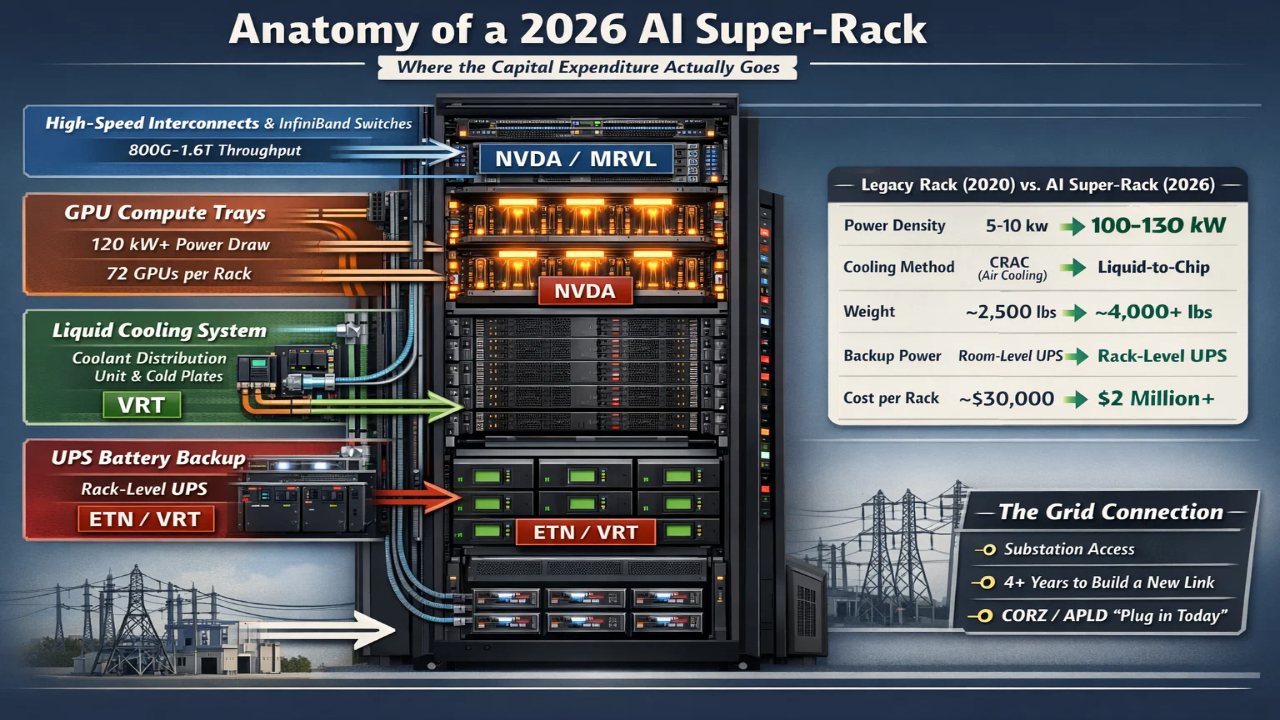

The initial rush into AI stocks focused entirely on the chips. But as the market move toward 2026, the bottleneck has shifted from silicon to concrete, copper, and cooling. If you are looking to capitalize on the next phase of the AI boom, you need to understand the physical infrastructure required to run Nvidia's Blackwell and Rubin chips.

Investing in ai data center stocks is no longer just about who has the most square footage. It is about who has the power, the cooling technology, and the ability to bring capacity online before the competition. This playbook cuts through the noise to help you identify the winners in the race for AI infrastructure.

The Real Bottleneck: Grid Connectivity and Power Rights

In the world of real estate, the mantra is "location, location, location." In the world of AI data centers, it is "power, power, power." You can buy all the land you want, but if you are sitting in a five-year queue for a substation connection, your asset is effectively stranded.

For 2026, the true economic moat isn't the building; it is the grid connection. Hyperscalers like Microsoft and Amazon are desperate for immediate capacity. This has created a massive premium for companies that possess "shovel-ready" power.

| Tech Hub / Market | Historical Wait Time (Pre-2023) | Current Projected Wait Time (For New 2025/26 Applications) | Primary Utility / Grid Operator |

| Northern Virginia (Ashburn, Loudoun Co.) | 12 – 24 Months | 4 – 7 Years | Dominion Energy / PJM |

| Silicon Valley (Santa Clara, San Jose) | 18 – 36 Months | 6 – 10 Years | Silicon Valley Power / PG&E / CAISO |

| Dallas-Fort Worth (North Texas) | 12 – 18 Months | 3 – 5 Years | Oncor / ERCOT |

| Atlanta (Data Center Alley South) | 18 – 24 Months | 4 – 5 Years | Georgia Power / Southern Company |

| Chicago (Elk Grove Village) | 12 – 24 Months | 3 – 5 Years | ComEd / PJM |

| National Average | ~2 Years | 4+ Years | Various |

The Lead-Time Advantage

This power scarcity has turned former crypto-mining companies into arguably the most valuable assets in the sector. Why? Because they already own massive grid connections.

Companies like Core Scientific (CORZ) and Applied Digital (APLD) have successfully pivoted from mining Bitcoin to hosting High-Performance Computing (HPC).

Core Scientific recently rejected a takeover bid from CoreWeave, opting to go independent because they recognize the value of their 500+ MW pipeline. They are converting existing mining infrastructure into high-density AI hosting sites faster than greenfield developers can break ground.

Applied Digital has secured a $2.35 billion financing package to build out its "Polaris Forge" campus. They aren't just planning; they are executing, with 100 MW coming online immediately and a clear path to 600 MW for their anchor tenant.

For you as an investor, these stocks represent a "time-arbitrage" play. You are betting that their speed-to-market is worth more than the established scale of the legacy giants.

Valuation Framework: Calculating EV per Megawatt

When analyzing AI data center stocks, traditional metrics like Price-to-Earnings (P/E) often fail to capture the growth potential of infrastructure assets. A massive REIT might look expensive on earnings but cheap when you consider its pipeline of power.

Comparing data center stocks using traditional P/E ratios is often misleading because it ignores the massive, dormant value of secured power pipelines. In a power-constrained world, a megawatt of grid-connected capacity is a tangible asset that commands a premium.

| Ticker | Company | Enterprise Value (Approx.) | Total Capacity (Op + Pipeline) | EV per Megawatt (Valuation) | Investment Thesis |

| EQIX | Equinix | ~$93 Billion | ~3,000 MW | ~$31.0M / MW | The Premium Moat. You pay a premium for the "interconnection" ecosystem. Equinix doesn't just rent space; it owns the internet's central switching points. High reliability, low risk. |

| APLD | Applied Digital | ~$11 Billion | ~2,300 MW | ~$4.9M / MW | The Growth Value. Trading at a massive discount to EQIX. The market is pricing in execution risk, but if they deliver their 600MW+ pipeline, this gap closes rapidly. |

| CORZ | Core Scientific | ~$6 Billion | ~1,200 MW | ~$5.0M / MW | The Conversion Play. Similar value proposition to APLD. The market still discounts them as a "miner," ignoring their pivot to high-value AI hosting (HPC). |

| BN | Brookfield Corp | ~$465 Billion | ~5,000 MW | N/A (Conglomerate) | The Scale King. You can't value BN solely on MWs because of its diverse assets, but with 1.6 GW contracted and 3.5 GW in development, they effectively control a "utility-scale" power bank hidden inside a financial giant. |

Note: EV/MW fluctuates with share price and pipeline updates. Use Intellectia's Stock Monitor to track these real-time metrics.

By focusing on EV/MW, you can spot dislocations. For example, if Core Scientific trades at a fraction of the EV/MW of Digital Realty, but is signing contracts with the same investment-grade hyperscalers, that represents a potential repricing opportunity.

The 'Hidden' Infrastructure: Cooling and Electrical Systems

Data centers are getting hotter. Much hotter. A traditional server rack consumes about 10 kilowatts (kW) of power. An Nvidia GB200 rack consumes over 100 kW. Traditional air conditioning cannot handle that heat.

This physical reality creates a massive tailwind for the "pick and shovel" providers—the companies making the cooling and electrical equipment.

The Liquid Cooling Revolution

Air cooling is dead for next-gen AI. Liquid cooling is the future. Two companies dominating this transition are Vertiv (VRT) and Eaton (ETN).

Vertiv (VRT): Their recent earnings call highlighted a 60% year-over-year increase in orders, driven almost entirely by the AI build-out. They provide the complete thermal chain, from the chiller to the chip.

Eaton (ETN): Known for electrical equipment, Eaton is aggressively moving into cooling. They recently acquired Boyd Thermal to secure liquid cooling technology. With data center orders up 70%, they are embedding themselves into the design of the next generation of data centers.

Source: Analyst’s Compilation

Investing here is a bet on the density of AI, regardless of which hyperscaler wins the cloud war.

REITs vs. Independent Operators: Risk-Reward Profiles

Your choice of ai data center stocks depends heavily on your risk tolerance. The market is split into two distinct camps.

The Yield Play (REITs)

If you want stability and dividends, look at the Real Estate Investment Trusts (REITs).

Equinix (EQIX): They are the "airport" of the internet. Everyone connects through them. They just announced a "Build Bolder" strategy to double their capacity, including buying 900 MW of land. They pay a steady dividend and offer lower volatility.

Digital Realty (DLR): They focus on massive wholesale campuses. With a 5 GW power bank and a backlog of over $850 million, they are the safe, steady hands of the industry.

The Growth Play (Independents)

If you want capital appreciation, look at the independent operators like Applied Digital (APLD).

These companies are not structured as REITs, meaning they reinvest cash flow into growth rather than dividends. They are taking on more development risk but offer significantly higher upside if they successfully execute their gigawatt-scale campuses.

Downside Risks: The Hyperscaler In-Sourcing Threat

No investment thesis is without risk. For AI data center stocks, the biggest threat is the customers themselves.

Microsoft, Amazon (AWS), and Google possess balance sheets larger than any data center operator. There is a risk that they eventually "in-source" their infrastructure, building their own proprietary power plants and campuses to cut out the middleman.

Mitigation: This is why location and interconnection (Equinix) or speed (Core Scientific) are vital moats. Hyperscalers can build their own shells, but they cannot replicate Equinix's ecosystem of 10,000 customers or Core Scientific's energized power lines overnight.

Additionally, pay attention to the chip supply chain. If Nvidia's supply stabilizes or slows, the frantic grab for data center space may cool, compressing lease rates.

Top Picks for the Next Phase of AI Expansion

Based on the analysis of power access, technological leadership, and valuation, here are the top stocks to watch for the 2026 cycle:

1. The Infrastructure King: Eaton (ETN). They sell the electrical backbone and cooling required by every data center, insulating them from tenant risk.

2. The Aggressive Grower: Applied Digital (APLD). If they execute on their 600 MW pipeline and financing, the stock could re-rate significantly higher.

3. The Safe Harbor: Equinix (EQIX). Their pivot to buying land and expanding xScale capacity makes them a blend of safety and growth.

4. The Dark Horse: Brookfield Corp (BN). With $180 billion in deployable capital and a massive renewable power business, they are uniquely positioned to solve the energy side of the AI equation.

The 2026 AI Data Center Scorecard:

| Ticker | Company | Growth Potential (1-10) | Safety Score (1-10) | The Verdict |

| APLD | Applied Digital | 10/10 | 3/10 | The Rocket Ship. Revenue up 250% YoY. Massive pipeline (1.5 GW). Highest execution risk, but highest potential re-rating if they deliver. |

| CORZ | Core Scientific | 9/10 | 4/10 | The Conversion Play. Transitioning from crypto to AI Hosting. Sitting on valuable, energized power infrastructure that would take years to build from scratch. |

| VRT | Vertiv | 8.5/10 | 7/10 | The Liquid King. Orders up 60% YoY. Dominates the "thermal chain" for high-density chips. High growth, but valuation is already premium. |

| ETN | Eaton | 7.5/10 | 9/10 | The Sleep Well Pick. They sell the electrical backbone for every data center. 70% data center order growth with a fortress balance sheet. |

| BN | Brookfield Corp | 7/10 | 9/10 | The Heavyweight. $180B in deployable capital. They own the power and the data centers. The safest way to play the energy-infrastructure nexus. |

| EQIX | Equinix | 6/10 | 10/10 | The Safe Harbor. The "Airport of the Internet." Lower growth (8% revenue), but unmatched stability, dividends, and an interconnection moat that hyperscalers can't replicate. |

| DLR | Digital Realty | 6/10 | 9.5/10 | The Landlord. Massive 5GW power bank guarantees long-term relevance. A steady dividend payer for income-focused portfolios. |

Conclusion

The AI revolution is entering its industrial phase. The easy money in chip stocks has been made; the smart money is now moving into the physical infrastructure that makes AI possible. By focusing on power rights, liquid cooling technology, and favorable valuations, you can build a portfolio ready for 2026.

Don't invest in the dark. Sign up for Intellectia.AI today to get daily AI stock picks, real-time market analysis, and institutional-grade alerts delivered straight to your dashboard. Stay ahead of the power curve.