Wall Street’s TACO Trade and Tariff Paradox

Understanding the TACO Trade Phenomenon

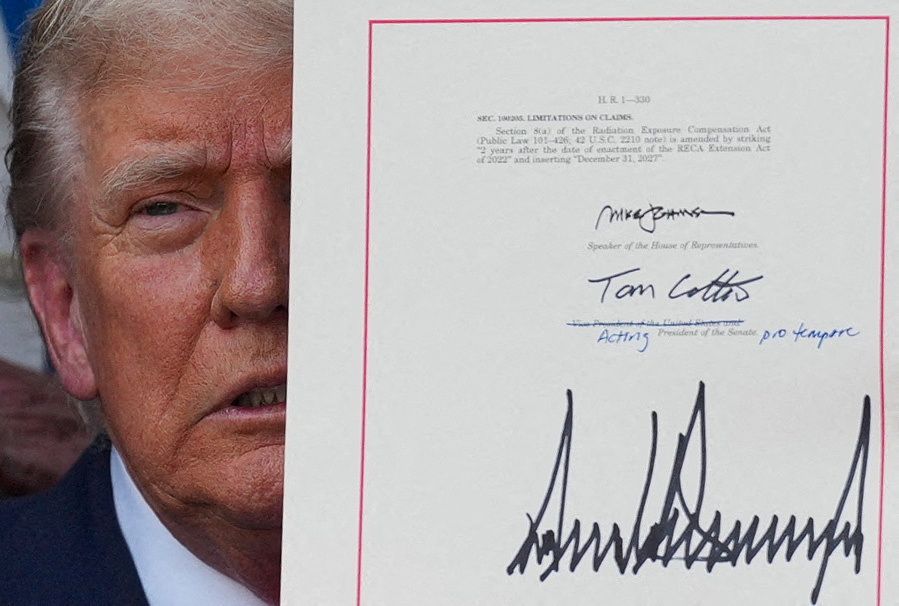

Wall Street has coined the term "TACO trade," short for "Trump Always Chickens Out," to describe its perception of former President Donald Trump’s pattern of issuing extreme tariff threats, only to withdraw or soften them later. This belief stems from a series of past events where initial tariff announcements caused market turbulence, but eventual policy reversals mitigated the fallout. For example, in early 2025, markets reacted sharply to proposed "Liberation Day" tariffs, only for Trump to delay their implementation by 90 days, leading to a swift market recovery.

This expectation of policy reversals has contributed to a muted response to recent tariff announcements. Investors appear to price in the likelihood that Trump will ultimately negotiate or modify his stance, rather than follow through with severe measures. While this logic has provided a cushion for equity markets, it raises questions about whether the TACO trade phenomenon creates complacency among investors in the face of genuine risks.

The Paradox of Market Calm and Policy Impact

While the TACO trade has helped markets maintain relative stability, it may inadvertently embolden Trump to escalate his tariff threats. A calm market could signal to policymakers that their decisions are less economically disruptive than feared, reducing the pressure to reverse or moderate their actions. This dynamic creates a paradox where the very stability investors count on could lead to policies that undermine long-term economic growth.

The risk of the TACO trade backfiring grows as tariff threats intensify. For instance, recent proposals to impose a 50% tariff on copper imports and a 200% levy on pharmaceuticals have sparked concerns among businesses and trade partners. If these tariffs materialize, the resulting disruptions to global supply chains and increased input costs for U.S. manufacturers could lead to more significant economic consequences. Investors banking on another policy reversal may find themselves caught off guard if Trump decides to follow through this time, particularly as he asserts a firm stance to strengthen his political position.

New Tariff Deadlines and Investor Uncertainty

The August 1 tariff deadline represents a pivotal moment for global trade and market sentiment. Trump has repeatedly emphasized that no extensions will be granted, a departure from prior instances where deadlines were pushed back. In a Truth Social post, Trump declared that payments would begin on August 1, 2025, "without exceptions." This firm stance has added an air of finality to the current round of negotiations, leaving investors to weigh the likelihood of further delays against the potential for actual implementation.

The looming deadline has created significant uncertainty for businesses and investors alike. Exporters in nations such as Japan and South Korea, which received tariff letters outlining rates as high as 40%, face mounting pressure to adapt to an unpredictable trade environment. Meanwhile, central banks, including the Federal Reserve, must navigate mixed economic signals, balancing the potential inflationary effects of tariffs with slowing growth. The lack of clarity has already had ripple effects, with some industries holding off on investment decisions and others accelerating purchases to preempt higher costs. As the deadline approaches, markets will be closely watching for any shifts in Trump’s rhetoric or policy decisions.

Sources

Sources- Wall Street’s Trump TACO trade chicken egg problem | CNN Business

cnn

cnn - 3 takeaways investors survey tariff delay: Morning Brief

yahoo

yahoo - Trump tariffs live updates: Trump says won't extend August 1 deadline; promises tariff letters

yahoo

yahoo

Keep Reading

Keep ReadingAbout the author

Top News

Related Articles

Latest Newswire

- Wall Street’s Trump TACO trade chicken egg problem | CNN Business

cnn

cnn - 3 takeaways investors survey tariff delay: Morning Brief

yahoo

yahoo - Trump tariffs live updates: Trump says won't extend August 1 deadline; promises tariff letters

yahoo

yahoo

People Also Watch