Trending tickers: Burberry, Imperial Brands, Boeing and Oracle

Written by Emily J. Thompson, Senior Investment Analyst

Updated: May 15 2024

0mins

Source: Yahoo Finance

- Burberry Struggles: Burberry's profits plunged as Chinese consumers turned away from luxury retail, with pre-tax profit down 40% and underlying earnings down 34%.

- Imperial Brands Performance: Tobacco company Imperial Brands reiterated its full-year outlook despite a fall in interim profits and sales, with NGP brands seeing a 16.8% increase in sales.

- Boeing Legal Troubles: Boeing shares slipped amid reports of potential prosecution over the 737 MAX plane crashes, with the US Department of Justice accusing the company of breaching obligations.

- Oracle Cloud Deal: Oracle is close to securing a $10bn cloud contract with Elon Musk's xAI, making xAI one of Oracle's largest clients in the AI landscape.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy ORCL?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on ORCL

Wall Street analysts forecast ORCL stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for ORCL is 309.59 USD with a low forecast of 180.00 USD and a high forecast of 400.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

34 Analyst Rating

25 Buy

9 Hold

0 Sell

Moderate Buy

Current: 172.800

Low

180.00

Averages

309.59

High

400.00

Current: 172.800

Low

180.00

Averages

309.59

High

400.00

About ORCL

Oracle Corporation offers integrated suites of applications plus secure, autonomous infrastructure in the Oracle Cloud. The Company operates through three businesses: cloud and license, hardware and service. Its cloud and license business is engaged in the sale, marketing and delivery of its enterprise applications and infrastructure technologies through cloud and on-premise deployment models including its cloud services and license support offerings, and its cloud license and on-premise license offerings. Its hardware business provides infrastructure technologies including Oracle Engineered Systems, servers, storage, industry-specific hardware, operating systems, virtualization, management and other hardware-related software to support diverse IT environments. Its services business provides services to customers and partners to help maximize the performance of their investments in Oracle applications and infrastructure technologies.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

Oracle's Cloud Market Share Growth and Financial Outlook

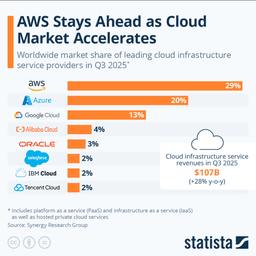

- Cloud Market Share Increase: Oracle's focus on high-performance computing has raised its cloud market share from 2% in 2024 to 3%, showcasing a competitive edge in a $944 billion industry, with expectations for further growth by 2026.

- Strong Financial Performance: For the first half of fiscal 2026 ending November 30, 2025, Oracle's cloud segment generated over $15 billion in revenue, a 31% year-over-year increase, driving overall revenue to $31 billion with the cloud segment accounting for 49%.

- Future Growth Potential: Analysts forecast a 17% revenue growth for fiscal 2026 and 29% for the following year, which could enhance Oracle's stock performance despite its current debt of $108 billion.

- Strategic Investment Returns: While Oracle's heavy investment in cloud infrastructure has increased its debt, its P/E ratio of 33 is close to the S&P 500 average of 31, indicating market confidence in its future growth prospects.

Continue Reading

Amazon Plans Up to $50 Billion Investment in OpenAI

- Massive Investment: Amazon is in talks to invest up to $50 billion in OpenAI as part of a broader fundraising round aiming to raise up to $100 billion, significantly bolstering OpenAI's financial resources.

- Far-reaching Market Impact: This investment will not only provide OpenAI with substantial funding to advance its AI technology development and applications but could also reshape the competitive landscape of the tech industry, prompting more companies to explore investment opportunities in AI.

- Strategic Collaboration Potential: The partnership between Amazon and OpenAI may facilitate deeper integration in cloud computing and AI, enhancing the competitiveness of Amazon Web Services and offering customers more advanced AI-driven solutions.

- Industry Trend Leadership: As tech giants ramp up investments in AI, Amazon's move reflects its confidence in the future of AI and may lead other companies in the industry to accelerate their own initiatives, driving rapid market growth.

Continue Reading