Tech Sector Essential for S&P 500 Breakout, but Delay Likely.

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 2d ago

0mins

Should l Buy LPLA?

Source: Barron's

- Market Performance: U.S. stock markets, particularly the S&P 500, have been stagnant, showing little change over the past month.

- Sector Influence: Gains from sectors outside of technology are limiting the overall performance of the benchmark index.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy LPLA?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on LPLA

Wall Street analysts forecast LPLA stock price to rise over the next 12 months. According to Wall Street analysts, the average 1-year price target for LPLA is 430.92 USD with a low forecast of 380.00 USD and a high forecast of 486.00 USD. However, analyst price targets are subjective and often lag stock prices, so investors should focus on the objective reasons behind analyst rating changes, which better reflect the company's fundamentals.

14 Analyst Rating

11 Buy

3 Hold

0 Sell

Strong Buy

Current: 338.670

Low

380.00

Averages

430.92

High

486.00

Current: 338.670

Low

380.00

Averages

430.92

High

486.00

About LPLA

LPL Financial Holdings Inc. is an independent broker-dealer and an investment advisory firm. The Company offers an integrated platform of brokerage and investment advisory services to independent financial advisors and financial advisors at institutions in the United States. Through its comprehensive platform, it offers integrated technology solutions; brokerage and advisory platforms; clearing, compliance, business and planning and advice services; consultative practice management programs and training, and in-house research. Through its custody and clearing platform, using both proprietary and third-party technology, it offers access to diversified financial products and services, enabling its advisors to offer personalized financial advice and brokerage services to retail investors. Its products include alternative investments, annuities, exchange-traded products, insurance-based products, mutual funds, and retirement plan products. It also offers wealth management solutions.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

Market Reaction: Shares of Charles Schwab and other wealth management firms declined due to concerns over the impact of artificial intelligence on the industry.

AI Developments: Investors were particularly focused on a new AI-enabled tax planning tool from fintech start-up Altruist, which heightened fears about competition.

Industry Adaptation: Despite the concerns, Charles Schwab's CEO, Rick Wurster, indicated that established firms are also leveraging AI to enhance their operations and efficiency.

Future Outlook: The ongoing developments in AI technology are prompting both challenges and opportunities for traditional wealth management companies.

See More

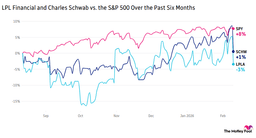

- Overreaction in the Market: Following Altruist's launch of a new AI tax planning tool, LPL Financial's stock dropped over 8%, Charles Schwab fell 7.4%, Raymond James declined nearly 9%, and Ameriprise slumped about 6%, reflecting market fears regarding the sustainability of wealth management fee streams and competitive dynamics.

- Analysts Optimistic for the Future: Morgan Stanley's analyst believes that despite the current sell-off being viewed as an overreaction, wealth management firms are well-positioned to leverage AI for productivity gains, especially with an impending generational wealth transfer expected to increase the number of clients seeking advisory services.

- Potential Opportunities with AI: Deutsche Bank's analyst emphasizes that AI is not a threat but a significant opportunity, noting that Charles Schwab has integrated over 220 AI use cases into its operations, which is expected to accelerate growth by enhancing client experience and enabling personalized outreach.

- Evolution Rather Than Disruption: Citizens JMP's analyst suggests that while the wealth management industry will evolve over the coming decades, there is currently no clear short-term disruption risk, highlighting that the fundamentals of the industry remain strong and the market's reaction may be overly dramatic.

See More

- AI Tax Tool Impact: Altruist's new Hazel AI tax planning tool can analyze 1040 forms, pay, and account statements in minutes, significantly enhancing advisor efficiency, which led to LPL Financial and Charles Schwab shares dropping 8.3% and 7.4% respectively, highlighting the pressure traditional financial services face from AI competition.

- Cloudflare's Strong Performance: Following its 2022 recommendation, Cloudflare reported a 34% year-over-year revenue increase in Q4, with annual contract value growing nearly 50%, and forecasts close to $2.8 billion in revenue for 2026, resulting in a 14% stock price increase in after-hours trading, indicating robust market demand and investor confidence.

- Mattel's Major Decline: Mattel's stock plummeted 30% due to disappointing Q3 results, with the CEO expressing skepticism about the return of toy manufacturing to the U.S., reflecting significant challenges and a loss of market confidence for the company.

- Moderna's Vaccine Application Rejected: The FDA rejected Moderna's application for a seasonal mRNA flu vaccine, causing a 9% drop in pre-market trading, illustrating the substantial impact of regulatory hurdles on biopharmaceutical companies.

See More

- Financial Stock Volatility: Financial stocks experienced significant declines as LPL Financial dropped 8.3%, Charles Schwab fell 7.4%, and Morgan Stanley decreased by 2.4%, indicating investor concerns about AI tools potentially replacing traditional advisory firms.

- Weak Retail Sales: U.S. retail sales for December were flat month-on-month, missing the expected 0.4% increase, which reflects a lack of consumer confidence that could hinder future economic recovery and spending.

- Divergent Market Performance: While the S&P 500 fell by 0.33% and the Nasdaq Composite retreated by 0.59%, the Dow Jones Industrial Average managed a slight gain of 0.1%, suggesting a rotation into sectors that may be more insulated from AI-related pressures, potentially offering new investment opportunities.

- European Company Performance: Siemens Energy reported a 12.8% year-on-year increase in its fiscal first quarter, with net income exceeding expectations, showcasing its competitive strength, while Heineken announced plans to cut 6,000 jobs due to weak beer sales, highlighting challenges in the industry.

See More

- Financial Stock Volatility: Financial stocks experienced significant declines, with LPL Financial down 8.3%, Charles Schwab down 7.4%, and Morgan Stanley down 2.4%, as investors feared that AI tools could disrupt traditional advisory firms, indicating a shift in market sentiment towards financial services.

- Weak Retail Sales: U.S. retail sales for December were flat month-on-month, missing the expected 0.4% increase, which suggests a lack of consumer confidence that could hinder economic recovery and affect holiday spending expectations.

- Major Index Performance: Amid disappointing retail data, the S&P 500 fell 0.33% and the Nasdaq Composite dropped 0.59%, while the Dow Jones Industrial Average managed a slight gain of 0.1%, reflecting a divergence in market performance and investor focus.

- Shifting Market Sentiment: Market strategists noted a rotation into sectors that may be more insulated from the impacts of AI, suggesting a structural change in investment strategies that could influence future market dynamics.

See More

- Retail Sales Weakness: US December retail sales were unchanged month-over-month, falling short of the +0.4% expectation, indicating weakness in consumer spending that could lead to a downward revision in Q4 GDP, thereby impacting market confidence and economic growth outlook.

- Employment Cost Index Decline: The US Q4 employment cost index rose by +0.7% quarter-over-quarter, below the expected +0.8%, marking the smallest increase in 4.5 years, suggesting easing labor cost pressures that may influence the Fed's monetary policy decisions.

- Mixed Market Performance: The Dow Jones Industrial Average reached a new all-time high, closing up +0.10%, while the S&P 500 and Nasdaq 100 indices fell by -0.33% and -0.56%, respectively, reflecting divergent market sentiment and uncertainty.

- Focus on Upcoming Economic Data: The market will closely monitor upcoming economic data, including January nonfarm payrolls and unemployment rate, which are expected to significantly influence future monetary policy and market trends.

See More