Three Must-Buy AI Stocks for 2026 That You Can Get for $200 Today

AI-Driven Market Growth: The current bull market, fueled by artificial intelligence (AI) since October 2022, has led to significant stock price increases, creating a perception of missed opportunities for investors, especially those with limited capital.

Datadog's Competitive Edge: Datadog, which provides IT system analysis tools, has seen substantial revenue growth driven by its AI integrations, with a notable increase in AI-native customer revenue, indicating strong demand and retention.

Fortinet's Security Solutions: Fortinet is expanding its market share with next-gen firewalls and software solutions, showing impressive revenue growth in its SASE and SecOps segments, while maintaining attractive valuation metrics for investors.

Tencent's AI Integration: Tencent is leveraging AI across its gaming and advertising platforms, resulting in increased engagement and revenue growth, despite facing supply constraints in its cloud computing segment.

Trade with 70% Backtested Accuracy

Analyst Views on FTNT

About FTNT

About the author

- Price Range Analysis: The XLK ETF's 52-week low is $86.225 per share, with a high of $152.995, and the latest trade at $141.37 indicates relative stability in the current market environment, potentially attracting investor interest.

- Technical Analysis Tool: Comparing the latest share price to the 200-day moving average can provide valuable insights for investors, helping them better assess market trends and timing for investments.

- ETF Trading Mechanism: Exchange-traded funds (ETFs) trade similarly to stocks, where investors are buying and selling 'units' that can be created or destroyed based on investor demand, impacting the ETF's liquidity and market performance.

- Inflows and Outflows Monitoring: Weekly monitoring of changes in shares outstanding for ETFs highlights those experiencing significant inflows or outflows, which not only affects the overall performance of the ETF but can also have substantial impacts on the individual stocks held within these funds.

- Analyst Rating Changes: Top Wall Street analysts have adjusted their ratings on several companies, indicating a shift in market sentiment that could influence investor decisions and market trends.

- Upgrades and Downgrades: While specific stock names are not mentioned, such rating changes typically lead to price fluctuations in the affected stocks, prompting investors to closely monitor these adjustments for portfolio optimization.

- Market Reaction Expectations: Analyst rating adjustments may trigger short-term market reactions, especially when investor sentiment is sensitive towards certain stocks, thereby impacting overall market sentiment.

- Information Access Channels: Investors can access a comprehensive view of rating changes through Benzinga's analyst ratings page, enabling them to make more informed investment decisions.

- Earnings Beat: Fortinet reported Q4 earnings of $0.81 per share, exceeding the consensus estimate of $0.74 and improving from $0.74 a year ago, indicating enhanced profitability.

- Significant Revenue Growth: The company achieved revenue of $1.905 billion in Q4, surpassing expectations and rising nearly 15% year-over-year from $1.66 billion, reflecting strong market demand.

- Optimistic Guidance: Fortinet expects Q1 2026 revenue between $1.70 billion and $1.76 billion, with diluted non-GAAP EPS of $0.59 to $0.63, demonstrating confidence in future performance.

- Analyst Rating Divergence: While Rosenblatt raised its price target, Scotiabank downgraded Fortinet to sector perform with a target of $85, indicating a divide among analysts regarding the company's outlook.

- Analyst Rating Changes: Top Wall Street analysts have adjusted their ratings on several companies, reflecting varying market perspectives on their future performance, which could influence investor decisions and market sentiment.

- AMZN Stock Outlook: Analysts' opinions on Amazon (AMZN) stock indicate mixed views on its future growth potential, prompting investors to pay close attention to the latest ratings and recommendations when considering purchases.

- Impact of Rating Changes: Upgrades and downgrades from analysts can lead to stock price volatility, necessitating that investors closely monitor these changes to timely adjust their investment strategies and optimize their portfolios.

- Market Sentiment Reflection: Changes in analyst ratings not only affect individual stock performance but can also impact overall market sentiment, urging investors to consider these factors comprehensively for informed investment decisions.

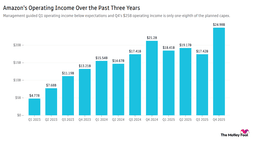

- Amazon's Capital Expenditure Surge: Amazon plans to increase its capital expenditure to $200 billion in 2026, nearly matching its total revenue of $213 billion for Q4, leading to an over 8% drop in stock price during morning trading, indicating market concerns about its financial health.

- Accelerating AWS Growth: CEO Andy Jassy reported a 24% growth rate for AWS, the fastest in 13 quarters, with an annualized revenue of $142 billion; however, management anticipates Q1 operating income will fall short of analyst expectations, reflecting intensified market competition.

- Bitcoin Price Volatility: Bitcoin has dropped 50% from its 2025 peak, falling to around $60,000, which reflects waning confidence in government support for cryptocurrencies, although some analysts suggest this is merely a market correction rather than the end of crypto.

- Severe Market Reactions: Despite a 10% revenue increase in Q3, DOCS and PIDoximity saw their stock plunge over 30% due to declining net income under margin pressure, highlighting investors' acute sensitivity to profitability.

- Stock Market Movement: Stock futures increased on Friday despite concerns regarding artificial intelligence spending.

- Big Tech Earnings Impact: Recent earnings reports from major technology companies did not alleviate fears related to AI investments.