Trump's Executive Order Urges Cannabis Rescheduling, Potentially Eliminating 280E Tax Burden

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 19 2026

0mins

Should l Buy ACB?

Source: Benzinga

- Significant Policy Shift: President Trump's executive order urging the DOJ to reschedule cannabis is hailed as the most consequential federal cannabis policy change in over 50 years, potentially transforming the tax landscape for U.S. cannabis operators.

- Tax Burden Relief: Rescheduling cannabis would automatically eliminate Section 280E, allowing legal state operators to deduct standard operating costs, significantly improving their balance sheets and cash flow profiles.

- Positive Market Reaction: The AdvisorShares MSOS ETF outperformed the S&P 500 in 2025, and while the sector remains the 'most volatile' place to invest, Ahrens predicts a market 'pop' upon finalization of the rescheduling.

- Challenges Ahead: Despite the positive first step of rescheduling, U.S. cannabis companies still cannot list on major exchanges, and the industry awaits 'safe harbor' provisions for banking, necessitating caution from investors regarding future market volatility.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy ACB?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on ACB

Wall Street analysts forecast ACB stock price to rise

3 Analyst Rating

3 Buy

0 Hold

0 Sell

Strong Buy

Current: 3.510

Low

6.28

Averages

6.77

High

7.39

Current: 3.510

Low

6.28

Averages

6.77

High

7.39

About ACB

Aurora Cannabis Inc. is a Canada-based medical cannabis company. The Company’s principal business lines are focused on the production, distribution and sale of cannabis and cannabis-derivative products in Canada and internationally. The Company’s segments include Cannabis and Plant Propagation. The Company's adult-use brand portfolio includes Drift, San Rafael '71, Daily Special, Tasty's, Being and Greybeard. Its medical cannabis brands include MedReleaf, CanniMed, Aurora and Whistler Medical Marijuana Co, as well as international brands, Pedanios, IndiMed and CraftPlant. The Company also holds a 50.1% controlling interest in Bevo Farms Ltd., a supplier of propagated vegetables and ornamental plants in North America. Its subsidiaries include Aurora Cannabis Enterprises Inc., Aurora Deutschland GmbH, Whistler Medical Marijuana Corporation, and Indica Industries Pty Ltd., among others.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Poor Market Performance: Aurora Cannabis has lost 96% of its stock value since 2021, indicating the company's struggle to establish itself in a highly competitive market; despite cannabis being legalized in Canada since 2018, Aurora has failed to achieve significant success, highlighting deficiencies in its market strategy.

- Regulatory Change Opportunities: President Trump’s executive order reclassifying cannabis to Schedule III offers research and banking advantages, yet Aurora's negligible presence in the U.S. market limits its potential gains from these changes, constraining growth opportunities.

- Acquisition Challenges: The acquisition of Reliva, focused on CBD products, in 2020 was undermined by significant challenges in the CBD market, leading to the shutdown of operations in 2023, which underscores the difficulties and risks Aurora faces in expanding into new markets.

- Bleak Future Outlook: While a potential cannabis market revival exists, Aurora Cannabis's weak revenue growth and consistent net losses present substantial challenges for re-entering the U.S. market, prompting investors to carefully assess the company's future performance amidst these uncertainties.

See More

- Stock Price Plunge: Aurora Cannabis has seen its shares plummet by 96% since 2021, indicating severe financial distress and a significant loss of investor confidence in its future prospects amid fierce market competition.

- Limited Market Opportunities: Despite recent regulatory changes in the U.S. that could create new cannabis market opportunities, Aurora Cannabis has virtually no presence in the U.S. market and shut down its Reliva operations in 2023, highlighting challenges in the CBD sector.

- Financing Challenges: Should Aurora Cannabis seek to re-enter the U.S. market, it may need to pursue dilutive financing methods for acquisitions, further eroding existing shareholder value and increasing investment risks.

- Investor Confidence Lacking: Given Aurora Cannabis's weak revenue growth and consistent net losses, analysts generally view the company as a poor choice to capitalize on any upcoming cannabis market boom, potentially positioning it as a wealth destroyer.

See More

- Conference Participation: Aurora Cannabis CFO Simona King will participate in TD Cowen's 46th Annual Health Care Conference on March 2, 2026, where she is expected to engage in one-on-one meetings with investors, showcasing the company's leadership in the global medical cannabis market.

- Market Trends Discussion: The conference will explore significant shifts in the global medical cannabis landscape and their impact on industry growth, with Aurora sharing insights on its excellence in Canadian manufacturing, further solidifying its market position.

- Completion of Bevo Transaction: Aurora announced the completion of its transaction with Bevo Agtech Inc., initially announced on February 4, 2026, marking a significant step in expanding its product lines and market share.

- Global Expansion Strategy: As a global leader in medical cannabis, Aurora is committed to improving patient lives through scientific expertise and high-quality products, and will continue to expand its operations in markets such as Canada, Europe, and Australia.

See More

- Conference Participation: Aurora Cannabis will participate in TD Cowen's 46th Annual Health Care Conference on March 2, 2026, where CFO Simona King will engage in discussions, likely drawing investor attention to its international leadership and market opportunities.

- Market Trends Discussion: The conference will address significant shifts in the global medical cannabis industry and market forces, with Aurora aiming to reinforce its market leadership by showcasing its excellence in Canadian manufacturing.

- Completion of Bevo Transaction: Aurora announced the completion of its transaction with Bevo Agtech Inc., previously disclosed on February 4, 2026, marking a strategic advancement in expanding its product lines and market share.

- Global Expansion Strategy: As a global leader in medical cannabis, Aurora is committed to improving patient lives through scientific expertise and high-quality products, and will continue to seek high-margin opportunities in Canada, Europe, and other markets.

See More

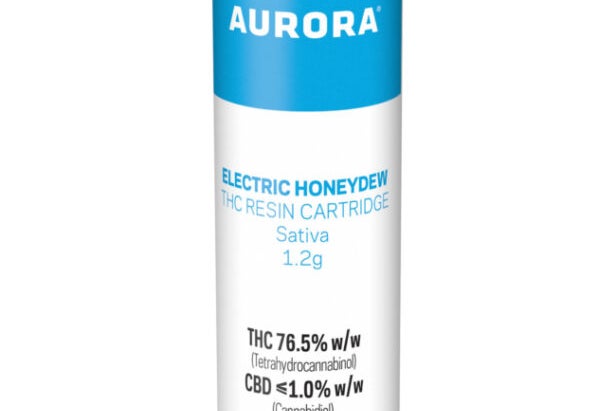

- Market Expansion Strategy: Aurora Cannabis is launching new products in Australia and New Zealand, including two THC flower products and four resin cartridges, aimed at meeting the needs of patients and prescribers for high-quality medical cannabis, thereby enhancing its leadership position in international markets.

- Product Diversification: The introduction of Big Wave™ and Night Ride™ in New Zealand, along with the upcoming Half Moon™ product, showcases Aurora's ongoing commitment to product innovation, which is expected to enhance patient choice and experience, further solidifying market share.

- Quality Assurance: All new products are derived from Aurora's proprietary genetics and manufactured in EU-GMP and TGA-GMP certified facilities, ensuring safety and high quality, which enhances customer trust and brand loyalty.

- Long-term Investment Commitment: Aurora has pledged to continue investing in the Australian and New Zealand markets to support the evolving needs of patients, reflecting the company's strategic focus on global growth, which is anticipated to drive future business expansion and revenue growth.

See More

- Aurora Financial Performance: Aurora Cannabis reported net revenue of $94.2 million for Q3 2026, a 7% year-over-year increase, with global medical cannabis sales reaching $76.2 million, accounting for over 80% of total sales, indicating strong growth potential in the high-margin medical market.

- Strategic Transformation Plan: Aurora announced plans to gradually exit select Canadian consumer cannabis markets to reduce sales and marketing costs, which is expected to significantly improve overall profit margins in the coming quarters.

- Canopy Growth Results: Canopy Growth reported net revenue of $90.4 million for Q3 2026, with a nearly 50% reduction in net loss despite weak international performance, reflecting positive progress in cost control and market integration.

- Cronos Brand Expansion: Cronos Group launched its premium Lord Jones brand in Israel, marking a significant step in its global expansion strategy aimed at meeting local market demands with high-quality products while enhancing brand recognition in international markets.

See More